How Every Asset Class, Currency, and S&P 500 Sector Performed in 2021

The U.S. Stock Market in 2021: Best and Worst Performing Sectors

Mapped: Economic Freedom Around the World

The Top 10 Biggest Companies in Russia

The World’s Biggest Startups: Top Unicorns of 2021

A Visual Guide to Profile Picture NFTs

The Companies that Defined 2021

The World’s Biggest Startups: Top Unicorns of 2021

Ranked: The World’s Most Popular Social Networks, and Who Owns Them

How Central Banks Think About Digital Currency

Visualizing the $94 Trillion World Economy in One Chart

How Central Banks Think About Digital Currency

The Richest Women in America in One Graphic

Ranked: The Best and Worst Pension Plans, by Country

Visualizing The World’s Largest Sovereign Wealth Funds

Mapped: The Most Common Illicit Drugs in the World

Visualizing The Most Widespread Blood Types in Every Country

Pandemic Recovery: Have North American Downtowns Bounced Back?

Ranked: The Most Prescribed Drugs in the U.S.

How Does the COVID Delta Variant Compare?

Mapped: Solar Power by Country in 2021

Visualizing the Race for EV Dominance

Ranked: The Largest Oil and Gas Companies in the World

The Top 10 Biggest Companies in Brazil

Which Countries Have the Most Nuclear Weapons?

Mapped: 30 Years of Deforestation and Forest Growth, by Country

Mapped: The Most Common Illicit Drugs in the World

This Clever Map is a Window into 19th Century New York City

The Problem With Our Maps

Mapped: Countries by Alcohol Consumption Per Capita

Visualizing the Abundance of Elements in the Earth’s Crust

Rare Earth Elements: Where in the World Are They?

Mapped: Solar Power by Country in 2021

The Top 10 Biggest Companies in Brazil

All the Metals We Mined in One Visualization

Mapped: 30 Years of Deforestation and Forest Growth, by Country

Visualizing Global Per Capita CO2 Emissions

Visualizing the Accumulation of Human-Made Mass on Earth

A Deep Dive Into the World’s Oceans, Lakes, and Drill Holes

Mapped: Solar Power by Country in 2021

Published

on

By

It was another eventful year—and while it may not quite compare to the pandemonium experienced in 2020, it was still jam-packed with market moving events, such as:

Let’s take a look at which sectors thrived during the twists and turns of 2021—and which couldn’t stomach the volatility.

Want extra insight into 2022?

Gain access to our 2022 Global Forecast series

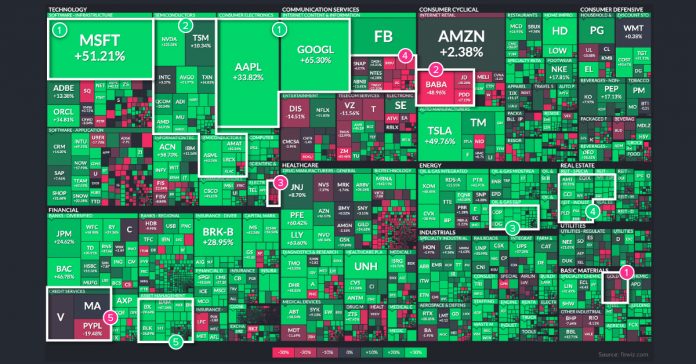

Our visualization today uses an augmented screenshot of the FinViz treemap, showing the final numbers posted for major U.S.-listed companies, sorted by sector and industry.

Here are the big beneficiaries of last year, along with those that got left behind.

Over recent years, it’s been no surprise to see Big Tech near the top of any list. In 2021, Alphabet continued its tear, soaring 65% to hit a $2 trillion market cap.

Microsoft finished up the year 51%, Apple up 34%, and even Meta Platforms (née Facebook) posted double-digit gains. Only Amazon had single-digit gains, up 2.4% in 2021.

Who benefitted most from the ongoing semiconductor shortage? Those that design or manufacture them, of course.

Nvidia, for example, more than doubled its share price over the course of the year, with 125% growth. Other companies in the semiconductor equipment and materials space, such as ASML and Applied Materials, saw gains above 60%.

2020 was touch-and-go for oil prices, with futures even sliding negative at one point. However, the most recent year was much kinder to those in the energy industry.

The WTI price started the year below $50 per barrel, but finished the year at $75 per barrel—a swing that makes a big difference in the economics of each barrel.

It was one of the biggest years in decades for REITs, which saw the FTSE Nareit All Equity REITs index have its best performance since 1976.

Those that know REITs are aware that returns vary by property sector, and this remains the case here. Specifically, it was industrial REITs—and especially self-storage REITs—that outperformed. Extra Space Storage, a REIT that invests in self-storage units, finished up the year 96% and is the perfect example of this.

With record-low interest rates and continued upheaval from COVID-19, it sets a perfect stage for opportunistic private equity firms.

The asset management industry as a whole did well in 2021, but specifically it was PE firms like Blackstone and KKR that took advantage, posting gains of 99% and 84% respectfully.

Honorable Mentions:

Banks, Retail Home Improvement, Building Materials, Healthcare Plans, Engineering & Construction

Inflation took off in 2021, and a usual beneficiary of this is the precious metals sector.

However, in the last 12 months, this has not been the case. Both gold and silver finished with negative returns on the year, which hurt precious metal miners.

Beijing has been cracking down on China’s domestic tech sector as of late, and this has had a knock-on effect on companies like Pinduoduo, Alibaba, Baidu, and JD.com, which saw a collective collapse in their share prices.

All were down double digits, but Pinduoduo—the largest agriculture-focused technology platform in China—saw the highest amount of drag, falling over 67% on the year.

Solar installations in the U.S. are chugging along at a record pace, as expected.

However, both regulatory uncertainty and supply chain problems have hampered stock prices in the short term. That’s why companies like Sunrun, a residential solar panel company, saw a 51% dip in stock performance in 2021.

Big tech continued its surge, but other tech-enabled content and information companies saw tougher years. One example of this is Zillow, which shuttered the doors on its home flipping operation after realizing losses of $500 million.

Zillow stock was down 54% on the year, and has laid off a quarter of its staff.

It was a mediocre year for the big credit card companies like Visa and Mastercard, which were both flat in terms of stock market performance. Meanwhile, PayPal fell 19%.

According to billionaire investor Chamath Palihapitiya, 2022 may not be any better. Days ago, he predicted that both Visa and Mastercard will be the biggest business failures in the coming year.

How Every Asset Class, Currency, and S&P 500 Sector Performed in 2021

Mapped: Economic Freedom Around the World

How Every Asset Class, Currency, and S&P 500 Sector Performed in 2021

Mapped: Economic Freedom Around the World

Four Reasons to Watch UK Equities

Who are the Longest Serving Active CEOs in the S&P 500?

The Regional Breakdown of Stock Market Sectors Over Time

The Decline of Long-Term Investing

2021 was a strong year for stocks, commodities, and cryptocurrencies, as most asset classes provided positive returns.

Published

on

By

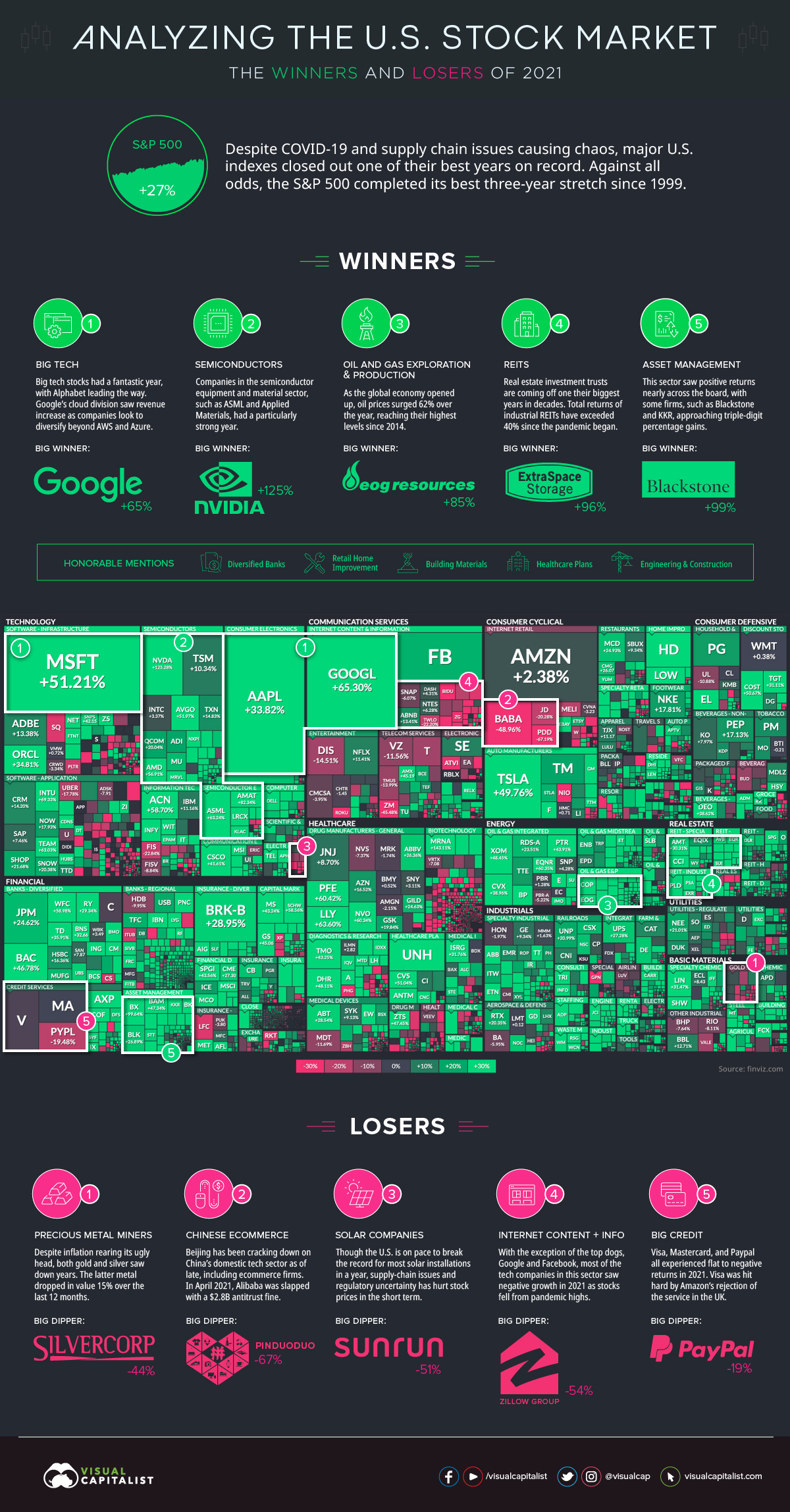

After the roller coaster of volatility in 2020, the majority of asset classes in 2021 saw positive returns as the world reopened for business.

The Federal Reserve’s accommodative monetary policy, supply chain struggles, and high demand for fuels and raw materials for the clean energy transition largely shaped the markets.

Alongside the rise in inflation, commodities and cryptocurrency outperformed as broad equity indices saw double-digit returns, with the S&P 500 rising by 26.9% in 2021.

Speculation and the energy fuels for the world’s reopening were two of the main themes for markets in 2021, reflected in Bitcoin (59.8%) and crude oil (56.4%) being the top two performing assets in that time frame.

The S&P GSCI commodity index (37.1%) was another top performer, as agricultural and livestock food prices rose alongside the Dow Jones Real Estate Index (35.1%).

Source: TradingView

Despite most physical and digital commodities seeing price gains, precious metals such as gold (-3.6%) and silver (-11.7%) struggled to hold onto their value, while industrial and battery metals like lithium (477.4%) and cobalt (207.7%) surged.

Large cap equity indices like the S&P 500 (26.9%) almost doubled the returns of small caps (Russell 2000, 13.7%), with emerging markets failing to keep up as they fell 5.5%.

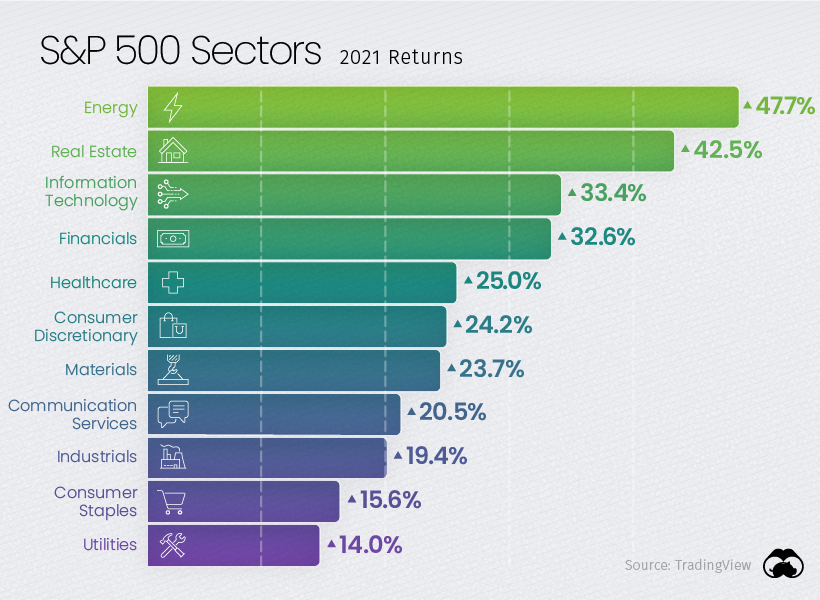

After last year’s poor performance as the worst-performing S&P 500 sector, energy (47.7%) was 2021’s best performing sector alongside the rise in crude oil and other energy commodities.

Two other negative performers last year, real estate (42.5%) and financials (32.6%), also turned it around and were among the top performing sectors this year.

Despite many value equities performing well, growth equities still managed to keep a strong pace. Information technology (33.4%) continued to provide strong returns with Microsoft (51.2%) outperforming many of the other tech giants.

As Amazon (2.38%) and Netflix lagged behind (11.4%), Apple (33.8%) capped off its strong 2021 returns by becoming the first U.S. company to reach a $3T market cap at the start of 2022.

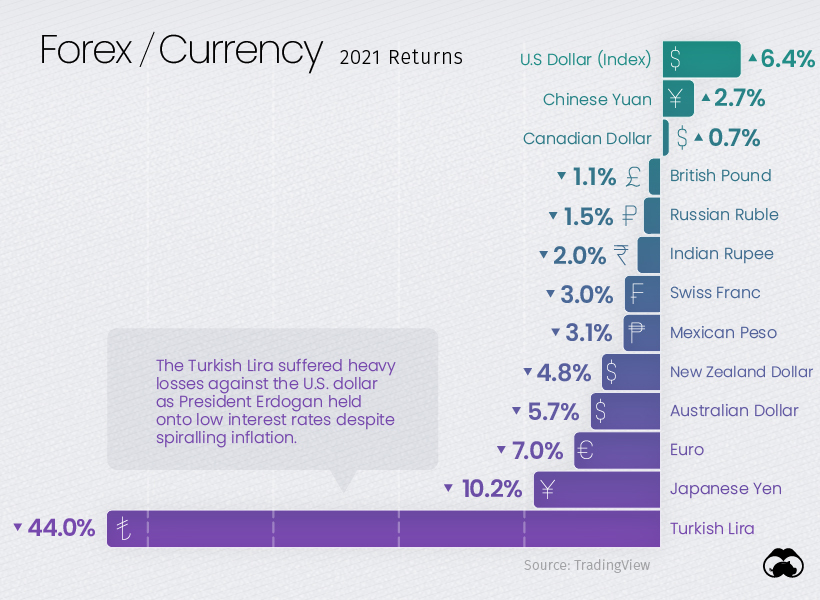

While the U.S. dollar struggled last year with most currencies outperforming it, 2021 saw the dollar index rise by 6.4%, outperforming most other currencies.

The Chinese yuan (2.7%) and Canadian dollar (0.7%) were the only major currencies that managed positive returns against the U.S. dollar, while the Australian dollar (-5.7%), Euro (-7.0%), and Japanese Yen (-10.2%) were among the worst performers.

The Turkish lira was the standout loser in foreign exchange, and the turmoil was punctuated by turnover in the country’s finance minister position. While most other emerging economies raised interest rates to fight against inflation, Turkey has continued cutting rates and looks set to default on its $446 million of external debt.

As the COVID-19 pandemic defined many of the winners and losers in 2020, the gradual reopening of international travel and business shaped the over and underperformers of 2021.

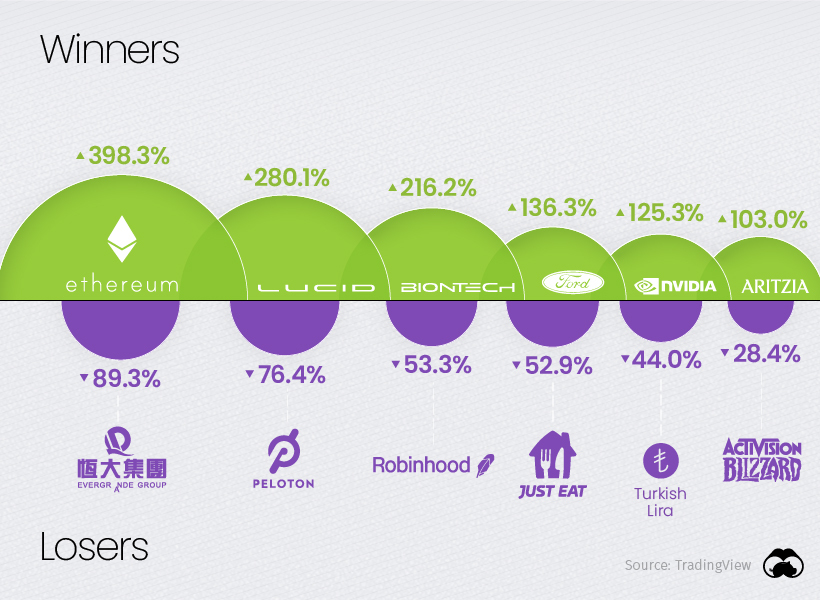

Cryptocurrencies had a standout year beyond Bitcoin (59.8%), which was greatly outpaced by many other cryptocurrencies and smart contract platforms like Ethereum (398.3%), Solana (11,177.8%), Avalanche (3,334.8%), and Luna (12,967.3%).

While Tesla (49.8%) had another strong year, Lucid and Ford Motors greatly outperformed Elon Musk’s company and the rest of the auto industry with their EV efforts. Demand was so great that Ford had to halt reservations for its F-150 Lightning pickup trucks at the end of 2021.

The pain of Evergrande Group (89.3%) shareholders is set to end soon, with the company starting 2022 by halting shares in Hong Kong as its $300 billion in liabilities remain in limbo.

Peloton (-76.4%) was another big loser in 2021 as it gave back nearly all of its gains from last year, proving lockdown speculation fueled most of its former valuation. Just Eat (-52.9%) was similarly hit hard as restaurants reopened in 2021.

Robinhood’s (53.3%) weak performance since its IPO puts a bow on 2021’s retail “stonk” frenzy kicked off by the Wall Street Bets subreddit.

With 2021 being a breakout year for retail traders and investors online, we’ll see if 2022 remains risk-on as the Fed begins tapering, or if markets are due for a change in direction.

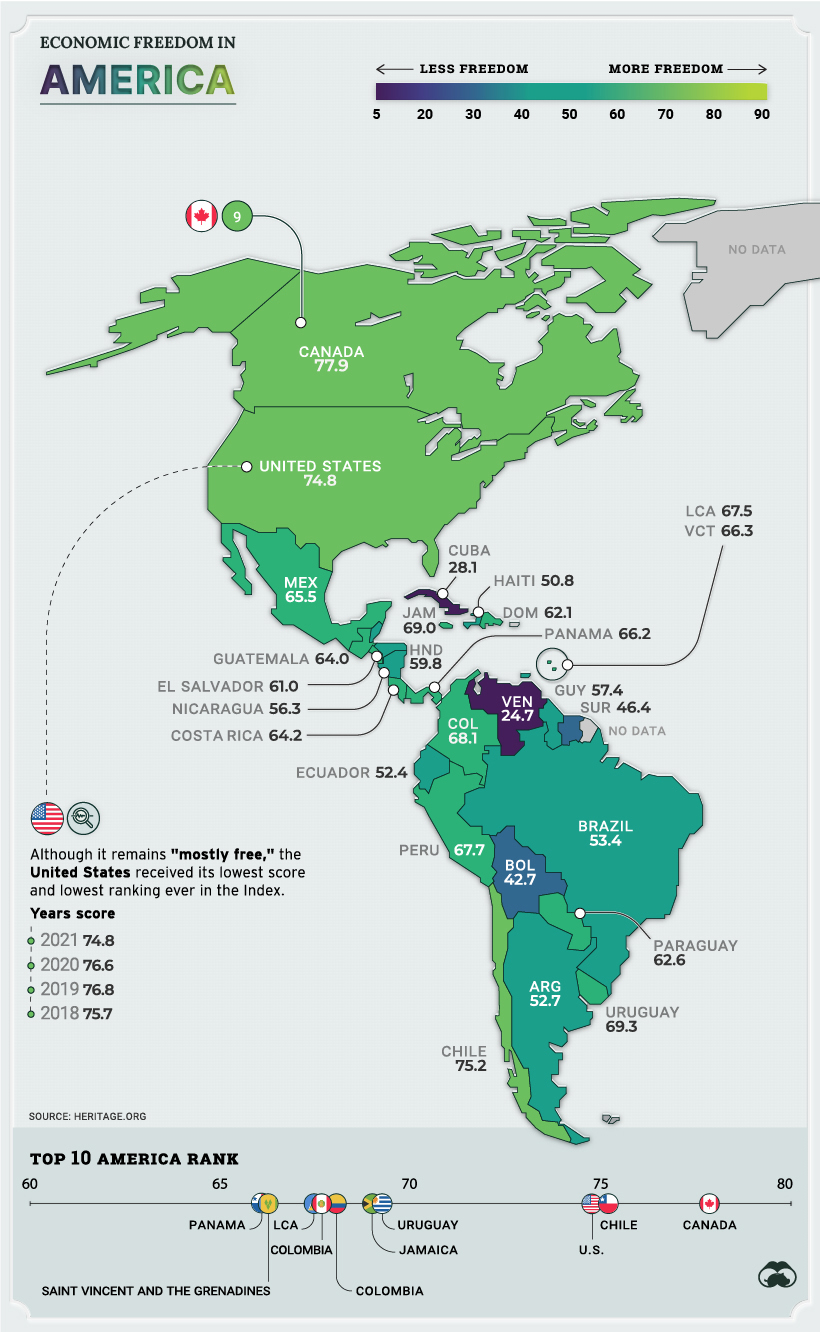

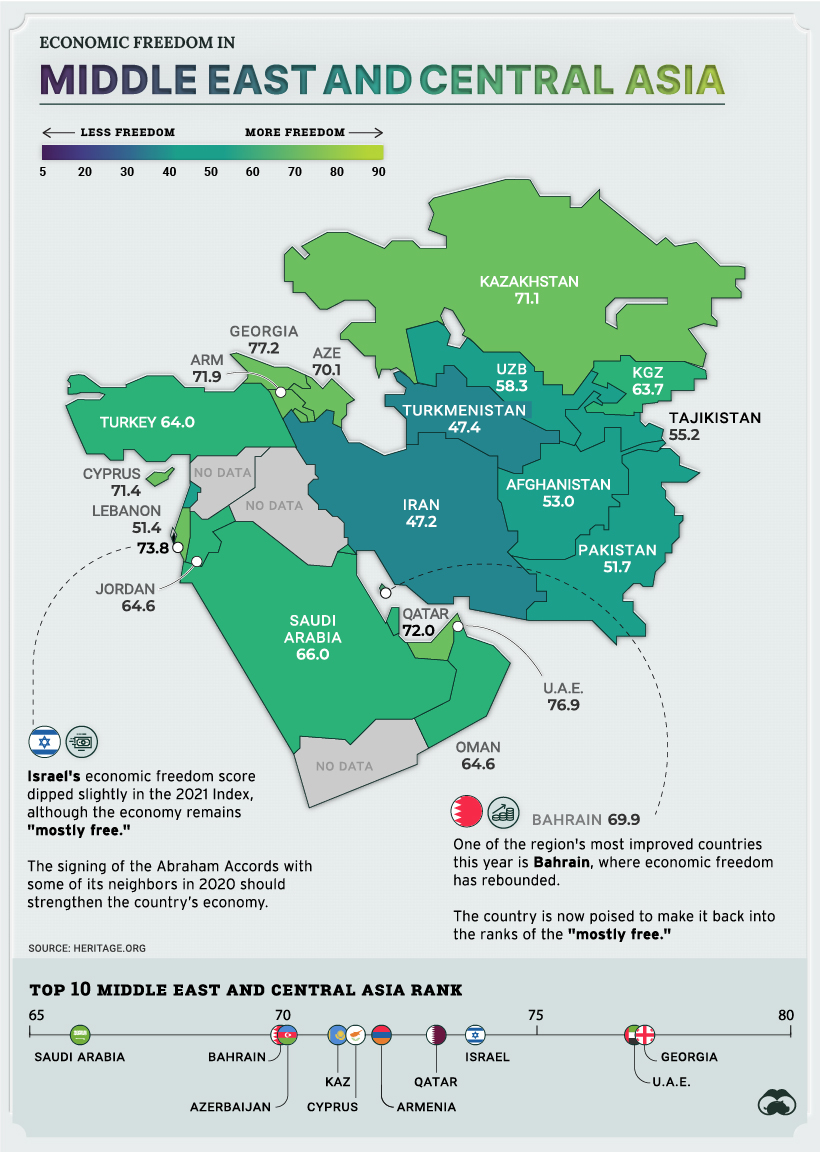

The global average economic freedom score is at the highest its been in 27 years. Here we map the economic freedom score of nearly every country.

Published

on

By

How would you define a country’s economic freedom?

The cornerstones of economic freedom by most measures are personal choice, voluntary exchange, independence to compete in markets, and security of the person and privately-owned property. Simply put, it is about the quality of political and economic institutions in countries.

Based on the Index of Economic Freedom by the Heritage Organization, we mapped the economic freedom of 178 countries worldwide.

The index uses five broad areas to score economic freedom for each country:

In 2021, the global average economic freedom score is 61.6, the highest its been in 27 years.

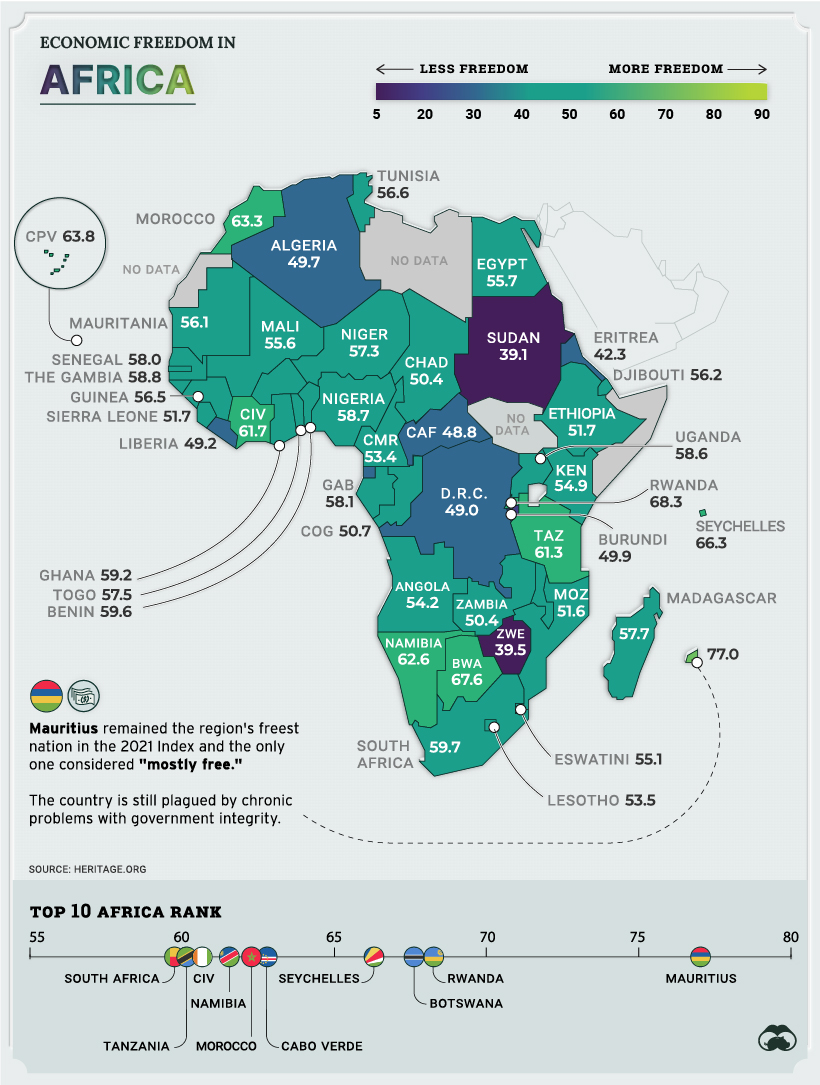

But from Mauritius and smaller African nations being beacons of hope to East Asian and Oceanic countries epitomizing economic democracy, every region has a different story to tell.

Let’s take a look at the economic freedom of each region in the world.

Even though the U.S. and Canada continue to be some of the most economically free countries globally, some markers are suffering.

The regional average unemployment rate has risen to 6.9%, and inflation (outside of Venezuela) has increased to 5.2%. The region’s average level of public debt—already the highest globally—rose to 85.2% of its GDP during the past year.

Across many Latin American countries, widespread corruption and weak protection of property rights have aggravated regulatory inefficiency and monetary instability.

For example, Argentina’s Peronist government has recently fixed the price of 1,432 products as a response to a 3.5% price rise in September, the equivalent to a 53% increase if annualized.

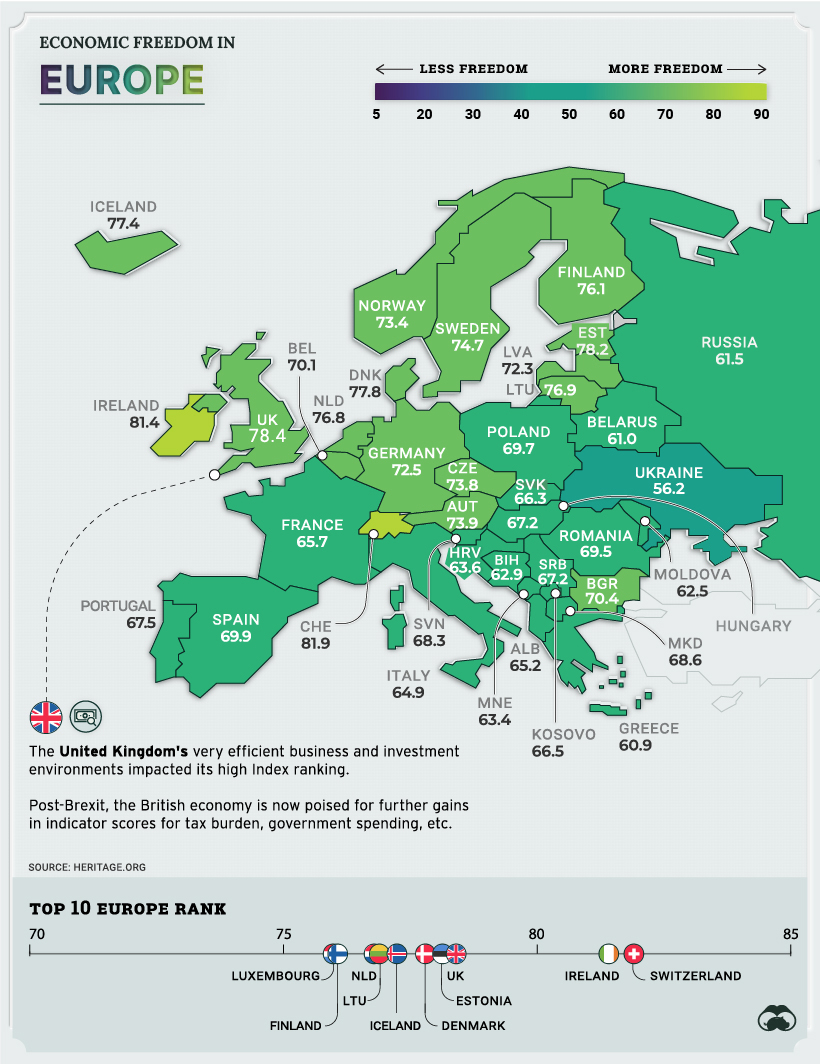

More than half of the world’s 38 freest countries (with overall scores above 70) are in Europe. This is due to the region’s relatively extensive and long-established free-market institutions, the robust rule of law, and exceptionally strong investment freedom.

However, Europe still struggles with a variety of policy barriers to vigorous economic expansion. This includes overly protective and costly labor regulations, which was one of the major reasons why the UK voted to leave the EU.

Brexit has since had a major impact on the region.

Even a year later, official UK figures showed a record fall in trade with the EU in January 2021, as the economy struggled with post-Brexit rules and the pandemic.

Dictatorships, corruption, and conflict have historically kept African nations as some of the most economically repressed in the world.

While larger and more prosperous African nations struggle to advance economic freedom, some smaller countries are becoming the beacon of hope for the continent.

Mauritius (rank 11), Seychelles (43) and Botswana (45) were the top African countries, offering the most robust policies and institutions supporting economic self-sufficiency.

From property rights to financial freedom, small African countries are racing ahead of the continent’s largest in advancing economic autonomy as they look to build business opportunities for their citizens.

When Israel, the UAE, and Bahrain signed the Abraham Accords last year, there was a sense of a new paradigm emerging in a region with a long history of strife.

A year into the signing of this resolution, the effects have been promising. There have been bilateral initiatives within the private sector and civil society leading to increasing economic and political stability in the region.

Central Asian countries once part of the Soviet Union have recently starting integrating more directly with the world economy, primarily through natural resource exports. In total, natural resources account for about 65% of exports in Kyrgyzstan, Tajikistan, and Uzbekistan, and more than 90% in Kazakhstan and Turkmenistan.

Despite this progress, these countries have a long way to go in terms of economic freedom. Uzbekistan (108), Turkmenistan (167) and Tajikistan (134) are still some of the lowest-ranked countries in the world.

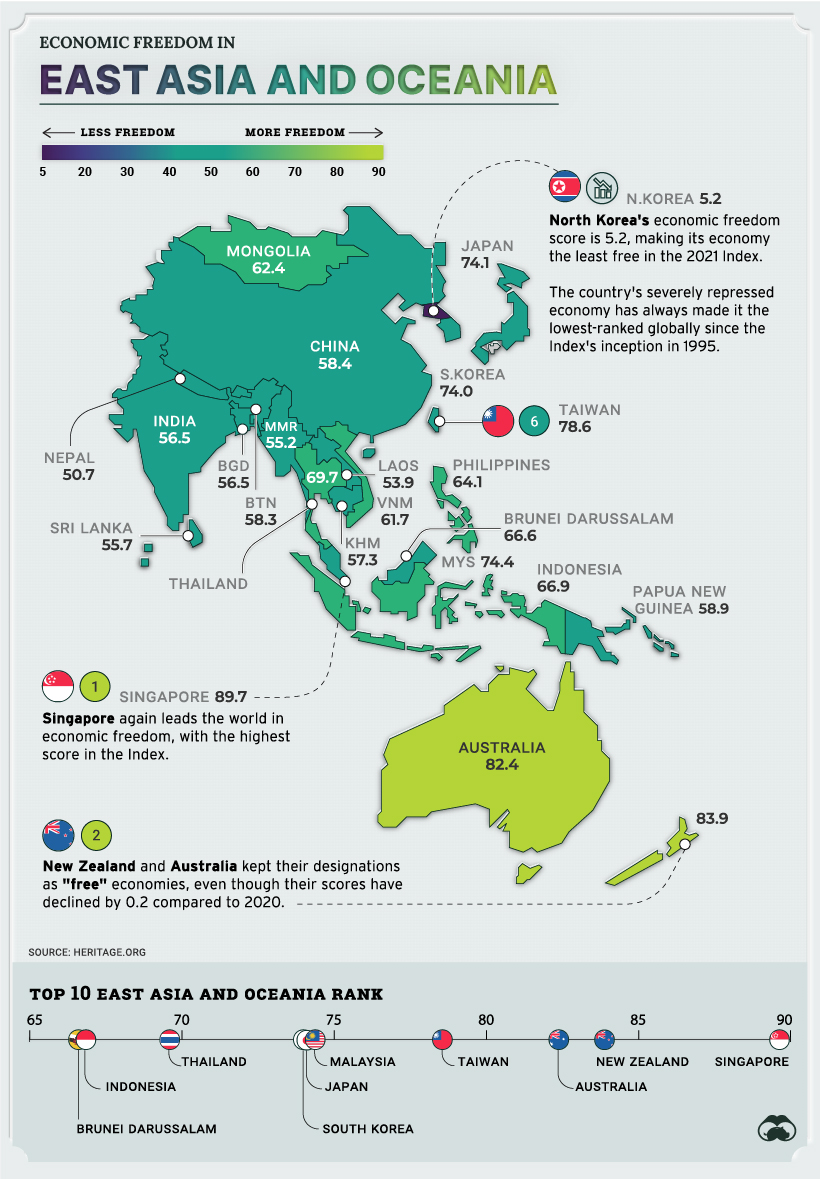

Despite massive populations and strong economies, countries like China and India remain mostly unfree economies. The modest improvements in scores over the last few years have been through gains in property rights, judicial effectiveness, and business freedom indicators.

Nearby, Singapore’s economy has been ranked the freest in the world for the second year in a row. Singapore remains the only country in the world that is considered economically free in every index category.

Finally, it’s worth noting that Australia and New Zealand are regional leaders, and are two of only five nations that are currently in the “free” category of the index.

Visualizing the $94 Trillion World Economy in One Chart

The Most Commonly Spoken Language in Every U.S. State (Besides English and Spanish)

The World’s Biggest Startups: Top Unicorns of 2021

Our Top 21 Visualizations of 2021

Mapped: Economic Freedom Around the World

The Top 10 Semiconductor Companies by Market Share

Mapped: The Most Common Illicit Drugs in the World

Mapped: Top Trending Searches of 2021 in Every U.S. State

Copyright © 2021 Visual Capitalist