anyaberkut/iStock via Getty Images

anyaberkut/iStock via Getty Images

Purely based on my risk and valuation analysis, Udemy (NASDAQ: NASDAQ:UDMY) is an attractive high reward/high-risk stock. My advice is to “hold” however, as I can see the stock drop even further in the short term due to investors dropping stocks with a high-risk level in current insecure times.

Introducing Udemy and its industry

Stock performance

Competition and competitive advantages

Growth

Margins

Risk

Valuation

Final judgment

Udemy pioneered a unique approach to education that allows real-world professionals to develop and update relevant information on its platform, making it easily available to learners all around the world. Its teachers create material to fulfill student demand on Udemy, which is a two-sided marketplace. Udemy’s customer base can be categorized into two groups, consumers and businesses.

Its services are displayed more visually in the image below:

S-1 Form

S-1 Form

Udemy is part of the online education market. I selected several companies which have exposure to this market to create an industry proxy to better benchmark Udemy’s performances throughout this article. Furthermore, in most of this article, Coursera is used as a benchmark as well, since it is one of Udemy’s primary competitors and has similar characteristics.

Selection of companies with exposure to the online education market:

Company Name

Symbol

Skillsoft Corp.

(NYSE: SKIL)

Coursera, Inc.

(NYSE: COUR)

2U, Inc.

(NASDAQ: TWOU)

Chegg, Inc.

(NYSE: CHGG)

Stride, Inc.

(NYSE: LRN)

Ambow Education Holding Ltd.

(NYSEAMERICAN: AMBO)

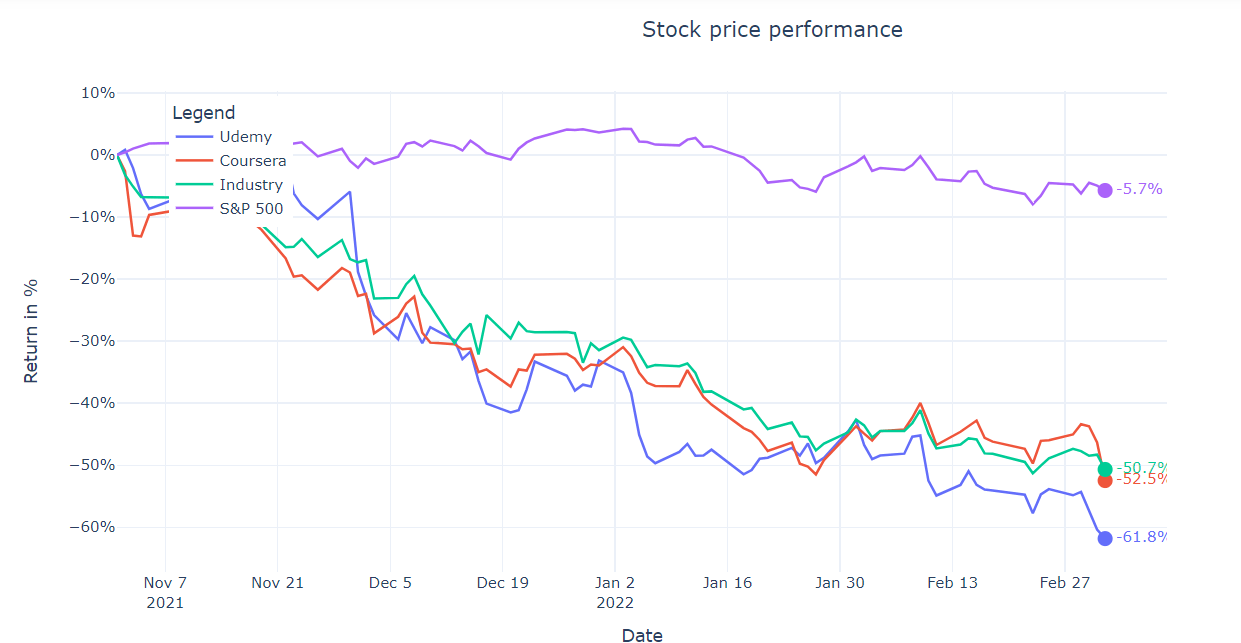

I computed a plot of the stock returns of the time period since Udemy’s IPO till now.

Prices from Yahoo Finance

Prices from Yahoo Finance

The industry has significantly underperformed the market. This especially applies to Udemy, losing more than 60% since its IPO. Part of the underperformance might be a switch in sentiment after an enormous rise in valuation for internet (education) related stocks since the beginning of the Covid pandemic. Furthermore, competition has intensified and revenue growth has dropped in comparison to the beginning of Covid, scaring off investors.

According to Udemy’s S-1 form, competition can include:

Corporate training offerings, such as those from Pluralsight, LinkedIn Learning, and Skillsoft.

Direct-to-consumer training offerings, such as those from Coursera and edX.

Specialized content training offerings, such as those from A Cloud Guru and Skillshare.

Online free resources used to gather and share knowledge and skills.

Extremely large and respected education groups such as Pearson are also looking to get their share of the digital education market, according to a Financial Times article. The online education competition is extremely intense, as many different providers invest a lot to maximize their market share. Moreover, consumers can very easily switch between providers if they are not satisfied anymore.

Udemy believes its business model offers the following advantages over these competitors:

Its marketplace model has created a vibrant ecosystem of individual learners, organizations, and instructors

Its learner base of over 44 million individuals

Its network of over 65,000 instructors, many of whom are expert practitioners in their fields

Its data and analytics platform continuously improves as they scale

Its ability to provide individual learners with relevant content based on their interests and objectives, with over 183,000 courses covering a broad array of subjects and over 70,000 courses in local languages as of June 30, 2021

Its global presence and brand recognition

According to its Q3 earnings call, they are trusted by extremely large companies such as Citibank and multiple other Fortune 500 companies, which shows the quality of their reputation.

Research has shown that future business growth is very dependent on industry growth. According to a Research and Markets report, the global education technology market is expected to grow at a CAGR (compounded annual growth rate) of 15.5% by 2027.

Part of the growth can be explained by an increasing need for reskilling. According to a McKinsey Global Survey on future labor requirements, nearly nine out of ten executives and managers indicate their companies are either experiencing or anticipating skill shortfalls in the next five years.

Recent growth rates in percentages

Stock

Revenue Growth (Quarterly YoY)

Revenue Growth (TTM YoY)

Revenue Growth Rate (3Y)

Udemy

25.3

20.53

nan

Coursera

38.07

41.49

nan

Industry

11.98

21.28

25.34

Source: Seeking Alpha, income statement and earnings

The industry had a really robust growth rate for the last 3 years, driven by mostly the Covid pandemic.

Udemy had a decent growth rate in the last 12 months but had troubles keeping up the high growth of consumer revenue as it was difficult to top the revenue numbers of the beginning of the Covid pandemic. According to Q3 2021 earnings call, consumer revenue was down 13 % year-over-year in Q3. In Q4, consumer revenue was up 3% year-over-year, stabilizing a bit. On the other hand, Udemy did really well with its business segment, which was up 81% year-over-year in Q4. For comparison, Coursera’s consumer revenue was up 24% and business/enterprise revenue 72%, which confirms again the intensity of the competition.

Growth estimates by analysts in %

Stock

Revenue Current Year

Revenue Next Year

Earnings Current Year

Earnings Next Year

Udemy

20.7

23.6

17.3

17.7

Coursera

29.7

24.8

4.3

18.2

Industry

10.9

12.9

2.95

20.5

Source: Analyst estimates from Seeking Alpha

Analysts expect that this year and next year Udemy will grow at a lower rate than Coursera, but at a significantly higher rate than the industry. Management expects for the fiscal year 2022 a business revenue growth of 60% to 66% year-over-year, and consumer revenue down 6% to flat year-over-year. They expect the business revenue to represent 50% of the total revenue.

Udemy is transforming its strategy to be more focused on businesses, which seems to be a very attractive segment, growth and gross margin wise. However, this is also a very competitive segment, as we saw with the growth rates of Coursera.

Catalysts for future growth are its investments in geographical expansion: They’ve started partnerships to get more exposure in Korea, China, and parts of Africa. Furthermore, it invested a lot in AI and machine learning which is used in matching, recommendations, and pricing engine.

Revenue growth means nothing without knowing the quality of the margins. I computed several key margins for Udemy and its industry. The first number in the cells in the following table refers to Udemy, while the number between the parentheses refers to the median of the industry.

Accounting item as % of revenue: Udemy (Median Industry)

Accounting Item

2021

2020

2019

Gross Profit

54.45 (60.07)

51.33 (52.69)

48.07 (51.42)

Operating Expense

69.0 (57.1)

68.39 (59.31)

72.68 (73.21)

Normalized EBITDA

-11.6 (-3.72)

-14.5 (5.62)

-21.46 (6.02)

Normalized Income

-14.96 (-13.59)

-18.06 (-12.7)

-25.22 (-2.32)

Source: Seeking Alpha income statement

While Udemy’s gross profit has been increasing and is expected to increase due to the larger part of the business segment revenue, the gross margin is lower than the industry margin. Furthermore, its operating expenses are higher than the industry.

This lower margin and higher operating expenses resulted in a negative normalized EBITDA of 11.6%, compared to negative 3.7% of the market. Udemy saw its normalized EBITDA increase over the years, however.

Before we get into the valuation of the stock, I will touch upon the risks of owning Udemy.

Key risk measures

Stock

52W Beta, daily

Market Correl

Debt/Equity %

Udemy

1.71

0.42

nan

Industry

1.35

0.65

66.92

Source: Yahoo Finance prices and Seeking Alpha

Udemy’s beta is high, showing that it’s really sensitive to market movements. Correlation to the market is quite low, indicating a good additional diversification for a portfolio. Furthermore, debt is zero.

Another risk factor is its extremely negative momentum, having lost almost 60% in a few months. Especially with the current chaotic market, growth stocks, no matter their value, can continue their negative momentum for a while, resulting in a high short-term price decline.

In the longer term, risks are the intense competition, which could press its future growth and all margins to under the expected statistics, resulting in significant potential losses.

All the analysis up to this part could be used to estimate a fair value and compare it with the market value. I have computed several key valuation metrics.

Key valuation measures

Stock

Enterprise Value/Revenue

Enterprise Value/EBITDA

Enterprise Value/Gross Profit

Enterprise Value/Gross Profit

Forward PS

Forward PE

Udemy

2.58

-22.28

4.74

4.74

2.42

-22.68

Coursera

4.84

-15.65

8.06

8.06

4.18

-54.83

Industry

1.61

-8.03

3.29

3.29

1.16

-20.61

Source: Seeking Alpha

Udemy has higher enterprise value multiples than the market, which makes sense as their expected growth rate is much higher. Notably, Udemy is significantly cheaper than Coursera.

I computed a sensitivity analysis to see what these valuations could look like with several assumed growth rates and gross margins. I used gross margin as a profitability proxy instead of EBITDA or earnings as it makes more sense for a relatively young industry that invests heavily resulting in high operating expenses.

The left column shows the low, best, and high estimates of the gross margin after 5 years, while the top row shows different possible revenue CAGRs.

As the best estimate gross margin, I used 60%, which is above its current margin, in line with the expected increased gross margin as a result of increasing business revenue. The best estimate of annual revenue growth is based on the current year and next year’s estimate from the analysts, and then let it decelerate to 18% after 5 years.

5-year forward EV/EBITDA valuation estimations of Udemy

Annual Revenue Growth

18.0%

20.0%

22.0%

Gross Margin

55.0%

2.05

1.89

1.74

60.0%

1.88

1.73

1.59

65.0%

1.73

1.6

1.47

Source: Growth and margin estimations from the author, based on growth and margin analysis

This results in the best estimate 5-year forward EV / gross profit of 1.73.

For comparison: the industry with its current valuation, a best estimate gross margin of 60%, and annual revenue growth of 12.50% has a 5-year forward multiple of 3.04. The median market 5-year forward multiple is 4.7.

As Udemy could achieve higher longer-term gross profit, it wouldn’t be too crazy to say that its 5-year forward multiple could trade at 1.5x-2x the market, which means a fair 5-year forward EV/gross profit of 7.05 to 9.4. The potential return would be the difference between the 5-year expected actual forward of 1.73 and the 5-year expected fair forward, which would theoretically yield a return of 406% to 533%.

However, these are the optimistic, high estimate “fair” returns. It’s not clear when, or even if, a positive EBITDA will be achieved, as competition could significantly push down the profit margins. The intense competition could also push down any excess growth. Thus, the downside is large as well.

Udemy’s stock lost more than 60% of its value in a short time. The cut has resulted in a cheap current EV / gross profit valuation now, but even more so for the 5-year forward multiple. With a potential long-term growth future, Udemy could become a multi-bagger. However, as with many potential high-reward stocks, its risk is high as well, as indicated by the 1.77 beta. Intense competition and its impacts could lead to a significant further drop in stock price.

Personally, I am not buying this stock in the short term due to its risk level. In the chaotic market that we are in right now, people want to get rid of stocks that are not safe to hold. Udemy, unfortunately, holds that condition due to its extremely negative momentum, its negative industry momentum, negative EBITDA, decreasing consumer revenue, and the questions on the impact of increasing competition.

I can see this stock drop more in the short term, which helps push the valuation drop down even more.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.