Spencer Platt/Getty Images News

Spencer Platt/Getty Images News

Robinhood (NASDAQ:HOOD) had a simple mission when it went public in the summer of 2021; democratize finance for all. In this regard, the Menlo Park-based company founded just 8 years prior brought commission-free trading to the masses. The company through its iconic app pioneered the free trading of stocks, exchange-traded funds, and cryptocurrencies. Hence, it lived up to its namesake Robin Hood, the legendary heroic outlaw and skilled Archer from English folklore who robbed the rich to give to the poor. This modern capitalist retelling saw a near-total elimination of the high trading fees previously enjoyed by stockbrokers.

Robinhood IPOed at a near $32 billion valuation with its shares trading as high as $85 at one point on the back of a $2.1 billion raise. To state Robinhood as a financial revolution would be an understatement. The company almost singlehandedly brought trading costs to basement levels as a plethora of incumbent stock brokers including Charles Schwab (SCHW) and Interactive Brokers (IBKR) all eliminated their trading fees as a direct response to Robinhood’s dramatic rise during the pandemic.

With the pandemic also came an explosion in trading that led to the rise of the retail ‘meme traders’. This was Robinhood’s golden era and would see trading volumes and active traders catapult to new heights. Finance had truly been democratized and the new landscape was Robinhood’s for the taking.

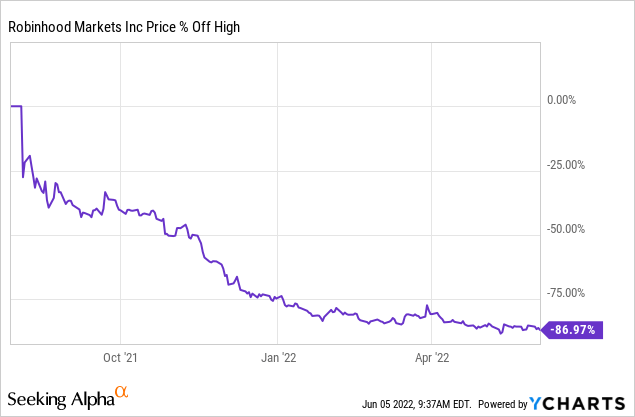

This fledgling orthodoxy has been shattered with the near 87% decline in Robinhood’s common shares as the stock market collapses. The torrid situation compounded as Bitcoin and other cryptocurrencies also plunged. The not yet named decimation of investor confidence and crumbling of equity valuations has all but brought an end to the meme stock era. Further, the material pullback of what had been an intense level of leverage as portfolios imploded has also likely created a new generation of lost wealth. These investors are very likely to avoid the stock market indefinitely as they seek to rebuild their wealth. What does this mean for Robinhood?

The golden era is all but over and the company now faces intense headwinds as a global inflationary led recession looms.

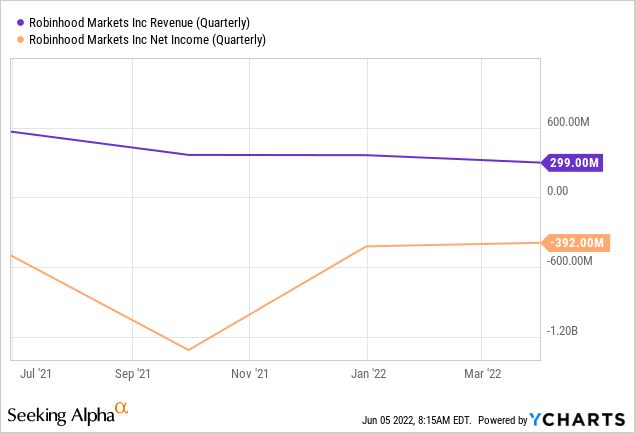

Robinhood recently released earnings for its fiscal 2022 first quarter which saw revenue come in at $299 million, a year-over-year decline of 42.7% and a miss of $58.21 million on consensus estimates.

Net loss was also high at $392 million, albeit an improvement from a net loss of $1.45 billion in the year-ago quarter. The company continues to suffer from a pullback in interest in the stock market. Monthly active users fell sequentially to 15.9 million from 17.3 million with average revenue per user also falling sequentially by 18% to $53. This was also a 62% year-over-year decrease.

Morning Consult

Morning Consult

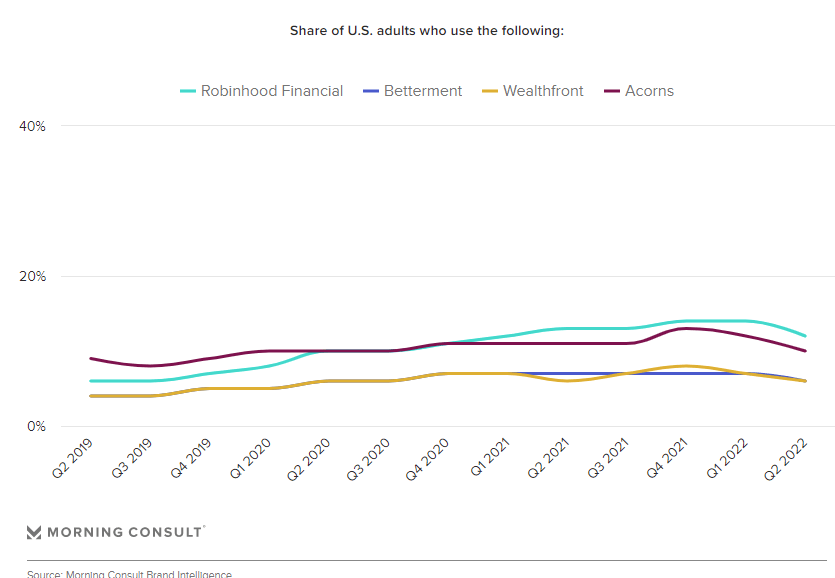

Following a trend of upward growth, the share of US adults who actively trade has started to decline as a reaction to the stock market crash. And Robinhood is responding to this with a 9% headcount reduction of its 3,800 employees following consecutive years of hyper-growth that saw this swell from 700 just a few years ago.

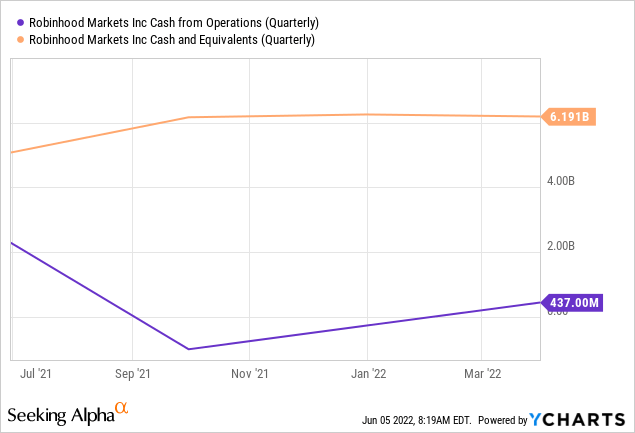

The quarter left the company with cash and equivalents of $6.19 billion with cash from operations positive at $437 million. A phenomenon that’s explained by the adjustment of net loss for non-cash expenses. Whilst Robinhood is expected to burn cash for the whole of fiscal 2022, the current large cash balance does provide a buffer for the company to survive the next few years of uncertainty.

This will come from competition that is now plenty. With not just the traditional incumbents offering free trading but a plethora of venture capital-funded startups like Lightspeed and newly public fintech companies like SoFi (SOFI).

Robinhood has icon status across the investment world. To its detractors, the company gamified the incredibly serious process of investing and inadvertently influenced its customers to take excessive risks. To its advocates, Robinhood is an iconic American company that revolutionised trading and is set to ride the wave it created through the current trying times. Indeed, the financials could worsen if the stock market malaise continues.

The company’s management deserves credit for accomplishing its mission. They stayed true to their namesake, rebelling against an old order for the sake of the many and winning. However, answering whether free stock trading is truly beneficial for retailers opens a pandora’s box.

For now, the wide exuberance that characterized the pandemic era has come crashing down. Easy money is gone and Robinhood faces a fight to remain relevant against the barbarians at its gate. In a worst-case scenario, it is likely to be snapped up, with a Citi analyst placing this at potentially $15 per share. In a best-case scenario, the golden era is revived. Robinhood longs will be hoping for the latter.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.