JHVEPhoto/iStock Editorial via Getty Images

JHVEPhoto/iStock Editorial via Getty Images

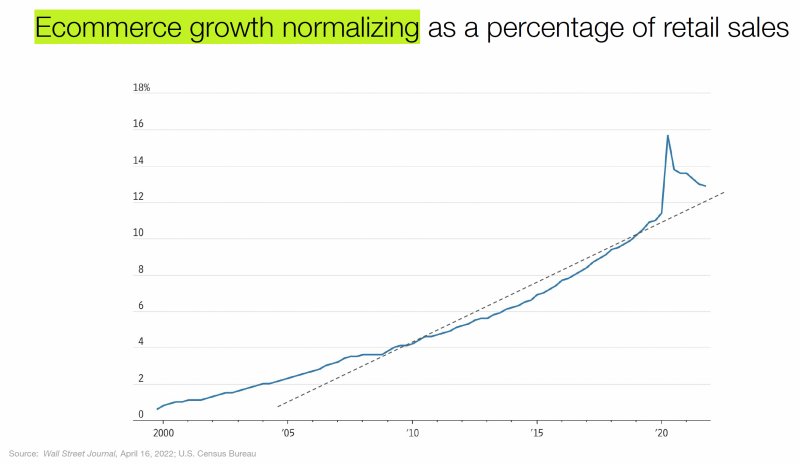

My thesis is that Shopify (NYSE:SHOP) will continue to focus on merchants which brings more volume into their ecosystem and makes commerce better for everyone. Their brick-and-mortar point of sale (“POS”) systems are up and coming but their bread and butter is helping merchants with online sales and this will continue as volume keeps moving online in the coming years. Citing a WSJ article that uses the U.S. Census Bureau as a source, Shopify’s 1Q22 presentation shows that e-commerce sales as a percentage of retail sales continue to climb as we move past the online supercharging seen during the height of the Covid pandemic:

E-commerce sales as a percentage of retail sales (1Q22 presentation)

E-commerce sales as a percentage of retail sales (1Q22 presentation)

64.5% of Shopify’s revenue is from the U.S. where e-commerce has plenty of room to climb as a percentage of retail compared to what eMarketer shows for other countries like China, South Korea and the UK:

E-commerce by country (eMarketer)

E-commerce by country (eMarketer)

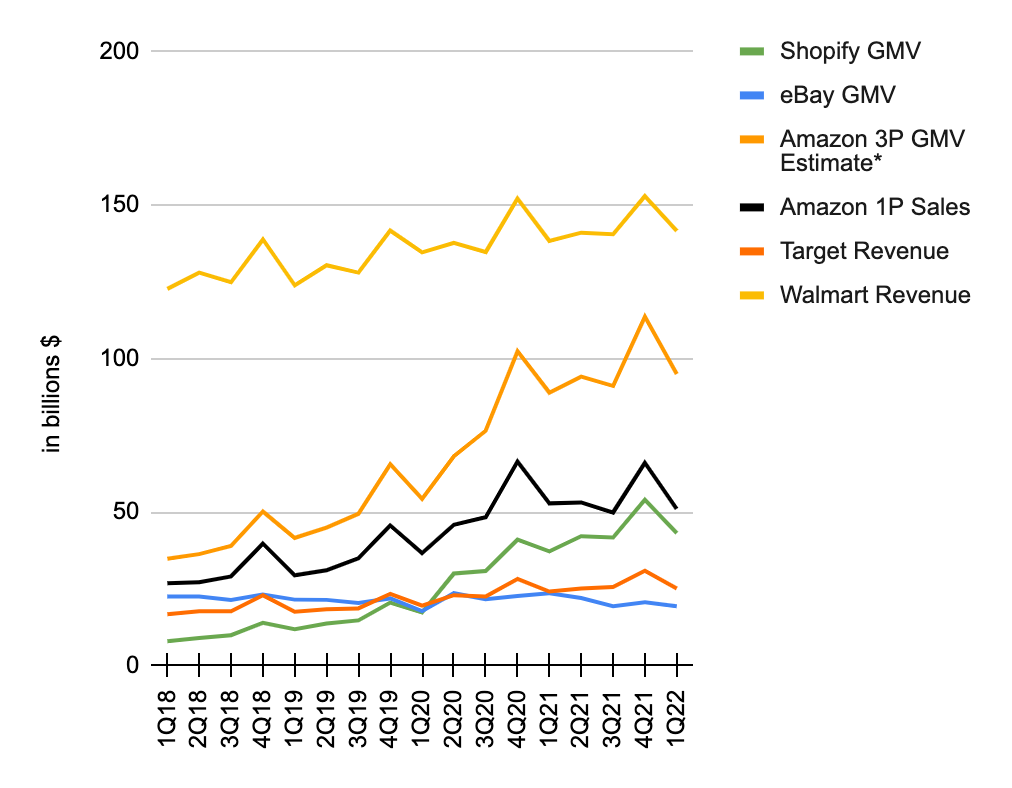

Some companies participate much more than others as e-commerce continues to become a larger part of overall retail. Headlines focus on Amazon (AMZN) but Shopify has been increasing participation at a faster rate than anyone including Amazon and I expect this to continue. Shopify is a commerce operating system for multiple channels whereas Amazon is a third-party marketplace channel. In some ways, comparing volume for these different types of businesses is apples and oranges but it helps put size and growth in perspective; Shopify’s gross merchandise volume (“GMV”) has been gaining rapidly on Amazon first-party (“1P”) sales and it won’t surprise me if Shopify passes this Amazon segment soon. Nothing goes up in a straight line but Shopify quarterly GMV has a 4-year CAGR of more than 52%, going from $8 billion in 1Q18 to $43.2 billion in 1Q22. Amazon’s quarterly estimated third-party (“3P”) GMV has also been impressive with a 4-year CAGR of more than 28%, going from $34.9 billion in 1Q18 to $95 billion in 1Q22. I find it noteworthy that Shopify’s GMV is now higher than Amazon’s estimated 3P GMV from 4 years ago:

Volume by company (Author’s spreadsheet)

Volume by company (Author’s spreadsheet)

Image Source: Author’s spreadsheet

*Amazon’s 3P GMV estimate is sales*3.75.

In the 1Q22 call, President Harley Finkelstein explained that even after the Covid pandemic, e-commerce will continue to become a larger part of overall retail:

Even with the current resurgence in offline retail, we still believe that e-commerce will continue to grow and take share of overall retail over the long term, and we are well positioned here with our online commerce GMV posting a 51% compound annual growth rate since the start of the pandemic in Q1 2020, faster than overall e-commerce over the same period, and we took share this past quarter as well.

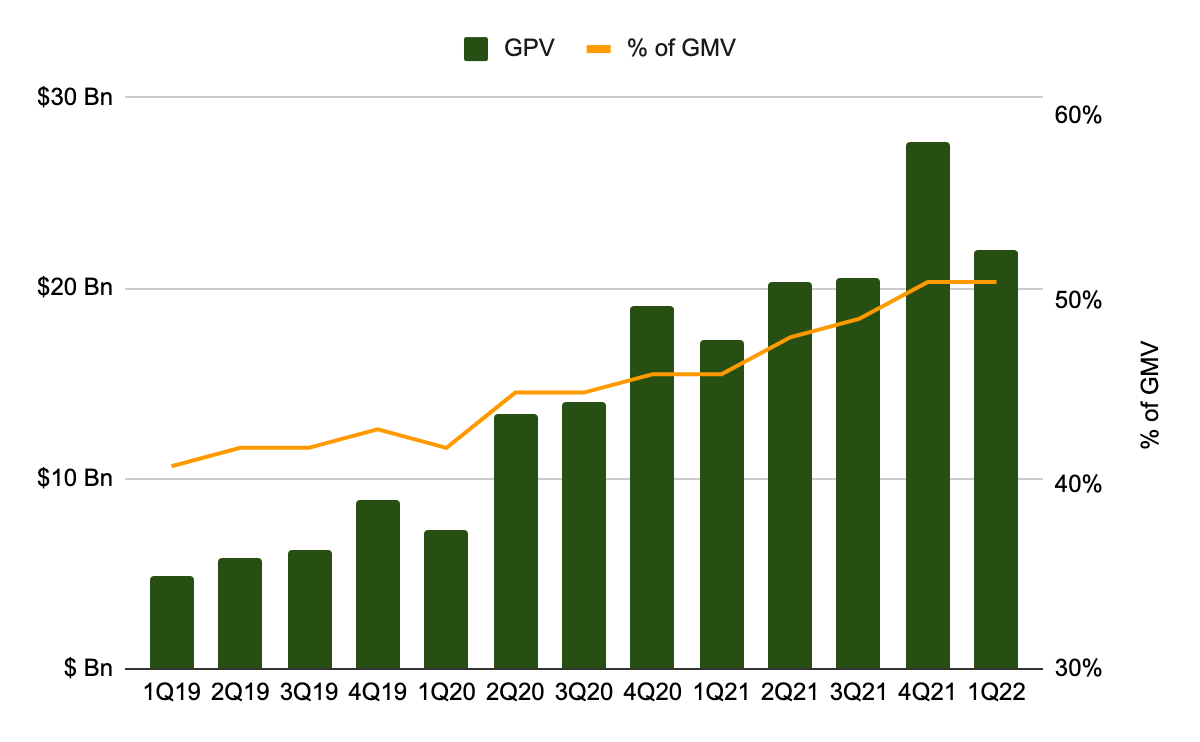

The Shopify Payments efficiencies help remove friction from checkout so merchants are increasing utilization. The 2021 Annual Information Form explains that merchants who have adopted Shopify Payments also have access to Shop Pay:

Shopify merchants that have adopted Shopify Payments also have access to Shop Pay, our accelerated checkout, which has been proven to improve speed-to-checkout and sales conversion rates for our merchants, as well as Shop Pay Installments, our ‘buy now, pay later’ product, which has been proven to boost repeat purchases among first time customers, benefiting Merchant Solutions revenue.

On January 12th, @bgurley wrote some thought provoking tweets about the significance of Shop Pay, saying:

It’s a singular eWallet across all Shopify stores storing addresses, CC#s, etc. This enables 1-click for all.

Bill Gurley goes on to say that many have tried to create a universal eWallet but no one has been successful. PayPal has made some strides but their solution is more cumbersome than Shop Pay:

The closest is obviously PayPal. Yet Shop Pay has created a user flow that has much fewer clicks/popups. It’s truly magical.

Gurley notes that Shop Pay helps merchants by creating a huge lift in conversions and by accelerating future sales. Finally, he mentions that history might look back on Shop Pay as one of the most impressive internal strategic launches of an era like AWS and Google’s Android. In the 4Q21 call, President Finkelstein explains that Shop Pay is 4 times faster than alternatives and it has a 1.7x higher checkout rate. We’ve seen Shopify Payments quarterly Gross Payments Volume (“GPV”) go from $4.9 billion and 41% of Gross Merchandise Volume (“GMV”) to $22 billion and 51% of GMV in the last 3 years:

GPV as a % of GMV (Author’s spreadsheet)

GPV as a % of GMV (Author’s spreadsheet)

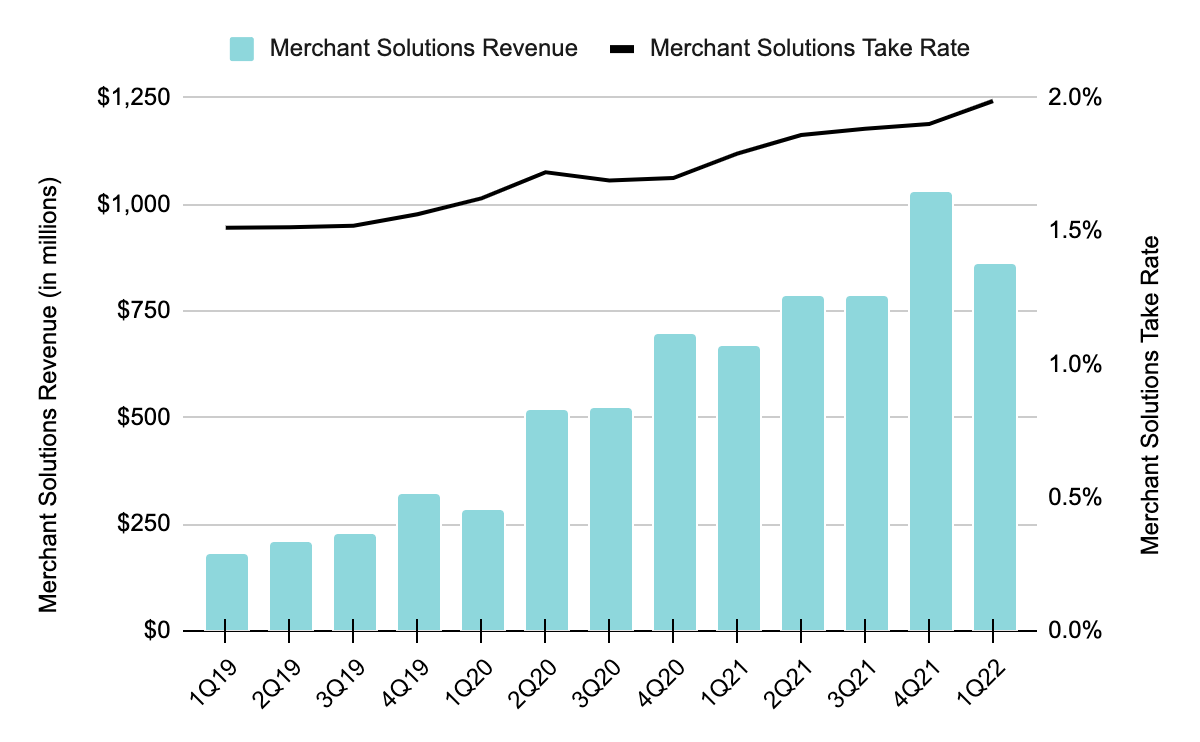

The above increase in GPV is one of the main reasons why Merchant Solutions revenue has escalated. In 3 years, we’ve seen the Merchant Solutions take rate go up 50 basis points from 1.5% in 1Q19 to 2% in 1Q22. I’m optimistic that the Merchant Solutions take rate will continue to rise as Shopify improves existing initiatives for merchants and implements new ones:

Merchant Solutions take rate and revenue (Author’s spreadsheet)

Merchant Solutions take rate and revenue (Author’s spreadsheet)

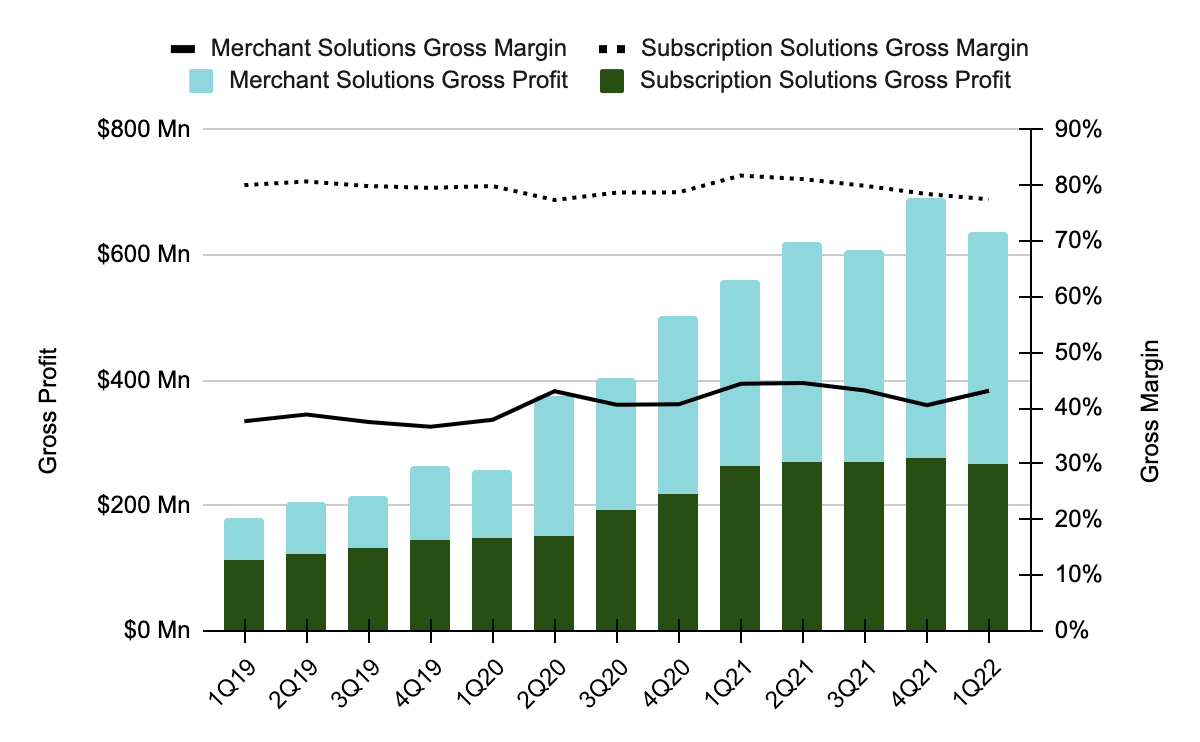

The Merchant Solutions quarterly gross profit has skyrocketed from $68 million in 1Q19 to $371 million in 1Q22. This is largely explained by an increase in the gross margin from 37.7% to 43.1% along with the above growth in GPV and Merchant Solutions revenue. Merchant Solutions has gone from less than 38% of overall gross profit to more than 58% in just 3 years:

Merchant Solutions gross profit (Author’s spreadsheet)

Merchant Solutions gross profit (Author’s spreadsheet)

One of the nice things about Merchant Solutions gross profit relative to Subscription Solutions gross profit is that more of the former would make its way to the bottom line if we were in a steady-state environment without growth reinvestments because it has little in the way of operating expenses. But of course Shopify is still in investment mode which obfuscates the economics that we would otherwise see on the bottom line in a steady-state environment. Shopify talks about this obfuscation in the 1Q22 release when discussing what they expect to do in 2022:

To reinvest all of our gross profit dollars back into the business to pursue our multiple paths to growth, including the expansion of our services to more merchants in more geographies, the development of new products, and the strengthening of our partner ecosystem to give independent brands of all sizes a way to build a strong, low friction presence across the internet, in apps, and in person.

The Amazon Jungle by Jason R. Boyce and Rick Cesari helps illustrate the importance of helping merchants with fulfillment:

Put frankly, if eBay had used its considerable wealth to build and execute an FBA-like fulfillment network for its Sellers 15 years ago, I’d be writing about how to sell on eBay right now rather than Amazon.

[ The Amazon Jungle – Kindle Location: 1,829]

Shopify knows it would be fruitless to try to mimic Amazon’s efforts with asset-heavy fulfillment investments. However, asset-light investments can be effective in terms of helping merchants navigate the maze of post-order requirements. President Finkelstein explained this in the 1Q22 call:

To actually get an order to a buyer, they have to fumble through a maze of freight providers, 3PLs and middle- and last-mile carriers. We know merchants trust Shopify to offer simple, reliable, cost-effective solutions to their biggest problems. That’s why we’re creating the world’s most merchant-obsessed, end-to-end software and logistics platform, fully integrated into the Shopify ecosystem. We are simplifying logistics across every stage of a merchant supply chain, from inventory inbounding to inventory distribution across all merchant channels, to fast and affordable D2C order fulfillment and returns.

As President Finkelstein said in the 1Q22 call, the recent acquisition of Deliverr will bolster Shopify’s Fulfillment Network and speed up their path to an end-to-end merchant supply chain solution. In the 1Q22 call, CFO Amy Shapero said the transaction is valued at about $2.1 billion, composed of about 80% cash and 20% shares.

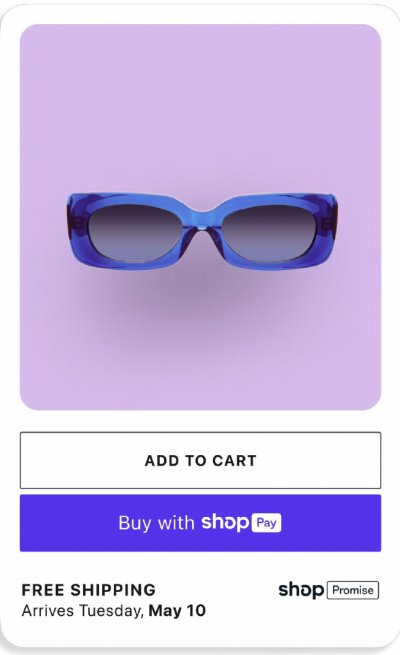

Shop Promise was introduced in the 1Q22 call and President Finkelstein talked about how it will help customers and merchants:

Now we can actually help consumers make better decisions by implementing Shop Promise, which shows 2-day and 1-day delivery promises to merchants’ online stores and across places like Facebook, Instagram and Google, which increases consumer trust, and we think can actually really help our merchants.

Shop Promise (1Q22 presentation)

Shop Promise (1Q22 presentation)

Introduced in April, Amazon’s Buy with Prime has similarities to Shopify Promise:

Buy with Prime (Amazon)

Buy with Prime (Amazon)

Buy with Prime is a threat to both Shopify Payments and Shopify’s fulfillment investments. CEO Tobi Lütke answered a question about it in the 1Q22 call saying they are “actually thrilled” that Amazon is taking their amazing infrastructure and sharing it with merchants. Saying it fits into their build view, he then states they are happy to integrate it and he likens it to other channel integrations like Meta, Google and TikTok:

And it’s not nearly as some people make it out to be. Whatever is good for merchants is — that will cause more entrepreneurship, which is exactly what helps the vision of a company. And from a business perspective, again, the more channels that exists that are valuable for selling, the more important Shopify tools have become, because managing this is a task of significant complexity and software integration can tame that complexity and create a cohesive view into the business and again, make it much more possible for small businesses to engage in very complex retail strategies that previously you would have to — you would need a lot of headcount for. So this is all — this is actually really good news from our perspective.

I’m optimistic that CEO Lütke’s statements above will ring true. There is a sense of panic when Amazon comes in as a competitive threat but this may not be as much of a zero-sum situation as some headlines indicate. In addition, Amazon failed when introducing a POS competitor to compete with Block which was then known as Square. Amazon also failed in their effort against Roku (ROKU) with their Amazon Fire TV Stick. I think some merchants will stick with Shopify’s slower fulfillment options as Shopify sits on the same side of the table as merchants unlike Amazon who has a first party sales channel. Shopify gives merchants full control over the business intelligence, customer data and the brand whereas this is more nebulous with Amazon.

Crypto.com recently announced that Shopify merchants can now expand their reach by giving customers more ways to close sales with cryptocurrencies. It is yet another example of how Shopify helps open up multiple options for merchants:

Crypto.com announcement (Crypto.com)

Crypto.com announcement (Crypto.com)

The 100 Baggers book shows that retailers and those directly supporting retailers have done exceptionally well in the U.S. over the years. Walmart (WMT) is the highest retailer in the book and the #4 company in the book by total returns. Every dollar invested in Walmart in October 1970 became $12,382 by 2014 and they had a CAGR of 23.8%. TJX (TJX) is a leading off-price retailer with T.J. Maxx and Marshalls chains. TJX is #8 overall in the book and they are the 2nd best retailer based on total return behind Walmart. A $10,000 investment in TJX from October 1962 turned into nearly $69.5 million by 2014 and their CAGR was 18.5%. Family Dollar was eventually acquired by (DLTR) and a $10,000 investment in Family Dollar from November 1972 turned into nearly $39.9 million by 2014 for a CAGR of 21.8%. They were the #11 company in the book and yet another retailer for price-sensitive customers. While Shopify is not a retailer, I believe they will become much more valuable in the fullness of time as they continue helping merchants flourish. I think both Shopify and Amazon are going to increase in value substantially in the decades ahead if they continue helping to make sure their merchants are successful.

Shopify’s 1Q22 release shows quarterly gross profit of $637.6 million on revenue of $1,203.6 million and GMV of $43.2 billion. By comparison, eBay’s 1Q22 release shows quarterly gross profit of $1,794 million on revenue of $2,483 million and GMV of $19.4 billion. So eBay’s gross profit is nearly 3 times bigger at this time but we have to think about what the past may tell us about the future. We know that 3 years ago, Shopify had 1Q19 quarterly gross profit of just $180.3 million on revenue of $320.5 million and GMV of $11.9 billion while eBay had quarterly gross profit of $2,042 million on revenue of $2,643 million and GMV of $22.6 billion. Shopify’s gross profit went up 3.5 times in 3 years while eBay’s went nowhere.

Shopify blew by eBay with quarterly GMV in 2Q20. Mr. Market expects Shopify to not only pass eBay in revenue and gross profit but continue climbing at a healthy rate from there. Shopify’s market cap is under $46 billion based on the 126,013,066 shares in the 1Q22 release and the May 20th share price of $363.85. The enterprise value for Shopify is lower than the market cap seeing as they have $2,451.5 million in cash and equivalents plus $4,795.1 million in marketable securities which are only partially offset by $19.3 million in short-term leases, $264.5 in long-term leases and $911.5 in convertible notes. eBay’s market cap is about $25 billion based on the May 20th share price of $44.31 and the 559,842,135 share count as of May 2nd from the 1Q22 10-Q. Unlike Shopify, eBay’s enterprise value is a little higher than their market cap as their debt outweighs their cash equivalents and investments.

One of the reasons I emphasize the gross profit level for Shopify is that growth investments cloud the steady-state economics for operating income. In the 1Q22 call, President Finkelstein talks about this noting that instead of making their way down to operating income, gross profit dollars are invested in APIs, Liquid, the app store and relationships:

Direct monetization from the customer in the short term is good. However, building something that may be less immediate and direct but will generate more value for the customer and for Shopify over the long run is much, much better. We have many examples of how we’ve applied the flywheel over the years from APIs to Liquid to our app store and the long-term relationship we have with our community developers, an ecosystem built over a decade. None of these were very material in the short run, but over time, they strengthen every aspect of our platform.

In the same call, CFO Shapero repeats the point of reinvesting gross profit dollars:

Our intention to reinvest all of our gross profit dollars back into the business this year remains intact since the pace of change independent brands need to get ahead of is not slowing down.

Let’s not forget that Shopify’s current GMV is already greater than Amazon’s estimated 3P GMV from 4 years ago. I like to think about a range of steady-state operating income in 5 years when coming up with a valuation range. On the high end, if GMV grows by about 1/3rd per year from the $175.4 billion in 2021, then in 2026 it could be at around the $740 billion level. In a lower growth scenario, GMV could increase at a 25% CAGR such that it ends up at about $535 billion.

The Merchant Solutions take rate climbed 50 basis points in 3 years which comes to almost 17 basis points per year. I’m optimistic that this can continue for another 5 years such that the Merchant Solutions take rate is 85 basis points higher in 5 years or 2.85% total. Fulfillment investments are likely to continue pressuring the Merchant Solutions gross profit margin such that it may stay at the current level of 43%.

Depending on the mix of gross profit components among other things, I could see 50% to 75% of this gross profit making its way down to operating income if growth investments were paused. Putting all this together, we could see steady-state 2026 Merchant Solutions operating income of $3.3 billion [$535 billion*0.0285*0.43*0.50] to $6.8 billion [$740 billion*0.0285*0.43*0.75]. I don’t know precisely what this is worth today but if we end up anywhere near the middle, then this segment alone is arguably worth more than the entire market cap of $46 billion. In other words, the Merchant Solutions segment alone is worth a great deal without even considering the Subscription Solutions business.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SHOP, AMZN, FB, GOOG, GOOGL, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.