| Source: Dizraptor

Middletown, UK,

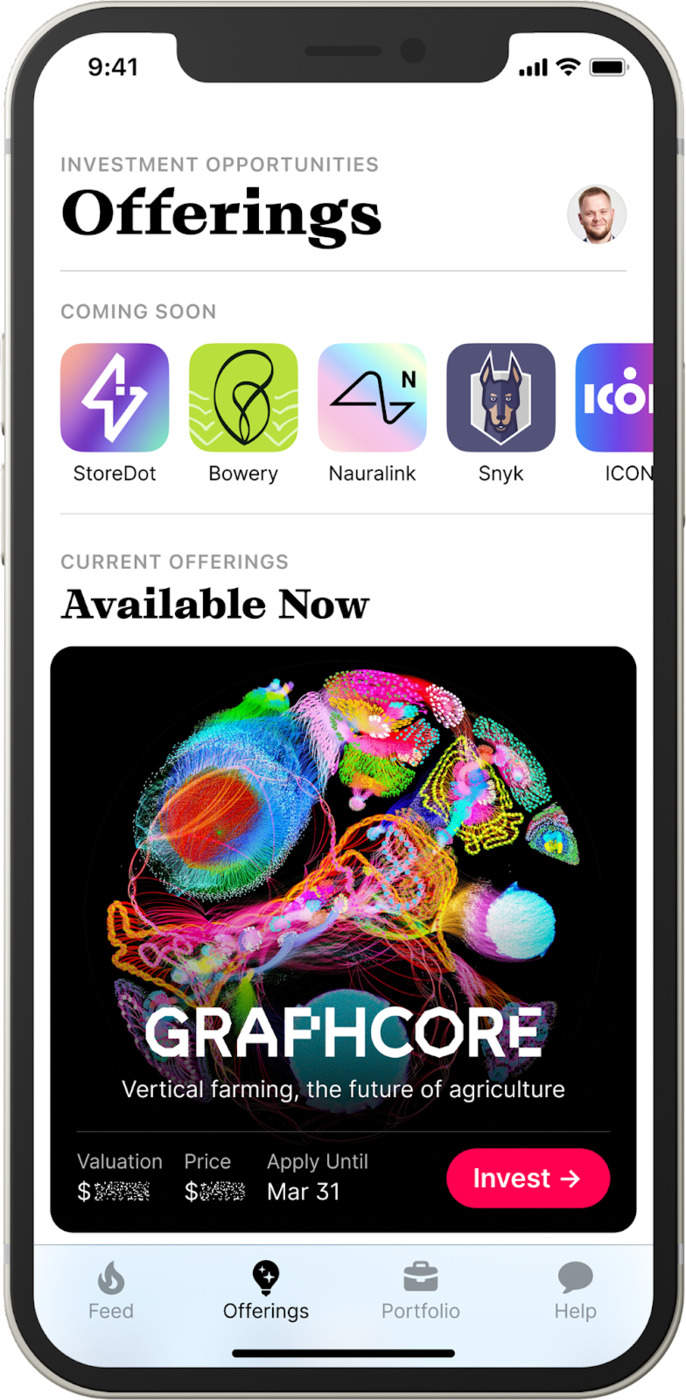

Middletown, UK, April 18, 2022 (GLOBE NEWSWIRE) — In March 2022, Dizraptor, one of the first apps for private equity investments, was released to the public. Now you can invest in Impossible Foods, SpaceX, Calm, Neuralink and other private companies just as easily as you trade on a stock market. The app works on iOS and Android phones.

Dizraptor lets you build a portfolio of innovative companies at the pre-IPO and middle stage. Now, let’s look at what pre-IPOs mean, why they produce a bigger return than the stock market, and how to invest in private companies through Dizraptor app.

Invest in rare pre-IPO shares

All investors dream about making a surefire investment in future Teslas. Dizraptor offers such an opportunity providing access to investments in unquoted firms.

These are major private companies. Late stage investments have a high potential return and carry less risk than early venture investments.

These are long-term investments. Mostly the app offers investments 1-3 years prior to a company’s listing. Such investments are also known as pre-IPOs. Their advantage is that investors are less likely to lose their money on emotion – private markets are not as volatile as public markets.

These are innovations. The high return potential of private companies is largely due to the fact that they are new businesses. They operate in new markets that have virtually no competition yet and create technologies that other companies are not contemplating.

Ark Invest predicts fast growth for the disruptive technologies market: from $14T today to $200T in 2030. AI, online learning, brain chips, metaverses, artificial life, 3D-printed houses, vertical farms and extreme fast charging batteries are some of the industries to invest in through Dizraptor app.

Why these shares will grow fast

Venture capital investments are trending up. The number of private stock transactions soared to $74 billion in 2018, from $2 billion in 2001 (Pitchbook). Companies themselves are in no rush to go public – Financial Times estimates that average timeframe for a company since foundation to IPO expanded from 5 years in 2011 to 11 years by 2020.

The number of big firms in the secondary market is growing too – they develop by absorbing VC investments and maximize their value before they go public. According to Crunchbase, the number of unicorns —private companies valued at $1 billion or more— tripled in 2021 alone.

The majority of such companies already have a finished product and are well-known in the market. Airbnb, Coursera, Robinhood and Udemy were private a few years ago, but their products were used by the whole world. SpaceX, while remaining private, single-handedly upended the space industry and hit a whopping $100 billion valuation by the autumn of 2021.

Dizraptor analysts point out that young private companies develop at a quicker pace than large listed businesses.

The chart shows the dynamics of private companies featured in Dizraptor app vs. the top 500 listed companies in the U.S.

Bottom line: new companies are developing fast, but they wait longer to go public. The unicorn club has reached 1,000 current private unicorns with promising products. Dizraptor makes it possible to capitalize on their growth within the private market.

Make your own disruptive portfolio

Dizraptor’s analysts select cutting-edge tech companies and post information about each of them. You can choose a company right in the app and place an investment. From there in your personal account you can follow changes in the share price and the company’s development up to its listing on a stock exchange. Exit is the main event all investors are waiting for. When the company begins trading and the lock-up period is over, investors get their return.

This app will prove useful even to users that haven’t started investing yet. It will help them understand how the secondary market works. You can read the How It Works section, watch videos about new disruptive technologies, scroll through the news feed, or study tech industry analytics.

The private equity market is still an uncharted territory for most investors, but it will become a leading investment trend in the coming years. Those who will adopt new private equity investing apps – get the upper hand. And Dizraptor will help you with that. The app is available on the App Store and Google Play.

Contact Person : Alex Markov, ССO

Email [email protected]

Disclaimer : There is no offer to sell, no solicitation of an offer to buy, and no recommendation of any security or any other product or service in this article. Moreover, nothing contained in this PR should be construed as any recommendation. Readers are encouraged to do their own research. Newsroom: socials.submitmypressrelease.com