JHVEPhoto/iStock Editorial via Getty Images

JHVEPhoto/iStock Editorial via Getty Images

Ever-rising recession worries and increasing interest rates have caused seemingly any company with economic sensitivity, real or perceived, to be harshly sold off. United Rentals (NYSE:URI), the country’s largest equipment rental firm, has been no exception to this trend. Shares have fallen by nearly one-third from their 2021 high, though they have been an excellent performer over the past decade as the company has consolidated smaller players, boosting scale and margins, while using free cash flow to repurchase stock:

Seeking Alpha

Seeking Alpha

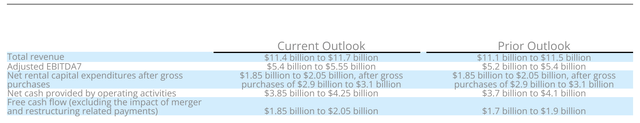

Importantly, this decline in the share price has not been driven by deteriorating financial performance. In fact, after the second quarter, United Rentals boosted its outlook for the year. The company will generate about $5.5 billion in EBITDA, leading to about $2 billion in free cash flow in 2022.

United Rentals

United Rentals

This strong free cash flow comes even as the firm invests significantly in expanding its fleet of rental equipment, with rental purchases up by about 11% to $1.35 billion. At the same time, its sales of used equipment are down about 19% to $362 million. Consequently, the carrying value of its rental equipment is up by nearly 5% year to date to $11.03 billion. The company is able to invest in expanding its fleet while still generating significant sums of free cash flow. At the midpoint of its outlook, URI is trading at just 9.5x that free cash flow, an attractive valuation.

Importantly, URI is not just growing its fleet for the sake of it. Indeed, if the firm couldn’t rent out incremental equipment, as shareholders, we would not want them to buy more. That is why I like to look at fleet productivity, which combines changes in rental rates and utilizations to determine how much more revenue the company is getting out of each piece of equipment. That figure is up 11.3% in Q2, meaning the firm is able to charge more for its equipment and have it rented out more frequently. In that environment where demand is outstripping supply, expanding the rental fleet can be very accretive for shareholders.

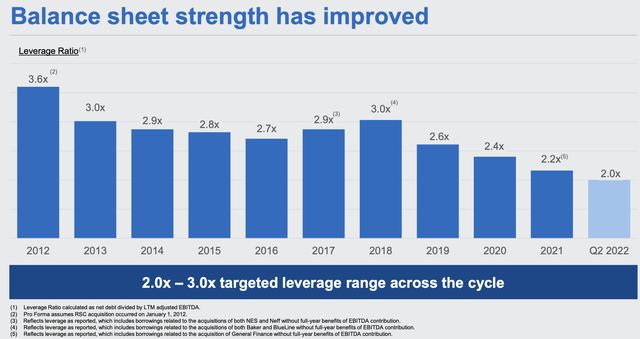

As United Rentals has grown in size, it has also increased the strength of its balance sheet. The company now targets a Debt/EBITDA ratio of 2-3x, down from 2.5-3.5x several years ago. Right now, the company’s leverage sits right at the low-end of target, or 2.0x. Companies with more leverage face risk as interest rates rise if they have to refinance maturities at higher rates, increasing interest expense and reducing free cash flow. URI’s low leverage positions it well for a period of rising rates. Indeed, a return to the midpoint of its leverage target would mean an additional $2.7 billion of debt. This gives the company significant capacity to make an acquisition if an opportunity presents itself.

United Rentals

United Rentals

Because the company does not need to focus on paying down debt, it can instead focus on repurchasing stock. In the first half of this year, the company has repurchased $762 million in stock, and it expects to have completed its $1 billion 2022 target by the end of the third quarter. These share repurchases add up over time. Back in 2015, URI had 95.2 million shares outstanding. Today, the company has 71.2 million outstanding, or a 25.2% reduction. So during this period, while net income has risen by 200% to $1.75 billion, net income per share has risen by 294%. The combination of underlying business growth with a shrinking share count provides explosive growth for shareholders, generating very strong returns over time.

With the company’s strong free cash flow generation, it is well positioned to reduce its share count by 5-10% per year over the next 3 years, helping to further accelerate EPS growth beyond the $25 or so I expect it to earn this year. Importantly, I believe the company will be able to sustain solid free cash flow results during this time period.

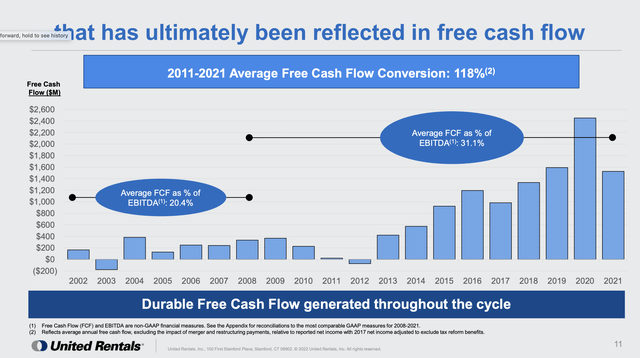

While one thinks of equipment usage as being highly cyclical, United Rentals actually has countercyclical free cash flow. The chart below shows two things. First, how much more free cash flow the firm has generated in recent years as it has consolidated the equipment rental industry, leading to greater scale and margins. Second, free cash flow actually rose in 2008 and 2020, both years we enter recession.

United Rentals

United Rentals

There are two reasons for this. First, during periods of economic uncertainty, businesses are more likely to rent equipment than purchase their own. So while overall equipment usage may fall in a recession, URI gets a bigger piece of that pie. Second, URI has considerable flexibility on its cap-ex. As utilization falls, it can extend the age of its fleet. Rather than sell equipment after three years, it may hold onto it a fourth or fifth. This greatly reduces cap-ex, boosting free cash flow. Then, as the economy bounces back (as in 2011-2012), it spends to expand its fleet, reducing that year’s free cash flow but creating the base for greater run-rate cash flow in future years.

So, even if you worry about an economic downturn, by reducing fleet purchases, URI could generate more cash and actually be able to increase share repurchase, which if done when the stock market is lower (as may be the case in a recession) would be even more accretive to per share results. However, I suspect demand for URI’s equipment may prove more resilient than some fear. First, only 4% of its business is tied to residential construction, and that is primarily multi-family, so as higher rates slow single-family housing construction, there is very little impact.

Additionally, last year, congress passed a new infrastructure bill that is still ramping up as large projects take time to be permitted. This year, the CHIPS Act was passed to boost semiconductor plant construction, and state governments have strong finances. Increased government construction spending will buoy demand for equipment, and URI gets nearly half of its revenue from non-residential construction. Demand here may actually rise as a result.

The other half of its business is tied to industrial equipment uses, with the energy and chemical sectors particularly important. Oil & gas cap-ex have been rising due to higher prices, and with Europe pivoting away from Russian energy, there is room for US energy infrastructure spending to rise to meet that demand. Plus, the recently passed Inflation Reduction Act specifically targets increased energy infrastructure spending. These sources of demand are reasons for optimism even as the rest of the economy slows.

Of course, no investment is without risk. If business investment and construction activity collapse, even with rental equipment gaining some market share, demand would likely fall and lead to lower fleet productivity. While URI can offset that to a degree by aging its fleet, if demand were to fall by over 15%, free cash flow would likely decline, though, given the tailwinds I have listed, I view this harsh of a scenario as unlikely.

URI is also better positioned than peers during a downturn. The equipment rental market is very diffuse with URI having top market share at 15%, and 71% of the market is controlled by firms with less than 3% market share. With smaller scale, lower margins, and less balance sheet flexibility than URI, they would likely suffer more significantly. Indeed the last downturn provided URI the ability to roll-up smaller players, adding scale, and boosting margins. So while downturn will create near-term headwinds, there would be long-term gains potentially.

Because URI is acquisitive, having done over 300 acquisitions big and small, there is always the risk management makes an over-priced acquisition or expands its fleet at the wrong time. Management missteps are a risk with any investment, but URI has proven to be a good acquirer, as its long-term free cash flow growth, share price performance, and margin expansion have shown. It also showed excellent discipline the past few years in bringing down leverage rather than buying firms at the top of the market. Now, it has balance sheet capacity to make deals if opportunities present themselves. This is a risk I believe investors should feel comfortable taking.

Overall, URI is a proven free cash flow machine that aggressively repurchases stock, has the business mix to weather an economic slowdown, and actually can grow free cash flow during downturns by aging its fleet. Given its business mix though, demand should stay firm, helping to further boost rental rates.

I believe shares should trade at about an 8% free cash flow yield, given its strong ongoing buyback capacity, which at a $2 billion run-rate equates to a share price of about $350, or a 14x P/E multiple, providing nearly 30% upside from current levels. I would recommend accumulating shares here and let the power of URI’s buybacks and cash generation provide strong returns over time.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of URI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.