small smiles/iStock via Getty Images

With interest rates at extreme lows, income-oriented investors have been clamoring for those few assets which still deliver decent dividend returns. One asset class that has seen immense in-flows in this challenging environment is covered call funds such as Global X’s S&P 500 Covered Call ETF (XYLD). Currently, this fund offers a staggering 9% yield, far above most dividend-paying stocks and even high-yield bonds. It does so by selling near-the-money short-term call options for a premium while owning the S&P 500 index. While this may seem like a fantastic opportunity, long-held wisdom has consistently held that if something looks too good to be true, it probably is.

To be fair, XYLD has many good qualities. The ETF has a decent track record, a modest expense ratio of 60 bps, and does pay a very high monthly yield. For those investors explicitly interested in generating cash through a covered-calling writing strategy, XYLD offers a very efficient means of doing so. That said, XYLD should not be confused with a “low-risk high-return” investment as there are significant caveats to covered-call strategies. Even more, XYLD has underperformed the S&P 500 relatively consistently, specifically since the 2020 crash. See below:

Since 2016, the S&P 500 ETF (SPY) delivered a total return (including dividends) of 126%, while XYLD’s was only ~57%. The two funds hold almost the same stocks, with the core difference being that XYLD also sells call options on the basket of stocks it holds. In general, this lowers gains from appreciation of stocks but increases returns in flat markets. Since the S&P 500 has been in a historically abnormally strong rally since 2020, XYLD has delivered negative relative returns to its benchmark since covered call options effectively “cap” upside potential.

Problematically, the S&P 500 has seen a considerable increase in volatility over the past month. As detailed in “Market Outlook For 2022: Avoid Stocks And Consider These Safe Havens“, there is considerable evidence that 2022 may be a challenging year for equity investors. If the market continues to drop, XYLD may face rapid declines, not unlike its ~33% crash in early 2020. Of course, this may also result in a spike in XYLD’s monthly premium since a rise in volatility usually pushes option premiums higher. As such, 2022 may be a relatively complex year for XYLD and similar strategic funds.

In my opinion, far too many investors pay too much attention to dividend yields and not the mechanics behind those yields. Put simply, not all yields are the same. XYLD does not generate an income from operational cash-flows from economic activity. Instead, it delivers a yield by essentially selling insurance on the stock market. For XYLD, these “call options” are obligations to pay out any gains on the S&P 500 if it rises past a certain level. Since XYLD also owns the S&P 500 index, potential losses on those call option sales from gains in the market are offset by gains from owning the index. However, if the S&P 500 declines, XYLD also declines since the call options eventually become worthless if the market falls below its strike price.

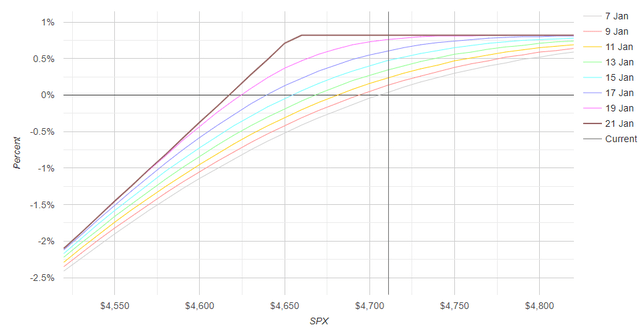

XYLD’s current call-option on the S&P 500 expires on January 21st with a strike price of 4655. With the index currently at 4700, the option is “in the money,” meaning XYLD’s further appreciation potential is capped until around January 21st. The specific profit & loss potential for XYLD depending on the S&P 500 is approximated below using the most recent option prices:

(Options Profit Calculator)

This chart shows how XYLD should generate a ~80 bps income premium from now to January 21st as long as the S&P 500 remains above 4650. If the S&P 500 declines below 4650, then those losses will still be offset by gains from the call option premium until the S&P 500 hits 4617, at which point XYLD’s net returns will become negative. Additionally, if the S&P 500 rises higher by January 21st, XYLD will not participate in those gains. However, it may see its 80 bps premium be accounted for more quickly since the risk of the market falling below 4650 declines the higher the S&P 500 rises.

While these mechanics may seem complicated, they are essential for investors to understand as it can be futile to invest in a misunderstood asset. Those interested in XYLD should know that the fund does miss out on gains. Roughly speaking, XYLD can only appreciate the market by 1-2% each month and will typically miss out on any extra appreciation. However, this comes with the benefit of generating roughly 50 bps to 1.5% even if the S&P 500 fails to rise. Thus, if the S&P 500 enters a flat period similar to the small-cap Russell 2000 (IWM), XYLD will generate higher total returns than the S&P 500.

Of course, if the S&P 500 crashes, XYLD’s income premiums will offset losses, but only by 1-2%. In my view, this is only a marginal benefit considering the S&P 500 can quickly decline by 30% during a crash. Crucially, unlike typical dividend stocks and bonds, which often see premiums remain flat during crashes, XYLD’s monthly premium will decline with the market since XYLD’s call option premiums are usually ~50 bps to 2% of the S&P 500’s value depending on the VIX index. As you can see below, XYLD’s dividend is generally tied to the VIX index:

This correlation is because the VIX index measures implied market volatility based on the S&P 500’s option prices. When a crash seems likely to investors (almost always only after a minor crash has occurred), option premiums (as a percent of the market’s value) spike. However, because the market’s value also declines, XYLD’s overall dividend yield hardly rises during periods of high volatility.

Importantly, XYLD’s dividend is volatile and should not be counted on as a means of generating income. Its dividend will cease to exist during materially adverse performance months for the S&P 500. This is important to keep in mind as the S&P 500 has been in a strong bull market since 2010 with no lasting downside. In this case, I do not believe the 2020 crash should be accounted for as a “bear market” since it was incredibly short-lived compared to true bear markets such as 2008’s and 2000’s.

The length of this bull market is exceptionally unusual by long-term historical standards, likely due to the introduction of quantitative easing, which has added liquidity to the market during each period of losses. This can be seen quite clearly by the tight relationship between the Wilshire 5000 market capitalization and the Federal Reserve’s total assets:

The ratio of the Wilshire 5000 to the Federal Reserve’s total assets has held around 5-6X on average since 2010. Quite frankly, I do not believe the stock market would be nearly as high today if it were not for the trillions in new money entering the financial system. Since this QE is now fueling multi-decade record inflation, the Fed has accelerated its plans to end the program to just a few months from now. As this occurs, the stock market will lose one of its primary fuel sources, which I believe could result in a bear market. This is particularly true given that the inflation outlook has remained high despite a sharp rise in short-term interest rates, implying relatively aggressive hawkish policies may be necessary to stop rising inflation finally.

XYLD technically outperforms during bear markets, but only marginally, and underperforms significantly during bull markets, as we’ve seen over the past two years. Given this and other reasons implying weak S&P 500 returns, I believe investors should avoid XYLD. Contrary to some popular opinions, the ETF does not truly offer “protection against declines,” and its dividend will likely decline with its price given a sustained bear market. XYLD is an excellent fund in the specific environment of a flat S&P 500 since it will generate premiums despite the flat market. Such an environment is very rare.

Most of all, its dividend-generating capacity is highly inconsistent since it needs the market to remain flat or rise to earn a premium. Thus, investors who want consistent, predictable income should avoid XYLD. While the fund’s dividend has remained relatively constant over the past year, this is due to the rare situation of a sustained rally which, in my view, is mainly attributable to quantitative easing. As this liquidity stream ends, I believe XYLD and most other equity-based funds will likely deliver negative returns, particularly after accounting for inflation and taxes.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.