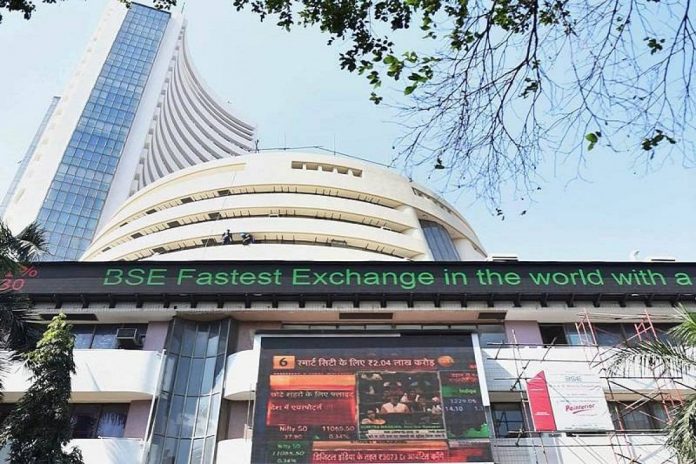

At the opening bell, the major gainers on the Nifty were Wipro, Bajaj Finserv, Tata Steel, Hindalco Industries and Bajaj Finance. | File pic

The benchmark indices opened in the green on December 21. At 09:16 AM, the Sensex was up 471.25 points or 0.84 percent at 56,293.26. The broader Nifty was up 133 points or 0.80 percent at 16,747.20. About 1,351 shares have advanced, 525 shares declined, and 71 shares are unchanged.

Bank Nifty was up almost 1 percent. India VIX was down 4 percent.

At the opening bell, the major gainers on the Nifty were Wipro, Bajaj Finserv, Tata Steel, Hindalco Industries and Bajaj Finance. Early losers included Cipla, Dr Reddy’s Labs, Shree Cements and Eicher Motors.

On December 21, the Sensex was down 1,189.73 points or 2.09 percent at 55,822.01. The broader Nifty was down 371.00 points or 2.18 percent at 16,614.20. About 621 shares have advanced, 2604 shares declined, and 97 shares are unchanged.

MapMyIndia to make debut today

In this tussle between bulls and bears, CE Info Systems widely known as MapMyIndia will make its debut today. The listing premium is expected somewhere between 50 percent to 80 percent but there can be some impact on the premium seeing current market scenario, said Nigam.

Wall Street slides on COVID-19 worry

Wall Street’s main indexes dropped more than 1 percent on Monday, dragged by concerns about the impact of tighter COVID-19 curbs on the global economy, and a potentially devastating setback to President Joe Biden’s investment bill.

The Dow Jones Industrial Average fell 143.32 points, or 0.41 percent, at the open to 35,222.12.

The S&P 500 opened lower by 32.74 points, or 0.71 percent, at 4,587.90, while the Nasdaq Composite dropped 236.68 points, or 1.56 percent, to 14,933.00 at the opening bell.

Asian shares claw back

Asian stocks rose on Tuesday, shrugging off a bruising Wall Street session, as Chinese markets cheered Beijing’s push to help troubled property firms, although surging cases of the Omicron coronavirus variant persist as a worry for investors.

US stock indexes retreated more than a percent as positive COVID-19 case counts rose and President Joe Biden’s social spending and climate bill hit a significant setback. The negative mood brightened somewhat in early Asian hours with US stock futures up and some assets battered in Monday’s selling finding buyers, although volumes were thin heading into end-of-year holidays.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.4%. Japan’s Nikkei rose 1.79 percent as investors bought into Monday’s heavy selloff while Australian stocks were up 0.47 percent. While the global shares rout appeared to pause, investors are still concerned about Omicron risks.

FIIs data

Selling by FIIs continued on Monday as they sold shares worth INR 3565 crores as per the data available on NSE.

Fuel prices unchanged

Petrol and diesel prices remained unchanged for over a month on Tuesday. Ddiesel and petrol prices in Delhi stood at Rs 86.67 per litre and Rs 95.41 per litre, respectively.

In Mumbai, petrol is retailed at Rs 109.98 per litre, while diesel is being sold at Rs 94.14 per litre. Diesel and petrol prices also remained static in Kolkata at Rs 89.79 and Rs 104.67. In Chennai too, they remained unchanged at Rs 91.43 and Rs 101.40.

Oil prices drop

Oil prices dropped amid concerns the spread of the Omicron variant would crimp demand for fuel. US crude recently fell 2.12 percent to $69.22 per barrel and Brent was at $72.01, down 2.05% percent on the day.

Dollar under pressure

The dollar came under pressure on Monday as US Treasury yields slipped. The dollar index fell 0.137 percent. In recent weeks it has rallied, and is up about 7 percent for the year.

Snapdeal likely to file DRHP: Report

Snapdeal is all set to file a draft red herring prospectus (DRHP) to raise Rs 1,250 crore in fresh issue through an initial public offering (IPO) on December 20, according to sources privy to the development, Moneycontrol reported. The IPO will see Softbank, Snapdeal’s lead investor, reduce its shareholding from 34 percent to 24 percent, the report said.

(To receive our E-paper on whatsapp daily, please click here. We permit sharing of the paper's PDF on WhatsApp and other social media platforms.)

Free Press Journal