The video site promised to pay the podcaster that amount over four years.

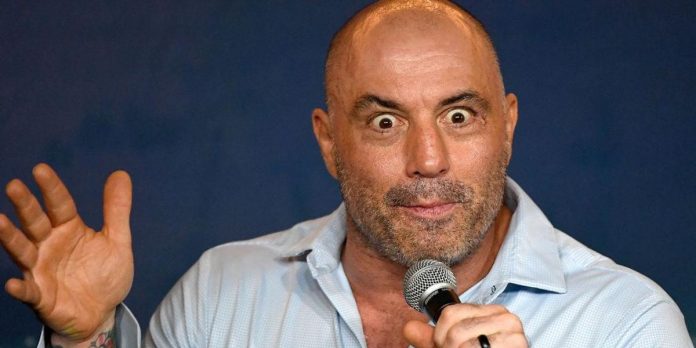

Rumble, a YouTube rival that’s popular among conservative audiences and video creators, offered Joe Rogan $100 million to leave Spotify and join its service.

Rumble posted a message from CEO Chris Pavlovski on its Twitter account Monday asking Rogan to bring all of his shows to the service for payment over the course of four years.

“We’d like to offer you 100 million reasons to make the world a better place,” Pavlovski said in the message. “This is our chance to save the world. And yes, this is totally legit.”

Rumble was founded in 2013 and has gained traction from right-leaning audiences for its lack of moderation, which has allowed anti-vaccine misinformation to spread on the service. Last May, the company attracted an undisclosed amount of funding from investors such as Peter Thiel and “Hillbilly Elegy” author J.D. Vance, giving it a valuation of $500 million. It is unclear how Rumble plans to finance the Rogan offer.

Spotify has come under fire in recent weeks for not moderating Rogan’s podcast, The Joe Rogan Experience, which has frequently dug into problematic themes and spread misinformation. After major artists Neil Young and Joni Mitchell left the audio service, Spotify CEO Daniel Ek said in a blog post that the company “[doesn’t] take on the position of being content censor.”

Days later, Spotify took down 70 episodes of Rogan’s podcast for using racial slurs, reportedly at Rogan’s request. Ek apologized to staff for the controversy in a company memo.

“Not only are some of Joe Rogan’s comments incredibly hurtful — I want to make clear that they do not represent the values of this company,” Ek wrote.

Spotify had previously paid Rogan $100 million to make The Joe Rogan Experience available exclusively on its service.

Correction: This story has been updated to correct the spelling of the names of Joe Rogan and Daniel Ek and the date of Pavlovski’s post This story was updated Feb. 7, 2022.

Want your finger on the pulse of everything that’s happening in tech? Sign up to get Protocol’s daily newsletter.

Your information will be used in accordance with our Privacy Policy

Thank you for signing up. Please check your inbox to verify your email.

Sorry, something went wrong. Please try again.

A login link has been emailed to you – please check your inbox.

In the tech giant’s latest step to unify its messaging platforms, Meta’s Messenger is making your DMs disappear.

The Facebook parent company announced a slew of updates to Messenger on Wednesday which includes “Vanish Mode,” which allows your messages to disappear after they’ve been seen. The addition makes Messenger the last of Meta’s big messaging apps to add a disappearing messages function: Meta-owned Instagram and WhatsApp both already have this feature, both adding it in late 2020. Vanish Mode for Messenger is the latest signal of the company’s continued push to unify its platforms and standardize their features.

Reports emerged in 2019 that Meta was planning to integrate its messaging apps, unifying their infrastructure but allowing the platforms to continue to operate as standalone apps. The company also aims to feature end-to-end encryption throughout the system. The infrastructure merger, which reportedly began in mid-2020, may help Meta compete with Apple’s iMessage, as the company’s messaging apps serve billions combined.

Meta has owned Instagram since 2012 and WhatsApp since 2014. Messenger became its own app outside of Facebook in 2011.

“The CFTC is well situated to play an increasingly central role in overseeing the cash digital asset commodity market,” commission chair Rostin Behnam said in testimony Wednesday before the U.S. Senate Committee on Agriculture, Nutrition, and Forestry.

Behnam asked for an increase of at least $100 million to the CFTC’s annual budget of $300 million to take on additional responsibilities in regulating the volatile crypto market.

The Senate and House Agriculture committees are the financial agency’s committees of jurisdiction because of its role in overseeing farm commodities, though its role has broadened over time well past that remit.

“We have also been a forceful and disciplined cop on the beat,” Behnam said. “The continued emergence of digital asset technology presents risks and opportunities, and the CFTC stands ready to leverage its expertise and experience to confront both.”

In his testimony, the CFTC chair outlined the ways in which his regulatory agency is uniquely positioned to oversee the digital asset market, repeatedly referring to it as the “cash digital asset commodity market”, stressing that digital assets should be viewed as commodities.

His stance that digital assets are commodities was a nod to an ongoing power struggle between the CFTC and the Securities and Exchange Commission on who gets to regulate crypto, which turns on the question of whether digital assets are commodities or securities. Some crypto companies have pushed for the CFTC to play a bigger role, while Coinbase has called for a brand-new regulator specific to digital assets.

Last month, Agriculture Committee chairwoman Debbie Stabenow and other committee members sent a letter to Behnam in which they wrote that “the two largest digital assets by market capitalization, bitcoin and ether, are commodities,” suggesting that the committee is inclined to give the CFTC more regulatory power.

SEC chair Gary Gensler still maintains that many crypto assets are securities and go under the SEC’s purview, with the exception of bitcoin, which the CFTC has been regulating.

A potential expansion of the CFTC’s role in regulating crypto could erode the SEC’s position. But it’s also possible the two agencies could emerge with joint oversight responsibilities, as is the case with securities futures.

Microsoft has announced a series of new app store policy commitments, which apply to its Microsoft Store on Windows and in its various gaming marketplaces. The company specifically cited proposed U.S. regulation, which includes the Open App Markets Act and the American Innovation and Choice Online Act, along with potential scrutiny of its Activision Blizzard acquisition, as the motivating factors.

The post, authored by President Brad Smith, outlines 11 principles the company has pledged to follow with how it treats developers and the rules it imposes on software distribution. Some of these principles cover existing positions, like Microsoft’s announcement last year it would not forbid app-makers from using a third-party payment system for software sales through the Microsoft Store.

But Microsoft is going a step further today in “adapting to regulation” rather than “fighting against it,” Smith wrote. He explained that the commitments the company is announcing today are “grounded in app store legislation being considered by governments around the world, including by the United States, the European Union, the Republic of Korea, the Netherlands, and elsewhere.”

The principles include three commitments to quality, safety, security and privacy; two on accountability, including a pledge to “not use any non-public information or data from our app store to compete with developers’ apps”; two on fairness regarding the ranking of apps and marketing and placement in its stores; and four principles on developer choice, outlining Microsoft’s positions on letting app-makers choose third-party payment systems and communicate with customers.

Many of these positions stand in stark contrast to App Store restrictions Apple has been vigorously defending both in the antitrust lawsuit against Epic Games and in bouts with regulators around the world. And Smith’s post takes a clear shot at Apple.

“Our vision is to enable gamers to play any game on any device anywhere, including by streaming from the cloud. App stores on the most relevant and popular everyday devices like mobile phones; PCs, including Windows PCs; and, in time, the cloud, are important to realizing this vision,” Smith wrote. “But too much friction exists today between creators and gamers; app store policies and practices on mobile devices restrict what and how creators can offer games and what and how gamers can play them.”

All 11 of these principles will apply to Microsoft’s approach to software distribution on PC, mobile and the cloud, but not all of them will apply to its Xbox platform. The company sees its Xbox console as a closed ecosystem; in the Epic trial, Xbox executive Lori Wright outlined how the company loses money on hardware sales and relies on the closed nature of the Xbox platform to earn money on software sales and subscription services.

“Some may ask why today’s principles do not apply immediately and wholesale to the current Xbox console store. It’s important to recognize that emerging legislation is being written to address app stores on those platforms that matter most to creators and consumers: PCs, mobile phones and other general purpose computing devices,” Smith argued. It’s a position Wright also emphasized in her testimony, and one Microsoft has publicly expressed to explain why Xbox should not be open to third-party app stores.

“Gaming consoles, specifically, are sold to gamers at a loss to establish a robust and viable ecosystem for game developers. The costs are recovered later through revenue earned in the dedicated console store,” Smith said. “Nonetheless, we recognize that we will need to adapt our business model even for the store on the Xbox console. Beginning today, we will move forward to apply Principles 1 through 7 to the store on the Xbox console.”

Smith did, however, add that Microsoft is “committed to closing the gap on the remaining principles over time,” and that it will “incorporate the spirit of new laws even beyond their scope, while moving forward in a way that protects the needs of game developers, gamers, and competitive and healthy game-console ecosystems.”

It’s unclear if that means Microsoft may in the future open the Xbox platform to third-party payment systems or alternative app stores, or if the company intends to lower its store commission on Xbox from 30% to 12%, as it did last year for PC gaming apps on the Microsoft Store.

Sony has developed what it’s calling a breakthrough artificial intelligence program for the Gran Turismo series of PlayStation racing games. The software, called Gran Turismo Sophy, is so sophisticated, Sony says, that it handily beat a group of the world’s best virtual race car drivers in test version of the 2017 game Gran Turismo Sport in October.

“Outracing human drivers so skillfully in a head-to-head competition represents a landmark achievement for AI,” Chris Gerdes, a Stanford professor specializing in autonomous driving, wrote in a Nature article published alongside Sony’s research. Gerdes said this research could one day affect self-driving car development, according to Wired. “GT Sophy’s success on the track suggests that neural networks might one day have a larger role in the software of automated vehicles than they do today,” Gerdes wrote.

Using video games to develop and train novel AI systems has become a popular research strategy for the world’s most cutting-edge AI labs. In just the last decade or so, board and card games like Go and Texas hold ’em and sophisticated strategy video games like Starcraft and Dota have been “solved,” so to speak, after becoming test beds for some of the world’s most advanced forms of self-learning AI. Many of these research teams use a variety of AI training called deep reinforcement learning, which effectively allows an AI to evolve over time using various combinations of trial and error and reward systems modeled after human neural development.

Gran Turismo Sophy is no different, though Sony said learning to operate a virtual race car as realistic as those deployed in Gran Turismo presented a unique challenge for its research team. While AI programs have become superhuman at numerous games, these programs often excel at ones in which they’re able to take considerable time computing the best move to make. In a racing game, the AI has to make continuous judgment calls while using near-perfect reflexes and obeying restrictions Sony put in place to replicate the rules of a real-life race, such as penalties for overly aggressive driving.

“In order to train the agent at massive scale, we developed a novel distributed reinforcement learning platform that can run many instances of GT Sport. We deployed these systems at massive scale using SIE’s cloud gaming infrastructure,” said Michael Spranger, the chief operating officer of Sony AI, in a virtual press conference on Wednesday. “Finding the right balance between aggressive but fair racing is one of the defining characteristics of motorsport. Collectively, this is what makes GT Sophy a unique AI achievement.”

Sony said it plans to incorporate Gran Turismo Sophy into the upcoming Gran Turismo 7, which releases in March, as a training tool for players. Like in chess, Go and other games, AI programs have shown to have a positive effect on human play, highlighting unique strategies humans had not yet discovered and pushing opponents to push beyond their limits to try to keep pace with machine play.

“Sophy takes some racing lines that a human driver would never think of,” Gran Turismo creator Kazunori Yamauchi told Wired. “I think a lot of the textbooks regarding driving skills will be rewritten.”

Correction: An earlier version of this story misstated the year Gran Turismo Sport was released. This story was updated on Feb. 9, 2022.

Tesla is recalling vehicles for the ninth time since October. The recall affects almost 27,000 U.S. vehicles over a software issue that could cause windshield defrosting problems, according to a report posted from the National Highway Traffic Safety Administration earlier this week.

The NHTSA said the EV company’s software used to defrost vehicles could cause issues with windshield visibility in particularly cold temperatures, increasing the risk of an accident. Tesla said the issue could allow a valve in its heat pump to unintentionally open and trap refrigerant inside the evaporator. Tesla said it’s not aware of any collisions related to the software issue and will perform an over-the-air software update to address the issue.

The recall affects some 2021-2022 Model 3, Model S, Model X and 2020-2022 Model Y cars. Tesla began deploying firmware carrying the windshield issue in December, and the company began receiving complaints about a loss of heating performance later in the month, according to the report.

“The heat stops working at cold conditions,” one complaint filed on Jan. 12 states. “Many other users have reported this problem … I have experienced this myself when going on a trip back home from upstate NY to NC , I had no heat with temps outside being at 3 degrees F, not only was the car extremely cold causing me and my wife to get sick, but you can not use the defrost because there is no heat.”

Tesla has faced a series of recalls in recent months. The company most recently recalled U.S. vehicles over its “rolling stop” feature, and recalled 475,000 vehicles in December because of defects with its rearview mirror camera and primary latch.

The wheels of justice grind slowly, but sometimes that means a 50x return.

The Justice Department seized $3.6 billion in bitcoin that was stolen in a hack of crypto exchange Bitfinex in 2016, officials said Tuesday.

Ilya Lichtenstein and Heather Morgan, the husband and wife charged with conspiring to launder the bitcoin, were arrested in New York Tuesday. After a hacker breached Bitfinex and initiated 2,000 unauthorized transactions in August 2016, the bitcoin was sent to Lichtenstein’s digital wallet. The stolen tokens were worth about $72 million at the time.

Officials said the case is the largest financial seizure in the department’s history — a feat largely attributable to the enormous run-up in the price of bitcoin in the period between the initial hack and the arrests in the case. The couple allegedly stole 120,000 bitcoin, worth $4.5 billion, and the Justice Department has reclaimed $3.6 billion of that amount. Officials said 25,000 of those bitcoin were transferred from Lichtenstein’s digital wallet into the couple’s financial accounts over the past five years.

“Cryptocurrency is not a safe haven for criminals,” Deputy Attorney General Lisa Monaco said in a statement. “In a futile effort to maintain digital anonymity, the defendants laundered stolen funds through a labyrinth of cryptocurrency transactions.”

Lichtenstein and Morgan face charges that carry a 20-year maximum prison sentence.

XRP’s price has soared on news that soon-to-be-unsealed documents expose a key flaw in the SEC case against Ripple.

XRP, the cryptocurrency used by Ripple, was up more than 30% over the past week after a federal court judge in New York ordered documents unsealed. Traders anticipated that the currently sealed legal documents would show that the crypto company got legal advice from an outside law firm which concluded that XRP were not securities.

The SEC sued Ripple in 2020, arguing that XRP is not a currency but a security, and therefore subject to strict securities laws. U.S. District Judge Analisa Torres of Manhattan has ordered that the documents must be unsealed on Feb. 17, Reuters reported.

“Once released, these documents will show that in 2012 Ripple received a legal analysis that XRP was not an investment contract,” Ripple General Counsel Stuart Alderoty said in a statement. “The fact that it took the SEC eight years to suggest they disagreed with that analysis — while XRP traded in a massive global market — is baffling.”

The SEC could not immediately be reached for comment. The agency had offered a different interpretation, saying the documents would show Ripple knew that XRP would be considered a security under federal law, according to the report.

Apple has officially announced its contactless payments feature through iPhones, a move that could simplify and expand acceptance of in-person, phone-to-phone payments.

Tap to Pay on iPhone, the NFC-reading hardware feature and supporting software, will be available soon for developers to integrate into their services, the company said. Apple isn’t involved in processing the payments and won’t be able to read the card numbers customers transmit when tapping their phones or other NFC devices, like contactless chip cards. The service could make it easier for merchants to accept payments, since they could do so from an iPhone without needing any additional hardware.

Stripe will be the first payment company to offer the service, and will provide these payments for Shopify’s point-of-sale app this spring. The move could also boost Shopify’s efforts to offer more in-store payments and shopping services.

News of the pending launch was previously reported by Bloomberg. Though some jumped to characterize the feature as a “Square killer,” Apple’s payments feature only replaces the card readers Square provides, not a full-featured point-of-sale system or other business services. But it could enable Square competitors — like Stripe and Shopify — to compete more effectively for in-person retail transactions.

Peloton’s CEO John Foley is resigning, and the company is slashing about one-fifth of its corporate workforce, affecting 2,800 jobs, The Wall Street Journal reported Tuesday. Foley’s departure follows pressure from Blackwells Capital, an activist investor that had called for Foley to leave.

Foley will become executive chairman of the company, and former Spotify CFO Barry McCarthy will take over as CEO and president. “I have always thought there has to be a better CEO for Peloton than me,” Foley said. “Barry is more perfectly suited than anybody I could’ve imagined.”

Peloton President William Lynch will also resign from his executive role but remain on the board, and Erik Blachford, a director since 2015, will leave the board. Angel Mendez, who runs an AI firm, and Jonathan Mildenhall, Airbnb’s former CMO, will join as new directors, according to WSJ.

Amazon, Nike and others have reportedly been looking to buy the exercise technology company as its stock sank and it laid off a slew of sales and marketing workers. Late last month, Blackwells Capital had called for Foley’s resignation, citing what the investor saw as a series of missteps by Peloton’s leadership.

Correction: This story has been updated to correct the spelling of Blackwells Capital. This story was updated Feb. 9, 2022.

Ahead of the midterm elections, Google is trying to keep campaign workers and candidates safe online. The company introduced an initiative Tuesday called Campaign Security Project, which will connect high-risk users like election workers and journalists with resources to better protect themselves online.

Google partnered with a group of political organizations including Collective Future, Women’s Public Leadership Network and LGBTQ Victory Institute to help train candidates and campaign workers on ways to stay safer online. A Google spokesperson said the organizations aim to educate “as many campaign and election-related workers as possible” through the project. Google did not say how much it’s spending on the initiative.

The Campaign Security Project builds off of Google’s past programs on online election safety. Last year, the company helped roll out a Cybersecurity for State Leaders program, which has educated over 8,000 election officials on ways to fend off digital attacks. Google has also worked with the nonprofit Defending Digital Campaigns to give federal campaigns free access to a two-factor authentication system.

Google also announced a $5 million partnership with Khan Academy to build free online lessons on internet safety. In an announcement, the company cited a 110% spike in searches for “how to stop identity theft” as part of the reason for the collaboration. “We’re delighted to deepen our relationship with Google and grateful for their continued support of our bold mission,” Khan Academy founder Sal Khan said in an announcement. “Google’s generous contribution will allow us to create new lessons about online safety that are available for free.”

Correction: An earlier version of this story misstated the percentage increase in identity theft searches. This story was updated on Feb. 9, 2022.

The year-and-a-half-long saga of Nvidia’s $40 billion proposal to acquire Arm may have finally come to an end.

The Financial Times reported late Monday that the Nvidia’s offer to buy Arm from SoftBank had collapsed amid regulatory pressures on three continents. The proposed acquisition had seen increasing opposition in recent months. Regulators in the U.S., U.K. and EU have signaled concerns with various aspects, and a handful of tech giants, such as Qualcomm, Google and Microsoft, have opposed it too.

The deal’s collapse prompted the replacement of CEO Simon Segars by Rene Haas, the head of Arm’s intellectual property division, according to the report.

SoftBank and Nvidia declined to comment.

The Arm acquisition was always a long shot for Nvidia, even by the bold standards set by the company’s CEO Jensen Huang. But as opposition mounted toward the end of last year, it seemed ever more unlikely to clear the necessary hurdles. Arm has said in regulatory filings that the Nvidia deal would give it the cash necessary to continue to improve its technology, which powers most of the world’s smartphones.

Now Arm and SoftBank will need to find another way to fund Arm’s innovation. One way may be through an initial public offering, and the Financial Times also reported that SoftBank is planning to take Arm public by the end of the year.

Last week, Bloomberg News also reported the deal’s imminent collapse, as SoftBank began to prepare for an initial public offering, and Nvidia told partners the deal was through.

The IRS announced Monday that it will “transition away” from using ID.me, a facial recognition company the agency had partnered with to verify online accounts. The government’s partnership with the company was widely criticized, as facial recognition technology has been proven to be less accurate with darker-skinned faces. Some had also expressed security concerns over a private company accumulating so much data of people’s faces and sharing it with a government agency.

Facial recognition was intended to make tax filings more secure and improve user experience, according to the IRS. Unlike with passwords, users can’t forget their own face, or accidentally share it with someone else through a phishing scam. Americans were not forced to use ID.me to file their taxes, but would need to upload a selfie to use the facial recognition software and access tax information online.

When the IRS announced its partnership with the private company in January, however, the backlash was immediate. Tensions only escalated when the company finally admitted that it uses a one-to-many matching technique, which requires accumulating a large database of faces users are then matched with. The company had initially denied the use of this technique, before ID.me CEO Blake Hall admitted the company used it in some circumstances to curb identity theft.

Senator Ron Wyden sent an open letter to the IRS Monday, pushing back. Though he didn’t highlight the one-to-many matching technique specifically, he named many of the security and bias issues other critics had raised. He also emphasized that the IRS “cannot solve digital identity,” urging federal agencies to wait for facial recognition technology to further develop before they choose to implement it.

The IRS quickly responded. “We understand the concerns that have been raised,” said IRS Commissioner Chuck Rettig, responding directly to the criticism in a press release just hours after Wyden published his open letter. “Everyone should feel comfortable with how their personal information is secured.”

The IRS had planned to roll out the use of ID.me in the summer of 2022. Now, the agency says it is “quickly pursuing short-term options.”

Peter Thiel, one of Meta’s first major investors, will leave the company’s board of directors at the company’s annual stockholders meeting, the company announced Monday. Thiel is leaving to focus on backing candidates in the upcoming midterm elections, The New York Times reported.

Thiel is reportedly looking to support candidates aligned with Donald Trump’s agenda, a source with knowledge on the matter told the New York Times. Ahead of the November midterm election, Thiel will support three candidates for Senate and 12 candidates for House, according to the report.

Thiel has become one of the Republican party’s biggest donors, giving $10 million each in 2021 to candidates running for senate seats in Arizona and Ohio.

“It has been a privilege to work with one of the great entrepreneurs of our time,” Thiel said in a statement. “Mark Zuckerberg’s intelligence, energy, and conscientiousness are tremendous. His talents will serve Meta well as he leads the company into a new era.”

Thiel, who invested $500,000 in Zuckerberg’s Meta 18 years ago, has been a board member of the company since 2005.

“Peter is truly an original thinker who you can bring your hardest problems and get unique suggestions,” Mark Zuckerberg said in a statement. “He has served on our board for almost two decades, and we’ve always known that at some point he would devote his time to other interests. I’m grateful he’s served on our board for as long as he has, and I wish him the best in his journey ahead.”

Google Cloud announced this morning that it added a new layer of threat detection in its Security Command Center, named Virtual Machine Threat Detection. The announcement said that the new security service will scan virtual-machine instances running on Google Cloud to help detect crypto-mining threats without requiring customers to install new software on their instances.

The added security layer comes after a report released by Google in November last year found that “86% of the compromised Google Cloud instances were used to perform cryptocurrency mining, a cloud resource-intensive for-profit activity,” and that attackers took advantage of “poor customer security practices or vulnerable third-party software in nearly 75% of all cases.”

Google also said that in an effort to preserve trust among cloud customers wary about providers monitoring their data, the new security feature will be an opt-in feature, as well as provide encrypted memory when moving from a CPU to RAM.

Crypto-mining attacks, otherwise known as “cryptojacking”, have been increasing over the past years, peaking at a high in April last year, according to Cointelegraph. Reports in 2018 also found that at least 55% of businesses worldwide were affected by the attacks, including Google-owned YouTube, whose ads were used by hackers to use unauthorized computing power.

A group of crypto companies, including Coinbase, Circle, Solidus Labs and Anchorage Digital, have launched a new alliance to combat “market manipulation and abuse” in an industry that has drawn fire for failing to crack down on bad actors.

The Crypto Market Integrity Coalition aims to make the digital asset financial services industry “more inclusive, transparent and productive” for all participants by preventing “market manipulation schemes.”

The coalition cited schemes such as pump and dump; wash trading, in which a market player “buys and sells the same asset so as to increase trading activity, attract investors, and ultimately affect prices”; and other “new crypto-specific” manipulation tactics.

The move comes at a time when federal agencies, led by the SEC, are expected to propose and push new regulations for the fast-growing crypto industry.

“We agree that, regardless of regulatory requirements, market activity should be reviewed and monitored on a reasonable ongoing basis for purposes of detecting and eliminating market manipulation and unfair market abuses,” the coalition said.

Amazon is having a tough time dealing with the labor shortage, primarily in its warehouses. That’s why, in last week’s earnings call, the company announced that it would be raising the price of Prime by $20 a year.

But it’s also grappling with hiring and retaining corporate workers, so it’s raising their maximum base pay from $160,000 to $350,000.

The move, which GeekWire first reported Monday, came as the company has been under fire for lower-than-average corporate salaries. Employees have asked leaders to address salary in company town-hall meetings. And churn has been high: Some sections of the company lost as much as 35% of their staff in 2021.

Though Amazon’s base pay was uncharacteristically low, the labor shortage has given employees at several companies leverage to demand better benefits and pay. Parental leave, employer-provided mental health care and ample vacation time have transitioned from wants to needs, in addition to workers demanding better pay. Recruiters have struggled to keep up across the industry — about 50% of Facebook recruits turned down job offers in the first quarter of 2021, for example.

Pay transparency is on the rise, too. Tools like levels.fyi and salary calculators help tech workers directly negotiate salary in comparison to their peers. Without raising pay, Amazon risked losing staff to its competitors.

According to a post on Amazon’s internal corporate site, the company will adjust compensation during the employee performance review process.

Big Tech has emerged from a couple of busy earnings weeks. Most of those companies will feel pretty good about their earnings … except for Meta.

Amazon and Microsoft pointed to their cloud businesses as bright spots, while chip companies say they feel they have this whole chip crisis increasingly under control. On the other hand, TikTok is scaring seemingly everybody, as the race for short-form video supremacy heats up. Then there’s Tesla, which is more concerned about its humanoid robot than its cars.

Here’s a look at some of the biggest takeaways from tech earnings over the past couple weeks:

Mark Zuckerberg confirmed what everyone knows to be true: TikTok is a force to be reckoned with. As Meta’s stock tanked after the company reported its first drop in Facebook users ever, Zuckerberg emphasized the importance of short-form video. So expect to see even more focus on Reels, Meta’s short-form video feature, as it looks to take on TikTok. Meta isn’t the only platform feeling pressure from the short-form video giant, either. Sundar Pichai said YouTube is continuing to focus on Shorts, its own TikTok clone.

The key to building the best short-form video platform seems to come down to how well companies can treat creators: YouTube highlighted all of the ways creators can make money off its platform late last month, and Instagram most recently began testing out creator subscriptions.

Meta said that Apple’s ad-tracking change, which requires apps to ask users if they want to be tracked, will result in a $10 billion sales drop this year. That admission has been a long time coming: The company said back in October that Apple’s ad-tracking rule was bound to hurt business. “The Facebook ad product — thanks to the Apple iOS changes — just doesn’t cut the mustard anymore,” Alexis Ohanian noted.

Snap had also expressed concerns about Apple’s change a few months ago, but CFO Derek Anderson said the company bounced back from the change “quicker than we anticipated.” Snap remains cautious, though, adding that it’ll take a couple more quarters before its ad partners are fully behind its new measurement solutions.

Pinterest had also worried about Apple’s change, but its retail advertisers helped offset that concern.

The chip shortage hasn’t gone away, but chip companies came out strong this quarter. Qualcomm performed well this quarter, following the likes of Samsung and Apple, which said the chip crisis has mainly impacted its older models. Intel even posted the best quarterly and full-year revenue in its history.

Not everyone is so optimistic about the shortage: Tesla said it won’t release any new models this year, in part because of the bottleneck.

AWS is keeping its commanding lead over the cloud-computing business, despite long-held predictions that Google and Microsoft would eventually outpace it. While Microsoft Azure revenue increased 46% and Google Cloud grew 44% last quarter, AWS revenue increased by 40%.

But Satya Nadella thinks Microsoft might make bigger moves in the coming quarter. He’s been saying since the fall that cloud infrastructure can combat inflation, and though Azure’s growth slowed from 50% and 51% the previous two quarters, the company is still broadcasting an optimistic outlook. Microsoft indicated that its cloud business will continue to accelerate next quarter, and given it has an edge on Amazon in business software, the company is probably hoping committed Office 365 users will shift towards wanting all their enterprise tech in one place.

Amazon is still dealing with a labor shortage. The issue is impacting Amazon Prime, which will see a $20 increase in its annual membership due in part to the rising cost of workers. Andy Jassy said labor supply shortages continued because of a surge in COVID-19 cases, but a rise in wages and transportation costs also haven’t helped.

The price hike for Amazon Prime follows a stressful holiday season for the company. Amazon spent billions to offset labor costs, transportation fees and supply chain issues ahead of the holiday season, while Apple said it lost billions because of similar issues. Apple hasn’t completely navigated labor shortages and high shipping fees either, but said it’s expecting those problems to let up by March.

Sure, Amazon might also be competing with Tesla in the race for the first efficient electric truck. But Elon Musk hasn’t seemed to notice.

The chip shortage is getting in the way of Tesla finally delivering its Cybertruck, which Musk originally said would be in production by 2021. But he missed that self-set deadline, and is again delaying expectations at least another year.

Instead, Musk wants all eyes on a flashy new humanoid robot Tesla will be releasing … at some point, maybe this year. (As we’ve learned, Musk is not great with deadlines.) It’s been assigned the code-name “Optimus,” and Musk said it’s the “most important product development” Tesla’s working on — despite the fact that he warned about an AI apocalypse just a few years ago.

“It is important to me that we don’t take on the position of being a content censor.”

Sound familiar? That was Spotify’s CEO explaining to investors his handling of the Joe Rogan Experience podcast in a blog post last week, ahead of the company’s earnings call. But it’s awfully similar to how Mark Zuckerberg describes his thoughts on content moderation, over and over again.

Will platforms ever learn? Probably not until earnings force their hands. And though Spotify’s stock took about a 20% hit over the Joe Rogan controversy, the company is hoping it’ll blow over, just like Netflix’s controversial decision to stick with Dave Chappelle. “Usually when we’ve had controversies in the past, those are measured in months and not days. But I feel good about where we are in relation to that,” Ek said at the top of the company’s earnings call.

FAANG — the initials for five tech stocks that seemed perpetually bound for the moon.

While Apple, Amazon and Alphabet continue to appear unstoppable, earnings calls this past week have shaken up that inevitability for Meta and Netflix. Facebook’s daily users declined for the first time ever, while Netflix’s membership growth is slowing, and Netflix forecasted even bleaker news next quarter.

Make no mistake, though: The giants remain giant. Facebook has nearly 2 billion daily users, despite a more pronounced downturn in the U.S. Netflix added 8.3 million new subscribers last quarter. But stock prices still took a major hit, each falling about 20% after earnings. So while it may not yet be the end of the road, the ceiling may be in sight.

Coinbase CEO Brian Armstrong has spelled out the crypto company’s policies for removing content from the site, a move that underlines the growing push to remove objectionable or misleading information on the web.

In a blog post published on Friday, Armstrong said Coinbase will take “moderation action” – including removing content or terminating an account – if the content is deemed “illegal in a jurisdiction in which we operate,” if it falls under an exception under the First Amendment or if a “critical partner” such as Apple’s App Store “required us” to do so.

“We believe everyone deserves access to financial services, and that companies should put appropriate controls in place to prevent censorship or unjust account closures from taking place,” Armstrong said. “I’m sure we won’t get it perfect with our policy …but my hope is that we’ve laid out some principles we can fall back on when difficult decisions arise, and that investors, customers, and employees can have a better understanding of our process.”

Armstrong explained Coinbase’s policy at a time when tech companies have drawn fire for content that was denounced as misleading and dangerous. The most recent example involved Spotify, which has faced heavy criticism for hosting Joe Rogan, the podcaster accused of spreading misleading information about the pandemic. Armstrong said that even though Coinbase is unlikely to face the kind of moderation decisions that companies like Meta and Spotify do, “we still need to set clear policies around acceptable use of our products.” As Coinbase expands into NFTs and other products, he added, these policies could be tested more often.

After announcing its long-awaited NFT marketplace yesterday powered by Immutable X, Gamestop has already dumped almost one-third of the tokens it received as part of the deal. The video game retailer is poised to receive over 56.2 million IMX tokens, used to operate the Immutable X blockchain, from Immutable as part of their partnership, according to a document it filed with the SEC.

GameStop has only received about 37.5 million IMX tokens so far, and has already dumped 15 million of them, worth about $47 million total, across three transactions. The tokens were sold on the Huobi, Binance and OKX crypto exchanges.

The three transactions were timed with its NFT marketplace teasers and announcements, with GameStop selling its tokens right when the price of IMX surged, resulting in a crash after the sale. Yesterday’s rally saw the token value hit a high of $4.25, but the IMX token is now valued at $2.99, down 16.5% over the last 24 hours, with a high of $3.58.

As of publication, GameStop still holds about 22.5 million IMX tokens, valued at about $67 million. GameStop shares rose 3% today, leaving the company worth $7.8 billion.

After months of stagnation, the House voted in favor Friday of legislation that would create billions of dollars in subsidies for semiconductor companies building factories in the U.S.

The proposed law, the America Competes Act, is broadly aimed at China’s growing global influence, but it includes roughly $50 billion in funding to subsidize chip manufacturing, research and development in the U.S. The legislation is broadly supported by the chip industry. The benefits are clear: Funding for new chip factories, or fabs, would help the companies that build them and the fabless businesses such as AMD, Nvidia and Qualcomm that rely on contractors to manufacture their products.

“We’re excited that the House and the Senate agree on the need to provide the manufacturing and R&D incentives that our industry needs to maintain America’s leadership role,” Intel Vice President of U.S. Government Relations Al Thompson told Protocol in a phone interview. “And we’re looking forward to the House and Senate reconciling their bills to get something to the president’s desk sooner rather than later.”

The U.S. share of chip manufacturing has dropped to roughly 12% from nearly 40% over the last 30 years. And because semiconductors are becoming an increasingly important part of the global economy, political tension — between the U.S. and China, for example — has prompted the U.S. and other countries to seek to increase their chip manufacturing capacity. Geopolitical tension has been compounded by the chip shortage triggered by COVID-related supply disruptions and big changes to people’s buying habits.

A similar piece of legislation to the House bill passed the Senate last year with bipartisan support. According to people familiar with the process, the House version stalled because the Democrats prioritized other laws ahead of it. The House bill, which received more than 500 amendments, is unlikely to make it to the president’s desk in its current form as many of the additions are not in the Senate version of the bill.

The proposed law will undergo a reconciliation process with the Senate that could take weeks or months as the midterm election approaches.

Biden said at a recent event unveiling new Intel factory construction in Ohio that the administration supports chip subsidies, and urged Congress to pass the $52 billion package.

Meta’s stock fell a record 26% on Thursday, wiping out more than $200 billion in market capitalization after disappointing earnings. Reddit’s cofounder Alexis Ohanian wasn’t shocked by the company’s fall from grace, he told Bloomberg, as its digital advertising model isn’t catching the eyes of ad buyers anymore.

Meta was one of several ad-heavy platforms that was hit hard by the Apple privacy updates that rolled out in May, which required apps to get users’ permission before tracking activity for advertising uses. Because of this change, Ohanian said all of the “savviest marketers,” have started ditching Facebook for advertising.

“The Facebook ad product — thanks to the Apple iOS changes — just doesn’t cut the mustard anymore,” he told Bloomberg in an interview Thursday.

Meta put the blame on Apple for its poor quarter, claiming in its earnings call that the iOS advertising changes could cost Facebook $10 billion in 2022.

The pandemic is continuing to send people back home to work. The share of people teleworking in January increased to 15.4%, up from about 11% in December, according to a new report from the U.S. Labor Department.

During the prior seven months, the share of people working remotely remained well under 15%. The last time the share of people teleworking stepped over that figure was last May, when 16.6% of employed people worked at least in part from home.

The average workweek also dipped for the first time in the past 12 months: the average employee worked 34.5 hours per week in January, a slight decrease from the month before. The decrease is marginal, but cutting the number of working hours in the week continues to be popular among tech companies. The number of companies transitioning to a four-day workweek is rising, and scheduled company-wide breaks are also popping up.

The new data show that COVID-19 is continuing to keep people home in general: The Census Bureau found that nearly 9 million people couldn’t work because they were sick or caring for someone who was ill, a three-fold jump from December. The coming months will show how lasting the trend is, though, with the number of infections slowly starting to come down from a major omicron-related spike. But last summer, when a similar spike subsided and companies prepared to open their offices, a sizable number of workers stayed home anyway.

The White House has said it supports “the bipartisan progress being made in Congress” on reining in Big Tech through antitrust in a victory for would-be reformers in the U.S., according to a report by Politico.

At the same time, the Thursday evening statement made clear the administration has concerns about “distinct elements” of the European Union’s fast-moving competition revamp, which largely aimed at American tech companies.

The nod to Congress’s work got cheers from those who want to remake competition law. They’ve been hoping for help in overcoming concerns from moderate Democrats, California lawmakers, floor leaders and Republicans allied with big business.

Many of those same advocates and consumer groups have said, however, that the U.S. should support the EU finalizing its antitrust-focused Digital Markets Act. That measure could kick off international regulation of the companies sooner than the U.S. bills would be ready.

Splits have also emerged in the U.S. government itself, between those who support increased competitive scrutiny of Big Tech and those whose job is to defend American companies on the world stage.

Packages of antitrust bills are moving forward on a bipartisan basis in both chambers of Congress, with a Senate bill aimed at app stores advancing to the floor as recently as Thursday.

Getting those proposals to the president’s desk, however, could mean sacrificing or altering key portions, and the White House’s focus on “progress” may signal that the administration would like to see further changes to the bills.

Amazon raised the annual cost of Amazon Prime memberships by $20 a year to offset increasing wage and supply-chain costs, the company announced in its Thursday earnings release.

Starting Feb. 18, annual Prime memberships will go up from $119 to $139 per year, or a monthly cost increase to $14.99 from $12.99. Current Prime members will be affected by the price change after March 25 on the date of their next renewal. The price hike will help balance out the costs of “labor supply shortages and inflationary pressure,” CEO Andy Jassy said, which began over the holidays.

“These issues persisted into the first quarter due to omicron,” Jassy said in the release. The company also attributed the cost increase to “the rise in wages and transportation costs” in its release.

Amazon previously raised Prime prices in 2018 from $99 annually to $119, and upped them from $79 to $99 prior to that in 2014. The company has more than 200 million Prime subscribers.

Amazon Prime’s fast delivery times are a key part of its business, but come at a steep cost: The company’s shipping costs increased 10% year over year in the in the fourth quarter, up to $23.6 billion.

As Meta’s stock price plummeted in one of the biggest collapses in U.S. history Thursday, tech policy wonks noticed something peculiar: The company’s market value is creeping mighty close to falling below the threshold set by Congress in its antitrust bill specifically targeting Meta.

Sen. Amy Klobuchar’s American Innovation and Choice Online Act, which is headed to the Senate floor, prohibits large tech platforms from boosting their own products and services on the platforms they own. Just how large is large? The bill says covered platforms have to have a market cap of $550 billion or higher “over any 180-day period during the 2-year period” prior to any alleged violations.

A day ago, it was more or less unthinkable that Meta would ever cross into uncovered territory. But that was before the company reported a bruising quarter, during which Facebook’s user base declined for the first time in its history. Meta’s stock price dropped more than 26%, shaving hundreds of billions of dollars off of its market cap in a single day.

The schadenfreude from Big Tech critics was swift — but it was also quickly followed by some keen-eyed observation that Facebook might soon bomb its way out of antitrust enforcement. To be clear, that scenario is still extremely unlikely. Even if Meta’s stock price keeps falling, that wouldn’t shield it from the law, if it’s enacted. The bill looks at platforms’ average value over time, not on any single day. And Meta’s value could — and very likely will — recover at least somewhat.

Still, the staggering one-day drop raises questions about Congress’s approach. In attempting to narrowly target specific companies by their value — not just their behavior — the bill risks missing its intended target if the market, which can be unpredictable, fluctuates for any substantial period of time.

Which would certainly weaken the company somewhat, but wouldn’t necessarily solve the antitrust problem. Sure, Meta lost a few hundred billion dollars in value overnight — but with more users than any other social media company in the world, it isn’t any less of a competitive threat than it was yesterday.