Chip Somodevilla/Getty Images News

Chip Somodevilla/Getty Images News

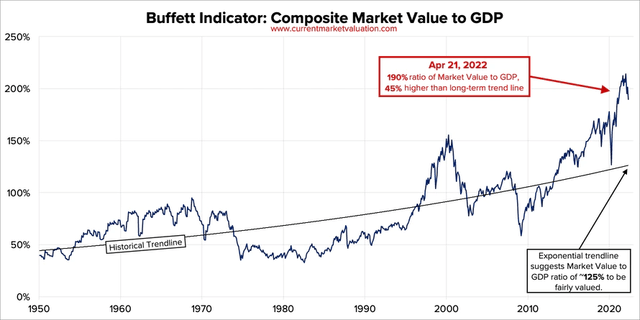

The ratio of total US stock market valuation to GDP has been named “The Buffett Indicator” because Warren Buffett – the legendary CEO of Berkshire Hathaway (BRK.A)(BRK.B) – once called it “the best single measure of where valuations stand at any given moment.”

Essentially what it represents is the value of expected future economic activity discounted back to the present compared to the total value of current economic activity. In this sense, it is strikingly similar to the price to earnings ratio that is commonly used to value individual stocks.

Based on the historical data, the Buffett Indicator looks extremely bloated, with the total market value to GDP ratio at ~190%. This looks overvalued even when assuming an exponential trendline that accounts for improving technology that should lead to increased capital productivity and therefore more rapid growth over time.

Buffett Indicator (Current Market Valuation)

Buffett Indicator (Current Market Valuation)

With popular index funds like SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust (QQQ) trading near record highs and an increasingly large percentage of the stock market consisting of high growth tech stocks with rosy future projections delivering frothy price to earnings ratios (for example, Tesla (TSLA) and virtually all of the stocks in the ARK Innovation ETF (ARKK)), it is a legitimate question whether or not the market is in a bubble. In fact, several big name tech giants have taken a beating recently due to a failure to deliver on those rosy expectations, including Meta Platforms (FB) and Netflix (NFLX).

Other reasons to be bearish include the soaring inflation that is pinching corporate profits as well as the consumer’s pocketbook, ongoing supply chain challenges that are taking a bite out of global economic growth, the severe COVID-19 lockdowns taking place in China that could cause the country to experience a material economic slowdown, and rapidly rising geopolitical tensions between the world’s superpowers in the U.S., Russia, China, and Europe. If any one of these issues are not successfully resolved in the near future, the global economy will likely significantly underperform future expectations. This would then undoubtedly lead to serious underperformance for the stock market.

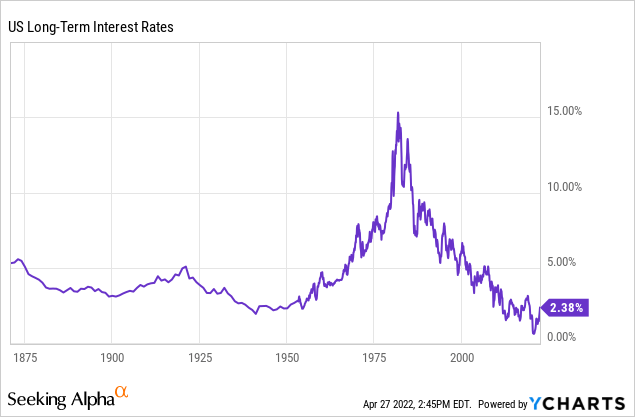

A final risk to keep in mind involves interest rates. We have been in an environment of historically low interest rates for years now, especially over the past decade. This has undoubtedly played an outsized role in pushing stock market valuation multiples higher. If interest rates indeed soar higher in an effort to combat runaway inflation, it would likely pull market valuations materially lower in the process.

While the case for bears on the current market valuation is certainly compelling, the market is not entirely irrational either. Bulls do have a strong case as well.

In a manner similar to the broader stock market, the “fair value” ratio of market value to GDP is largely a function of interest rates as well as the future economic growth outlook. The lower the interest rate and the stronger the future economic growth outlook, the higher valuation multiples are warranted in going.

As a result, when you consider that we are still in an era of historically low interest rates, it should not be surprising that the stock market is trading near historic highs:

Additionally, perhaps the biggest wild card of all that could render historical data relatively moot when assessing the current market valuation is the simple fact that technological innovation is accelerating at an unprecedented pace.

While interest rate trends, inflation rates, and historical valuation data all paint a fairly gloomy outlook for future market performance, if the current exciting technological innovation trends manifest as quickly as they appear on pace to, inflation may not be such a big problem after all, and the economy could see a new period of growth and prosperity with deflation rather than inflation.

With technologies like artificial intelligence, robotics, autonomous mobility, genomics, blockchain, and alternative energy generation and storage currently undergoing rapid development, we could see our world and understanding of how the economy works change rapidly in the coming years. As a result, we could see an “age of abundance” as prophesied by Elon Musk with goods and services readily available to virtually everyone, qualities of life soaring higher, and prices for these goods and services dropping dramatically due to rapid improvements in automation. We could also see healthcare costs plummet from advances in medical technology as well as genomics that will lead to more efficient medical services and treatments as well as an explosion in preventative medicine.

If this scenario actually plays out, much of the inflation we are seeing today – largely stemming from supply chain bottlenecks and a labor shortage in key industries – will be wiped out and growth rates should soar. As a result, interest rates will likely turn out to not be so unrealistically low after all and the growth rates will more than justify the current sky-high valuation multiple assigned to product capital.

While it is tempting to come down on one side or the other here, we believe the most important trait for any investor is humility. We openly admit that we have no foreknowledge of how things will play out. The current geopolitical crises could very possibly devolve into World War 3 and involve a nuclear holocaust for one or more major economies. Inflation could remain untamable for years as technological innovations are simply overwhelmed by massive government spending programs, major wars, and ongoing labor shortages.

On the other hand, it is tough to bet against technology, especially given that our world is becoming smaller and smaller, and information is spreading and being combined at an exponential rate of acceleration. We truly could have an exceptionally exciting future of prosperity in store for us if we can avoid more major wars and governments can temper spending enough for technological innovation to bring inflation down to the point where consumers are greeted with abundance.

As a result, we try to remain diversified and hedge our bets against all potential outcomes while maintaining an emphasis on quality, value, and income. We also like to invest in businesses that will likely remain in demand regardless of what outcome plays out (barring a devastating nuclear war, obviously). Some of our favorite picks of the moment include Barrick Gold (GOLD), Virtu Financial (VIRT), Energy Transfer (ET), and Patria Investments (PAX).

GOLD positions our portfolio to benefit from runaway inflation as it provides leveraged exposure to gold, silver, and copper prices. At the same time, its operational excellence, world class portfolio of mines, cheap valuation relative to peers, net debt-free balance sheet, massive free cash flow generation, and increasingly shareholder friendly capital allocation policy minimize much of the long-term downside risk. As part of a well-diversified portfolio, GOLD offers exceptional risk-reward.

VIRT is another great portfolio hedge for us against the negative scenario playing out for the global economy. As a high frequency trader across a wide variety of securities exchanges including stocks, fixed income, options, and cryptocurrency, VIRT profits from spikes in volatility. As a result, its most prosperous periods were the market crashes of 2008 and 2020 and we would expect it to profit similarly if we faced a similar scenario in the future. However, it also pays out a nice dividend yield of 2.83% at present and also has retired over 6% of outstanding shares over the past year and a half alongside numerous organic growth initiatives that it is advancing. As a result, VIRT serves as an excellent source of portfolio insurance that pays us a nice dividend, grows on an organic basis, and buys back stock while we wait for another market crash.

ET is a leading energy midstream stock that is growing its distribution rapidly while also fortifying its investment grade balance sheet. While the cheap valuation and high yield make it a compelling investment from a total return perspective, we also think its exposure to various macroeconomic factors makes it a great portfolio diversifier. First and foremost, it is an excellent inflation hedge since most of its pipeline contracts are indexed to inflation. Furthermore, energy prices tend to rise in an inflationary environment, increasing the value of the commodities that its infrastructure assets service. At the same time, its contracts tend to be long-term, fixed-fee, take-or-pay contracts that make it remarkably resilient to downturns in the energy sector and economy as a whole.

Last, but not least, PAX is an alternative asset manager in Latin America and is well-positioned to become the dominant player in that region. If that plays out, and the global economy enters a period of prosperity with lower inflation and interest rates than the current trends suggest, we expect PAX to be a major benefactor. As technological innovation spreads across the globe, developing markets like those in PAX’s area of operations will likely see enormous growth and the lower inflation and interest rates will push the value of its assets up substantially higher. In the meantime, PAX has a debt free balance sheet with plenty of cash and also pays out a hefty yield through its 85% distributable earnings payout ratio policy.

While the future is always unknown, the elevated Buffett Indicator is clearly a cause for concern. The bear case is unsettlingly compelling, with soaring inflation, reckless government spending, escalating geopolitical tensions, and rising interest rates all threatening to pop the bubble-like valuations currently seen in public markets.

At the same time, technological innovation is also marching rapidly and relentlessly forward. If current innovation trends successfully deliver on their exceptional promise in the coming years, we could see some massive deflationary forces successfully counteract the aforementioned inflationary trends and the globe could see a period of abundance.

Our approach to this is to – instead of trying to guess which scenario will play out and to what degree – maintain portfolio balance and invest in attractively priced high-quality businesses that are poised to profit from a wide variety of scenarios. This way we can sleep well at night, collect substantial income, and be prepared to profit from whatever happens. While we hold over 30 securities in our portfolio at High Yield Investor, we shared four of our picks in this article that we believe can help investors begin to build a well-diversified portfolio to weather potential market turbulence in the years to come without giving up potential upside either.

If you want access to our Portfolio that has crushed the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest growing high yield-seeking investment service on Seeking Alpha with ~1,200 members on board and a perfect 5/5 rating from 145 reviews.

Our members are profiting from our high-yielding strategies, and you can join them today at our lowest rate ever offered.

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Disclosure: I/we have a beneficial long position in the shares of ET, GOLD, PAX, VIRT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.