Signing out of account, Standby…

Euronet’s (EEFT) epay arm unveils a recurring billing solution in several countries to provide feasible subscription-based and buy-now-pay-later payments options.

Euronet Worldwide, Inc.’s EEFT digital payments business segment epay launched a recurring billing solution, mainly aimed at the subscription products for Microsoft 365, Xbox Game Pass Ultimate and Xbox All Access in North and South America, Europe, Asia and Australia.

People will now be able to opt for subscription-based and buy-now-pay-later payments options and use the digital products on their laptops, phones, etc. Companies and brand partners across the globe will now be able to offer this option to their customers.

The new solution helps retailers, telcos and companies witness recurring revenues that were previously provided in a single transaction. Channel partners now can enrich their product portfolio by leveraging epay’s connectivity to its providers and strategic partners.

This unit of EEFT processes digital payments and works with value-added services with the help of technologies and APIs of the REN payments platform. This subscription-based business model holds tremendous prospects as the same supports growth and digital transformation.

The epay segment performed well for the last many quarters. epay has been taking several initiatives to bolster its presence and enhance its digital portfolio for a while.

In September, epay announced the integration of PayPal QR Code in their point-of-sale solution. In 2020, the same contributed 33.7% to EEFT’s total revenues on higher transactions, expansion of digital media products and SaaS solutions. epay gained traction from this strategy of boosting digital channel distribution in certain markets during 2020.

Some of the most significant product distribution expansions in the unit were enabled by mobile wallets. The segment launched the Microsoft XBOX Subscriptions service with Telefonica Spain and Microsoft Office 365 distribution through fnac.com France, apart from enhancing other digital channel distributions. We expect this segment to continue performing well on the back of robust online and in-app sales of digital media products as well as the surging retail sales of the same product category.

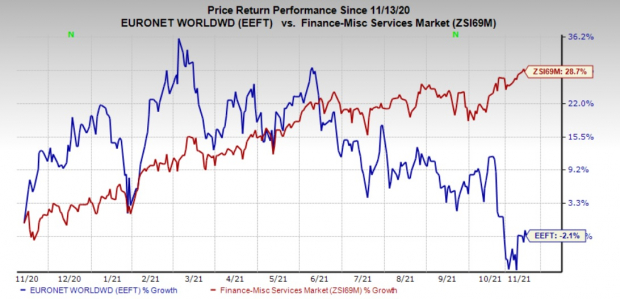

Shares of Euronet, which currently carries a Zacks Rank #3 (Hold), have lost 2.1% in a year’s time against the industry’s rise of 28.7%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Some better-ranked stocks in the same sector are Houlihan Lokey, Inc. HLI, Virtu Financial, Inc. VIRT and Jefferies Financial Group Inc. JEF.

Houlihan Lokey is an investment bank, which focuses on mergers and acquisitions, financings, financial restructurings and financial advisory services. With a Zacks Rank #1 currently, the stock has gained 82.9% in a year’s time. HLI managed to deliver a trailing four-quarter earnings surprise of 39.5%, on average.

Headquartered in New York, NY, Virtu Financial is a market-leading financial services firm that leverages cutting-edge technology to provide execution services and data, analytics and connectivity products to its clients and deliver liquidity to the global markets. With a Zacks Rank #2 (Buy) at present, VIRT’s shares have gained 18.6% in a year’s time. VIRT’s earnings managed to surpass estimates in three of the trailing four quarters (while missing in one), the average beat being 25.3%.

Jefferies Financial is a diversified financial services company. This currently Zacks #1 Ranked financial service provider has gained 85.3% in a year. JEF managed to deliver a trailing four-quarter surprise of 222.9%, on average.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jefferies Financial Group Inc. (JEF): Free Stock Analysis Report

Euronet Worldwide, Inc. (EEFT): Free Stock Analysis Report

Virtu Financial, Inc. (VIRT): Free Stock Analysis Report

Houlihan Lokey, Inc. (HLI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

J. Samuel

Zacks Equity Research

Zacks Equity Research

Entrepreneur Store

Rocío Reyes Trejo

Jerry Reid

Successfully copied link