Phynart Studio/E+ via Getty Images

Udemy (NASDAQ:UDMY) was founded in 2010 and is an online learning (E-learning) platform aimed at professionals and students. As of June 2021, there are over 183,000 courses offered, with 44 million students. Udemy is now looking into going public on the Nasdaq.

The company has grown significantly in the last 10 years and is one of the leading E-learning platforms in the industry. The downside is the company has yet to turn a profit, and the low barriers to entry in the E-Learning space makes Udemy a difficult stock buy.

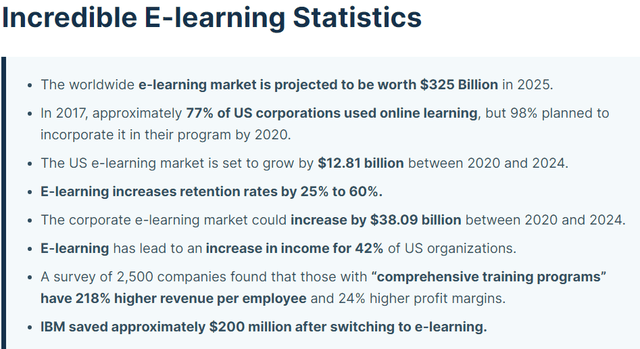

The online learning industry is expected to reach $457.8 billion in size by 2026. In 2020, the industry was valued at $250.8 billion. This approximates to about 10.3% in CAGR.

This growth makes sense, Coivd-19 and social distancing protocols had made in class learning difficult. Also, declining costs of communication and technology has made online learning more cost efficient.

Even corporations have saved money by switching to an E-learning platform. In a lot of ways, E-learning is changing the way companies operate and how students access education:

Source: techjury

An industry life cycle is divided into 4 phases:

It’s clear the E-learning industry is currently in the growth phase. A lot of companies in the industry are looking for growth, and some companies like Udemy are looking to raise funds through the listing on the stock exchanges:

Also, during this growth phase, the industry is highly fragmented with a lot of different competitors. Do a search on google for “competitors udemy” and a few articles pop up for websites that are similar to Udemy. This shows the industry has low barriers to entry and anyone can easily start a platform to host online classes: Source: Google Search

Source: Google Search

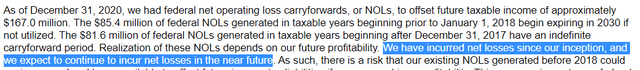

In early October 2021 Udemy issued a prospectus along with its financials. The financials provide a glimpse of its past performance, and its past performance wasn’t that spectacular. The company has not been profitable at any point in time:

(Source: Udemy Prospectus)

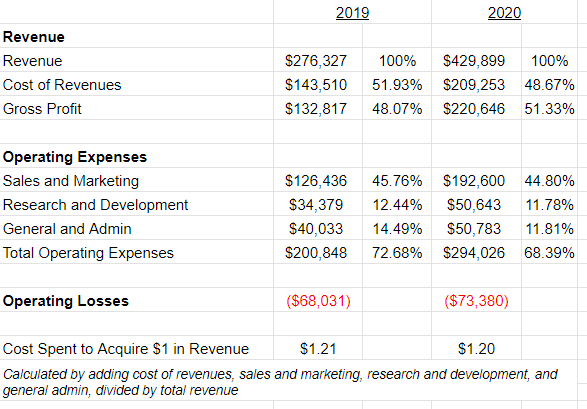

A look at its 2019 and 2020 financial results shows the bottom line has not improved. Revenues have grown tremendously from 2019 to 2020 but operating expenses have increased as well. There was an increase in operating losses from $68.03 million to $73.38 million: (Source: Udemy Prospectus; in thousands of dollars, except the cost spent to acquire $1 in revenue)

(Source: Udemy Prospectus; in thousands of dollars, except the cost spent to acquire $1 in revenue)

In the middle of a pandemic when schools have largely shut down, the uptick in Udemy’s revenue makes sense. But the increase in operating losses shows Udemy has not achieved the economies of scale to make its business profitable.

To put it in another way, Udemy spends $1.20 to acquire $1 of revenue. Between 2019 to the end of 2020, this spending rate has not changed. This is a concern because at some point the revenue will need to grow faster than the expenses, otherwise the company will just go back to the public markets for new capital.

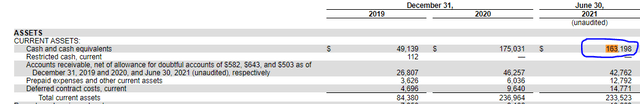

For now, the company does have cash to keep its operations running and the management believes (from the prospectus) there is at least 12 months of cash to keep its operations running. As of June 30th, 2021, there is $163MM cash in its balance sheet:

(Source: Udemy Prospectus)

After the IPO there will be even more cash in Udemy’s coffers. The IPO is expected to sell 14,500,000 shares at a price of $27 to $29. Using $28 as the average IPO price then the net proceeds are estimated to be $406MM. With the current cash balance of $163MM and the IPO proceeds then the combined cash is about $570MM. I do believe the $570MM will come down with IPO fees, legal fees, and other short term liabilities the company needs to pay out.

A quick comparison of the current firms looking to IPO (or have already IPO-ed) shows revenue is growing, but being profitable is still far off:

Source: Duolingo, Coursera, D2L and Udemy Financials or Prospectus

Duolingo is the closest firm to be profitable and so far its stock is up 27.1%:

While Coursera which lost $46.4 million in its most recent quarter has seen its stock fall by 26.5%:

Udemy’s financial performance is closer to Coursera’s. Both company’s saw large revenue gains in the past year but it operates deep in the red. Therefore, if Coursera’s stock price is any indication, Udemy’s stock price could also crater too.

To bring everything I have mentioned together, what does this all mean?

I do believe in the future of E-Learning. The pandemic has furthered the development of E-Learning. I’m bullish in the E-Learning space.

What I’m not convinced about is what’s Udemy’s natural advantage over other E-Learning firms. The barriers to entry seem low enough that almost any company big or small can create a course online. There are online tools available for anyone to host their own online classes.

I have a friend who enrolled in Udemy’s options trading course. They were classes paid for by his employer. I took a similar course on options trading but it was through an individual firm that built the course using their own hosting platform. The course I took invited industry experts to teach some of the modules, and made the online classes interactive so you can ask questions in real time. My friend finished the options course with even more questions on how to option trade. I finished the class with at least some comfort level to read charts and execute trades.

Udemy can offer hundreds of different courses. But how is the quality in those lessons and what prevents another instructor from offering a similar class in a competing platform? I’m not stating Udemy offers a bad product. I’m just stating the E-Learning space is such an equal playing field that I’m not sure how Udemy can stand out from the others.

At the end of 2020 when Udemy’s business have really grown, it’s acquisition cost to earn $1 of revenue was still at $1.20 (similar to its 2019 results). That is a problem because I interpret that as the company is still overspending to build its business.

With the IPO I do hope the company now has the resources to narrow its operating losses but I don’t see this happening any time soon. The industry is still in its growth phase so every competitor is racing to build and expand.

There is a possibility that Udemy’s stock price can rise from its brand recognition and popularity. But if the company doesn’t find a way to reverse its operating losses then the stock price will eventually fall.

Investors interested in Udemy should take a wait and see approach here.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.