Both RBI and the country’s public need to prepare themselves for the long haul as inflation-targeting finally takes priority

The German Bundesbank has long been the envy of central banks across the world. To understand why, just recall the words of European Commission President Jacques Delors 30 years ago: “Not all Germans believe in God, but they all believe in the Bundesbank.” Sure, that was before the European Central Bank made the Bundesbank largely redundant. Even so, today, as central banks scramble to salvage their reputations amid the debris of shattered inflation projections, they want, above all, to be seen as credible.

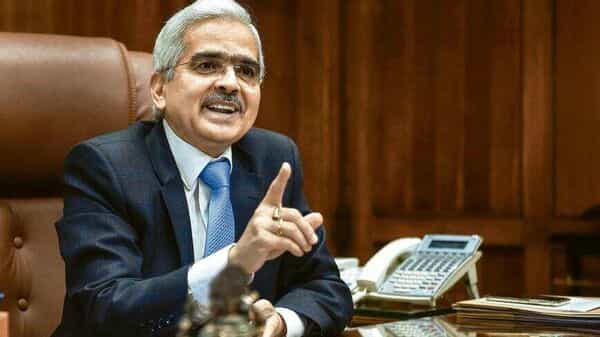

Keep the faith, said the Reserve Bank of India (RBI) Governor Shaktikanta Das, if not in quite as many words, while recalling the words of the Father of the Nation, Mahatma Gandhi’s, “It is faith that steers us through stormy seas, faith that moves mountains and faith that jumps across the ocean” at the conclusion of his monetary policy statement. The message was clear. The central bank has begun the policy normalization process and will (hopefully) stay the course.

This was reiterated at the press conference later in the day, when the governor unambiguously declared a change in RBI’s priorities. Never mind the status quo on the policy rate (4%) and stance (accommodative). In contrast to the earlier practice of putting ‘growth before inflation’, RBI would henceforth sequence ‘inflation before growth’. That is as close to an announcement of RBI’s changed priorities as can be expected from a bank that has been notoriously reluctant to shift gear.

To be sure, Governor Das did not use the word ‘normalization’. But the impact of the new Standing Deposit Facility at which banks can park surplus funds (without collateral) with RBI at 3.75%, while positioning the MSF (Marginal Standing Facility) at 4.25 % as the upper end of the new Liquidity Adjustment Facility (LAF) corridor is nothing if not the start of the ‘normalization’ process (the width of the corridor is now reduced to its pre-covid level of 50 basis points, down from 65 basis points earlier).

One could argue, of course, that the reduction in the LAF corridor, as well as the more nuanced statement from Governor Das are baby steps, given the dramatic shift in the growth-versus-inflation trade-off. Thus, RBI’s growth estimate for the current fiscal is down from 7.8% to 7.2%, while its inflation estimate is up from 4.5% to 5.7%. A policy suited to earlier estimates had to be modified. Hence the change in choice of words and introduction of a new facility where banks can park their excess liquidity.

The change in the choice of words is not insignificant. Contrast the far more nuanced, “The MPC also decided unanimously to remain accommodative while focusing on withdrawal of accommodation (emphasis added) to ensure that inflation remains within the target going forward, while supporting growth,” in its latest statement with the February 2022 statement. Then there was no mention of ‘withdrawal of accommodation’. On the contrary! Then RBI’s position was that “forward guidance of accommodative stance” would be maintained “as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward”.

Presumably the tectonic shift in the macro- economic scenario left RBI with few options. Remember, risks remain high. The US Federal Reserve is expected to announce a much larger increase (50 basis points) in the Fed rate at its upcoming meeting in May and commence a more aggressive withdrawal of liquidity. At the same time, the continuance of the war in Europe will keep oil and other commodity prices high. Given the much larger increase in inflation estimates compared to the reduction in growth estimates, there was really no option but to start this course correction. Especially since monetary policy acts with long and often indeterminable lags.

No doubt, an improvement in capacity utilization—from 68.3% to 72.4%—as well as better external sector strength has given RBI the courage to make the much-needed shift in priorities. But given that RBI has been late to heed the warning signals that had been flashing red for a while now, it will take a while before it yields results.

The challenge now is for both RBI and the public to keep the faith; to persevere with the new set of priorities till average (rather than point-to-point) inflation reverts to the mid-point of its target range —which is 4%. This is not going to be easy. Growth is seldom linear, and, as with any course correction, there will be some pain. Inflation is like a tube of toothpaste; once pushed out, it is near-impossible to be put back! The yield on risk-free government securities will move up and with that interest rates across the spectrum will also rise. Both government (which has an ambitious first-half borrowing target) and other borrowers will have to pay a higher rate of interest. In tandem, depositors, who have long suffered a negative real rate of interest on their savings, will benefit.

To complete the journey it has embarked upon, RBI will need to be both nuanced and nimble—a tall order for an institution that turned 87 on 1 April.

Mythili Bhusnurmath is a senior journalist and former central banker

Download the App to get 14 days of unlimited access to Mint Premium absolutely free!

Log in to our website to save your bookmarks. It’ll just take a moment.

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

You are now subscribed to our newsletters. In case you can’t find any email from our side, please check the spam folder.

This is a subscriber only feature Subscribe Now to get daily updates on WhatsApp