Washington — More Americans applied for unemployment benefits last week but the total number of people collecting jobless aid is at its lowest level in more than 50 years.

Jobless claims in the U.S. rose by 19,000 to 200,000 for the week ending April 30, the Labor Department reported Thursday. First-time applications generally reflect the number of layoffs.

The four-week average for claims, which softens some of the weekly volatility, rose 8,000 from the previous week to 188,000.

The total number of Americans collecting jobless benefits for the week ending April 23 fell by 19,000 from the previous week, to 1,384,000. That’s the fewest since January 17, 1970.

American workers are experiencing historically strong job security two years after the coronavirus pandemic plunged the economy into a brief but devastating recession. Weekly applications for unemployment aid have been consistently below the pre-pandemic level of 225,000 for most of this year, even as the overall economy contracted.

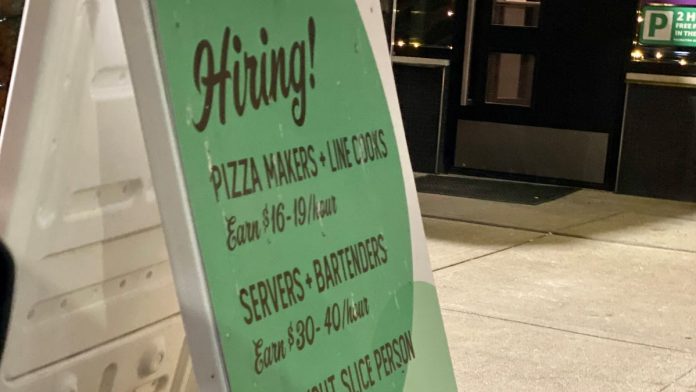

On Tuesday, the Bureau of Labor Statistics reported that U.S. employers posted a record 11.5 million job openings in March — an unprecedented two job openings for every person who is unemployed. A record 4.5 million Americans quit their jobs in March — a sign that they are confident they can find better pay or improved working conditions elsewhere.

Employers have added an average of more than 540,000 jobs a month for the past year, pushing the unemployment rate down to 3.6%. The Labor Department is expected to report Friday that the economy generated another 400,000 new jobs in April, according to a survey by the data firm FactSet. That would mark an unprecedented 12th straight month that hiring has come in at 400,000 or more.

The only thing hotter than the job market is inflation. On Wednesday, the Federal Reserve intensified its fight against the worst inflation in 40 years by raising its benchmark short-term interest rate by a half-percentage point — its most aggressive move since 2000 — and signaling further large rate hikes to come.

The increase in the Fed’s key rate raised it to a range of 0.75% to 1%, the highest point since the pandemic struck two years ago.

The Commerce Department reported last month that the U.S. economy shrank last quarter for the first time since the pandemic recession struck two years ago, contracting at a 1.4% annual rate, even as consumers and businesses kept spending in a sign of underlying resilience.