demaerre/iStock via Getty Images

demaerre/iStock via Getty Images

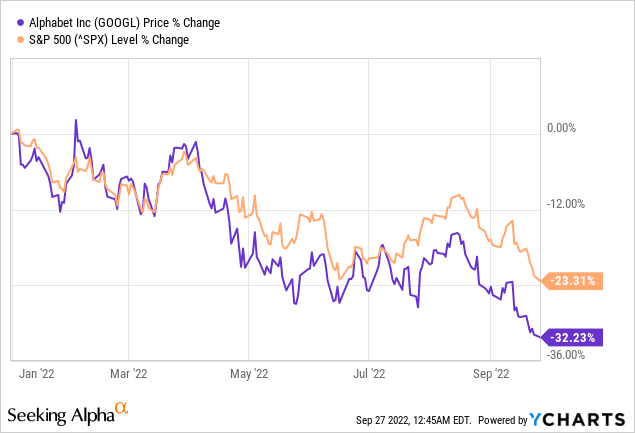

Alphabet Inc.’s (NASDAQ:GOOGL, NASDAQ:GOOG) stock slides as investors spend too much energy focused on things that don’t really matter. I discuss some of the near-term headwinds that are weighing on the stock.

I note that there’s some short-term pain ahead while arguing that it’s important to take hold and think through what’s really at play here. Then I turn our focus to why there’s a compelling long-term opportunity in this name.

Ultimately, paying 12x operating profits for Google Services is a terrific investment opportunity. Here’s why.

Alphabet saw a convergence of two different forces coming together 2 years apart but in different directions.

During the pandemic, there was a rush online. We stayed at home, and for a while, it was cool to be stuck at home (let’s be honest).

That led advertisers to move to where the consumer was, online. The economy was swinging, and ad budgets were strong. Alphabet was primed to benefit.

And investors rewarded the stock at the end of a decade-long bull market, where every pullback was a clear reason to buy the dip. Accordingly, buying every dip was indeed the right thing to do, and investors were rewarded for that risk-seeking behavior.

Today, the setup is as diametrically oppositive as it could get. Let’s discuss three distinct headwinds impacting Alphabet right now.

You have ”the great reopening.’. Consumers are not glued to their screens quite as much. Consumers are out and about embracing experiences. So, immediately, ad dollars to digital platforms get reduced.

Then, to complicate matters, the economy is far from strong. So, what’s going to happen to business confidence in a weakening economy? Businesses pull back on ad spending. Everyone takes a ”wait and see approach.” Meanwhile, time is ticking by, and things are not looking to improve any time soon.

And then, clearly not favoring business behavior, the Fed is having to pull the handbrake as it swings around this corner. This vehicle must stop by any means. And it’s going to raise interest rates to cool the economy.

Next, let’s think about Alphabet from an investor’s perspective.

Hedge funds, institutional capital, and family offices are now in a situation where nearly everything else that they’ve invested in, outside of mega-caps, has been nothing short of a calamity in 2022.

What’s more, the portfolio manager’s bonuses are contingent on peer outperformance. Since the vast majority are secretly closet-indexers, you are facing up a tough choice.

Do you stay the course, or do you know start to take some profits off the table, from the few winning you hold of relative outperformance on the trades you have left?

I believe the answer is obvious. Particularly when you are about to enter tax loss season. Investors are not really thinking about investing for the long term. Now is not a good time to think about long-term investing.

The time to think long-term is when stocks are going steadily up. When stocks turn down, everyone starts asking difficult questions about their holdings. And uncertainty becomes too synonymous with bad news. But what about the business?

Intuitively, it’s not difficult to understand that Alphabet is probably one of the best businesses in the world. I’m not sure if it’s the best. It’s not for me to make such bold claims. But I believe that we can all agree that before the digital transformation was a thing, Google had already set up its toll bridge that businesses would pass through.

That being said, Alphabet is not immune to competition either, obviously. Every business at some point has to deal with a competitor, whether it be Amazon (AMZN), Meta (META), Apple (AAPL), or TikTok (BDNCE). Anyone that doesn’t think that Alphabet’s future growth opportunities are not under threat is deluding themselves.

But its core business, which is Search, is just too perfect for what it offers. Google will continue to take a slice of the West’s digital transformation. And as long as we continue to tick along in our digital migration, Alphabet’s Search dominance will continue to pervade and take its slice of our transition online.

Even though there is a huge swath of eager competitors, such as Yahoo! (PRIVATE), Bing (MSFT), DuckDuckGo (privately held, but with some agreements to Microsoft), Yandex (YNDX), and more.

My point is that Alphabet’s core search business makes up nearly 60% of its total revenues, and that’s not going anywhere. All the while, Alphabet is more than just its Search business.

Alphabet succeeded in monetizing Search. Perhaps too well. Hence, it was too flat-footed in finding its next substantial growth opportunity.

Again, my point is not that Alphabet is only Search.

September conference

September conference

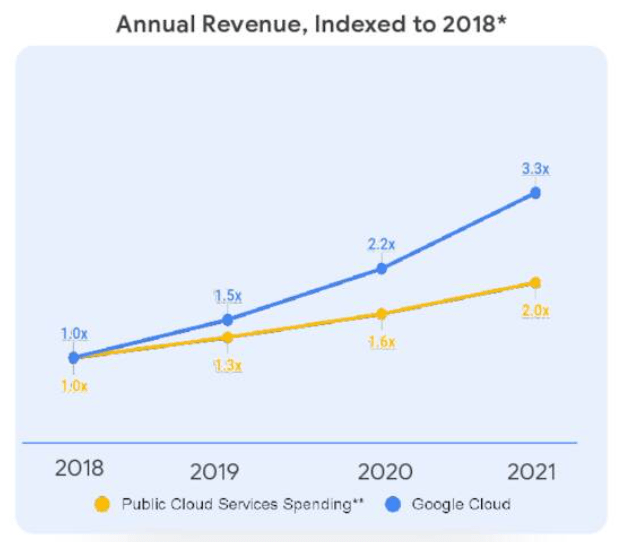

As you can see from a recent conference, Google Cloud is gaining substantial market share in the past few years among public cloud services spending.

Yet, even if one were to extol high praises on Alphabet’s management team in finally succeeding in finding another compelling revenue stream, let’s be honest.

We are talking about less 10% than of Alphabet’s total revenues as of Q2 2022. And even if it’s growing at a rapid clip, so what? It will still be a considerable amount of time before Google Cloud becomes a free cash flow driver.

I argue that it’s not going to move the needle on the investment thesis.

Alphabet has always been reticent about disclosing the level of profitability of its Search business.

It has done this to avoid bringing even more attention to Search by regulatory bodies. What we as investors have to go on is its Google Services operating profit line, which includes a myriad of businesses in addition to Search.

However, a reasonable assessment will probably see just over $100 billion of operating profits from this segment in 2022 or by early 2023.

If we were to assume that this business line grows by 10% CAGR for a while still, paying 12x operating profits for this segment means that investors get Google Cloud thrown in for free, Other Bets for free, and a management team that is clearly A-class also for free.

As I noted in the introduction, there are a lot of exogenous considerations at play that will make investors jump away from staying with Alphabet. There are interest rates rising, there’s a weaker economy, and there’s the ”smart money” that needs to move capital around. In sum, there’s a whole arsenal of factors not to own it right now.

But the thing with investing is that nobody rings a bell to say when things are about to improve. And I believe that paying 12x for a business with a moat seems to me laughably cheap.

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. There are no gimmicks and no place to hide because all I care about is delivering high performance against the S&P500.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.