gorodenkoff

gorodenkoff

VTEX (NYSE:VTEX) went public in July 2021, raising approximately $361 million in gross proceeds from an IPO that priced at $19.00 per share.

The firm has developed a digital commerce platform for enterprise brands and retailers who want to do business in Latin America.

Given VTEX’ continued high operating losses, moderate growth and international expansion risks, I’m on Hold for VTEX in the near term.

London, UK-based VTEX was founded to develop an online retail platform that enables enterprises and large retailers to more easily do business in Latin America.

Management is headed by Co-CEO and Co-Chairman Geraldo Thomaz, who previously graduated with a degree in mechanical engineering from the UFRJ.

The company’s primary offerings include:

API

Multi-tenant platform

Low code development

The firm pursues large enterprise customers who seek to sell their products online in Latin American countries through its ecosystem.

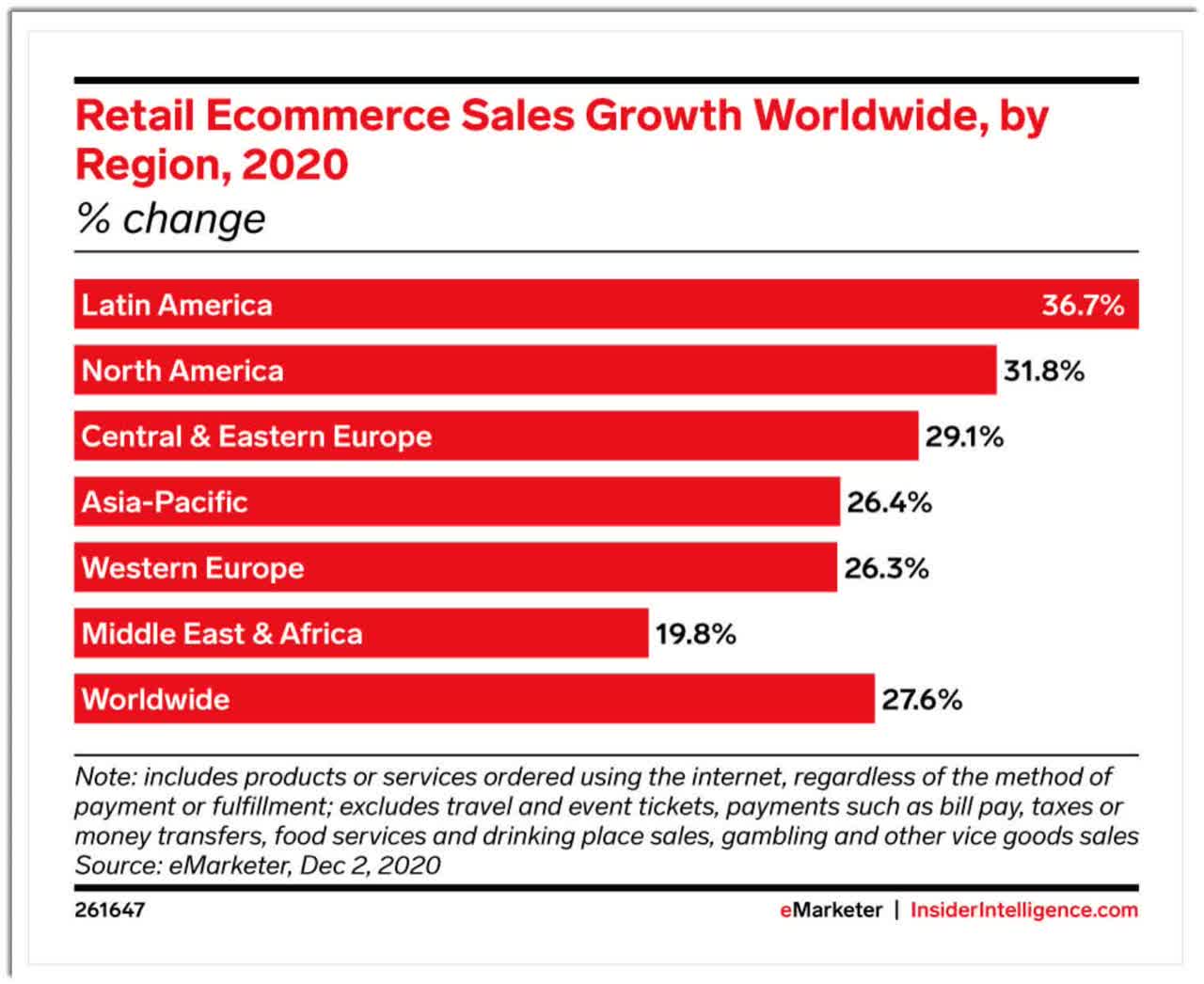

According to a 2020 market research report by eMarketer, the market for ecommerce shopping in Latin America was expected to grow by over 36% in 2020 to reach nearly $85 billion.

The main drivers for this expected growth are long lockdowns in Brazil and Argentina that have forced consumers to purchase more goods online.

Also, in 2020, Latin America saw the highest growth of retail ecommerce of all global regions, as the chart shows below:

Global Retail Ecommerce (eMarketer)

Global Retail Ecommerce (eMarketer)

Major competitive or other industry participants include:

SAP SE (SAP)

Oracle (ORCL)

Magento

Salesforce (CRM)

Shopify (SHOP)

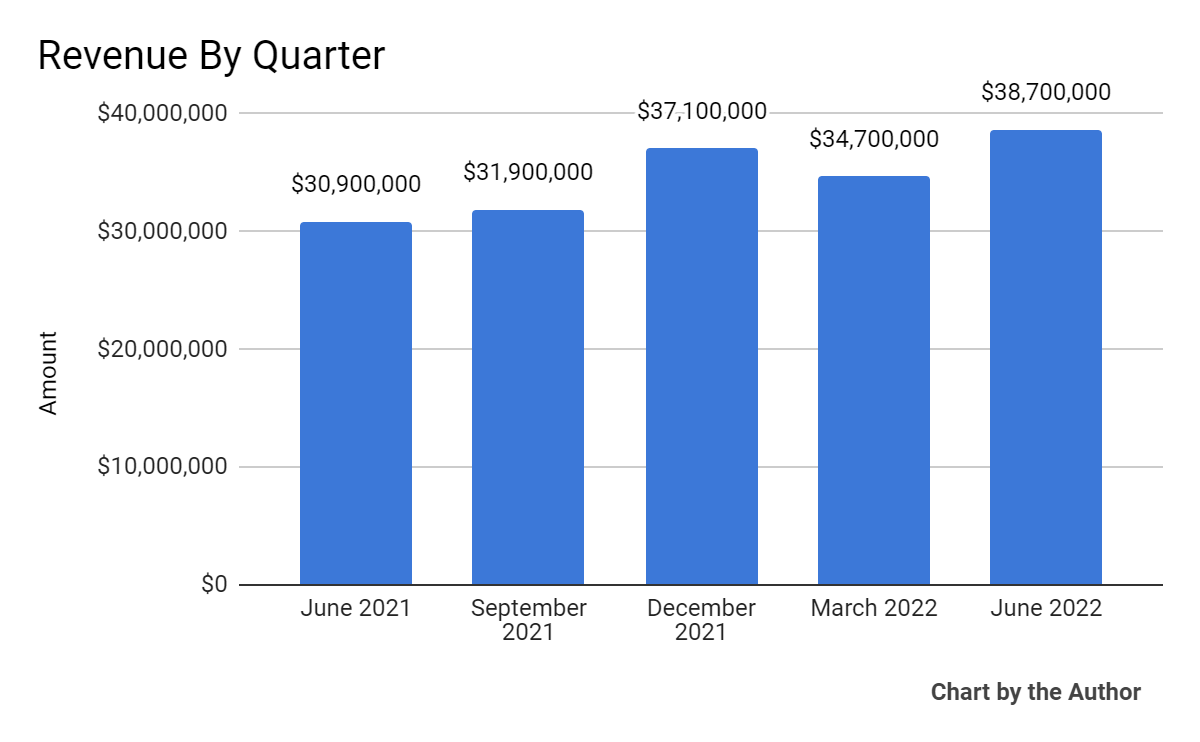

Total revenue by quarter has grown unevenly over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

5 Quarter Total Revenue (Seeking Alpha)

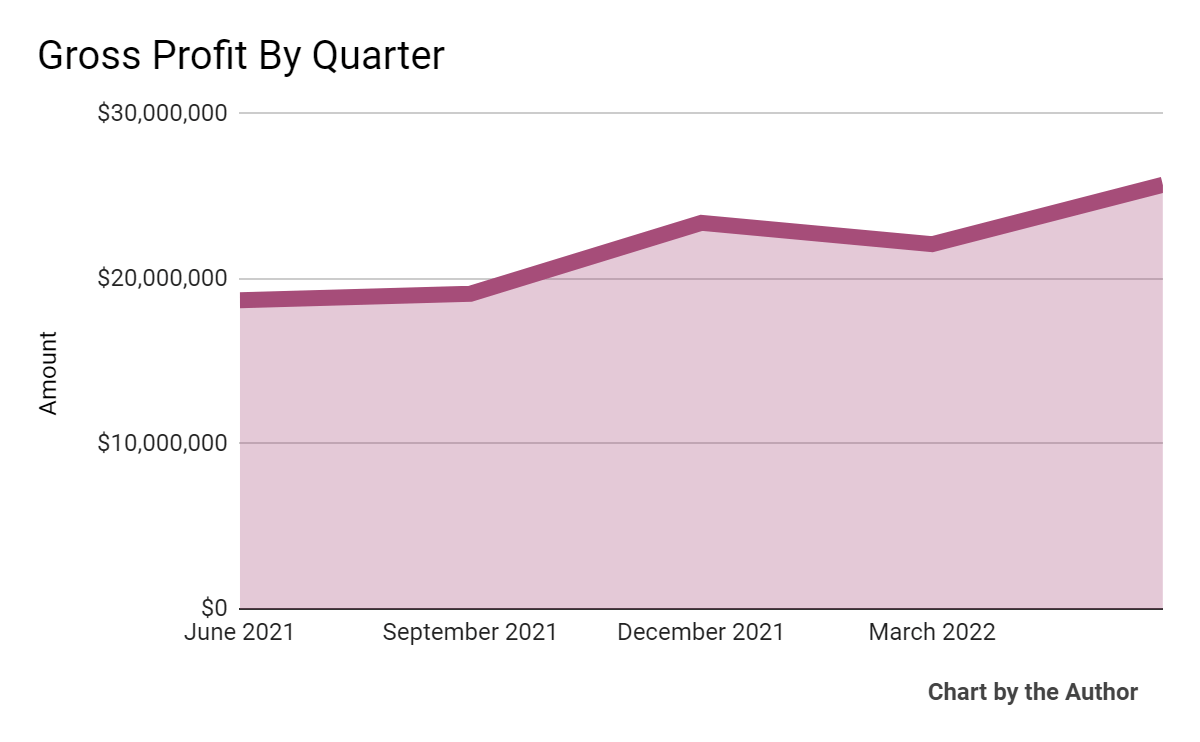

Gross profit by quarter has followed a similar trajectory to that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

5 Quarter Gross Profit (Seeking Alpha)

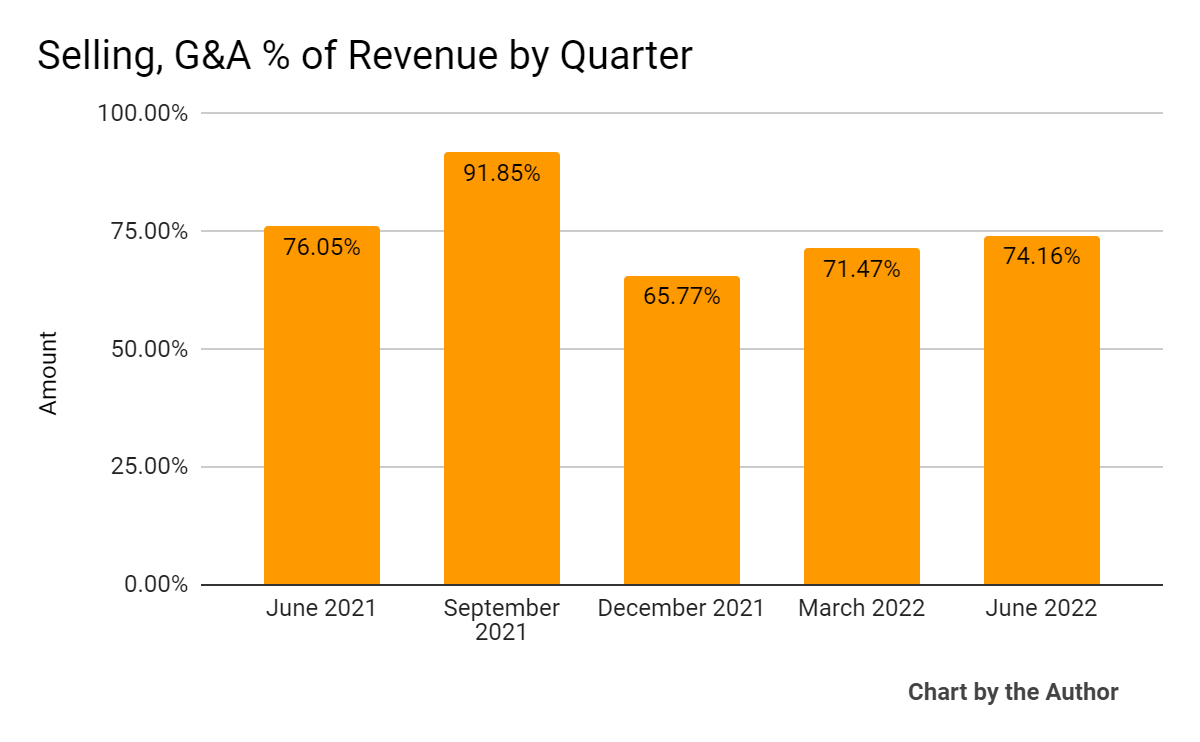

Selling, G&A expenses as a percentage of total revenue by quarter have produced the following results:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

5 Quarter SG&A % Of Revenue (Seeking Alpha)

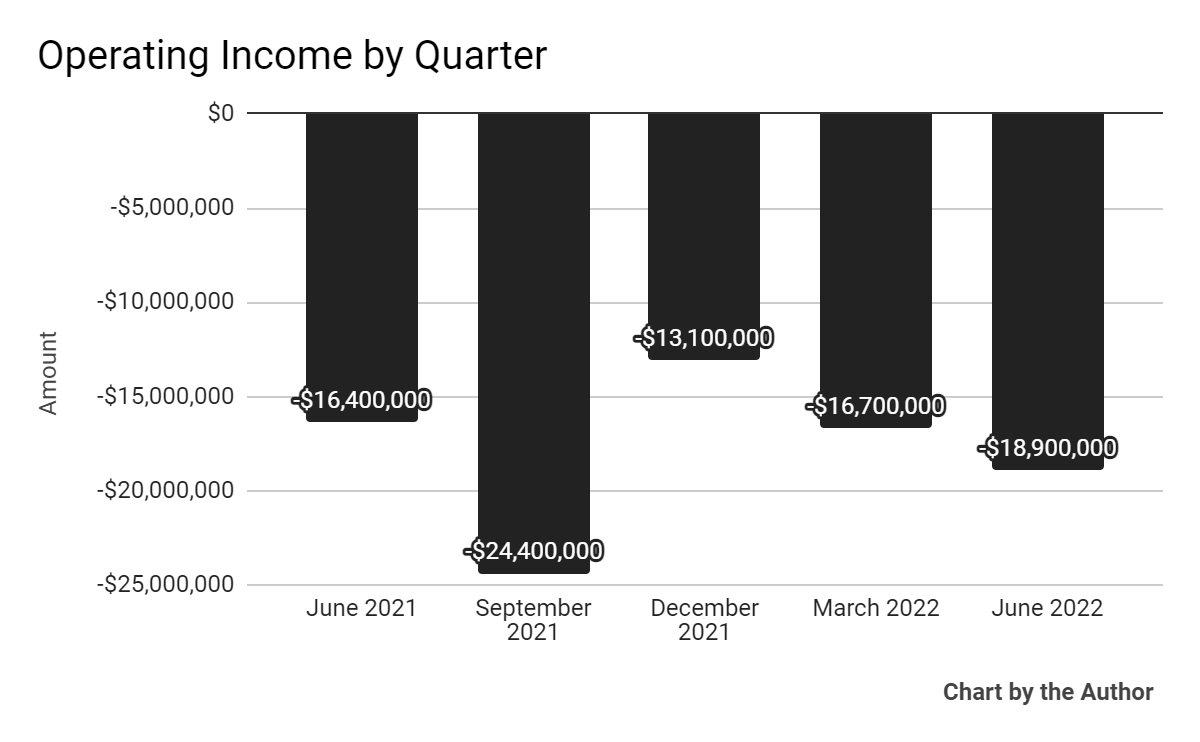

Operating losses by quarter have remained substantial over the past 5 quarters:

5 Quarter Operating Income (Seeking Alpha)

5 Quarter Operating Income (Seeking Alpha)

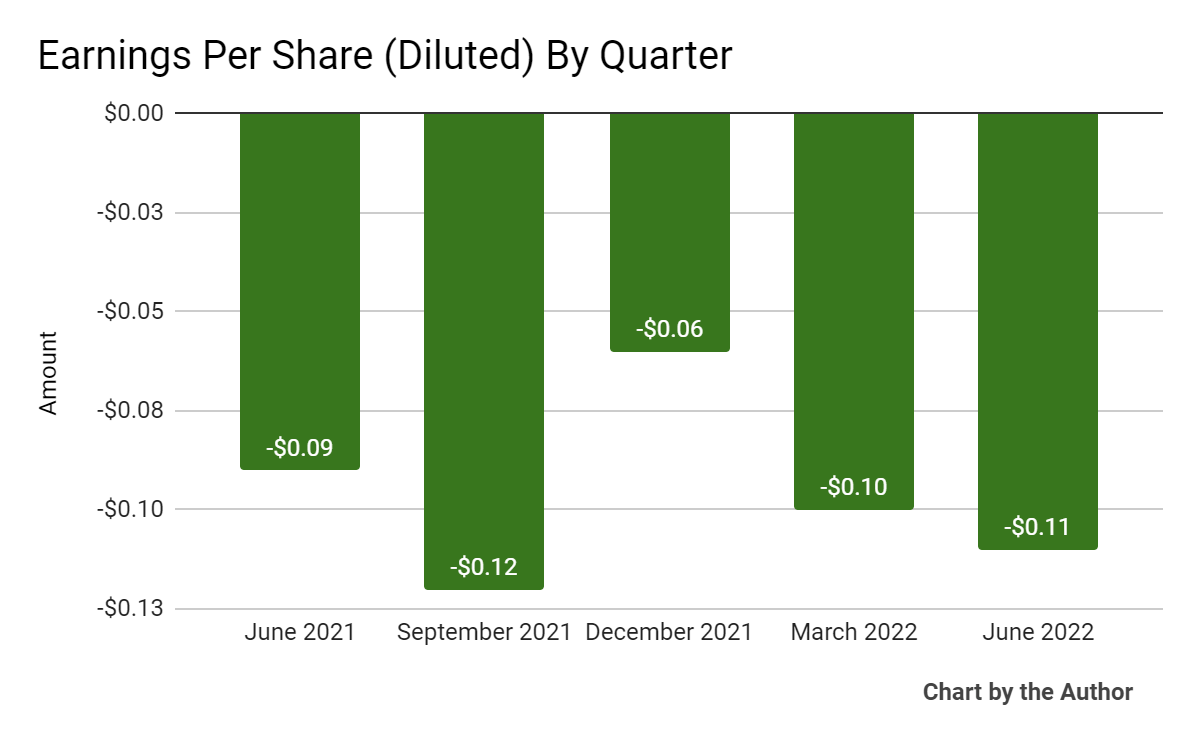

Earnings per share (Diluted) have remained negative as well:

5 Quarter Earnings Per Share (Seeking Alpha)

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

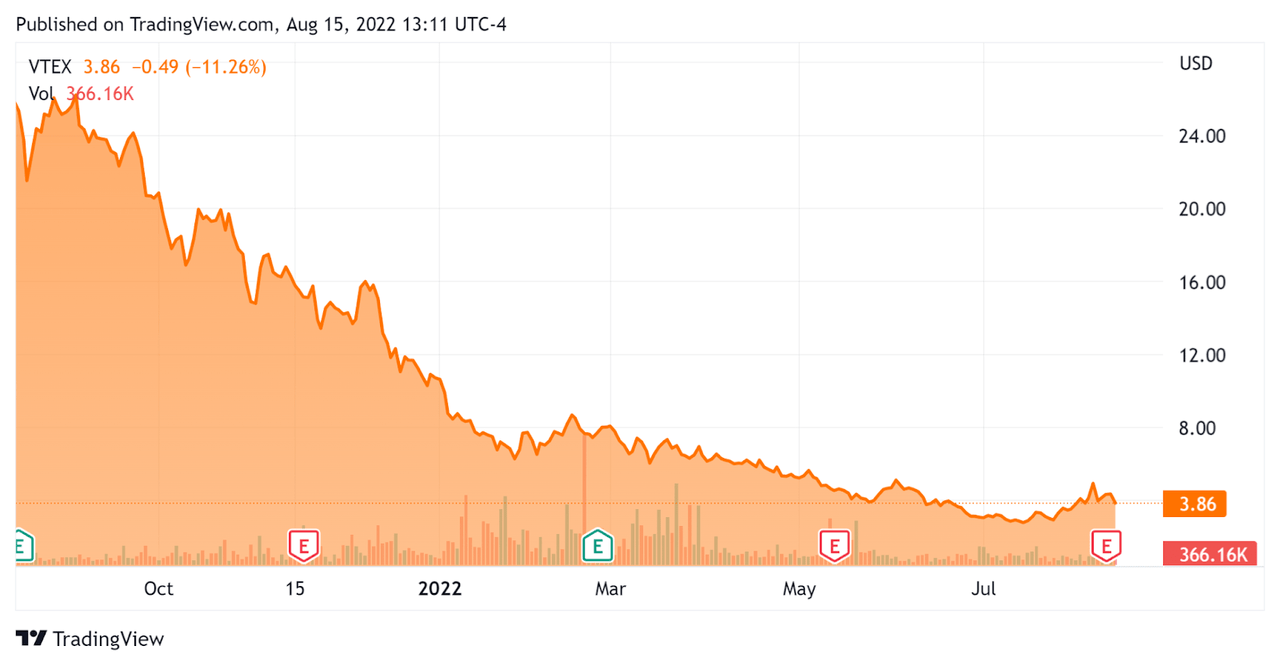

In the past 12 months, VTEX’ stock price has dropped 85.2% vs. the U.S. S&P 500 index’ drop of around 4.0%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

52 Week Stock Price (Seeking Alpha)

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM]

Amount

Enterprise Value

$585,820,000

Market Capitalization

$831,770,000

Enterprise Value / Sales

4.12

Revenue Growth Rate

25.4%

Operating Cash Flow

-$60,000,000

Earnings Per Share (Fully Diluted)

-$0.39

Net Income Margin

-51.4%

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be DLocal (DLO); shown below is a comparison of their primary valuation metrics:

Metric

DLocal

VTEX

Variance

Enterprise Value / Sales

28.99

4.12

-85.8%

Operating Cash Flow

$181,000,000

-$60,000,000

-133.1%

Revenue Growth Rate

130.5%

25.4%

-80.6%

Net Income Margin

30.0%

-51.4%

-271.5%

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

VTEX’s most recent GAAP Rule of 40 calculation was negative (24%) as of Q2 2022, so the firm needs significant improvement in this regard, per the table below:

Rule of 40 – GAAP

Calculation

Recent Rev. Growth %

25%

GAAP EBITDA %

-49%

Total

-24%

(Source – Seeking Alpha)

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the growth of its GMV (Gross Merchandise Volume) of 27.6%.

In addition, the company continues to proceed with its international expansion outside of Latin America, in part through a partnership with Adyen, with strong intention to focus on the U.S. and Europe.

Management is focusing on two company types, midsize B2B companies and firms seeking to migrate their legacy systems.

As to its financial results, revenue grew 25% year-over-year in US dollars and 20% on an FX neutral basis, with subscription revenue accounting for 95% of total revenue.

However, GAAP operating losses remained significant and the company continues to burn free cash, at $14.7 million negative free cash flow for the quarter.

For the balance sheet, the company finished the quarter with $254.8 million in cash, equivalents and short term investments.

Looking ahead, management maintained its previous revenue guidance despite an uncertain macroeconomic environment and said it could use part of its capital for select M&A deals due to a growing gap between private and public market valuations.

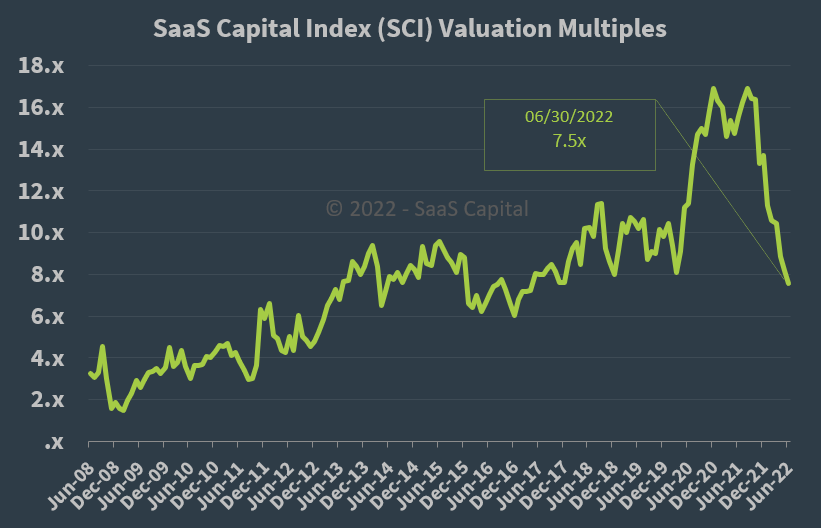

Regarding valuation, the market is valuing VTEX at an EV/Sales multiple of around 4.1x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

SaaS Capital Index (SaaS Capital)

So, by comparison, VTEX is currently valued by the market at a discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth estimates.

Additionally, the firm is expanding outside of Latin America, so there may be significant costs associated with that expansion. Of course, that expansion may be a net positive as it reduces the firm’s reliance on one region and increases its value proposition to multi-regional prospective customers.

A potential upside catalyst to the stock could include a slowing interest rate hike environment which would likely increase its valuation multiple due to an implied lower cost of capital growth trajectory.

While VTEX appears to be on the right track in its moves to expand outside of Latin America, the jury is still out on its ability to do so successfully.

So, given its continued high operating losses, moderate growth and international expansion risks, I’m on Hold for VTEX in the near term.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I’m the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider’s ‘edge’ on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is intended for educational purposes only and is not financial, legal or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or removed at any time without notice. You should perform your own research for your particular financial situation before making any decisions.