marchmeena29

marchmeena29

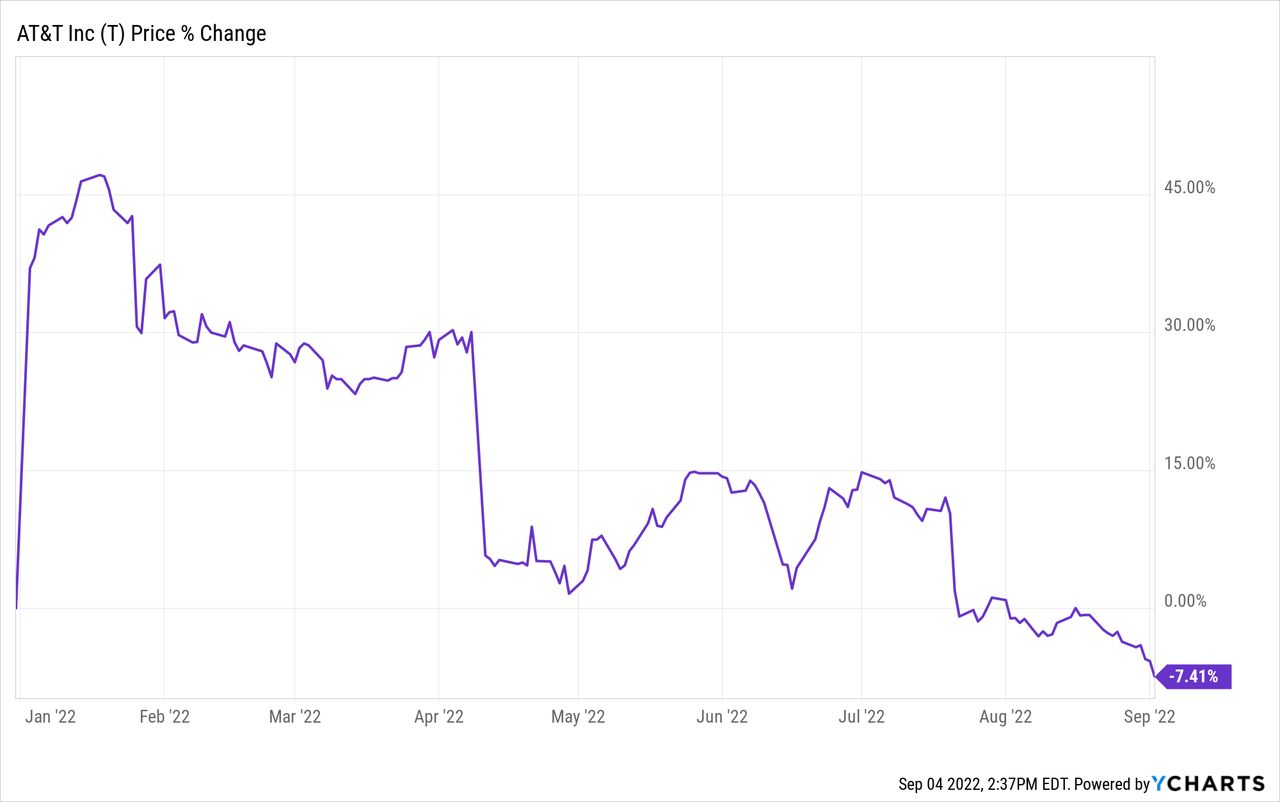

It’s no real surprise that AT&T (NYSE:T) is down this year. Here’s a quick peek:

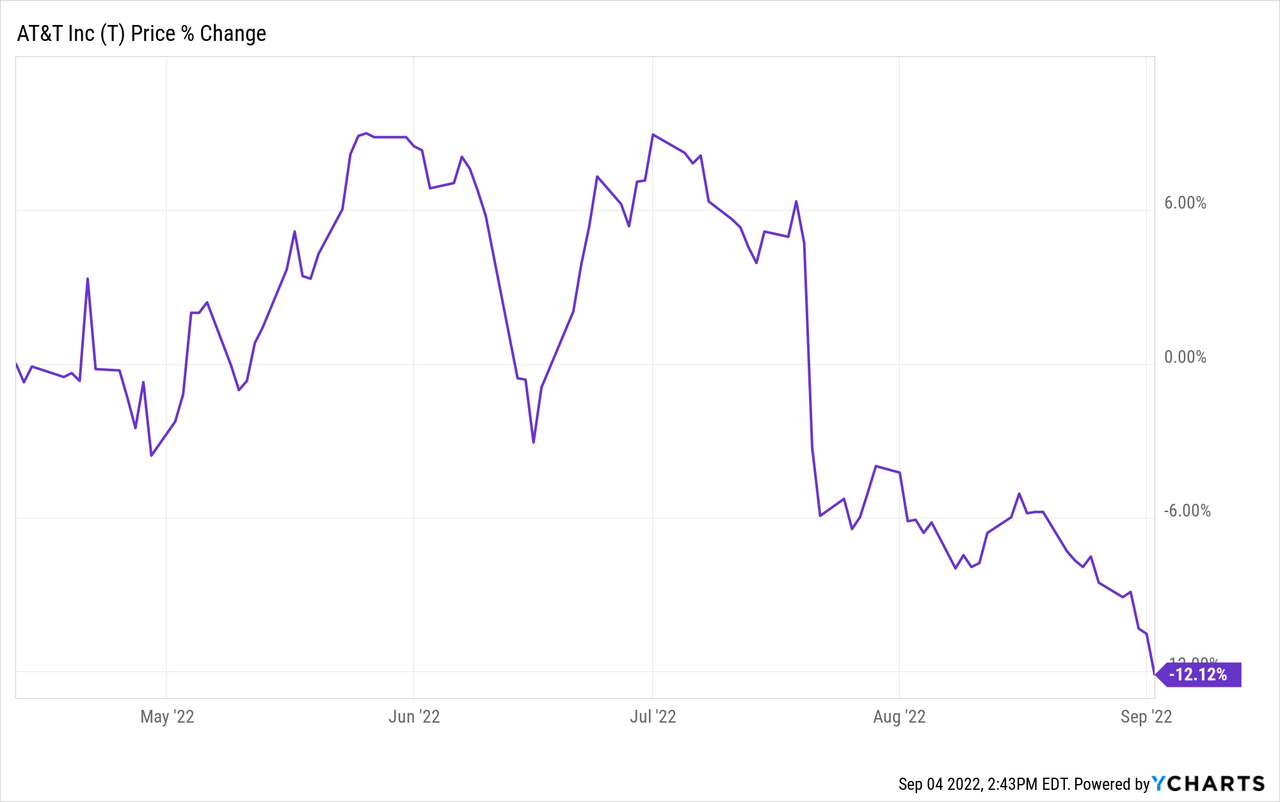

It’s a weird view. Here’s why. On April 11th, AT&T completed the spin-off of Warner Bros. Discovery (WBD). Depending on your thinking, that was just a few days ago or years back in time. There’s a whole time warp around the spinoff of WBD. At least, that’s how it feels to me. In any event, here’s a better way to look at T, starting on April 12th.

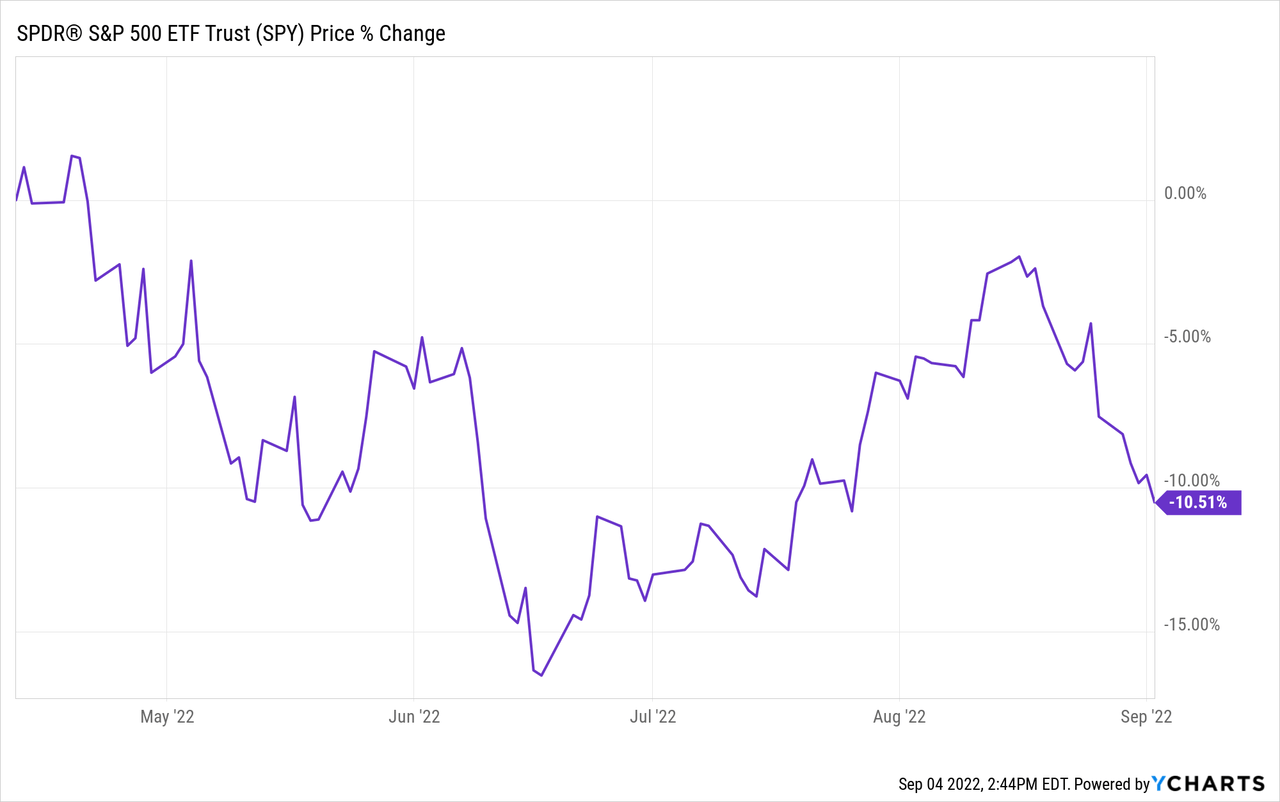

This is a far more true view. And, interestingly, here’s how that compares with the S&P 500 (SPY), in case you’re wondering.

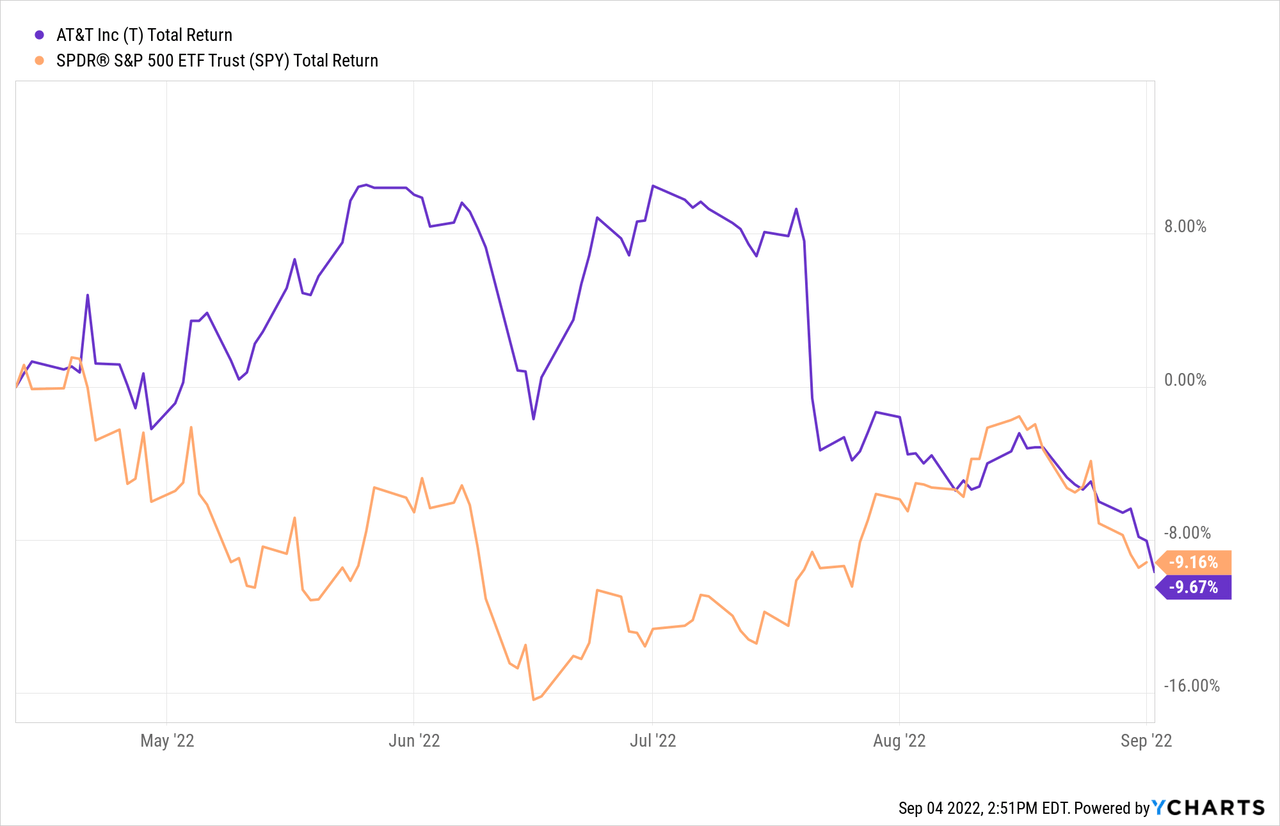

Really, there’s almost no difference. Roughly speaking, and on the surface only, you would be better off owning SPY for the diversification and smaller capital loss. On the other hand, you would probably be better off with T if you’re looking for income. Here’s a simple view that puts capital gains and losses together with yield.

This is really important because it shows that there’s often not much difference between a single stock and the market. However, sometimes you can get a fat yield while you hold on to a single stock. On the other hand, you can potentially lower your risk by holding the whole market via an ETF or mutual fund. Pick your poison depending on your goals, timeline and the rest of your portfolio.

That’s the background. Now, in the rest of this article, we’ll dig into free cash flow and T’s dividend. But first, let’s explore the bigger picture, and how we made it to this point.

Let’s spend a moment digging into risk because high capital returns and high dividends can mask risk. First, to be clear, I’m no fan of MMT, or Modern Monetary Theory. Second, I don’t buy into the idea that volatility is the best definition of risk. With those points in mind, I do think it’s instructive to consider how much stocks move in relation to the overall market.

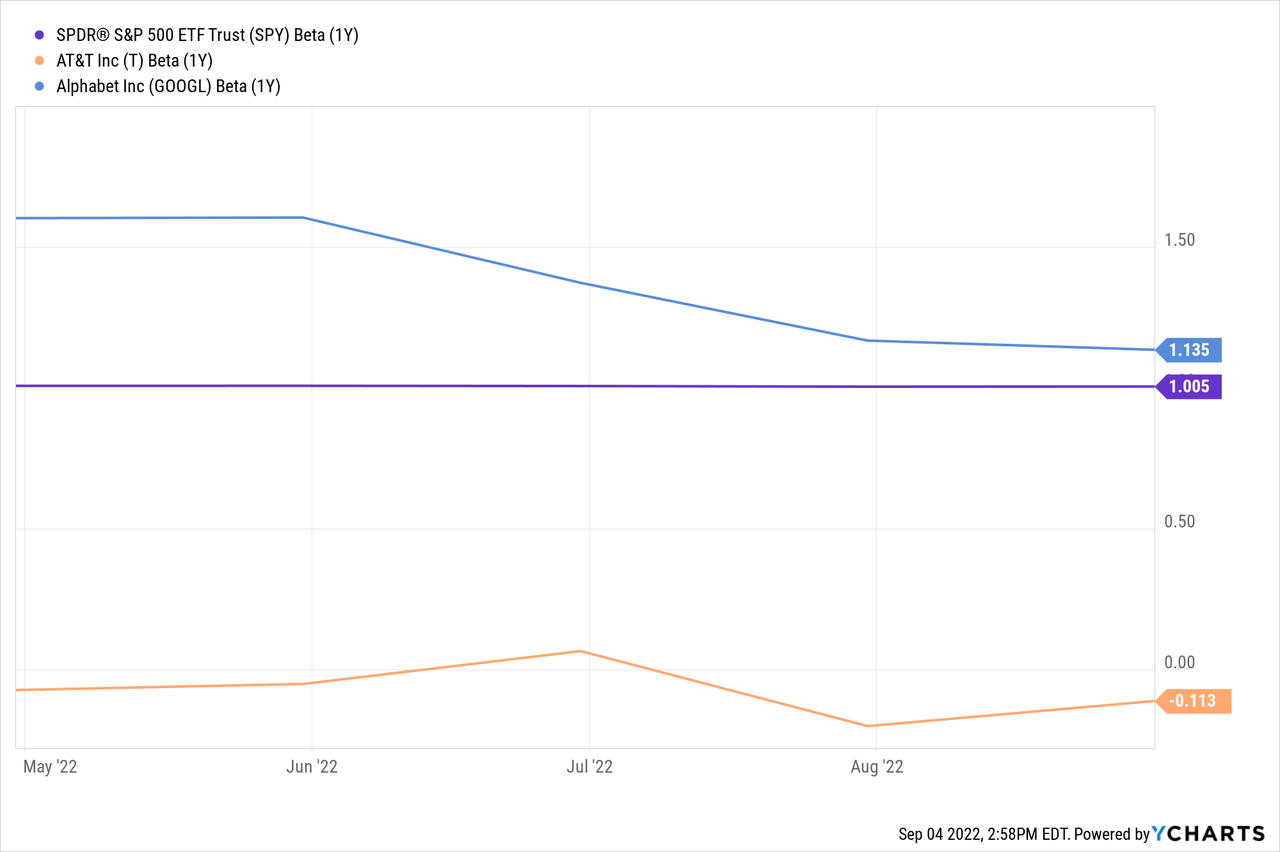

Below, you’ll see SPY, T, and Alphabet (GOOGL). The measurement starts on April 12th, so it’s after the WBD spinoff. In any case, you’ll see that GOOGL is higher than SPY and T is lower than SPY. Take a look, then I’ll explain.

Here’s how to understand the math of Beta here:

The S&P 500 is an unmanaged index generally considered representative of the U.S. stock market and has a beta of 1. A stock with a beta of 1 means that, on average, it moves parallel with the S&P 500 – the stock should rise 10% when the S&P 500 rises 10% and decline 10% when the S&P 500 declines 10%. A beta greater than 1 indicates the stock should rise or fall to a greater extent than stock market movements, while a beta less than 1 means the stock should rise or fall to a lesser extent than the S&P 500. Since beta measures movements on average, you cannot expect an exact correlation with each market movement.

Putting it all together, SPY is basically a representation of the market so it’s very close to 1. On the other hand, GOOGL will move higher faster and lower faster than the market, whereas T will move higher slower and lower slower than the market. Putting it in more simple terms, GOOGL is going to be more volatile than the market, and the market is more volatile than T.

Now we can properly transition into the critical update. Specifically, I’m talking about AT&T’s free cash flow, given the news from Q2 2022.

Back in June, I issued a free cash flow yield alert. In that article, I posted this little gem for readers:

AT&T is guiding for expansion of free cash flow in 2023 and beyond, both through growing adjusted EBITDA and cutting capital expenditures. EBITDA is expected to grow 6% in 2023, accelerating from 3% growth this year, and capex is expected to fall by nearly 17% in 2024 to $20 billion, with the relaxing of 5G rollout spending.

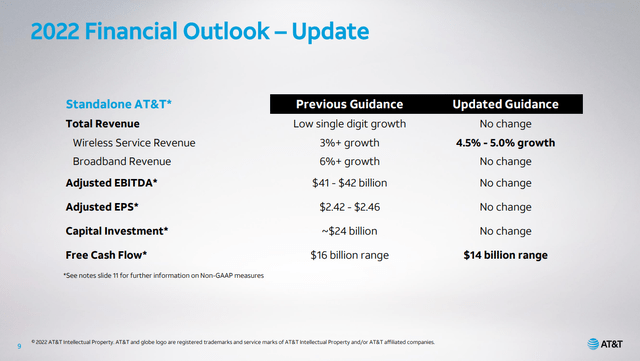

Some time has passed, so now we can look at the 2022 Q2 earnings call for clues. There’s good news and bad news, in one chart.

AT&T Guidance – Q2 2022 (Seeking Alpha and AT&T)

AT&T Guidance – Q2 2022 (Seeking Alpha and AT&T)

T provided clarity by increasing Wireless Service Revenue estimates to 4.5% to 5% growth but dropping Free Cash Flow by a whopping $2 billion.

Here’s the footnote for your reading pleasure, from the horse’s mouth:

Free cash flow is a non-GAAP financial measure that is frequently used by investors and credit rating agencies to provide relevant and useful information. In 2Q22, free cash flow is cash from operating activities from continuing operations of $7.7 billion, plus cash distributions from DIRECTV classified as investing activities of $0.3 billion, minus capital expenditures from continuing operations of $4.9 billion and cash paid for vendor financing of $1.8 billion. Due to high variability and difficulty in predicting items that impact cash from operating activities, cash distributions from DIRECTV, capital expenditures and vendor financing payments, the company is not able to provide a reconciliation between projected free cash flow and the most comparable GAAP metric without unreasonable effort.

On the earnings call, we learned the following:

So, we know why Q2 was a bit more cash flow intensive. And, it sounds good, but there are some headwinds too:

The way I read it, these headwinds are expected to chew up about $2 billion in cash flow. The simple math is that FCF is taking a 15-20% hit, as T’s expected FCF slips from $16 billion to $14 billion.

In any case, here’s what matters to most T investors. The dividend isn’t threatened. The dividend is $1.11 which will likely land somewhere between 58-62% of the anticipated free cash flows per share in 2022. Perhaps my range isn’t quite big enough, but the point is that T’s dividend is safe, and the yield is close to 6.5% if you’re looking to collect.

If I was looking for current income then I would consider T at these prices. It’s marginally a Buy, although I’m much more keen on other companies at this point in time. In fact, I deliberately pointed to GOOGL because it’s a better company. In the longer view, I fully expect GOOGL to beat T in terms of total return. But, T absolutely crushes companies like GOOGL if you need dividends and income, simply because GOOGL pays nothing. You could simply sell off small bits and pieces of GOOGL to generate income, but that’s a topic for another day.

So, still interested in T, eh? Well, here’s some more good news. T’s CFO, Pascal Desroches, had this to say in Q1 2022, and I haven’t seen a modification since:

Now, let’s take a step back and look at the free cash flow generation expected from our business. As outlined at our Analyst Day, we expect to generate in the range of $20 billion of free cash flow in 2023. After paying dividends and non-controlling interest commitments, we expect to have at least $10 billion of cash remaining. [Emphasis: Author]

Again, there’s enough to like about what T is doing. And, T’s dividend is very healthy right now. Well, healthy enough that I don’t expect a freeze or cut.

T is a reasonable Buy at this price for income investors. But, of course, other options like GOOGL are superior to T in terms of long-term capital gain potential, and therefore total return opportunity.

If you’re thinking about “bottom fishing” for high quality, beaten down growth stocks, then perhaps it’s time to look at Growth Stock Renegade.

Join today for less than $2 per day. And when you join, I’ll instantly share my actively managed growth stock portfolio.

Right now is the perfect time to subscribe because it’s affordable for any budget. Plus, there is a 14-day FREE TRIAL.

(You are fully protected by Seeking Alpha’s unconditional guarantee.)

This article was written by

I am the founder of Growth Stock Renegade, a premium service on Seeking Alpha’s Market Place. Subscribe right now because you get 14 days for FREE. Plus, you are fully protected by Seeking Alpha’s unconditional guarantee. Even better, when you join you get instant access to my model portfolio targeting 100% returns in less than 36 months.

I am an investor, entrepreneur, father, husband, coach and teacher. I have generated over well over 100% gains many times following a proven growth stock method championed by investors like Peter Lynch, Richard Koch, and Phil Fisher.

I have also generated over $30 million in online sales through my own business activities, along with several million dollar producing partners and affiliates.

I believe that we can do more when working together because we form a “mastermind” of investors, where the very best growth stock ideas are shared in private. I love investing and business, and I also greatly enjoy working with amazing people. I appreciate your feedback, comments and questions.

I hope to see you inside Growth Stock Renegade.

Disclosure: I/we have a beneficial long position in the shares of T, GOOGL, WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.