Enter your search terms then press the return/enter key to submit your query.

/

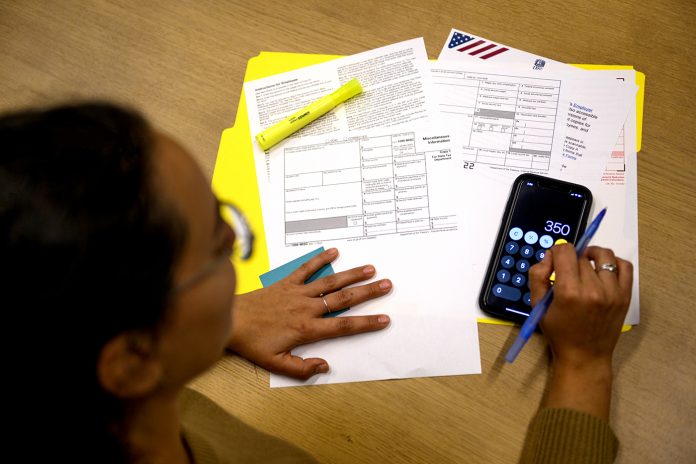

With inflation rising faster than expected in September and fears of a recession on the horizon, many Americans are feeling symptoms of financial stress that are typically characteristic of PTSD.

“Seeing these kinds of downturns in the economy can be very provocative,” says Kristen Lee, a Northeastern University teaching professor, clinical social worker and expert in behavioral health and resilience.

People may experience “difficulty concentrating and a flooding of anxiety,” she says.

“It can be hard to focus on what is possible and who we can turn to.”

The feelings may be particularly severe in people who already have experienced some form of financial trauma, defined by financial experts as intergenerational poverty, going for a period of months without the resources to meet basic needs or a sudden change in fortune due to job loss, bankruptcy, divorce or widowhood.

“People sometimes think of trauma as one big event like a war or an accident or an assault,” Lee says.

“We also know there’s something called small ‘t’ trauma. I would see financial trauma as fitting in that category. Something sustained over time that’s very disruptive, that affects our daily life,” she says.

An article in ForbesWomen defines financial trauma as when “expenses outweigh income for an extended period of time.” The article says one-third of millennials have experienced it.

Like other forms of trauma, financial stress brings on responses that while natural in the short run do not help sufferers in the long term.

“The traumatic response can be fight or flight. It can be having trouble sleeping or concentrating or eating. Being easily agitated,” Lee says.

Thinking and worrying about financial stress can take up a lot of head space, she says. “Rumination can be an example of a traumatic response.”

While feeling frozen and helpless are common reactions to stress and trauma, inaction can lead to worsening outcomes, including the loss of necessities of life such as housing, food and health care.

According to Lee, building resilience is key to surviving trauma and thriving in life.

In her new book, “Worth the Risk: How to Microdose Bravery to Grow Resilience, Connect More, and Offer Yourself to the World,” she offers an action plan that can be tailored to meet the goals of overcoming financial trauma, from seeking support to embracing education.

Two other Northeastern University professors—a psychologist and finance instructor—also share their insights on overcoming traumatic responses that stop people from addressing their financial challenges.

Stop shaming yourself

The first step is to stop the self blame game, says Lee, who teaches a Northeastern course called “Stress, Resilience and Behavioral Change.”

“Obviously the economy now is atrocious,” she says. “Know it’s not our fault and find ways to maneuver through it.”

Too often people faced with financial problems “marinate” in shame and feel embarrassed, Lee says. In our society, “financial discussions are generally taboo.”

Carlos Cuevas, a clinical psychologist and co-director of the Violence and Justice Research Lab at Northeastern, says his trauma patients sometimes express shame about needing to reach out for help.

He says he asks if they would refuse to go to the hospital for an injury.

“I tend to really normalize it. Everyone at some point in time needs assistance in one form or another. I really try to help them understand a lot of this isn’t about them but about their circumstances.”

Find your community

“We need to find our sources of nourishment,” Lee says. “We have to look at who we can tap into for that sense of safety, reciprocity, kindness and nurturing.”

Supportive friends and family who offer an ear to listen without judgment or pity can help financially struggling people find the candor they need to address their problems, Lee says.

Increasingly, support groups offer a sense of safety and community for people with financial trauma, with some groups particularly tailored for women and people of color.

Membership in Debtors Anonymous is free of charge.

Educate yourself

“Even if our financial literacy isn’t great, that’s a skill that can be developed over time,” Lee says.

Online courses and books—including free library books—offer detailed information on personal finance and many of them address the feelings of fear and anxiety that pop up when financially traumatized people look a balance sheet in the eye.

Vincent Muscolino, a Northeastern University lecturer of finance, tries to make learning about budgets, credit scores and even insurance umbrella policies fun by having students in his intercession courses on personal finance sign up for an online simulation sponsored by Bank of America.

The financial simulation, now available to the community by clicking on the link, provides students with a persona who is just out of college working on their first job. They are told what their salary is and offered an array of options on how much to pay for rent, mobile phones, food and restaurant meals.

Then they roll the dice to see what the financial fates have in store for them for the next few days—unexpected bills are sure to pop up, and opportunities for side jobs may not pay as much as they hoped.

“My vision starts with awareness,” Muscolino says.

His immediate goal is to have students see the need to build an emergency fund for three to six months and to look at the importance of rental and disability insurance—things college students might not think about normally.

“I’m trying to get everyone focused on the fact that (financial stability) requires planning ahead,” Muscolino says.

He asks students to take what they’ve learned and spread the word that financial literacy doesn’t have to be complicated.

In addition, there are a variety of online personal finance courses available, including free offerings by Udemy and Coursera.

Self care is important, not expensive

Self care is a buzzword now, and it’s an important topic, Lee says. But it doesn’t have to stretch a non-existent budget.

“All the hype around self care is mani pedis and expensive spas and chocolate cake and salt baths. There are also a lot of things we can do that don’t cost us extra time and money,” she says.

Spending time in nature, meditating, breathing deeply and reaching out to a trusted friend can help address traumatic responses and promote self regulation, Lee says.

Don’t be afraid to seek professional help

A therapist can help people traumatized by financial disaster to get their footing by using cognitive behavioral models and offering the tools to build resilience, Lee says.

In some cases, therapies such as eye movement desensitization and reprocessing could be helpful, she says.

“It allows for new associations to be developed to reduce unwanted automated symptoms,” Lee writes in “Worth the Risk.”

“EMDR also helps recipients create imagined templates of future events to acquire skills that support ongoing adaptation.”

Lee writes about inoculating oneself against inaction and despair by “microdosing bravery.”

“Small steps can help us move in a better direction. You don’t have to do it all at once.”

“When we think about generating resilience, it’s not linear, it’s not formulaic,” Lee says.

“It’s looking at what is possible and asking oneself what are the protective factors that are present in my life, what the resources are. A protective factor could be a positive, kind relationship. It could be having a library next to you with resources and having a therapist to run things by.”

“It could be a great sense of humor or great analytical skills. It could be prior experience,” Lee says.

“For anyone who has gone through a traumatic circumstance of any sort, that wisdom and knowledge acquired can be very beneficial and very helpful for ongoing and future circumstances.”

“You learn a lot through those difficulties,” Lee says.

Advocate for others

Overcoming trauma can make one a powerful advocate for individuals facing financial post-traumatic stress disorder, especially when the cause is social inequality and intergenerational financial trauma, Lee says.

Think about societal changes that need to be in place to make child care and education accessible, she says.

“It needs to be the number one priority in society to take care of people,” Lee says.

For media inquiries, please contact [email protected].

Share

News @ Northeastern

We are Northeastern University’s primary source of news and information. Whether it happens in the classroom, in a laboratory, or on another continent, we bring you timely stories about every aspect of life, learning and discovery at Northeastern.

Sections

Keep in touch

© 2022 Northeastern University

This website uses cookies and similar technologies to understand your use of our website and give you a better experience. By continuing to use the site or closing this banner without changing your cookie settings, you agree to our use of cookies and other technologies. To find out more about our use of cookies and how to change your settings, please go to our Privacy Statement.