Koshiro Kiyota/iStock via Getty Images

Koshiro Kiyota/iStock via Getty Images

The education technology (aka, edtech) industry is unfavored as investors generally render a verdict of guilt by association. But we shouldn’t toss all public edtech companies into the same undifferentiated bucket. I’ve previously linked to HolonIQ’s excellent taxonomy of 50 different business models. If you want to peer into the future, we’ll need to avoid some assumptions. If traditional college enrollment further declines, some edtech will be procyclical with the trend, but some disruptors will be countercyclical. Publishing content is a tough, hard-to-scale business, but not all edtech models are saddled with high content production costs. Coursera (NYSE:COUR) does not create its own content (this is a common misperception, I’ve observed in SA comments). Rather, it is a three-sided platform for learners, teachers and institutions (both universities and corporations). Think Netflix (NASDAQ:NFLX) as platform, but prior to 2013, when Netflix started investing in original content. Coursera has none of the stranded assets that burden middle-ranked, administratively-bloated American universities.

The exciting growth will happen outside the high, expensive garden walls of a traditional American university. It will happen in offices, homes, on the train between ride between the home and office, in coffee shops, in virtual spaces, on phones while waiting-in-line. The customers will transcend age brackets and country borders, they already do. The “signal prestige” of an Ivy League degree will co-exist with learning models that prove themselves by helping their customers secure high-paying jobs at prestigious companies. The ultimate prestige is a high-paying job earned by demonstrating a portfolio of skills. Increasingly, cost and location will not be a barrier to developing these skills. The only barriers will be a supportive culture/context, high-speed internet and self-motivation.

Last week saw 2U (TWOU) plunge >40% after the earnings print. 2U is generally an online program manager (OPM) – see Phil on EdTech for great commentary – who is trying to mutate into more of a platform with the acquisition of edX. Coursera was always a platform, and this platform is powered by its least understood (by investors) asset, its skills graph. A massive data moat will power its machine learning models, and may render this the most AI-type company in the talent sub-theme of the future of work theme (my three sub-themes in the future of work are education, marketplace and work management). My previous article discussed the skills graph, and I also wrote an update after 21Q3.

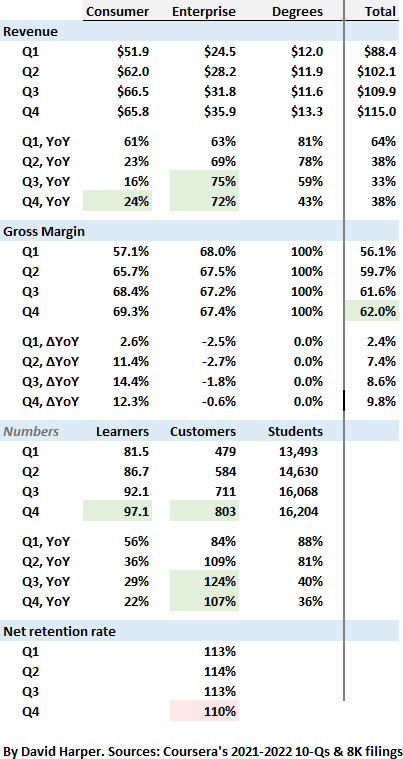

Below is my updated dashboard. I highlighted a few cells with red/green color. This dashboard does not focus on current profitability; it omits the expense pattern and cash flows that are obviously important. Green cells indicate positive developments. On the other hand, among my dashboard metrics, my only RED metric is the drop in the Enterprise segment’s net retention rate.

Source: SEC filings via BamSEC.com

Source: SEC filings via BamSEC.com

As you can see, the quarter contributes another data point to the thesis that Coursera’s growth is predictably durable, and the path to profitability is gradually coming into focus. At the top line, the 2021 full-year revenue of $415 million was +41% growth; the midpoint of the 2021 revenue guidance is +30% to ~$540 million.

Consumer segment: Coursera now has 97.1 million registered Consumer learners. A pleasant, small surprise to me was +24% in the Consumer segment, a bit ahead of its long-term pace. Management is guiding +20% revenue growth for this segment for 2022. Consumer is the least predictable, but let’s keep in mind this is the “top of the funnel.” Half of the Degrees students start as registered Consumer learners, and an increasing Consumer base will compress Coursera’s sales and marketing expense (S&M) over time. The S&M spend is arguably the most important doubters’ metric; improvement here is vital to decoupling Coursera from its public EdTech peers in investors’ perception.

Enterprise segment: Enterprise customers doubled over the year to 803. I highlighted (in green above) the 70+% YoY growth rates, and management says that continue to see >50% growth going forward. My only red mark on the dashboard (above) is the drop in Enterprise net retention, from a previous high of 124% to 107% in 21Q4. I remind investors that Enterprise includes three verticals because it happens to be the case that all three are performing and all three have big TAMs: Business, Government, and Campus. This quarter, Coursera for Government signed two “8-figure multiyear contracts” with (i) the Abu Dhabi School of Government and (ii) the National eLearning Center run by the Kingdom of Saudi Arabia.

Degrees segment: Year-over-year (YoY) growth in revenue and students, respectively, was 43% and 36%. This segment added one bachelor of science and four master’s degrees. I’ve noticed some SA commenters worry that a “Coursera degree” might not be as relevant (in the job market) or prestigious as – I hesitate to use this term – an Ivy League degree or a university degree with similar prestige. But Coursera does not originate its own curriculum. For example, it partners with most (almost all, I think) of the Ivy League schools. The CEO keeps repeating they are “more of enabler than a disrupter” to emphasize they are helping to transform their University partners (although I think it’s important to understand why they are both). This segment has no content costs, hence its 100% gross margins. This quarter’s new master’s degrees include:

Do we think these are relevant skills: applied data analytics, engineering, cyber security? (That’s a rhetorical question). I could not be less worried about Coursera’s relevance in the STEM-anchored future of education. Prestige? Prestigious is getting a job at Google (NASDAQ:GOOG), Meta (NASDAQ:FB), or Salesforce (NYSE:CRM), for example. Each offers Professional Certificates on Coursera. For example, here is Google’s IT Support Professional Certificate; here is Meta’s (Facebook’s) Social Media Marketing Professional Certificate.

As I’ve mentioned every time I write about Coursera, the least understood but most powerful ingredient in their long-term moat is their skills graph. The skills graph is neither directly visible to the public, nor trivial to define. Its future potential is impossible to quantify. Almost everybody in EdTech wants to help learners add job-relevant skills, generally in a stackable (and convenient) way. But Coursera’s machine learning models will be able to do this with more data.

During the quarter, Coursera launched LevelSets, which are skill assessments served by some of these machine learning models. These assessments guide learners to the relevant job-based learning programs (which are powered by SkillSets).

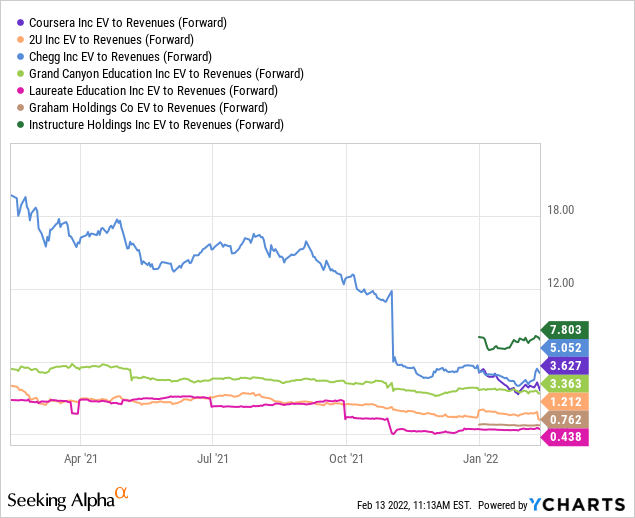

Last October, I looked at EV to Revenue and acknowledged that “it’s possible to make an argument that Coursera is not currently cheap, even after its steady decline since mid-June.” The price action continues to be sour. Here is an update (I switch to forward revenues, but the relative valuation ranks are similar). My equities portfolio added a position in Instructure (in December), but I exited my entire Chegg (NYSE:CHGG) position in September.

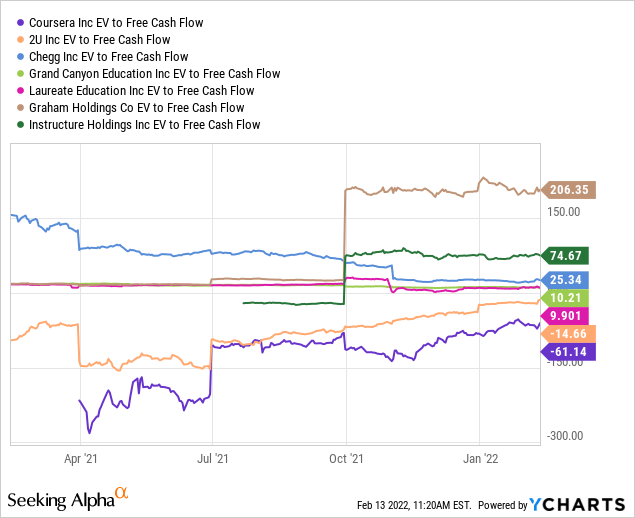

To get a balanced picture, we can also look at EV to free cash flow (FCF) where you can see Coursera is way at the bottom of this list.

These charts refer us to the two (or three) key problems with the stock:

These drawbacks explain why this, to me, was never presented to you as a good short-term investment. While I disapprove of this ESO dilution profile (and of course, I do not like the price action), my long-term multi-year thesis is unchanged. The durable, secular growth will grow the top-of-funnel Consumer brand, which will gradually compress the operating expenses (especially marketing) and assist the ongoing shift in mix such that there is a path to profitability. But it’s still early in this particular game.

I wrote many words to tell you simply that the 21Q4 print confirms we are pretty much where we want to be with this investment. I’m totally sympathetic to those who would avoid this investment based on the 2022 (and 2023) EBITDA profile. But I have long-term horizon for this stock. I’m investing in an eventual $50 billion market cap company because it’s increasingly obvious to me this will be the #1 platform in the space. This is a paradox of technology investing: for many tech companies, it’s utterly ridiculous to think we can see years into their future. The disruption (by definition) cannot be seen coming so the moats are insecure. But Coursera’s application of technology and data to a hard-to-scale business (learning) is one of those platforms where we can accumulate early evidence of a durable long-term business.

However, I am throwing a yellow flag on what appears to be an excessive 2021 ESO dilution profile (previously cited as a mere risk factor along with valuation risk). The minus in my “A-” grade is specifically due to the option dilution.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of COUR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.