smodj/iStock via Getty Images

smodj/iStock via Getty Images

Sin stocks are shares of companies that operate in the tobacco, alcohol, adult entertainment, cannabis, and defense industries. Some of the most popular names include Altria (MO), Penn Gaming (PENN), and Smith & Wesson (SWBI).

Many investors prefer to avoid these stocks due to personal convictions and that’s perfectly understandable.

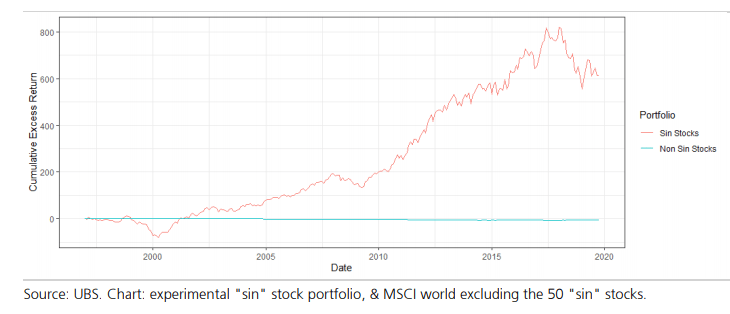

But my goal is to offer a wide range of unbiased investment options for my readers, and the fact is that sin stocks have historically been some of the most rewarding investments out there. They have literally crushed the returns of the broader stock market (SPY) over the long run:

UBS

UBS

Sin businesses do so well because they aren’t as cyclical, they are highly profitable, and most often, these stocks will still trade at discounted valuations because of the fact that many prefer to avoid them.

As a REIT analyst, it is rare for me to come across sin stocks, but there are actually a few real estate-heavy sin stocks that caught my eye recently. In what follows, I highlight my two largest sin stock investments. I believe that both of them have the potential to triple over the coming 5 years.

Please note that in writing this article, I am only sharing my opinion of these companies based on their financial merits as investments.

In a recent article, I explain that RCI Hospitality (RICK) is my #1 pick for 2022 and beyond. It has been my best performer since the beginning of the pandemic, and after suffering a ~10% dip, I am tempted to buy a bit more.

Put simply, I believe that RICK is the cheapest high-quality business with rapid growth prospects in today’s market. It trades at just around 10x estimated normalized free cash flow, despite having a clear path to 20% annual free cash flow per share growth.

Why is it so cheap then?

RICK is the only publicly listed company that specializes in the acquisition and operation of strip clubs. To give you an example, it owns the Tootsie’s Cabaret in Miami:

RCI Hospitality

RCI Hospitality

It is a sin industry. Few people understand it. It suffers from a pandemic. And until recently, RICK was also the victim of a short attack and was under investigation by the SEC. These are all good reasons why RICK still trades at a low multiple.

Nonetheless, this is a high-quality business with rapid growth prospects.

For one, its existing assets enjoy quasi-monopolies in their local markets because it is nearly impossible to get new licenses to open new clubs.

Also, because there are no natural buyers for these clubs, RICK is getting incredibly good deals, purchasing these local monopolies at 3-5x EBITDA and earning 25-33% cash-on-cash returns when you add some seller financing and a mortgage on the real estate.

In the next 10 years, a lot of strip club owners will look to retire and RICK will be the buyer of choice because it is the only publicly listed company with access to significant capital in this space.

That’s the main reason to invest in RICK. It is consolidating a highly fragmented sector, earning exceptional spreads over its cost of capital, and has a long runway of growth in doing so:

It issues equity and debt at cost X.

Uses this capital to buy clubs at return Y.

Implements changes to unlock synergies.

And pockets the spread that results in free cash flow per share growth.

Rinse & repeat.

In addition to the club business, RICK also operates a chain of new-generation sports bars, called Bombshells, and it expects to double its store count in the next 3 years.

All in all, RICK has been growing its free cash flow per share at 20%+ annually over the past 5 years, and it can keep doing that for many years to come. As we noted in our full thesis:

If they keep at 20%+ per year, this could be a $400+ stock in a decade from now, without even any repricing in its multiple.

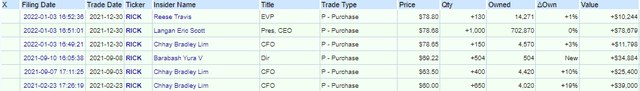

Add to that some multiple expansion, and RICK could more than triple in the coming years already. 10x FCF is just too low for a company of this quality and the management agrees. They have consistently accumulated more shares over the past years, and the CEO, Eric Langan, has $50+ million of his own skin in the game:

Openinsider

Openinsider

The company’s biggest shareholder, Adam Wyden, believes that the fair value is $200 already today.

You can read our full thesis by clicking here.

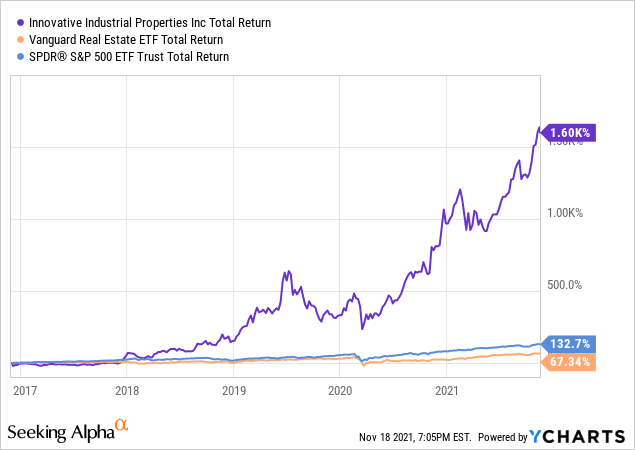

One of the biggest winners of all time in the REIT sector is Innovative Industrial Properties (IIPR). It returned a near 20x to investors in just 5 years:

YCHART

YCHART

It was able to earn these massive returns because:

It operates in a sector with little competition (cannabis cultivation facilities).

It was able to acquire properties at unusually high cap rates.

It had access to very cheap capital, resulting in unusually large spreads.

It started from a small size and each acquisition moved the needle.

And to top it all, its FFO multiple expanded drastically over the years.

Innovative Industrial Properties

Innovative Industrial Properties

Innovative Industrial Properties

Innovative Industrial Properties

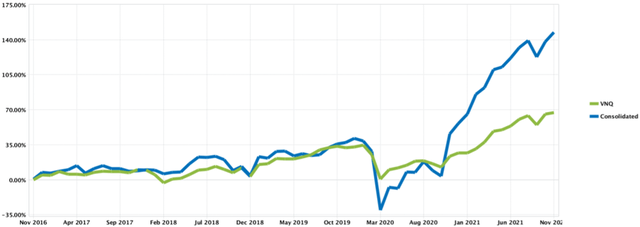

So – what does IIPR have to do with NewLake Capital Partners (OTCQX:NLCP)?

Well, NLCP is a brand-new Cannabis REIT that IPOed in late 2021 with the goal of replicating IIPR’s success.

If it can achieve just a third of IIPR’s success, it should more than triple your money in the coming 5 years, and we are optimistic because of three main reasons:

It is buying properties at ~12% cap rates, resulting in massive spreads over its cost of capital.

It is still 10x smaller than IIPR by market cap, meaning that each new acquisition moves the needle.

It is priced at 17x FFO, which compares very favorably to IIPR’s 34x FFO.

Just like RICK, NLCP’s business model is very simple. It issues equity and debt at cost X. Uses this capital to buy cannabis cultivation facilities at return Y. And pockets the spread that results in FFO per share growth. Rinse & repeat.

Given its small size and large spreads, NLCP has rapid growth potential and as it proves itself, its FFO multiple will also likely expand much closer to that of IIPR. If it can post 10-20% annual growth, and close the valuation gap to IIPR, that’s a triple in 5 years.

Best of all, NLCP is off to a very strong start. It just recently announced a 29% dividend hike, clearly signaling rapid growth ahead. While you wait, you also earn a 4.5% dividend yield, which goes a long way in today’s ultra-low yield world.

It goes without saying that these two sin stocks have more risks than your typical blue-chip stock. However, because they are discounted and enjoy rapid growth prospects, they also offer significantly more upside potential.

At High Yield Landlord, we invest heavily in this type of business that combines the best of both worlds: high yield and high growth. We then mitigate risks by building a diversified portfolio. The pandemic led to a lot of such opportunities and we expect more upside in 2022.

Interactive Brokers

Interactive Brokers

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the largest real estate investment community on Seeking Alpha with over 2,500 members on board and a perfect 5/5 rating from 400+ reviews:

For a Limited Time – You can join us at a deeply reduced rate!

(Update: Ending any time now)

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of “High Yield Landlord” – the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital – a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Disclosure: I/we have a beneficial long position in the shares of RICK; NLCP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.