JHVEPhoto

JHVEPhoto

Anything that is susceptible to recessions has been pummeled in the past few months, as sharply rising interest rates have caused a fear factor among the investing public of a deeper downturn. Whether that comes to fruition or not remains to be seen, but in the interim, there are some stocks that are bargains at the moment.

Ad stocks have been absolutely destroyed because ad spending contracts during recessions. After all, ad spending requires businesses to want to spend money on ads, so those at the margins will spend less or suspend ads altogether. When aggregated, this can mean a substantial decline in total ad spending during downturns, and ad stocks have already priced that into a large extent.

The good news is that if it doesn’t get significantly worse, ad stocks are very cheap. That goes in particular for the mothership in terms of ad stocks, Alphabet (NASDAQ:GOOG). The last time I covered Alphabet, the stock was on the verge of breaking out of a consolidation pattern. That never came to fruition, however, given the months since July have been quite harsh to equities, as we test the lows once again this week. However, the basic thesis is intact, but the valuation is much better now.

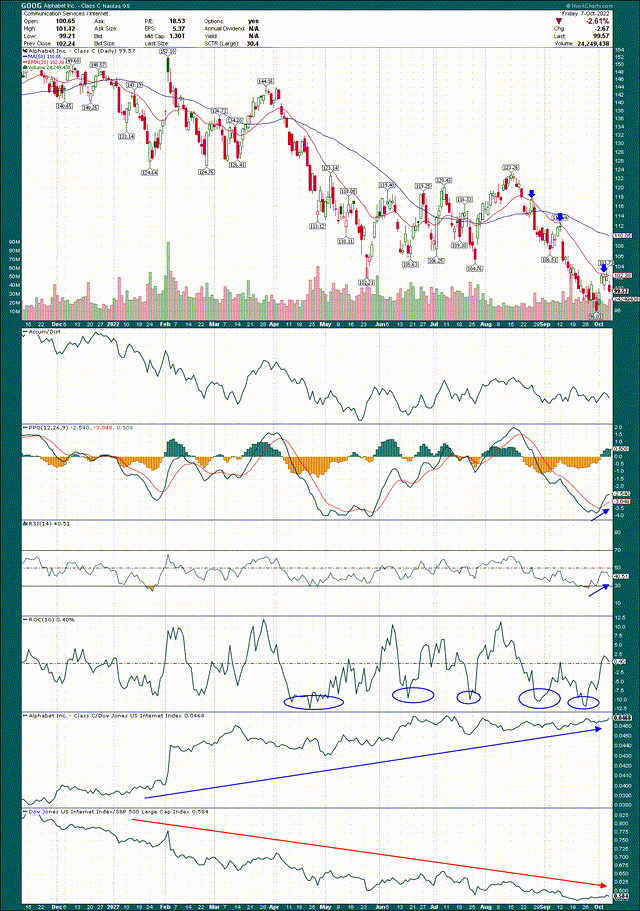

We’ll start with the daily chart, and while I won’t try to paint this as a pretty chart, I do think there is cause for optimism given the low-risk setup that’s in place right now.

StockCharts

StockCharts

On the price chart, we can see Alphabet has tried to crest the declining 20-day EMA three times in the recent past, and all have failed. The first thing that bulls need to do is crest that line convincingly, and then continue to rally the stock. Until that happens, it is firmly in the midst of a downtrend. So how will we know when that is more likely to occur? The indicators are showing we may just be on the cusp of that right now.

The accumulation/distribution line is fairly weak, so I don’t think we’re going to get any help there. If we start to see that turn sustainably higher, that’s an early indication big money is buying dips. We don’t have that right now.

However, the picture improves with the momentum indicators. The PPO made a bottom recently that was in the same area it has made intermediate-term bottoms before, which corresponded to the same in the 14-day RSI and 10-day rate of change. Now, just because history rhymes does not mean it repeats, but the correlation of these indicators bottoming along with price is too much for me to ignore.

In addition, if we do get a test of $96, we’ll almost certainly do so with positive divergences in the momentum indicators. That means the bottom is much more likely to form when we get those positive divergences, as they signal waning bearish momentum.

Finally, Alphabet remains the absolute pick of the litter when it comes to internet stocks, which are largely comprised of companies that rely upon ads to generate revenue. There are few stocks that have trounced their peer group like Alphabet has, so if/when the ad stocks turn higher, Alphabet will almost certainly be one of the largest beneficiaries. That’s a longer-term tailwind potentially, but something to keep in mind.

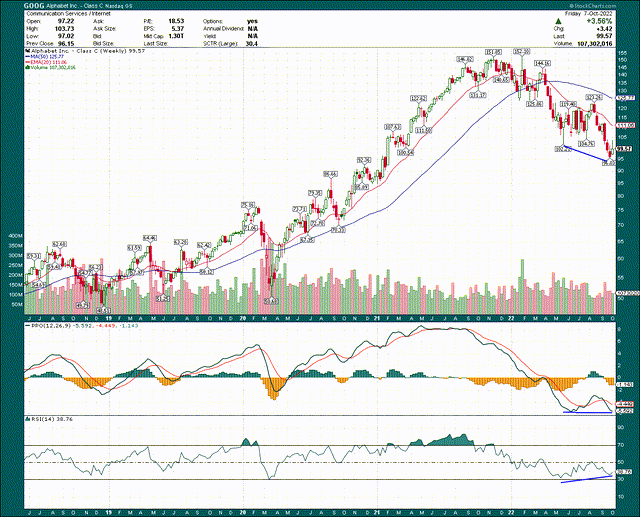

Now, let’s take a brief look at the weekly chart for a longer-term perspective.

StockCharts

StockCharts

The one thing I wanted to point out here is that we have more signs of positive divergences in place. Weekly price has made a significantly lower low since the spring, as noted above, but the PPO is flat and the 14-week RSI is actually much higher. That’s a textbook positive divergence, and in my view, it greatly increases the odds that the bounce potential we looked at on the daily chart will stick. Nothing is guaranteed, but all the pieces are in place for a sustainable bottom here.

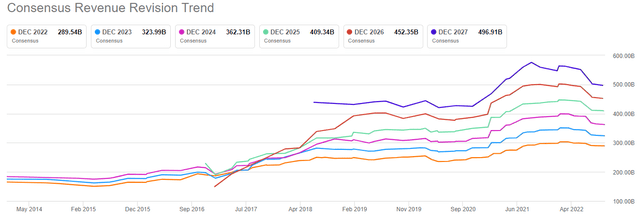

As I mentioned in the open, the environment for ad stocks is terrible. Investors believe we’re in a potentially harsh recession, and that would mean lower ad spending. Should that come to fruition, that’s not a good thing for Alphabet. If you need proof of this, have a look at the revisions for the stock in the past three months.

Seeking Alpha

Seeking Alpha

There’s one analyst out of more than 30 – one – that has seen fit to raise estimates. This is about as extreme as it gets in terms of sentiment from analysts, and its uncharacteristic of Alphabet to say the least. However, times of extreme sentiment (particularly bearish sentiment) tend to create the best trading opportunities. I believe we have one of those today.

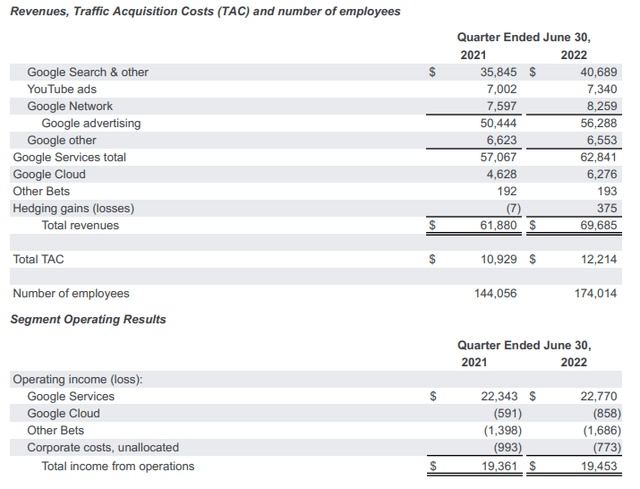

Looking ahead, those analyst revisions have taken a toll on the company’s revenue estimates, but the toll has thus far been fairly small.

Seeking Alpha

Seeking Alpha

Yes, estimates have come down, but the magnitude is hardly disastrous. This year’s revenue estimates peaked at $303 billion in March, and stand at $290 billion today. That’s a reduction of less than 5%, while the stock has fallen about five times that much since March. The out years are seeing somewhat larger reductions, but keep in mind that if you look at this year’s estimates (orange line above), back in 2014/2015/2016 they were a fraction of today’s reality. In other words, long-term, Alphabet’s estimates for 2025+ are much more likely to go higher than lower once this economic unpleasantness is behind us. The stock is being sold like Alphabet’s business model is facing long-term impairment, and I just don’t think that’s a reasonable assumption to make.

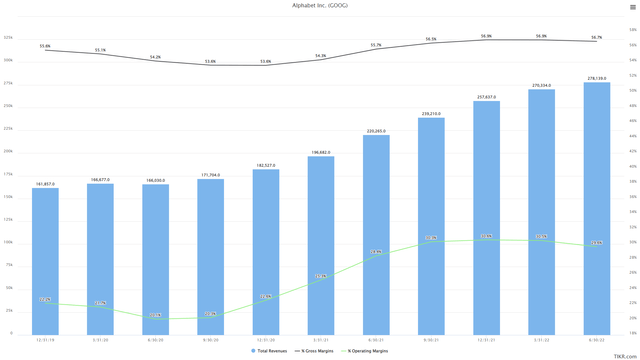

Now, one important consideration for any company is margins, so let’s take a look at trailing-twelve-months revenue, and its relationship with gross and operating margins.

TIKR

TIKR

There are other factors in play with these numbers – the company’s Other Bets and SG&A spending come to mind – but in general, higher revenue begets higher margins. Operating margins have ramped higher in recent years despite enormous spending by Alphabet to invest in future growth. As ad spending recovers into 2023 (as I believe it will), we should see a reflation of margins coinciding with higher revenue. Keep in mind also that just like the stock has been destroyed before the actual decline in revenue and earnings, it will rise again before the revenue and earnings have returned. We buy when sentiment is at its worst to capture the bulk of that move for that reason.

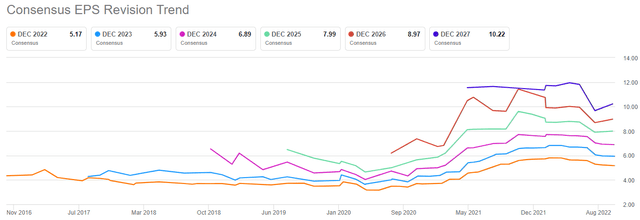

Let’s now boil all of that down to EPS revisions, which you can see below.

Seeking Alpha

Seeking Alpha

We can see more pronounced moves to the downside in EPS than we did in revenue, which is the product of operating leverage. The good news is this works both ways, so if/when the fundamental outlook improves for revenue, these lines should move meaningfully higher once more. Let’s also not lose sight of the fact that projections are for pretty steady mid-teens increases year after year.

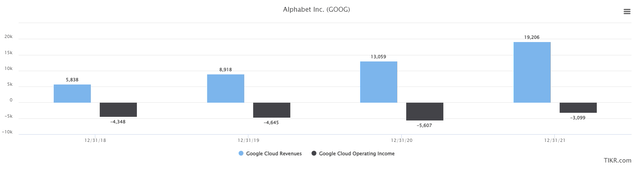

Let’s shift gears a bit to a segment discussion, and specifically, Cloud. We can see annual revenue and operating earnings below for that burgeoning but still small segment for the past four years.

TIKR

TIKR

Alphabet is still investing heavily in what is a money-loser, but obviously, the goal is that at some point down the road, it stops being a drag and starts being a tailwind. Amazon did this, as have other software/cloud services businesses, so it can definitely work. For now though, Alphabet’s value is being driven lower by its Cloud segment.

Q2 earnings release

Q2 earnings release

This year’s Q2 showed a widening loss for Cloud, as revenue was up ~36%, but the operating loss was up ~45%. This is one quarter, but it looks like Cloud is going to continue dragging on Alphabet for the foreseeable future. Investors would do well to examine Cloud’s results in the coming quarters for signs this will stop being a multi-billion dollar drag on earnings, because that’s the same as billions of dollars of earnings in the Services business if Cloud simply breaks even.

There is a variety of ways to value a stock like Alphabet, so let’s have a look at three. First, we’ll start with price-to-sales, which is seen below.

TIKR

TIKR

The stock is going for ~4.3X forward sales, which is very near the lowest valuation it’s had in the past five years. The COVID spike lower was briefly the lowest P/S ratio, but under normalized conditions, this is about as cheap as it gets. The average for this period is 5.5X, or ~28% higher than today.

Let’s now look at price-to-earnings for the past five years.

TIKR

TIKR

We’re at 18X forward earnings now, which is the cheapest it’s been in five years, even lower than COVID. The average here is 26X, or ~45% higher than today. Alphabet’s margins are better than they have been for much of the five-year period, and it’s growth isn’t slowing, so I don’t see a lot of cause for this. Temporary weakness of ad revenue is not a long-term impairment, but that’s what the valuation is suggesting.

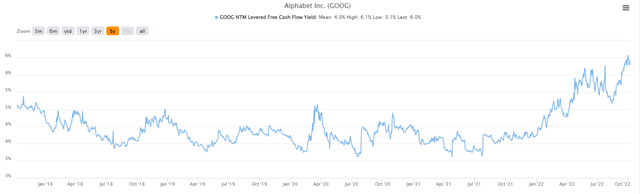

Finally, we can look at a non-traditional valuation technique, free cash flow yield. This is exactly what it sounds like, and the higher, the better.

TIKR

TIKR

FCF yield is higher than it’s ever been, as the value the market is placing on Alphabet’s ability to generate cash continues to decline. This chart is pretty clear, and it speaks for itself; the stock is cheap on this measure, as well as the others we looked at.

Could this recession get much worse? Absolutely. That would be a terrible situation for ad companies because ad buyers would slow spending on ads, and estimates would need to come down for the sector. That has already occurred to an extent for Alphabet, but as I said above, current estimates are pricing in a rough few quarters.

When you combine the very cheap valuation (however you value it), it appears the stock is being priced for even further cuts in the months to come. If that comes to fruition, the recovery in price is going to take longer. If it doesn’t, the stock should see a valuation reset significantly higher than it is today.

It appears to me that much of the risk of an ad recession has been priced in, and that the bias should be to the upside.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.

Sign up today!

This article was written by

I’ve been covering financial markets for ten years, using a combination of technical and fundamental analysis to identify potential winners (and losers) early, particularly when it comes to growth stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.