Remains

Remains

In my opinion, the key to successful investing is to start (early in life…) by constructing a well-diversified portfolio built for the long term and to hold it throughout the market’s up-n-down cycles. Following the advice of the legendary John Bogle, the cornerstone of my own personal portfolio is the Vanguard S&P 500 ETF (VOO) – a very cost-efficient fund that enables investors to match the success of the S&P 500. However, my portfolio has other “buckets” as well: Dividend paying stocks, technology stocks and funds, and sector plays like healthcare and consumer staples – just to name a few. Another piece of my portfolio’s core holdings is the Vanguard Total Stock Market ETF (NYSEARCA:VTI) – another low-cost Vanguard fund that casts an even a wider net compared to the VOO S&P 500 fund – VTI holds 4,000+ companies.

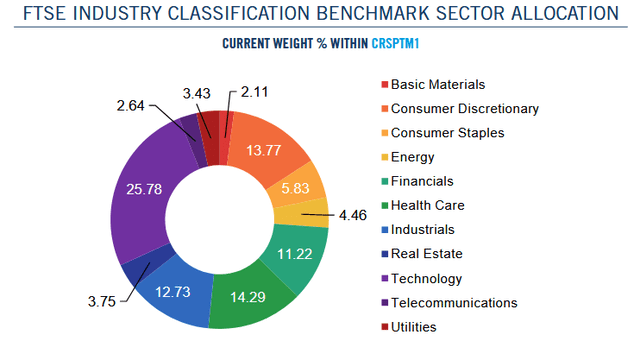

The VTI ETF is designed to track the CRSP US Total Market Index, and you can find the most recent quarterly fact sheet for this index here. As you can see from the publication, the index was developed by The Center for Research in Security Prices, LLC – an affiliate of the University of Chicago Booth School of Business. The index holds 4,070 companies, giving investors very broad exposure to the “total” market. The most recent sector allocation is shown below:

CRSP

CRSP

As you can see from the graphic, the index which the VTI ETF tracks is a very well-diversified portfolio across all major sectors of the market. Today I’ll take a closer look at the VTI ETF and you can determine for yourself if it’s worthy of an allocation within your portfolio.

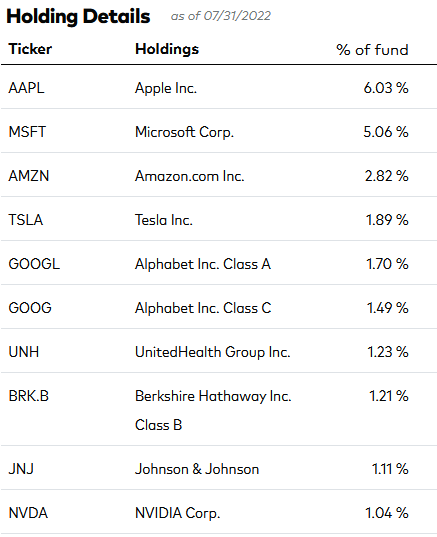

The top 10 holdings of the VTI ETF are shown below and equate to what I consider to be a very well diversified 23.6% of the entire portfolio of 4,000+ companies:

Vanguard

Vanguard

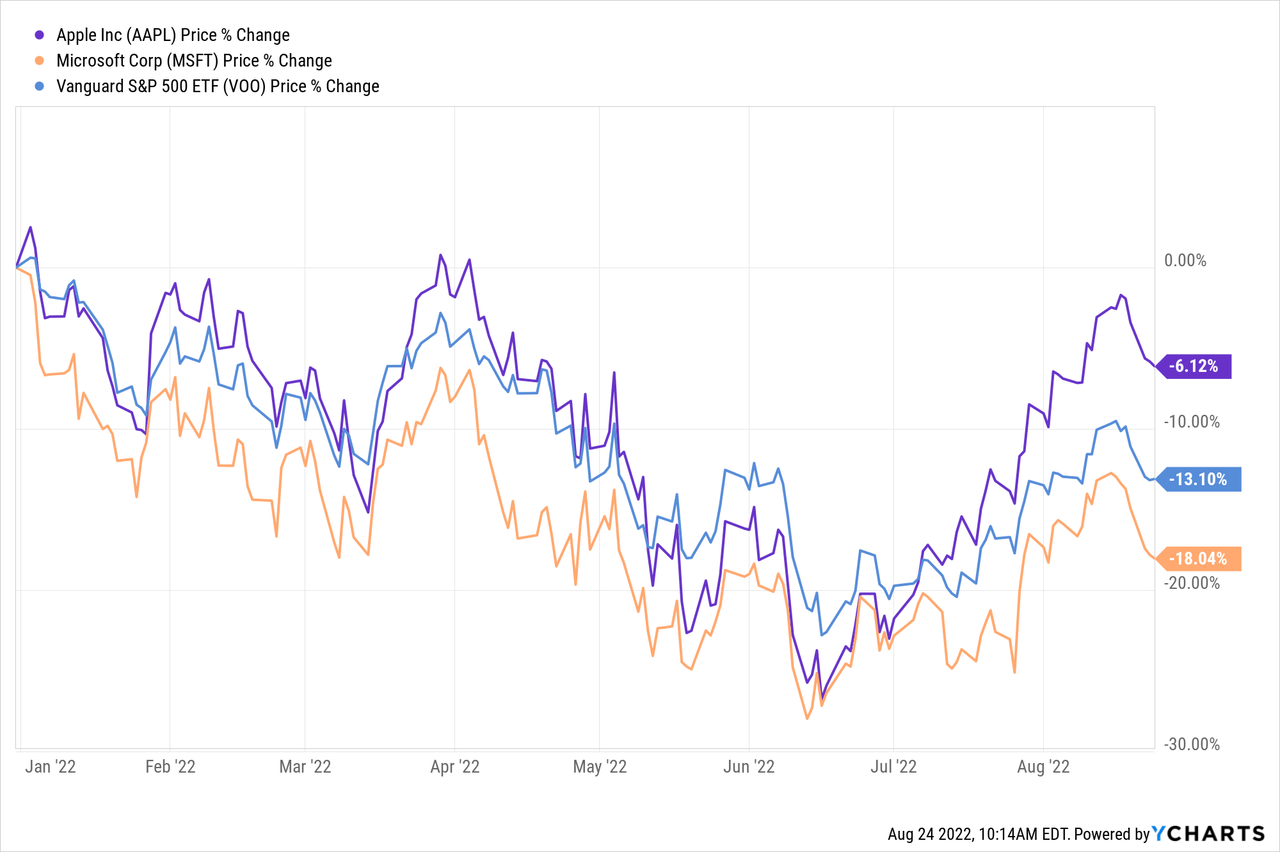

Not surprisingly, Apple (AAPL) and Microsoft (MSFT) are the largest two holdings and, in aggregate, account for a touch over 11% of the entire portfolio. For comparison, these two stocks equate to a 13% weight in VTI’s sister fund VOO – the S&P 500 ETF. Both companies have continued to generate excellent free cash flow through the 2022 bear market and while Apple has beaten the returns of S&P 500 YTD, Microsoft has lagged the S&P 500 by ~5%:

If we combine the two classes of Alphabet (GOOG) (GOOGL) stock, it’s the no. 3 holding with a 3.2% weight. Google is another company that has performed extremely well this year. In its Q2 EPS report, Google announced it had generated $12.6 billion in free cash flow and $1.21/share of net-income. Google’s Cloud Platform (“GCP”) remains a primary growth catalyst for the company going forward.

Google ended the quarter with $125 billion in cash, and note that was after purchasing $15.2 billion worth of stock during the quarter. Unlike many tech companies these days, Google’s stock buyback plan is actually outpacing employee stock compensation related issuance and the fully-diluted share count actually dropped from 13.592 billion shares to 13.239 billion shares on a year-over-year basis. Google remains my favorite mega-cap tech company, and with a TTM P/E of only 22.5x, is significantly undervalued, in my opinion.

Tesla (TSLA) is the no. 4 holding with a 1.9% weight. Tesla has really been through the ringer this year, as Elon Musk’s bid for Twitter (TWTR) has caused him to sell a significant number of his shares. Yet the stock is still up 28.6% over the past year, and another 3-1 stock split is scheduled to take place after the close of trading today (Wednesday, Aug. 24).

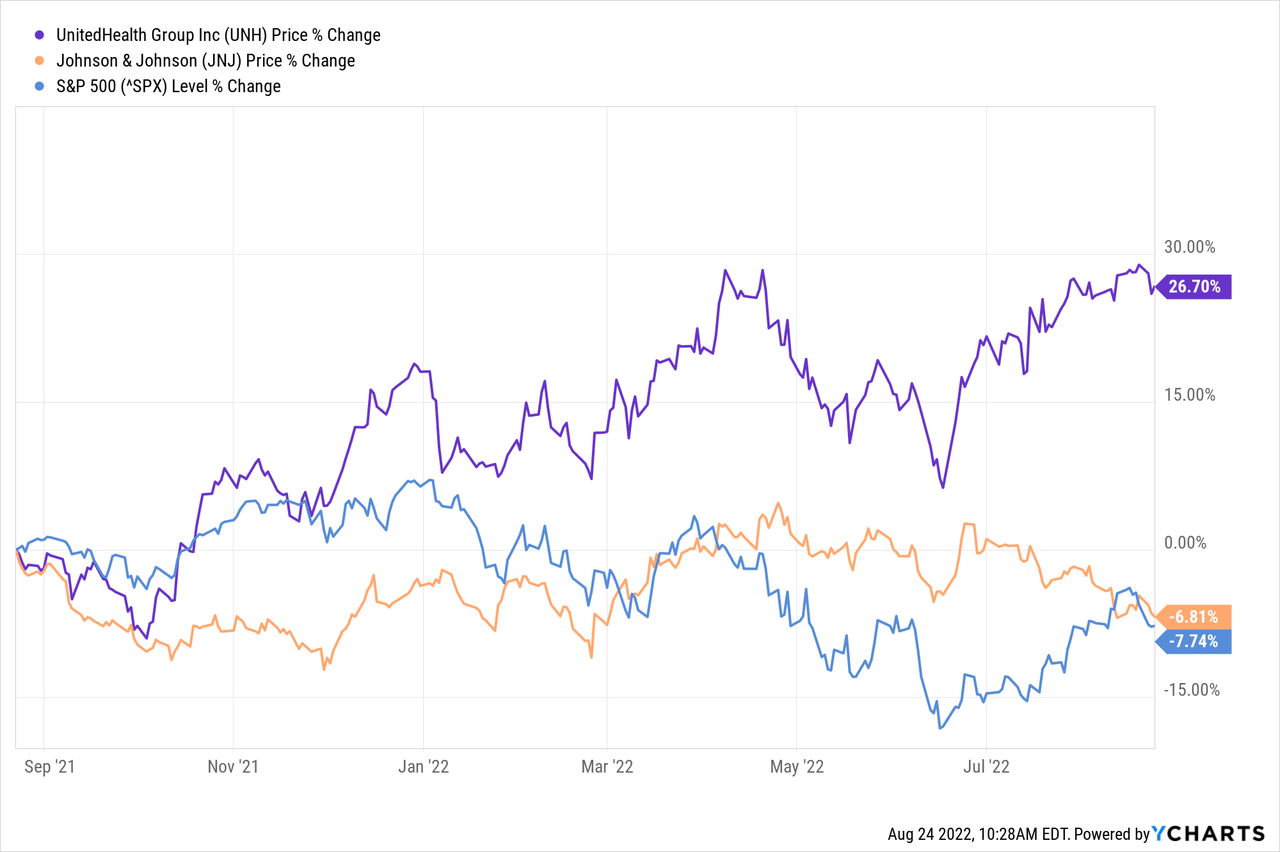

Two health-care conglomerates – UnitedHealth Group (UNH) and Johnson & Johnson (JNJ) – equate to 2.3% of VTI’s portfolio. Healthcare stocks are typically a good place to have exposure to during times of high inflation and weak overall markets. Indeed, both stocks have performed well this year in comparison to the overall S&P 500, with UNH being a stand-out performer:

In addition to VTI’s healthcare exposure, Berkshire Hathaway (BRK.A) (BRK.B) is another relatively defensive oriented stock due to its very strong balance sheet. However, note that Berkshire’s No. 1 holding is Apple and that the SEC recently gave the company permission to buy up to 50% of Occidental Petroleum (OXY) stock. Berkshire is up 5.8% over the past year.

Nvidia (NVDA) rounds out the top-10 holdings with a 1% allocation. Nvidia’s earnings (and stock price – down 22% over the past year) have been hit by a slowdown in gaming chip demand and overall lower product pricing. Perhaps somewhat under-appreciated is that Nvidia has evolved into a leading developer of AI/ML solutions. While NVDA is facing some headwinds in the short-term, in my opinion the company’s mid- and long-term potential is excellent. That said, with a forward P/E of 45.7x, arguably the company’s valuation is still quite elevated.

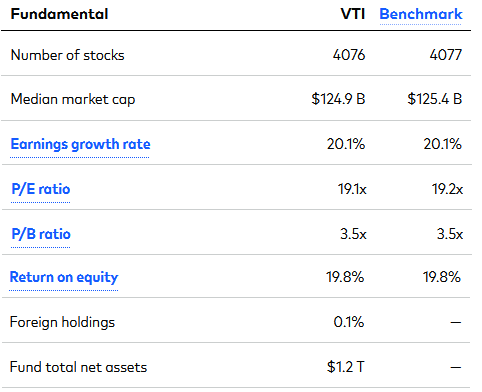

Some key metrics of VTI’s overall portfolio are shown below:

Vanguard

Vanguard

Takeaways from these metrics are that the valuation levels (P/E, P/B, and ROE) are roughly in-line with the S&P 500 and that VTI is – for all intents and purposes – a thoroughly domestic fund (only 0.1% foreign exposure). With total net assets of $1.2 trillion, there are no liquidity concerns. Lastly, not shown was the yield, which at 1.42%, is not much of a consideration either way. That is, income is not a reason to buy the fund, but at 1.42% it is not inconsequential either as it will provide some downside protection.

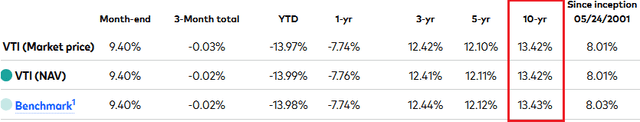

While the last 12 months (-9.9%) and YTD (-14.6%) returns are lousy, the VTI ETF has an excellent long-term performance track record of delivering a 10-year average annual return of 13.4%:

Vanguard

Vanguard

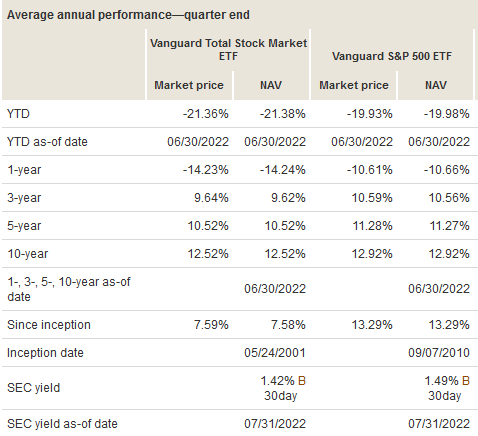

Interestingly enough, the VTI fund has underperformed the S&P 500 during the 2020 bear market, and lags over the 10-year timeframe as well:

Vanguard Fund Comparison Tool

Vanguard Fund Comparison Tool

That being the case, I find myself wondering if holding the 4,000+ VTI portfolio is really that differentiated from the VOO S&P 500 ETF and, is it really providing me the added diversification (from a returns perspective) that I thought it was.

The VTI ETF is not immune to the risks of the current macro-environment: The lingering and negative impact of COVID-19, high inflation, a higher interest rate outlook, and Putin’s horrific war-of-choice on Ukraine that, when combined with sanctions on Russia by the U.S. and its Democratic and NATO allies, has effectively broken the global energy and food supply chains. Any or all of these factors could lead to a slowing global economy, a recession (or worse …) and put downward pressure on the value of the VTI ETF.

The VTI ETF is another low-cost, high-quality Vanguard fund with an excellent long-term track record. That said, the differentiation between VTI and VOO isn’t as great as I expected it to be considering VTI holds ~3,500 more companies in the portfolio as compared to VOO. My followers know that over the past several years, I have been pruning my portfolio to reduce the number of overall equity holdings and, hopefully, increase the quality of the portfolio as well. That effort has resulted in a portfolio that is much easier to manage and track and its performance – as measured in relation to the S&P 500 – has generally improved. For now, I will keep the VTI ETF in my portfolio, but if over the next year or so it doesn’t appear to offer much in the way of differentiation to VOO (the cornerstone of my portfolio), I might consider selling it and simply moving the proceeds into VOO. However, for the time being, I think now is an excellent time to being taking advantage of market volatility and adding shares from time to time in VTI, which I rate a BUY based on its solid portfolio, valuation metrics, and excellent long-term performance track record.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.