Home ⇒ Index Investing ⇒

Published: November 27, 2022 at 6:00 am

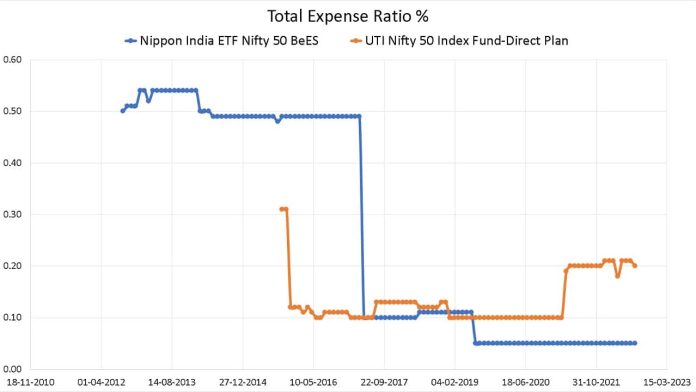

A reader asks, “I cannot decide between Nippon India Nifty 50 Bees ETF and UTI Nifty 50 Index Fund. The ETF has a total expense ratio of 0.05%, while the index fund’s TER is 0.2%. My friends tell me that ETF is bound to outperform the index fund over the long term and that choosing the ETF is a no-brainer. However, you repeatedly keep asking us to avoid ETFs. Can you please advise what to do?”

Your question reminds me of a line from the movie the Prestige. Hugh Jackman’s character says, “price is not an object.” David Bowie’s character (Nikola Tesla) responds, “Perhaps not, but have you considered the cost?” Yes, the price of investing in an ETF is much lower than that of an index fund, but what about the cost?

Unlike an index fund, an ETF trades like a stock (only high-net-worth individuals can buy and sell off the market). Therefore the NAV of an ETF is not relevant for tracking errors or returns. Only the market price matters.

The price of an ETF should ideally follow the NAV of an ETF. It can trade above/below the NAV for a few days, but an AMC-authorized participant reduces this difference via arbitrage.

However, when there is a supply-demand mismatch due to sudden positive or negative developments, the ETF price can significantly deviate from the NAV. The true cost of investing in an ETF is this price-NAV deviation.

Very few ETFs in India consistently keep this NAV-price deviation in check. Very few ETFs in India see active trading. A large AUM or active trading are not prerequisites for low-NAV price deviations.

If we compare the price of Nifty Bees (not NAV, never NAV!) with UTI Nifty, which would come out on top? Many would expect the ETF to win, but that is not necessarily the case.

Suppose a fund’s expense ratio is the only reason for deviating from the index, the tracking error will be zero. This is because a fixed amount is deducted from the NAV of the ETF/ index fund, and therefore the relative volatility wrt the benchmark is zero.

The main sources of tracking error in an index are the AUM in and outflow, the impact costs of stocks (buy vs sell price deviation when sold in bulk) and corporate actions of stocks (dividends, splits etc.) This is particularly notorious in small AUM index funds. See: These five index funds beat their indices! Why you should avoid them!

An ETF also suffers from all these issues. In addition, it suffers from demand vs supply in its investors’ pool. Then there is the authorized participant who would only efficiently reduce price-NAV deviation when there is enough arbitrage incentive.

Therefore even before we compare the returns, it is clear that an index fund is the simpler choice, but would the higher expense ratio makes a difference to the returns?

The 1y, 3Y and 5Y rolling returns based on ETF price and index fund NAV are shown below. The date range is from Aug 2nd 2016, to Sep 30th 2022.

Over 1 and 3 years, the difference is negligible. Over five years, the ETF edges up with an average higher return of 0.24%. The median return is also the same (to two decimals). Please note that 5Y data is only over a year (see the range of the X-axis shrink from 1 to 5 years).

Assuming both passive funds are just as efficient in tracking the index (given their specific circumstances), the ETF has a small edge originating, possibly because of the higher expense ratio of the index fund. In May 2021, the UTI fund doubled its expense ratio from 0.1% in March 2021 to 0.2%. For its part, the ETF has had a steady expense ratio of 0.05% only from July 2019. Before that, it was as expensive as the UTI fund (0.1%); before May 2017, the ETF was more expensive.

ETF or index fund, a simple thumb rule is when the expense ratio decreases, the fund house wants AUM and when it increases, the fund house wants to profit from the AUM increase and expects the inflow to be steady.

There is one catch to buying an ETF, though. A demat account is necessary, with its own one-time and recurring costs (brokerage and maintenance fee). So this would further narrow the gap in the five-year returns.

In summary, although Nippon India Nifty 50 Bees ETF is an excellent performer, the UTI Nifty 50 Index Fund is just as good and is the simpler choice for long-term investing. That said, experienced investors who can navigate the ETF price volatility can certainly consider Nifty Bees.

You Can Be Rich Too with Goal-Based Investing

Your Ultimate Guide to Travel

How to earn one lakh a month passive income?

Passive Income Automation: An Example

How to turn your social media comments into passive income!

Passive income examples that work in more ways than one!

Passive income is a crucial part of your retirement plan: How to get started

List of Fee-only Financial Planners

Create a start to finish financial plan with the freefincal robo advisory template

What we can learn from Petrol, Diesel historical price inflation data

Do not expect returns from mutual fund SIPs! Do this instead!

Do Not Invest Rs. 50,000 in NPS for additional tax saving benefits

If you have some information relevant to freefincal or have a question, you can send it to letters [AT] freefincal.com

Note: We do not accept paid/free guest post requests. We do not work with professional content writers or marketing agencies. We do not participate in link exchanges or brand campaigns Such emails will be discarded.

Increase your income by getting people to pay for your skills! (675+ members!)

Learn how to manage your portfolio regardless of market conditions! (2800+ members!)

Bhaskarapuram, Mylapore, Chennai, Tamil Nadu 600004

We do not provide investment advice!

Connect with us on social media

Get our free e-books!

Watch My Talks

Mutual Fund Reviews

Tactical Asset Allocation (Market Timing)

List of Fee-only Financial Planners

⭐ ⭐ ⭐ ⭐ ⭐ Our Google My Business Rating is 4.9 stars! Check our reviews!

Follow us via:

Learn more about us: