Editor’s note: Seeking Alpha is proud to welcome Varanond Dilokrungthirapop as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

guvendemir/E+ via Getty Images

guvendemir/E+ via Getty Images

The first week of May saw very strong bearish price movements in the stock market, especially for small-cap tech stocks trading on the Nasdaq. Scrolling through my tech watchlist on Friday, May 6th, I was seeing red all around with some being in the double digits. However, there was one ticker celebrating on the bright green that caught my eye. That company was Udemy (NASDAQ: NASDAQ:UDMY), an online learning marketplace that has transformed the skills training industry.

Looking over to see what has happened, it turned out the company has just announced its Q1 2022 financial results two days earlier (May 4th), which beat analyst expectations by margins in the bottom line. Curious about the fundamentals, I decided to read the full report but was disappointed with many of the numbers. Therefore, I am writing this article to explain why I think Udemy is not yet a buy and investors should be wary of a bull trap ahead if prices keep rising.

Being an online platform for skill-based learning, Udemy has over 180,000 courses covering a variety of expertise (e.g. programming, animation, design, business, marketing, soft skills, etc) and are available in up to 75 languages.

As courses are made by instructors who participate on Udemy’s platform, Udemy makes money by charging instructors a fee when a user/student purchases a course. This model is known as the consumer segment (B2C) where revenue is generated from purchases of individuals.

The company also has a business segment (B2B) where it provides companies and their employees access to its huge pool of professional training courses through a yearly subscription fee. Notable companies currently subscribed to Udemy’s platform include Citigroup Inc., Fender Instruments, Glassdoor, PayPal Holdings Inc., Volkswagen, etc.

While the business model certainly sounds interesting, the company has yet to make a profit and seems likely to take some time to do so. We will discuss why that is in the parts below.

Udemy’s recent price rise is mainly attributed to the announcement of its Q1 2022 financial results. The company has reported a non-GAAP (Generally Accepted Accounting Principles) net income per share of -$0.08, which is a far smaller loss than analysts were expecting (consensus of -$0.15). However, if we look at the full picture, the company’s outlook may not align with what the recent price movement suggests.

Revenue: $152.2 million (up 22% YoY and 12% QoQ)

Gross Profit: $85.8 million (up 29% YoY and 20% QoQ)

Gross Profit Margin: 56.4% (53.5% for Q1 2021, 52.7% for Q4 2021)

GAAP Net Income: -$25.6 million (down 42% YoY, up 36% QoQ)

Non-GAAP net loss: -$11.2 million (down 49% YoY, up 58% QoQ)

Non-GAAP EBITDA: -$7.0 million (down 241% YoY, up 69% QoQ)

Note: Non-GAAP net income and EBITDA exclude certain incomes or expenses that are deemed to not reflect the company’s operating performance (e.g. interest income/expense, provision for income taxes, non-cash stock-based compensation expense, depreciation and amortization).

Source: Udemy, Inc. Investor Relations

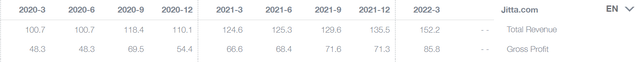

Looking at revenue growth, Udemy’s Q1 2022 revenue grew by 22% which is considered quite modest for a small-cap technology stock believed to be in its growth phase. Furthermore, if we zoom out, we will see that growth has been slowing down since 2021 as the company only grew its revenue by 19.95% from 2020, a big drop compared to the impressive 55.58% back in 2020 when COVID began.

Udemy’s Yearly Revenue (The Wall Street Journal)

Udemy’s Quarterly Revenue and Gross Profits (All Values in USD Millions) (Jitta.com)

Udemy’s Yearly Revenue (The Wall Street Journal)

Udemy’s Quarterly Revenue and Gross Profits (All Values in USD Millions) (Jitta.com)

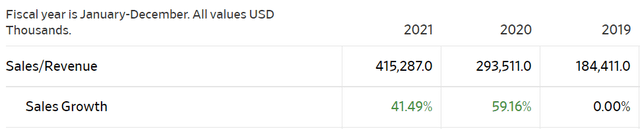

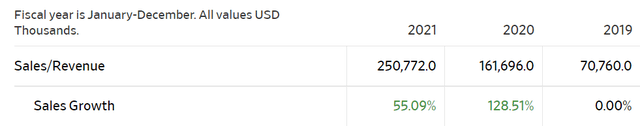

Udemy’s recent growth rate is also much lower than its peers. Other platforms such as Coursera (NASDAQ: COUR) and Duolingo (NASDAQ: DUOL) reported 2021 revenue growth of 41.49% and 55.09% respectively.

Coursera’s Yearly Revenue (The Wall Street Journal)

Duolingo’s Yearly Revenue (The Wall Street Journal)

Coursera’s Yearly Revenue (The Wall Street Journal)

Duolingo’s Yearly Revenue (The Wall Street Journal)

The slowing growth signals that Udemy’s platform might be struggling to attract new users, namely in its consumer segment which will be touched upon in the next part.

In Q1 2022, Udemy’s consumer segment generated a revenue of $87.3 million, down 1% YoY and up 9% QoQ. This is considered a worrying sign seeing that the global E-Learning market has grown by over 15% in 2021. Furthermore, comparing to its sizable competitor, Coursera, raises further questions on Udemy’s competitive ability as Coursera reported its consumer segment revenue grew 31% YoY in 1Q 2022 in contrast to Udemy’s flat growth.

Contrary to the consumer segment, Udemy’s business segment is thriving. Udemy reported its business segment revenue at $64.9 million for Q1 2022, increasing by 77% YoY and 12% QoQ. Annual recurring revenue also increased by a whopping 80% YoY to $279.6 million. This is thanks to a large number of new business customers acquired during the quarter (e.g., Baptist Health System, Inc., Crocs, Inc., Medici, and Volta Trucks Ltd.). Moreover, Udemy also has new key business customers from overseas, such as Woongjin ThinkBig in South Korea (generating nearly $500,000 in annual recurring revenue) and Sanjieke in China. The business segment is definitely where Udemy is shifting its focus to, which has high potential for future growth and a more predictable stream of income due to the subscription model.

While the business segment is indeed promising, let’s not forget that it is still 42.6% of the total revenue (less than the consumer segment). Udemy will need to keep this growth pace in the years to come in order to boost its top line given its consumer segment won’t be following.

The E-Learning industry is undoubtedly an attractive space, with the worldwide market expected to be worth $325 billion in 2025 (from $165 billion in 2014). This led to the birth of numerous online learning platforms over the past decade, competing for users who are looking to learn new skills or receive professional training from anywhere at any time.

The table below compares Udemy with other key players in the market (2021 Year-End Data).

Sources: ClassCentral, Octopus, Growjo

Looking at 2021 numbers, Udemy is ahead of its peers in terms of number of courses, revenue, and enterprise users. However, it could still be too early to tell who the clear winner will be in the long term as all companies are rapidly expanding their user base, especially in the business segment. While Udemy definitely has the most courses, it sometimes gets criticized for quality inconsistency as courses can be created by any instructor interested in participating. Whereas, Coursera has an advantage of having more certified courses with degree options through collaboration with renowned universities. LinkedIn Learning is also not to be underestimated as the LinkedIn social platform has up to 810 million members worldwide. Lastly, although Skillshare might be slightly smaller, it receives very positive reviews from users in the creative niche. With lots of competition, there is considerable uncertainty on whether Udemy can maintain healthy growth in the long term.

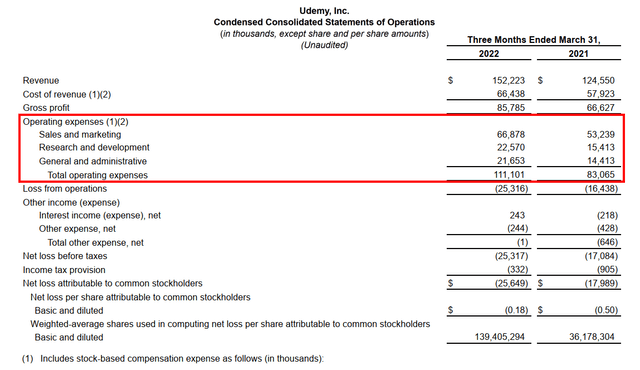

Even if revenue growth is maintained, Udemy still has another hurdle down the line: Profitability. Looking at the company’s Q1 2022 income statement below, the path to profitability still seems like a bumpy road.

Udemy’s Q1 2022 Income Statement (Udemy, Inc. Investor Relations)

Udemy’s Q1 2022 Income Statement (Udemy, Inc. Investor Relations)

Despite gross profit growing by 29% YoY ($85.79 million in Q1 2022 compared to $66.63 million in Q1 2021), total operating expenses increased at a faster rate of 34% YoY. This led to a larger net loss in the bottom line (-$25.65 million in Q1 2022 compared to -$17.99 million in Q1 2021).

Looking into the details, operating expenses increased substantially in all sectors with General and Administrative at 50% YoY, R&D at 46% YoY, and Sales and Marketing at 26% YoY. Even if non-cash stock-based compensations are excluded, the overall proportions still remain similar.

With staff and operating expenses still outpacing revenue and gross profits growth, there are still questions on whether Udemy can achieve the scale-effect to eventually become profitable as it expands its business segment. So far, I am not yet convinced that it will be so soon.

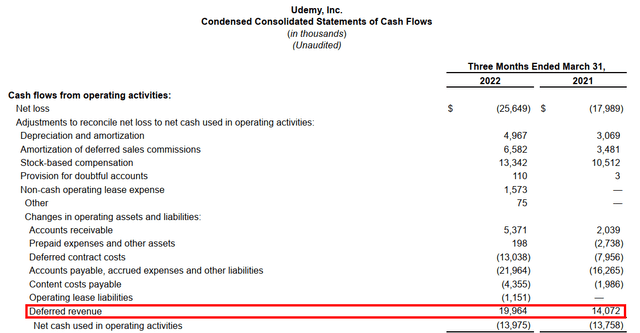

Unlike many online platform companies, Udemy has yet to generate positive cash flow from its operations as its business expands. The company reported an operating cash flow of -$13.98 million for Q1 2022, which is similar to that of Q1 2021 (-$13.76 million).

Udemy’s Q1 2022 Cash Flow Statement (Udemy, Inc. Investor Relations)

Udemy’s Q1 2022 Cash Flow Statement (Udemy, Inc. Investor Relations)

As Udemy has been rapidly increasing its annual recurring revenue from its business segment, I would expect its operating cash flow to be improving due to the increasing annual payments received in advance from the subscription model. While that is reflected in the increasing deferred revenue (payments received in advance for products or services to be provided), the high operating expenses are still keeping the cash flow negative.

Although the negative cash flow isn’t huge, if Udemy cannot improve its operating cash flow in the years to come, there could be concerns of issuing more shares or raising debt down the line. Nonetheless, the company still has a huge pile of cash from its IPO back on October 29, 2021, allowing for time to improve its cash-generation abilities.

As Udemy hasn’t shown signs of making a profit or free cash flow, conventional methods like the P/E ratio and DCF won’t be applicable. While not the multiple I often use, the Price-to-Sales (P/S ratio) can give us an idea of Udemy’s valuation. At the time of writing (May 11, 2022), Udemy’s is trading at 3.20 times its revenue, which is considered fairly low compared to similar companies in the market (see table below).

Whilst the comparison makes Udemy look cheap, the P/S ratio is usually not meant to be considered in isolation. Factors such as revenue growth rate, cash conversion abilities, and profitability can have considerable influence on the value. For instance, Duolingo’s revenue grew 55% with a positive operating cash flow in 2021, therefore it’s not that surprising to see its P/S ratio more than twice that of Udemy’s. Meanwhile, 2U on the other hand is having a high net loss and hence its P/S is lower.

With only P/S ratio, trying to determine if the stock is cheap at this point may be shots in the dark. Right now, I would put more emphasis on the momentum of the financial figures.

Despite better-than-expected Q1 2022 earnings, Udemy’s latest financials still indicate many challenges ahead. Concerns about slow revenue growth, intense competition, increasing expenses and negative cash flow are set to continue as we move further into 2022. While the stock has a lower P/S ratio compared to many of its peers, it seems to relate to their rates of growth and cash flow-generating ability to a somewhat reasonable extent. Considering the poor market sentiment for unprofitable tech stocks, rising interest rates and concerns over depleting liquidity, I am seeing little possibility of Udemy’s stock rising much further in the mid term.

Nevertheless, given that the E-Learning industry is still full of potential and the company can continue growing its business segment at such a pace in the quarters to come, I may give Udemy a second thought. For now, it would remain on my high-risk, high-return watchlist, not yet in my portfolio.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.