(Bloomberg) — Wall Street is starting to doubt that retailers can snap out of a yearlong stock-market slump as consumers increasingly tighten their belts heading into the crucial holiday shopping season.

Most Read from Bloomberg

Disney Shares Jump on Optimism Over Iger’s Surprise Return

Swedish Housing Is Now in the Worst Rout Since the 1990s

Malaysia Latest: Parties Race to Form Government Before Deadline

US Stocks Drop With Fed Policy, China in Focus: Markets Wrap

Malaysia Latest: Tight Election Race Points to Hung Parliament

It’s been a brutal 2022 for retail stocks. And sales from the fourth quarter, traditionally the strongest time of the year, may not be a savior this time around as more stores and chains warn that frugal shoppers are going to cut into their bottom lines.

Some traders are clearly betting against the sector or hedging their exposure to even deeper losses.

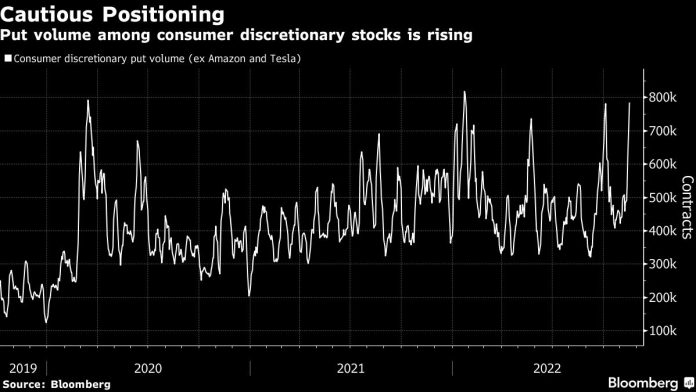

Trading volume in bearish put options for the consumer discretionary sector spiked recently, with the turnover now at levels similar to those during the March 2020 pandemic selloff. Similar skepticism was seen in May when a slew of retailers cut their annual profit forecasts.

A cautious approach is understandable. Target Corp. tumbled after announcing that sales trends softened in October, calling out weakness in key gift areas like toys. The National Retail Federation also predicted that holiday sales would grow at a significantly slower pace than last year. And Amazon.com Inc. projected the slowest holiday-quarter growth in its history, sending its market value briefly below $1 trillion.

The bad news reflects how much inflation, growing economic uncertainty and rising interest rates are weighing on holiday spending plans.

“The consumer is going to be looking for deals, and that will end up likely pressuring margins,” said Mark Stoeckle, chief executive officer of Adams Funds. “So if you believe that, why would you own these stocks right now?”

During the third quarter, the firm’s Adams Diversified Equity Fund, which has about $2 billion in assets under management, sold its stakes in Target and Walmart Inc. in favor of more defensive consumer stocks, like beverage companies and Tractor Supply Co., which sells animal feed and farm equipment.

And there clearly are more skeptics in the market. Shares out on loan for the members of the S&P 500 Consumer Discretionary Index, an indication of short positioning against the group, are up to 3.7% on average from 2.7% at the beginning of the year, according to data from S&P Global Market Intelligence.

The final months of the year are more crucial than ever for retailers, as the S&P 500 Retailing Index has lost more than 30% in 2022. Soaring inflation is forcing shoppers to pay more for essentials, and that’s left stores stuck with a glut of excess products, causing retailers to mark down prices at the expense of profits.

Read more: Holiday Shopping Deals Roar Back in US With ‘Massive’ Discounts

Kohl’s Corp.’s earnings report highlighted the uncertainty, as the discount department store withdrew its annual profit forecast and said that sales have slowed. While Walmart’s quarterly results topped analyst expectations, it is taking a wait-and-see approach with its holiday projections.

Target shares are down 30% this year through Friday’s close, while Kohl’s has slumped 37%. Walmart erased its loss for 2022 following earnings last week, and the stock is now up 3.8% for the year.

Read more: Apparel Earnings Beats May Be Eclipsed by Soft Holiday Season

US retail sales actually climbed the most in eight months in October, according to Commerce Department data released last week. But sales at department stores still fell, and other key discretionary categories like electronics and sporting goods declined. Looking ahead, Goldman Sachs surveyed 1,000 US consumers and found that nearly half plan to spend less this holiday season than they did last year.

One thing’s for sure: it will be a bumpy ride for investors in retail shares. From 2011 to 2021, the average stock in Goldman’s basket of consumer companies saw a 2.9% move, in either direction, from the day before Thanksgiving to the day following Cyber Monday, while the SPDR S&P 500 Trust (ticker SPY) typically moved 1.3%.

Investors will be closely watching quarterly earnings reports this week from Best Buy Co., Nordstrom Inc. and several mall-based apparel retailers for further perspective on holiday sales trends.

Stacey Widlitz, president of SW Retail Advisors, said it’s difficult to predict how the next couple of months will play out, with companies trying to sell through bloated inventories as consumers curb spending.

“You’re definitely seeing a customer that’s being much more careful about what they’re buying,” she said. “It’s like the perfect storm for this holiday.”

–With assistance from Jessica Menton.

(Adds details on retailers’ share-price performance in 12th paragraph.)

Most Read from Bloomberg Businessweek

Tech Layoffs Send H-1B Visa Holders Scrambling for New Jobs

A Nation in the Crosshairs of Climate Change Is Ready to Get Rich on Oil

Sears Limps Through What Could Be Its Final Holiday Season

Fatal Crashes Highlight Rising Danger of Illicit Charter Flights

FTX Was an Empty Black Box All Along

©2022 Bloomberg L.P.

Along with the holidays comes not only the pressure to buy gifts for loved ones, but also the pressure to host dinner gatherings, decorate your home and make extensive travel plans. Holiday…

Wall Street’s 'timid approach to earnings revisions sets up risks' for the U.S. stock market, which already is expensive, according to the CIO of Morgan Stanley Wealth Management.

(Bloomberg) — Malaysia’s stocks pared declines after Saturday’s election produced the country’s first-ever hung parliament and amid a broader slump in Asia.Most Read from BloombergDisney Shares Jump on Optimism Over Iger’s Surprise ReturnSwedish Housing Is Now in the Worst Rout Since the 1990sMalaysia Latest: Parties Race to Form Government Before DeadlineUS Stocks Decline With Fed Hikes, China in Focus: Markets WrapMalaysia Latest: Tight Election Race Points to Hung ParliamentThe benchmark KLC

Holiday shopping is here, and retailers are offering steep discounts to attract shoppers

(Bloomberg) — Most Read from BloombergSwedish Housing Is Now in the Worst Rout Since the 1990sDisney Shares Jump on Optimism Over Iger’s Surprise ReturnBeyond Meat Plant’s Dirty Conditions Revealed in Photos, DocumentsUS Stocks Drop With Fed Policy, China in Focus: Markets WrapCrypto Brokerage Genesis Is Said to Warn of Bankruptcy Without FundingIsrael raised interest rates less than forecast by most economists even as a top central banker signaled borrowing costs will need to go higher to get

Consumers, especially younger generational cohorts, are flocking to shopping malls this season.

The John Kander-Fred Ebb musical looks fresh and vibrant in a new staging by Josh Rhodes to open a new season at Sarasota’s Asolo Repertory Theatre.

(Bloomberg) — San Francisco Fed President Mary Daly said that officials will need to be mindful of the lags with which monetary policy works, while repeating that she sees interest rates rising to at least 5%.Most Read from BloombergSwedish Housing Is Now in the Worst Rout Since the 1990sDisney Shares Jump on Optimism Over Iger’s Surprise ReturnCrypto Brokerage Genesis Is Said to Warn of Bankruptcy Without FundingBeyond Meat Plant’s Dirty Conditions Revealed in Photos, DocumentsUS Stocks Drop W

China's accelerating Covid crisis, as well as renewed bets on a U.S. recession, sent stocks to a lower close to start the short Thanksgiving week.

Novavax (NASDAQ: NVAX) shares were down more than 16% in late-afternoon trading. On Tuesday, a dispute between the biotech maker of vaccines to treat infectious diseases and global nonprofit Gavi sent Novavax's shares dropping. On Monday, Novavax canceled its contract with Gavi, saying the nonprofit had breached an agreement to purchase, in advance, 350 million doses of Nuvaxovid, Novavax's COVID-19 vaccine.

Elon Musk has evolved in a world apart. For more than 10 months he was the only member of the most select financial club on the planet, one that has never welcomed more than two members at the same time. The Tesla CEO and owner of microblogging website Twitter was a regular member there for the past few months — until he was ousted a few weeks ago.

In this article, we talk about 10 stocks that billionaire Ray Dalio dumped from his portfolio. If you want to see more stocks in this selection, check out Billionaire Ray Dalio is Dumping These 5 Stocks. Ray Dalio is an American billionaire hedge fund manager, philanthropist, and the founder of Bridgewater Associates, one of the […]

FTX collapsed. These players held the keys.

It’s difficult to put a positive spin on the current state of the stock market. While 2022’s action has seen moments of relief, for the most part, the trend has been resolutely downbeat, as reflected in the main indexes’ performances. All are down by at least double-digits; the tech-heavy NASDAQ’s 30% drop has been the most acute, while the S&P 500 now sits 17% lower year-to-date. That said, while it’s hard to watch any owned stock sink to the bottom, the upside to the downside is that investors

Trouble had been brewing for months as CFO Christine McCarthy and other senior figures campaigned with the Disney board to force Chapek out.

Wall Street believes mean reversion and geopolitical tensions could play a key role

In minds and numbers, Tesla remains the star of the automotive industry. The market capitalization of Elon Musk's group is above $532 billion at last check. Toyota , General Motors , Ford and Volkswagen are far behind with market values $199 billion, $57 billion, $56.5 billion and nearly $100 billion, respectively.

Oxbow Advisors Managing Partner Ted Oakley and Morgan Stanley Private Wealth Management Advisor and Senior Vice President Jacqueline Remmen join Yahoo Finance Live to discuss buying opportunities in the market, Fed policy, and the likelihood of a recession.

Yahoo Finance Live anchor Seana Smith highlights which stocks to watch in after-hours trading.

These supercharged income stocks, with yields ranging from 8.5% to 17.7%, were on billionaire money manager's buy lists during the third quarter.