Momodine/E+ via Getty Images

Momodine/E+ via Getty Images

At the beginning of January 2022, I wrote about the food and beverage conglomerate Nestle (OTCPK:NSRGY) and in the article I also mentioned that I am not a big fan of new year’s resolutions, but if I made one I would focus on expanding my portfolio by trying to identify more companies with a wide economic moat.

And this article will contribute to the goal of expanding my portfolio as Illinois Tool Works Inc. (ITW) seems to fit all the criteria I am searching for and could therefore be a great long-term investment. However, to qualify as long-term investment, we not only have to identify a great business, but also need the stock to be trading for a reasonable price, which is not the case here. But before we look at the economic moat and valuation, we start with the business model of Illinois Tool Works.

Illinois Tool Works Inc. was founded in 1912 by Byron L. Smith and incorporated in 1915. Today, the company is one of the Fortune 200 companies and a global multi-industrial manufacturing leader with about 43,000 employees. The company manufactures and sells industrial products and equipment worldwide. On its own homepage, Illinois Tool Works writes:

From state-of-the-art dishwashers, ovens and refrigerators in restaurants and hotels, to automobile components inside vehicles all over the world … the products we manufacture and the solutions we design are all around us. The buildings where we live and work are built with ITW construction and welding products, and our ITW test & measurement solutions help to ensure the quality and safety of millions of products.

The company is reporting in seven segments:

Aside from “Automotive OEM”, which generated $2,571 million in fiscal 2020 (and was therefore responsible for about 20% of total revenue), the other six segments all generated more or less similar revenue – between $1,384 million and $1,963 million. Additionally, the seven segments contributed in a similar way to operating income – between $342 million and $507 million. In fiscal 2020, Illinois Tool Works generated $12.6 billion in revenue in total and a net income of $2,109 million.

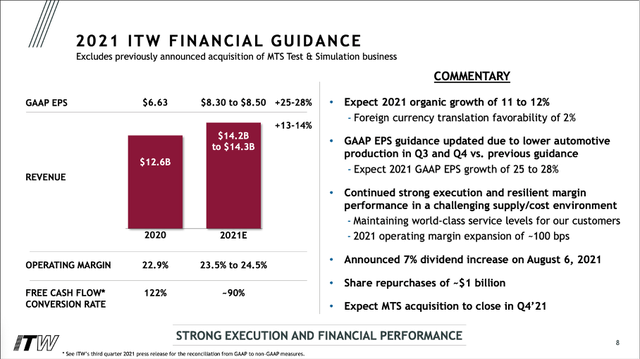

Financial Guidance Fiscal 2021

Financial Guidance Fiscal 2021

Illinois Tool Works Q3/21 Presentation

And for fiscal 2021, the company is expecting revenue to be in a range between $14.2 billion and $14.3 billion (resulting in 13-14% year-over-year growth) and earnings per share being in a range between $8.30 and $8.50 (resulting in 25% to 28% year-over-year growth).

When looking for aspects that contribute to a potential economic moat and might lead to a competitive advantage for Illinois Tool Works, we must mention the patents of Illinois Tool Works. At the end of fiscal 2020, the company had a portfolio of approximately 18,500 granted and pending patents with more than 1,900 new patent applications filed in 2020. Patents belong to the category of intangible assets and are a good way to keep competitors at bay.

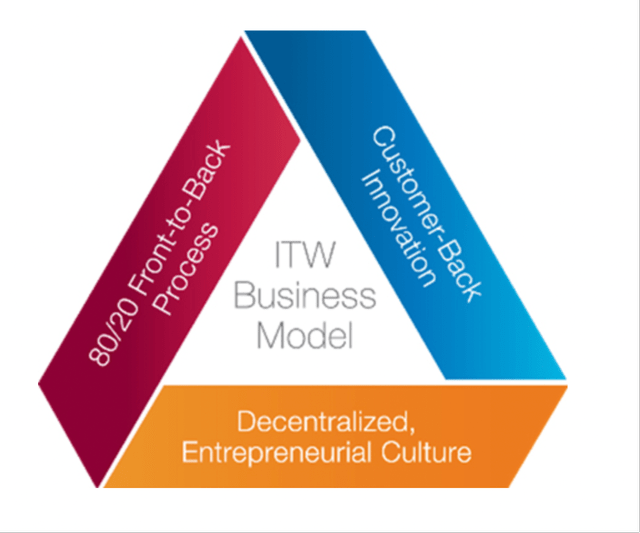

ITW Business Model

ITW Business Model

ITW Investor Relations

Management is also convinced, that its business model, which is consisting of three elements, is a huge competitive advantage for the business. The first element is the “80/20 Front-to-Back Process”, which defines how Illinois Tool Works is working (a unique set of proprietary tools and methodologies that the divisions use to structure and operate the business to maximize the performance and execution). The second element is the “Customer-Back Innovation”: ITW does not want to innovate from the research and development center out, but from the customer back. And the third and final element is the “Decentralized, Entrepreneurial Culture” as ITW empowers to think and act like entrepreneurs (also meaning, that they are accountable). Employees should be flexible within the company framework. And while a business strategy does not automatically imply a wide economic moat, it is certainly an important aspect.

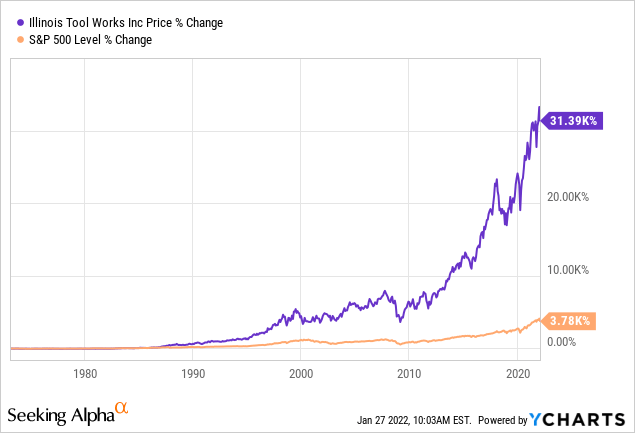

If a company has an economic moat around its business, this is also visible in different metrics, and we can start by looking at the share performance since the early 1970s. We see a clear outperformance of Illinois Tool Works compared to the S&P 500 (SPY) – while the S&P 500 increased “only” 3,780% during that time, ITW could increase 31,390% in the same timeframe (not including dividends). And I mentioned several times in the past, that the stock performance by itself could be misleading. Right now, we can find several assets, that are clearly outperforming the overall stock market – but are not a great investment. However, when a stock is outperforming the S&P 500 over such a long timeframe, it is a strong hint that we are dealing with a company that has a wide economic moat.

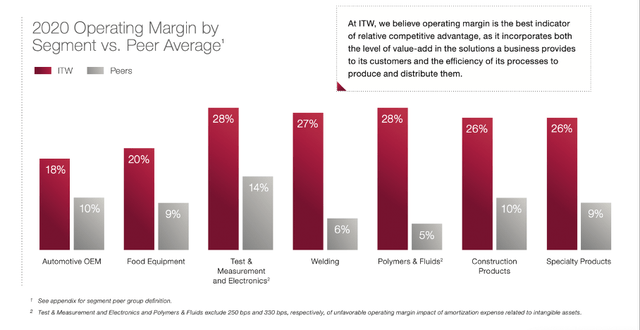

And in case of Illinois Tool Works, it is not just the outperformance of the stock. When looking at the operating margin of the different segments, Illinois Tool Works is clearly outperforming its peers. Especially in “Welding” as well as “Polymers & Fluids”, Illinois Tool Works has a much higher operating margin than its peers. And management sees this as the best indicator of relative competitive advantage.

ITW: Operating Margin Segments

ITW: Operating Margin Segments

ITW Annual Report

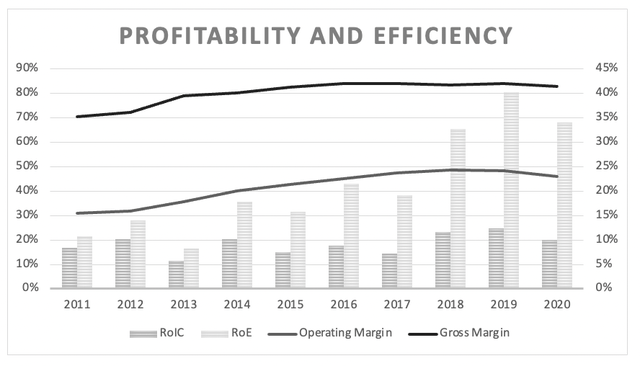

And when looking at the company’s gross and operating margin during the last ten years, we can see that ITW did not only outperform its peers, but it could also improve its margins over the last ten years – operating margin as well as gross margin. Over the last ten years, both margins also showed high levels of stability and consistency.

Illinois Tool Works: Margins and RoIC

Author’s work

Illinois Tool Works: Margins and RoIC

Author’s work

Aside from the company’s margins, we can also look at return on invested capital. On average, Illinois Tool Works reported a RoIC of 18.38% during the last decade. This is a rather high RoIC and clearly indicating, that ITW has a wide economic moat around its business.

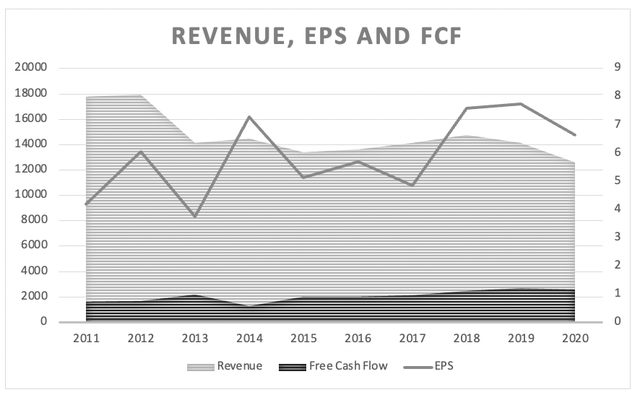

Aside from margins and return on invested capital, we can also focus on growth rates as a great business should also be able to grow with high levels of stability and consistency (it is not the most important aspect, but one we should not ignore). And when looking at the last ten years, the picture is not looking great. We see revenue declining with a CAGR of 2.3% during the last ten years, which is not a great sign.

Illinois Tools Works: Revenue, Earnings per share and free cash flow

Author’s work

Illinois Tools Works: Revenue, Earnings per share and free cash flow

Author’s work

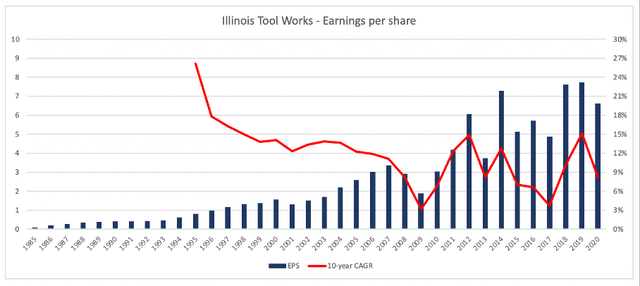

However, Illinois Tool Works divested parts of its business (leading to lower revenue) and earnings per share could still grow with a CAGR of 8.15% in the last ten years. And when looking at longer timeframes, the picture looks much better. Since 1985, earnings per share increased with a CAGR of 13.40%. Until the late 2000s, 10-year EPS CAGR constantly declined and in the last 10 years, the 10-year EPS CAGR fluctuated between 5% and 15%.

Illinois Tool Works: Earnings per share since 1985

Author’s work

Illinois Tool Works: Earnings per share since 1985

Author’s work

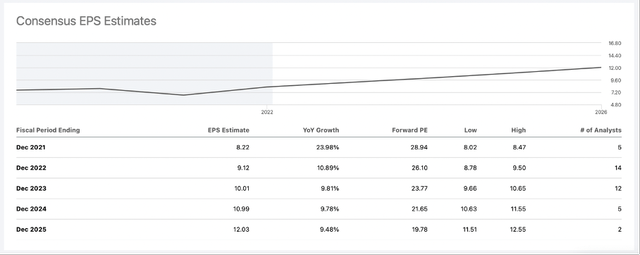

And when looking at the last 35 years, we can certainly make the case, that Illinois Tool Works should be able to grow with a higher pace – although growth slowed down, and the growth rates fluctuated a bit in the last ten years. Analysts also seem optimistic that Illinois Tool Works can grow with a high pace in the years to come – earnings per share are expected to grow with a CAGR of 9.86% in the next few years.

Illinois Tool Works: Earnings Estimates

Illinois Tool Works: Earnings Estimates

Seeking Alpha

And management also has its own long-term performance targets – expecting between 3% and 5% organic revenue growth and between 7% and 10% earnings per share growth.

ITW: Long-term performance targets

ITW Annual Report 202

ITW: Long-term performance targets

ITW Annual Report 202

Illinois Tool Works seems also interesting for dividend investors as it is one of the dividend kings with more than 50 years of consecutive dividend increases. And between 1990 and 2021, the company increased the dividend from $0.0826 to $4.72 resulting in a CAGR of 13.94% for the last three decades. And when looking at the last five years, the dividend was even increased with a CAGR of 14.48%. Right now, Illinois Tool Works is paying a quarterly dividend of $1.22, which is resulting in a dividend yield of 2.09%. And when using the expected earnings per share of $8.40 for fiscal 2021 and an annual dividend of $4.72, we get a payout ratio of 56% – a ratio that is rather high, but no reason to worry.

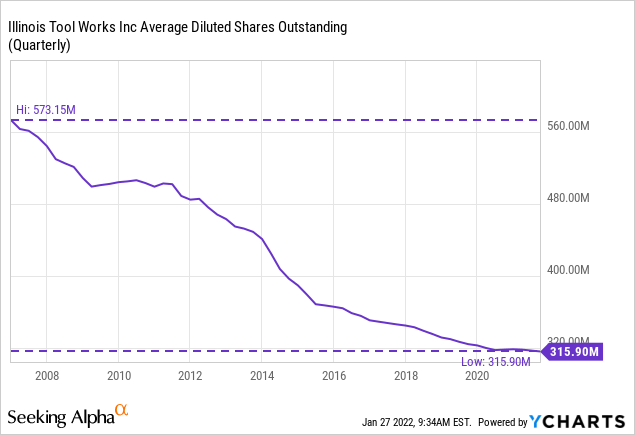

Aside from paying quarterly dividends, Illinois Tool Works is also using share buybacks and was constantly decreasing the number of outstanding shares during the last 15 years. Since 2007, Illinois Tool Works decreased the number of outstanding shares from 573.15 million back then to 315.90 million right now. This is resulting in a CAGR of 3.89% and the company decreased the number of shares outstanding with a rather aggressive pace in the last 15 years and share buybacks were clearly contributing to earnings per share growth.

And when looking at the company’s balance sheet, we don’t see a perfect one, but must neither worry about the company solvency and liquidity nor is the dividend in danger. On September 30, 2021, Illinois Tool Works had $579 million in short-term debt as well as $6,972 million in long-term debt on its balance sheet. When comparing the total debt to the total stockholder’s equity of $3,493 million we get a D/E ratio of 2.16, which is rather high. However, when comparing the total debt to the operating income of the last four quarters ($3,526 million) it would take only about two years to repay the outstanding debt, which is certainly acceptable for a company that can grow.

And we also must mention that Illinois Tool Works has $1,987 million in cash and cash equivalents on its balance sheet, which is enough to repay about 25% of the outstanding debt right away. Additionally, Illinois Tool Works also has $4,610 million in goodwill on its balance sheet – resulting in 29.7% of total assets ($15,517 million) being goodwill which is not great.

So far, we established, that Illinois Tool Works is a great business. But for Illinois Tool Works to be also a great investment, we must calculate an intrinsic value and compare it to the current stock price.

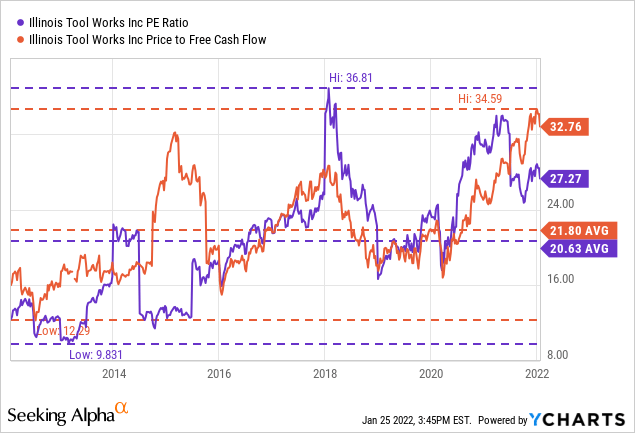

We can start by looking at the price-earnings ratio as well as price-free-cash-flow ratio and by looking at these two simple valuation metrics, Illinois Tool Works seems to be rather expensive. Right now, ITW is trading for a P/E ratio of 27.27, which is clearly above the 10-year average of 20.63 and although ITW has been trading for a higher P/E ratio (36.81) during the last ten years, the stock is rather expensive.

When looking at the price-free-cash-flow ratio, the stock is trading for 32.76 times free cash flow. This is clearly above the 10-year average of 21.80. And it is only slightly below the highest P/FCF of the last decade (which was 34.59).

And aside from simple valuation metrics, we can also calculate an intrinsic value by using a discount cash flow analysis. As basis for our calculation, we can use the free cash flow of the last four quarters ($2,271 million) and additionally, we assume 10% growth for the next decade (high end of the company’s long-term targets) followed by 6% growth till perpetuity. This leads to an intrinsic value of $238.54 for Illinois Tool Works (10% discount rate) and would make the stock fairly valued at this point.

We could also use the average free cash flow of the last five years, which is a bit higher than the free cash flow of the last four quarters ($2,364 million). When calculating with this free cash flow assumptions, we get an intrinsic value of $248.31 for Illinois Tool Works.

And while we could argue that Illinois Tool Works might be fairly valued, we also have to point out that we are using the higher end of the long-term performance targets and 10% growth is also above the 10-year EPS CAGR of the last decade. It seems possible that Illinois Tool Works could achieve 10% growth annually, but we should always include some margin of safety in our calculations and in my opinion, the stock is a bit too expensive right now to be a good investment.

Illinois Tool Works is without doubt a great business that outperformed over the last decades. Additionally, the company is a dividend king and is buying back shares with a high pace. And it also seems like Illinois Tool Works has a wide economic moat. But the current stock price is too high to be a great investment and Illinois Tool Works will therefore just remain on our watchlist.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.