Khanchit Khirisutchalual/iStock via Getty Images

Khanchit Khirisutchalual/iStock via Getty Images

Udemy, Inc. (NASDAQ:UDMY) went public in October 2021, raising approximately $421 million in gross proceeds from an IPO that priced at $29.00 per share.

The firm operates platforms for online learning for consumers and businesses worldwide.

Given the precarious status of the global economy, faltering consumer spending, and businesses confidence dropping, I’m not optimistic on UDMY’s outlook.

I’m on Hold for UDMY in the near term.

San Francisco, California-based Udemy was founded to develop a platform for consumers and employees to take courses on various topics and in numerous languages from instructors.

Management is headed by president, CEO and Chairperson Gregg Coccari, who has been with the firm since February 2019 and was previously CEO of Stella & Chewy’s, a pet food company.

The company’s primary offerings include:

Udemy

Udemy Business.

Udemy operates a two-sided marketplace connecting consumers of education with instructors who develop content to meet consumer and business user demand.

According to a 2021 market research report by Global Market Insights, the global market for e-learning exceeded an estimated $250 billion in 2020 and is forecast to reach $949 billion by 2027.

This represents a forecast CAGR (Compound Annual Growth Rate) of 21% from 2021 to 2027.

The main drivers for this expected growth are an increasing desire by learners of all ages to expand their knowledge, along with a growing incidence of new technologies to assist learning processes including AI, VR and cloud-based learning management systems.

Also, below is a graphic showing a snapshot and projected market growth for e-learning, from 2020 to 2027:

E-Learning Market (Global Market Insights)

E-Learning Market (Global Market Insights)

Major competitive or other industry participants include:

Pluralsight

Skillsoft

LinkedIn Learning

Coursera

edX

A Cloud Guru

Skillshare

Others

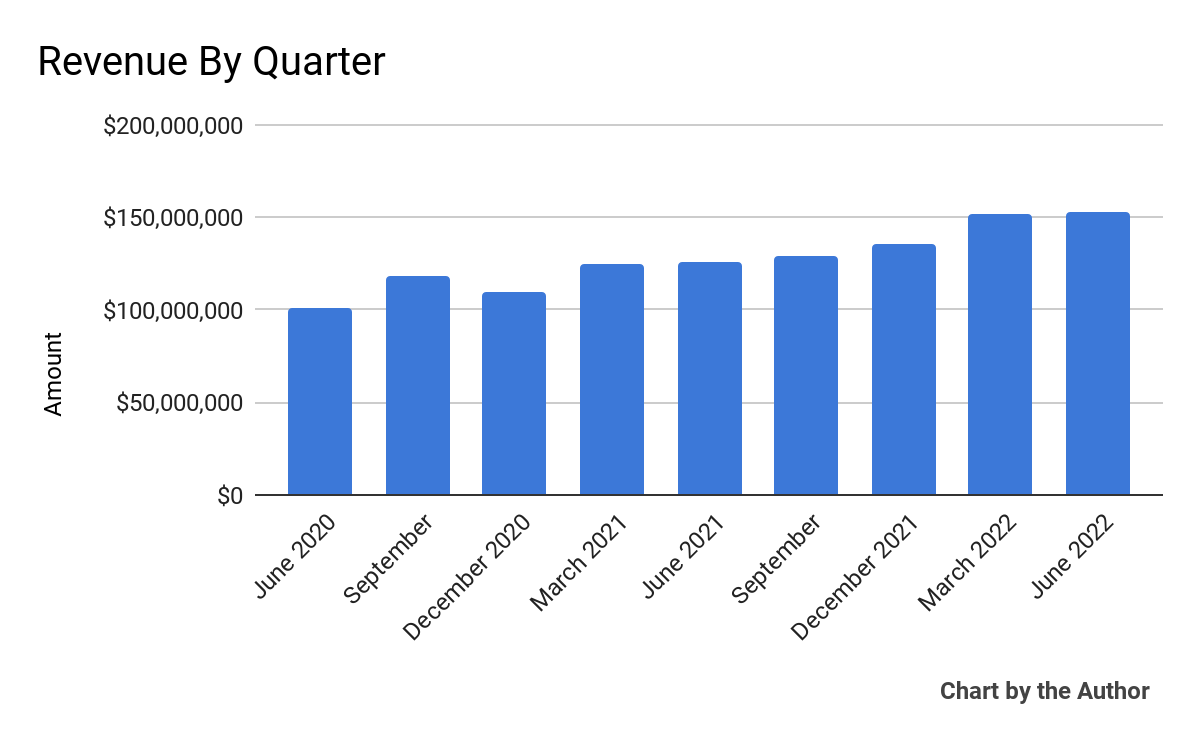

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

9 Quarter Total Revenue (Seeking Alpha)

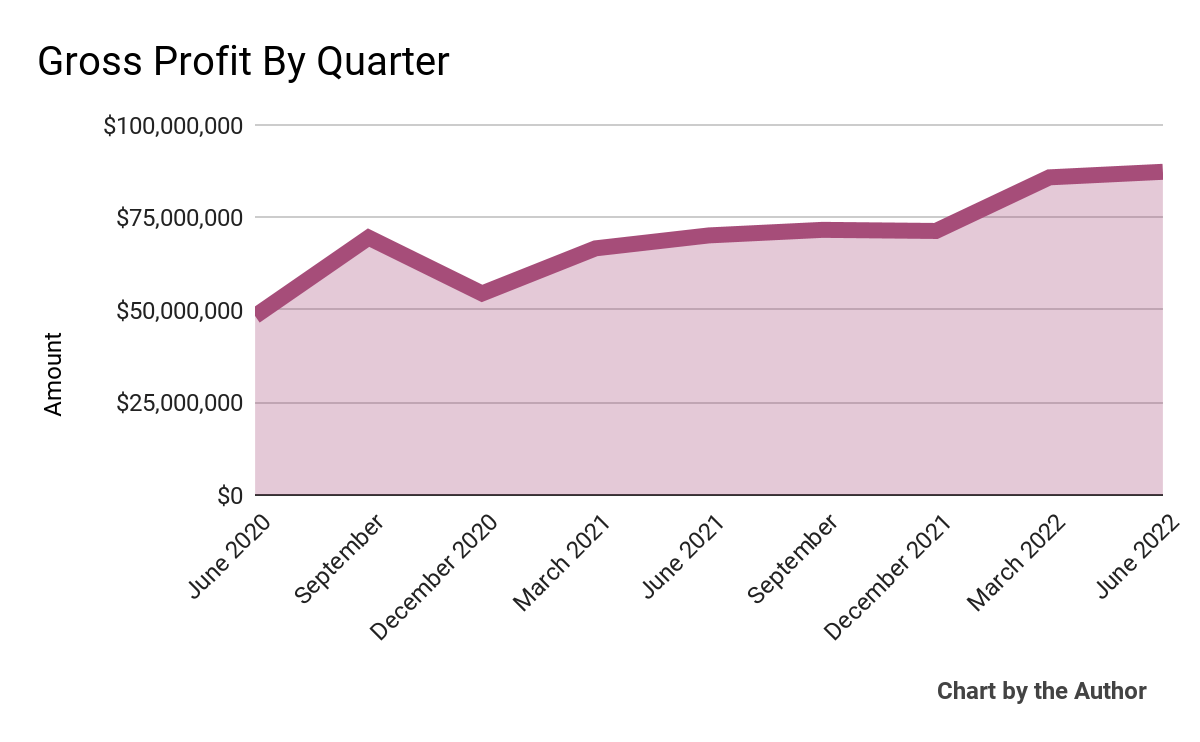

Gross profit by quarter has also grown in a similar trajectory to that of Total Revenue:

9 Quarter Gross Profit (Seeking Alpha)

9 Quarter Gross Profit (Seeking Alpha)

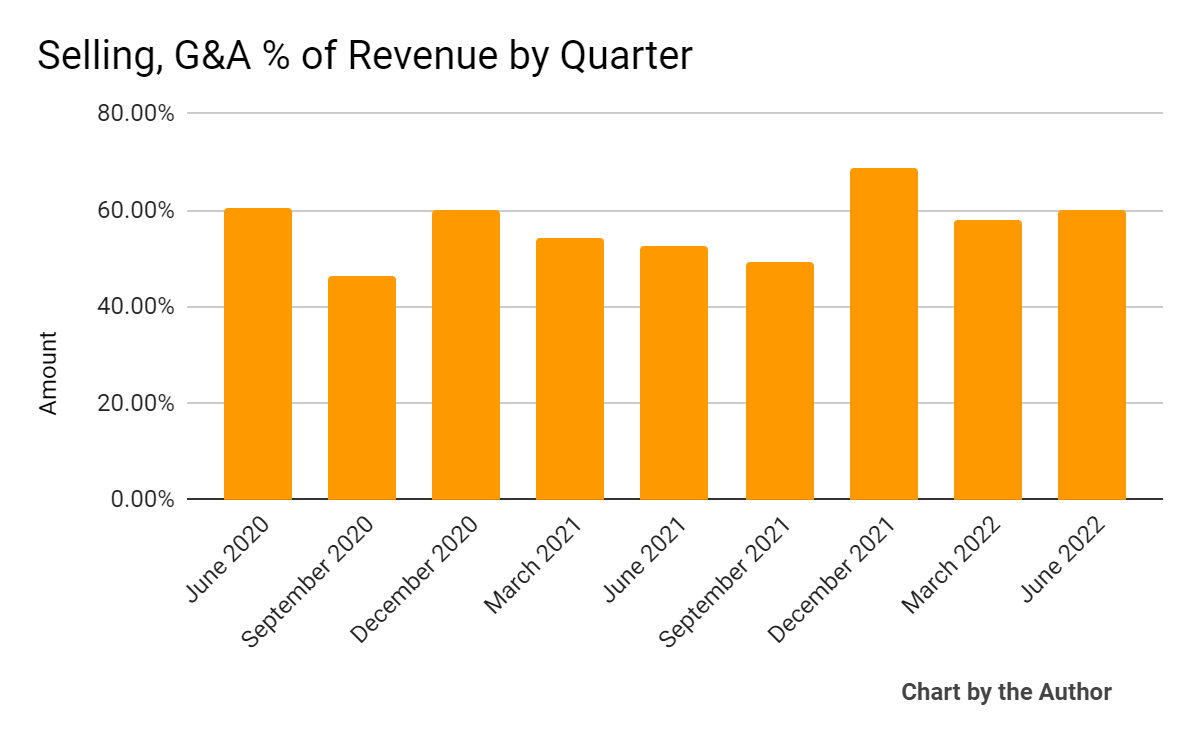

Selling, G&A expenses as a percentage of total revenue by quarter have risen in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

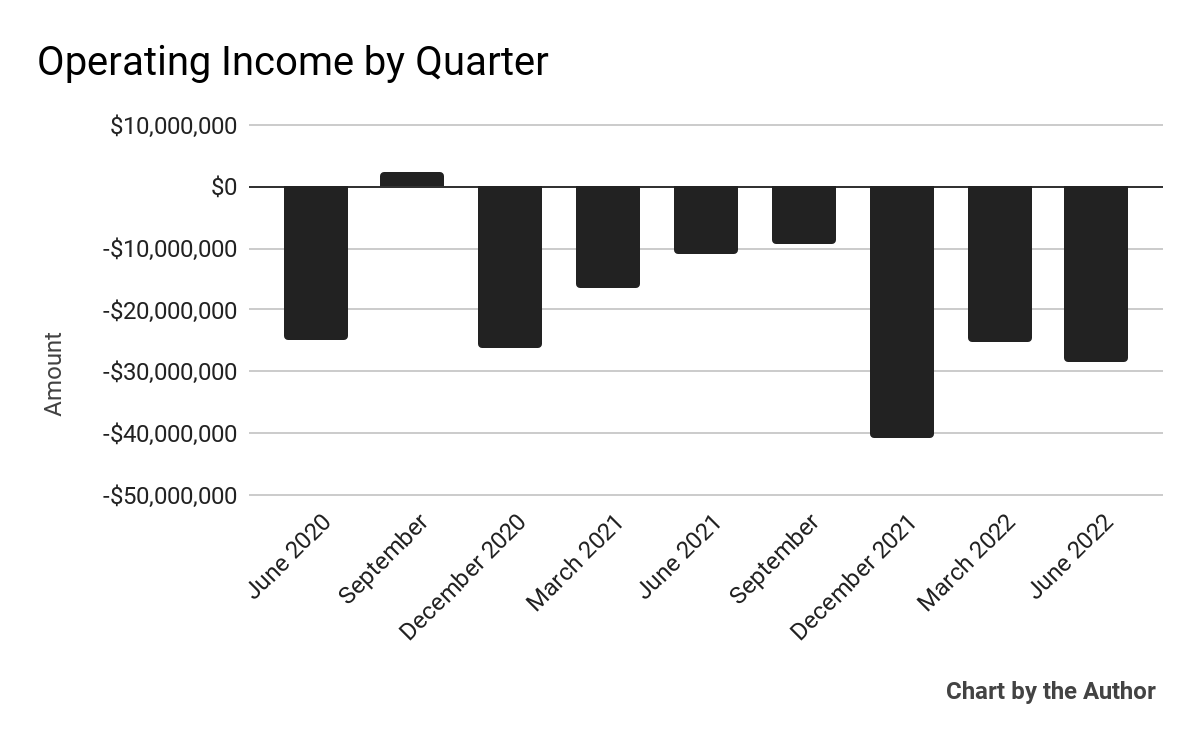

Operating losses by quarter have worsened in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

9 Quarter Operating Income (Seeking Alpha)

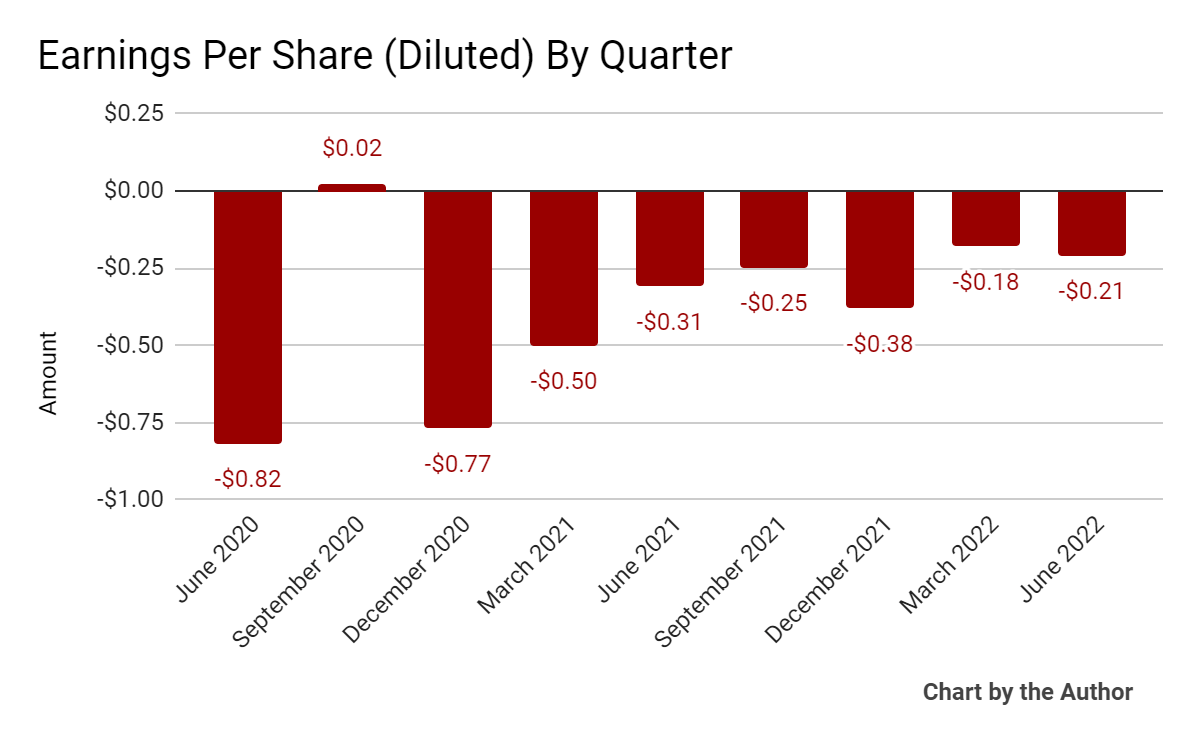

Earnings per share (Diluted) have generally remained negative, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP.)

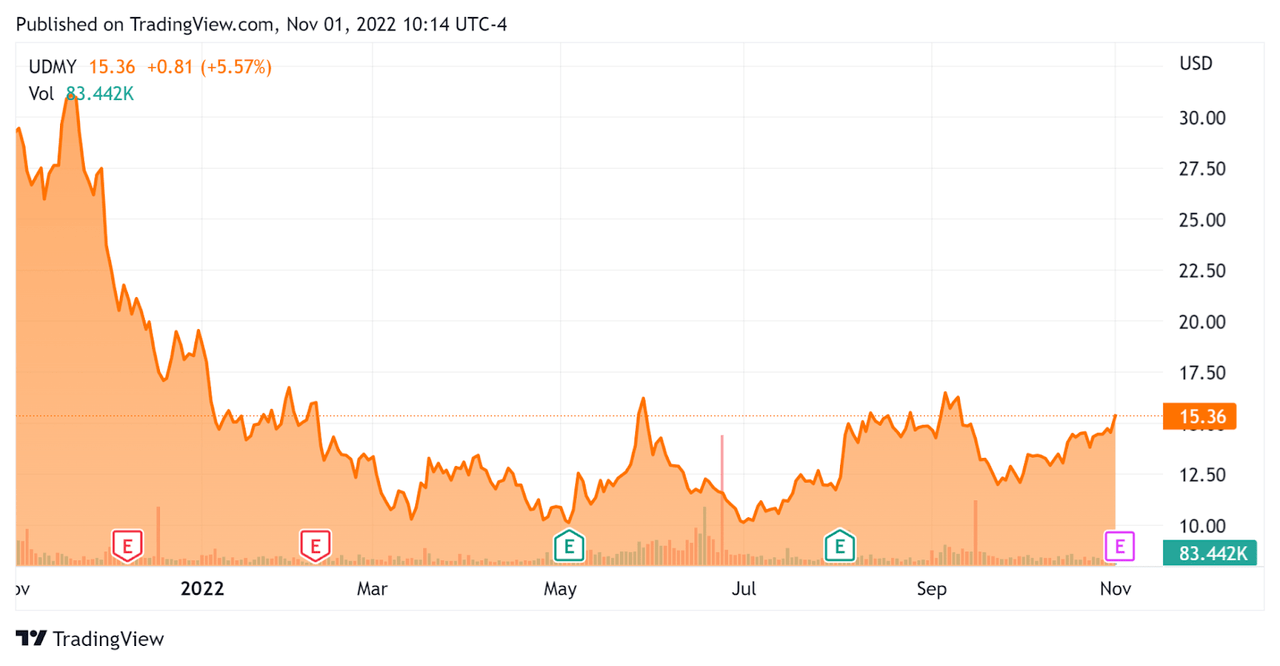

Since its IPO, UDMY’s stock price has fallen 48.3% vs. the U.S. S&P 500 index’ drop of around 16.2%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

52 Week Stock Price (Seeking Alpha)

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM]

Amount

Enterprise Value / Sales

2.75

Revenue Growth Rate

19.0%

Net Income Margin

-18.5%

GAAP EBITDA %

-16.9%

Market Capitalization

$2,070,000,000

Enterprise Value

$1,580,000,000

Operating Cash Flow

-$18,050,000

Earnings Per Share (Fully Diluted)

-$1.02

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Coursera, Inc. (COUR); shown below is a comparison of their primary valuation metrics:

Metric

Coursera

Udemy

Variance

Enterprise Value / Sales

2.33

2.75

18.0%

Revenue Growth Rate

29.4%

19.0%

-35.4%

Net Income Margin

-34.5%

-18.5%

-46.3%

Operating Cash Flow

-$31,800,000

-$18,050,000

-43.2%

(Source – Seeking Alpha.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

UDMY’s most recent GAAP Rule of 40 calculation was only 2.2% as of Q2 2022, so the firm is in need of significant improvement in this regard, per the table below:

Rule of 40 – GAAP

Calculation

Recent Rev. Growth %

19.0%

GAAP EBITDA %

-16.9%

Total

2.2%

(Source – Seeking Alpha)

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted a changing labor market as helpful for the firm’s platform that helps businesses re-skill and up-skill their workers.

Software developers find the platform especially relevant for online courses or certification programs in learning how to expand their skills.

In the month of June, its Udemy Business segment exceeded its Consumer segment in revenue for the first time ever.

However, this may have been due to a contraction in its Consumer business for the quarter.

As to its financial results, total revenue rose 21% year-over-year, with Udemy Business revenue up a very strong 77%.

The company’s Udemy Business net dollar retention rate was 118%, indicating reasonably strong product/market fit and good sales & marketing efficiency.

But, the firm’s Rule of 40 results have been disappointing.

Gross profit margin was 58% versus 56% in Q2 2021, while operating expenses were 66% of revenue versus 60% in the same period in 2021.

For the balance sheet, the company finished the quarter with $512.6 million in cash, equivalents and short term investments and no debt.

Over the trailing twelve months, free cash used was $21 million, of which $2.9 million was CapEx.

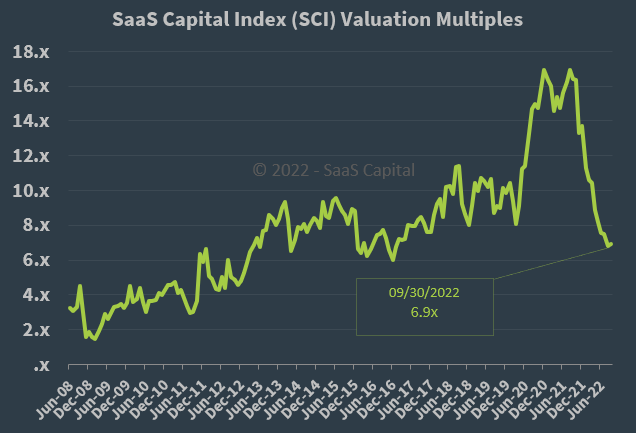

Regarding valuation, the market is valuing UDMY at an EV/Sales multiple of around 2.75x.

The SaaS Capital Index of publicly held SaaS (Software as a Service) companies showed an average forward EV/Revenue multiple of around 6.9x at September 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

SaaS Capital Index (SaaS Capital)

So, by comparison, UDMY is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of September 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may produce slower sales cycles and reduce its revenue growth trajectory for its Udemy Business offering and consumer segment.

A potential upside catalyst to the stock could include a tapering of U.S. Federal Reserve rate hikes, reducing downward pressure on valuation multiples for technology stocks like UDMY’s.

However, given the precarious status of the global economy, faltering consumer spending, and business confidence dropping, I’m not optimistic on UDMY’s outlook.

I’m on Hold for UDMY in the near term.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I’m the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider’s ‘edge’ on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is for educational purposes only and is not financial, legal or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or removed at any time without notice. You should perform your own research for your particular financial situation before making any decisions.