Home ⇒ mutual fund reviews ⇒

Published: August 1, 2022 at 6:00 am

We review Nippon India Nifty Alpha Low Volatility 30 Index Fund, an open-ended scheme tracking the Nifty Alpha Low Volatility 30 Index. The NFO period is from 1st Aug to the 12th of Aug 2022.

What is the Nifty Alpha Low-Volatility 30 Index? It is a 30-stock index selected from NIFTY 100 and NIFTY Midcap 50 based on 50% Jensen’s alpha and 50% low volatility. The index weight is capped at 5%.

What is alpha? Alpha is not an excess return! Alpha is excess return calculated on a risk-adjusted basis. There is a big difference! Alpha is a measure of risk-adjusted outperformance with respect to NIfty 50 and the MIBOR* 3-month bond rate representing the risk-free return. MIBOR = Mumbai Interbank Offered Rate (a benchmark rate for one bank to lend to another). Read more: What is the Alpha of a fund/stock? It is NOT excess return above the market!

Many people assume that “Alpha =Excess Returns over the normal returns”. This is incorrect. Alpha factors in how volatile a stock/fund has been compared to the market. A stock/fund that beats the market but is more volatile than the market in doing so will have lower alpha than a fund with lower volatility. Thus even stocks/funds with no excess returns can “produce an alpha”.

“Alpha” can be viewed as a form of momentum investing.

What is low volatility? It is defined as the “Standard deviation of daily price returns” over the last year. Also see: Watch my talk on momentum and low volatility stock investing in India.

What is a factor-based index? An index created by active stock selection using conditions such as low volatility, momentum, alpha, quality, value etc. and not market capitalization is called a factor index. Stocks in the index are weighted using these factors – for e.g., lower volatility stock has a higher weight. So this combines active stock-picking – quantitative, rule-based -with passive investing (if an ETF or index fund follows this index).

What is a multi-factor index? This is an index constructed with two or more factors or rules. For example, the NSE launched four multi-factor indices: 1. NIFTY Alpha Low-Volatility 30 = 50% alpha + 50% low volatility. 2. NIFTY Quality Low-Volatility 30 = 50% quality + 50% low volatility. 3. NIFTY Alpha Quality Low-Volatility 30 = 1/3 Alpha + 1/3 Quality + 1/3 Low Vol. 4. NIFTY Alpha Quality Value Low-Volatility 30 = 25% Alpha + 25% Quality + 25% Value + 25%Low Volatility.

For more details on each of these indices, see: How new stock investors can quickly start investing using NIFTY Multi-Factor Indices. Also see: Overview of indices and index investing in India (Youtube video)

What is the benefit of a factor index? Unlike a market-cap-based index, a factor index often (not always) has a weighting cap of, for example, 5%. This lowers concentration risk. Depending on the rule used, a factor-based index can, from time to time (not always), offer lower risk and/or higher returns than a market-cap-based index.

However, much of this “performance” is based on a backtest and not actual traded history. The general public cannot access all permutations and combinations of factors used. Therefore we can never objectively decide if the particular set of rules used for an index is the only possible set or if anything else would have worked just as well. Read more: Data Mining in Index Construction: Why Investors need to be cautious.

What is the benefit of a multi-factor index? This provides diversification in the rules. When an index house or fund house projects a single factor index or ETF, they would tell you “why a single-factor is better than a usual index”. They would leave out the fact that a single factor may not work all the time or can be riskier. When they project a multi-factor index or ETF, they will go, “Multi-factors counters the impact of the cyclicality of single-factor indices”.

This means factor X works on some days, factor Y on some other days. So we are hoping X + Y would be better. The problem is that we can never objectively find out if X+Y is better than X or Y.

For example, the NSE has three Alpha-based indices and two low volatility-based indices.

Now, if we were to combine Alpha and Low volatility, the logical way to do it would be to do this from either the top 100 or top 300 because there are corresponding single-factor indices.

However, the Nifty Alpha Low Volatility 30 Index is based on the top 150 NSE stocks. What is the reasoning for choosing a different base for the multi-factor index? We will never know. It makes us wonder if this was the combination that did the best in the backtest! If so, then the prospects of future failure are higher than usual. Without any supporting reasoning, the index construction appears to be arbitrary. This may or may not be an act of data mining, but it certainly makes someone driven by a sense of rigour and logic uncomfortable.

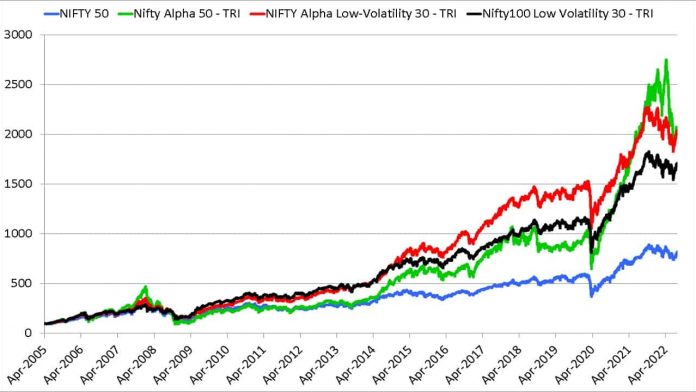

To see how the base stock universe makes all the difference, the inception evolution of Nifty Alpha Low Volatility 30 is compared with other indices.

The Alpha 50 index picked from the top 300 NSE stocks underperformed the low volatility index for several years. Even the alpha+ low volatility index did not outperform low volatility for the first 7/8 years since its inception.

So the NSE possibly did not want the top 300 stocks as a base for alpha+ low vol. It also did not want the top 100 as the base as the outperformance wrt low volatility was probably not that “optimal”. So they presumably chose the top 150 as a base for the red line to come out better than the black line without too much volatility.

If alpha + low volatility could underperform “low volatility” for years in the past. The same could happen in the future particularly after we start investing!

In July 2017, the NSE published a whitepaper on multi-factor indices in which it conceded “Low-Volatility index strategy has remained one of best-performing

strategies over long term period”. They also pointed out that “alpha” outperformance strongly depends on bull runs.

So intuitively, combining alpha + low volatility will make things worse for an investor preferring low volatility and make things better for an investor chasing after alpha. “Make things better/worse” here refers to a decrease or increase in the spread of rolling returns.

First, let us look at the five-year rolling returns of the Nifty Alpha Low Volatility 30 Index vs other Alpha-based indices and Nifty 100 TRI.

Now, we compare Nifty Alpha Low Volatility 30 Index with volatility-based indices and the Nifty 100 TRI. The quality index is also included.

The 10-year rolling returns data is shown below. Please keep in mind that the data window is quite short.

Should investors consider investing in Nippon India Nifty Alpha Low Volatility 30 Index Fund?

Investors must appreciate that Nippon India Nifty Alpha Low Volatility 30 Index Fund is a “high risk, high reward” choice. That is, the risk is guaranteed, and the returns are possible. The backtested history of such funds is short, and the actual traded history is shorter.

Then there is the arbitrary nature of selecting the stock universe. Momentum or alpha works well only during bull runs. It can be quite frustrating if the market goes nowhere or south (as it did from 2008 to 2013). We, therefore, feel that a basic market cap weighted index is the simplest choice. For those who fancy factor investing, low volatility is a better choice. See UTI S&P BSE Low Volatility Index Fund Review.

Nippon India Nifty Alpha Low Volatility 30 Index Fund is suited only for those who do not mind taking on higher return volatility with the “hope” to outperform both the market (Nifty 100 or Nifty 200) and the “low volatility” factor. However, even for such investors, we recommend waiting for a few months to study the AUM collected, the expense ratio and tracking errors.

You Can Be Rich Too with Goal-Based Investing

Your Ultimate Guide to Travel

How to earn one lakh a month passive income?

Passive Income Automation: An Example

How to turn your social media comments into passive income!

Passive income examples that work in more ways than one!

Passive income is a crucial part of your retirement plan: How to get started

List of Fee-only Financial Planners

Create a start to finish financial plan with the freefincal robo advisory template

What we can learn from Petrol, Diesel historical price inflation data

Do not expect returns from mutual fund SIPs! Do this instead!

Do Not Invest Rs. 50,000 in NPS for additional tax saving benefits

If you have some information relevant to freefincal or have a question, you can send it to letters [AT] freefincal.com

Note: We do not accept paid/free guest post requests. We do not work with professional content writers or marketing agencies. We do not participate in link exchanges or brand campaigns Such emails will be discarded.

Increase your income by getting people to pay for your skills! (675+ members!)

Learn how to manage your portfolio regardless of market conditions! (2800+ members!)

Bhaskarapuram, Mylapore, Chennai, Tamil Nadu 600004

We do not provide investment advice!

Connect with us on social media

Get our free e-books!

Watch My Talks

Mutual Fund Reviews

Tactical Asset Allocation (Market Timing)

List of Fee-only Financial Planners

⭐ ⭐ ⭐ ⭐ ⭐ Our Google My Business Rating is 4.9 stars! Check our reviews!

Follow us via:

Learn more about us: