PeopleImages/E+ via Getty Images

PeopleImages/E+ via Getty Images

For anyone who’s ever looked into taking online courses, perhaps even in something like accounting and finance to get the hang of investing, Udemy Inc. (NASDAQ:UDMY) might be a company you are already familiar with. The model is straightforward: Udemy provides a platform on which courses can be published by pretty much anyone for almost anything, from woodworking to accounting. Udemy takes a cut of all revenues made by the courses on the platform, and take a bigger cut if the students came to the course organically by searching through Udemy. Udemy also offers selected courses to businesses. While platform economics can be supremely attractive due to network effects, especially in areas like digital education which has received a powerful impulse due to COVID-19, we still have to determine whether at the current price, which is still very much around IPO levels, the company is a worthwhile investment. But first, a little background.

It is a typical business in the unscaling paradigm, whereby content creation is put into the hands of the many rather than the few, and the efficient player is the platform. The idea is very in vogue, and Udemy clearly saw fit to IPO just now on the 29th October at a time where their model would hopefully be given attention. As of now the price trades barely above the IPO price, which means from Udemy’s point of view, the IPO was a great success. Primary investors will not be as happy, likely having expected meaningful gains upon landing on public markets due to Udemy’s quite prolific brand.

Currently, the ownership is in the hands of a couple of independent directors of the board, as well as Insight Ventures and Naspers Ltd, which is a publicly listed South African company that holds a venture portfolio. Basically all the common stock in the business is subjected to lock-up agreements of 180 days, with only very small holders, less than 4% of shares, able to receive discretionary releases from lock-ups without public notice. So major venture holders like Insight Ventures and to a lesser extent Naspers, which together hold more than half of the shares outstanding with stakes from very early stages of the business, might be inclined to lock in those gains as soon as the lock-up period expires, especially given the general threat of legislation for higher capital gains taxes under the Biden administration.

The business model is fairly straightforward. They provide a platform that hosts courses by anyone who’s willing to make them. Users in the market for courses can then search the various categories on the Udemy website and buy access to courses on a one-time basis where they are then able to watch the videos associated with the courses and do the tests and quizzes. Some courses dominate categories through social proof, quality and also the Udemy search parameters, which of course has the purpose of maximising overall sales of courses in order to take a substantial commission of about 50% for organically acquired courses. Courses sold through coupons issued by the course authors entitle Udemy only to a small 2-3% commission.

The other side of the marketplace is to businesses, including Fortune 500 companies, where what we have discussed so far is the direct to consumer channel. The Udemy Business segment (UB) is constituted of contracts that are made on a case by case basis where a curated set of courses in a catalogue are offered over a subscription term to large companies to be able to offer their employees. While most of these contracts are one-year, a growing proportion are multi-year contracts. The marketing here is primarily direct and therefore pricing is variable, although there are self-service features and the ability for this segment to grow by organic growth through digital marketing, although we expect this to be a limited marketing channel in the long-term.

The model’s most attractive characteristic is that it benefits from network economics on both sides of the marketplace, driven by the direct to consumer market. The availability of many courses, the high level of traffic and prolific Udemy brand all feed into each other. On the UB side, a wide availability of courses, of increasingly high quality in order to compete, means a more valuable catalogue to choose from when offering courses for training at companies. While some other authors might disagree, Udemy’s early mover position in a business with network effects is a durable advantage, however, not any more durable than other early adopters. New entrants are not a massive threat in our opinion. All these effects are also bolstered by the typical use of personalisation and other recommendation algorithms to maximise learner retention and engagement.

Of course the cardinal question is whether Udemy’s valuation is fair. Firstly, we note massive growth in revenues both on a longer term and shorter term basis.

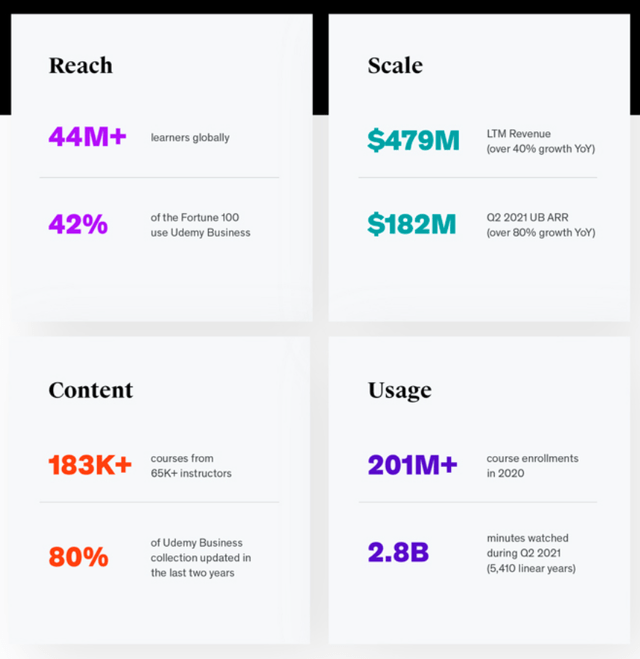

(Source: Prospectus)

The reach is large, but knowing the opportunity for learning at scale, this number could be much larger. While the revenue growth is impressive and encouraging, ultimately valuations are based on capacity to generate cash. The following is a spread of multiples for Udemy and competitors.

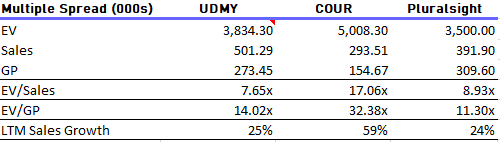

(Source: VTS and relevant SEC prospectuses, Pluralsight take-private data)

Coursera (COUR) is clearly the highest valued of them, but also growing the most effectively on great partnerships with prestigious education institutions under the COVID-19 impulse. Coursera’s stock has been languishing even, due to reports from Chegg (CHGG), another digital education company, that the business was even contracting after the COVID-19 boom with enrollment downturn.

Udemy and Pluralsight achieved slower growth in the recent periods, with each having higher overall sales than Coursera. Pluralsight, which was taken private by Vista Equity Partners at a $3.5 billion EV almost a year ago, is the more focused on business customers of the companies above. Udemy, with about 33% of sales in UB, is the leader in terms of the DTC market. They also compete with Skillshare whose finances are undisclosed but are likely much smaller than Udemy’s, which offers quite a similar similar suite of specialised courses. Overall, the Udemy valuation and the Pluralsight take private valuation from last year are more or less the same at the moment, even though the GP profile of Pluralsight is superior. Vista secured a good deal evidently.

With the business revenues being the most recurring in nature, they are of the highest value. Udemy’s UB segment is growing at almost 80% YoY as of their prospectus-reported financials. Right now, Coursera’s recurring revenue streams in the form of Coursera Plus is at almost 25% of revenue, with some analysts even linking the growth of this segment to the overall decline in community college enrollments. Clearly, on a relative basis, the question of valuation lies between the two of them, however, the offers are quite different. Coursera is a play, really, on online education, meaning the scaling of traditional education to online video classes, and this more centralised instructor focus as well as institution defined courses reflects somewhat on their lesser marketing burden, where the prestige of institutions likely makes driving traffic more efficient especially by SEO. Udemy sources courses from a highly decentralised base of instructors, who may or may not have extensive and verifiable credentials in the DTC segment, where the courses they choose to offer are far more esoteric, and where only the UB courses are vetted. The gross margin profiles are similar, but the models and products are quite different on the instruction side.

However, given the similar financial profile and differentiation between recurring and non-recurring revenue, our opinion is that Udemy looks cheap. They are less likely to experience enrollment contraction that is more of a risk to explicit online education companies, their recurring revenue is growing massively and is already 33% of revenue, and their GM profile is the same as Coursera’s. With a multiple almost a third of COUR’s on sales and a half on GP, UDMY looks reasonably cheap even though Coursera has been growing more handsomely. Indeed, even compounding GP for a few years at the current 25% rates for UDMY, the multiple contracts very quickly to one of a mature company. With rates of growth likely to hold for a while, and with the revenue mix skewing towards the more valuable channel, things do not look bad for UDMY. However, that is not to say Coursera is not attractive either.

Right now, there are network effects benefiting all the major enterprise and DTC players in platforming courses. We are likely to see an ongoing oligopoly, where smaller companies like Skillshare are having to resort to more niche online marketing measures to create a base, and might struggle to scale massively against the more prolific players. The overall market opportunity is clearly large, with the scope for online learning being massive, with UDMY’s estimate being that the market across enterprise and DTC being over $200 billion in size, with the total market of online education being in the trillions. While we think that UDMY’s multiple seems reasonable compared to other peers with similar financial, albeit somewhat different business profiles, relative valuations can of course fail us. We need continued growth for the current multiples to be at all reasonable, and earnings are still not ample at all, even non-existent still in the case of Udemy and COUR. Expectations are not particularly low. For us to get multiples more fair to a recurring revenue business, which are fundamentally cash flow generative, we need the sales multiples to at least drop by half at least. Which means we need 3-4 years of current Udemy growth to persist. Not a particularly tall order, but disappointments in this horizon will likely lead to weaker returns for UDMY investors. Nonetheless, the market is attractive, the rates are high, the financial profile is improving with UDMY business which incurs a lesser marketing burden than DTC marketing, and the multiple is not excessive. Overall, Udemy is a speculative buy even for a value investor thanks to robust demand side economics and proven growth, but maybe wait for the lock-up periods to expire as of 180 days from IPO, because venture holders might exit.

If you thought our angle on this company was interesting, you may want to check out our service, The Value Lab. We focus on long-only value strategies, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our group of buy-side and sell-side experienced analysts will have lots to talk about. Give our no-strings-attached free trial a try to see if it’s for you.

This article was written by

Valkyrie Trading Society, formerly Bocconi’s Valkyrie Trading Society, is a society of Alumni that have graduated into successful financial services careers. We seek to provide honest and global dividend-value insight leveraging our group’s broad and deep experience in finance to contribute to Seeking Alpha. We provide more obscure research on our marketplace service, The Value Lab, covering value stocks in global developed markets.

DISCLOSURE: All of our articles are a matter of opinion, informed as they might be, and must be treated as such. We take no responsibility for your investments but wish you best of luck.

DISCLOSURE: Some of Valkyrie’s members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab and account. Formerly Bocconi’s Valkyrie Trading Society.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.