TARIK KIZILKAYA/iStock Unreleased via Getty Images

TARIK KIZILKAYA/iStock Unreleased via Getty Images

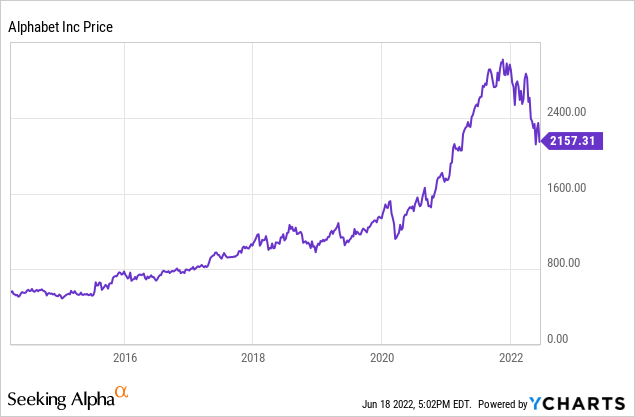

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) has been on an absolute tear in recent years.

If you had invested in Alphabet (then known as Google) ten years ago, you would have seen your capital compound at ~22% through the decade as the shares moved from $280 to over $2k per share.

And that’s including the recent correction where shares moved down nearly 30% from their all-time high. Impressive results!

But, most of that growth was built on the back of Alphabet’s 24-year-old search product, Google. And later, it was Android that drove Alphabet’s growth. Google and Android are no slouches and both still boast impressive market share in their respective niches (Search and Mobile OS).

But that’s old news.

So, what will drive Alphabet’s next leg of growth?

My view: It’ll be YouTube.

It started as a small online website to share videos with friends, but it’s become so much more. Now it’s the News, Education, and Entertainment all rolled into one (mostly) free service. YouTube has since grown so large that it threatens Cable, VOD, and OTT Streaming Services like Netflix (NFLX).

Alphabet is known for online products and services that boast a strong market share.

That’s probably an understatement…

Alphabet is known for its online products and services that dominate the market. Let me show you what I’m talking about.

Google Search, Alphabet’s first breakthrough, has an 87% market share in the US, its Chrome browser has a 69% market share, Google Maps has a 72% market share, and Android OS has a 71% market share. Each of these products and their market dominance is incredible but seeing one company that is so dominant across so many different lines of businesses is truly remarkable.

But it doesn’t stop there, just like Search, Maps, Chrome, and Android dominate, so too does YouTube. According to Datanyze YouTube’s market share stands around 76% and Vimeo (VMEO) is just a distant second, only holding around 19% of the market. But the businesses are quite different. Vimeo targets businesses with a suite of SaaS products and hosting for a recurring fee. Whereas YouTube provides a limited set of free tools and free hosting and makes its money from Ads not recurring subscription fees (for the most part).

In Alphabet’s most recent 10-Q they revealed that YouTube Ad revenue increased from $6B to nearly $7B for the latest quarter, marking an increase of 14% from the same quarter last year.

Taking that 14% growth rate and applying it to the revenue YouTube earned in 2021 ($28.9B), means YouTube Ads may drive ~$33B in revenues this year for (assuming growth is constant YoY).

In the earnings call that went out shortly after the results were posted, Alphabet shared some other highlights on YouTube’s continued growth.

Source: Alphabet Q1 Webcast

Let’s come back to the $33B in YouTube ad revenues for 2022 that I calculated earlier and see how that compares against expectations for Netflix, the largest subscription streaming service in the world.

According to analyst expectations, Netflix is forecasted to gross $32.44B in revenues this year, that’s roughly 9% higher than the year before. So, if all goes according to street expectations and my calculations YouTube may be set to overtake Netflix before year-end. Of course, that’s not set in stone, a slowdown in ad sales could drastically change YouTube’s performance.

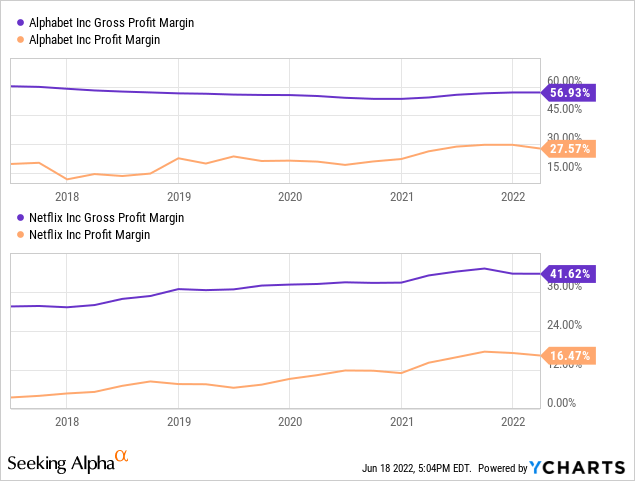

Revenues are one thing but don’t forget this: YouTube has a more profitable business model.

Netflix must constantly invest in new content to keep its customers subscribed, some shows like Stranger Things cost $30mm an episode; YouTube doesn’t have that problem. YouTube simply takes a cut from the ad revenues the video generates. Doing this allows YouTube to outsource all development costs to the creators on its platform.

Unsurprisingly, Netflix has worse margins than YouTube. Netflix has a pre-tax margin of around 20% according to Yahoo Finance. It’s impossible to determine the exact margin YouTube has because Alphabet doesn’t share it, but we can come to a ballpark estimate using Alphabet’s pre-tax margin of around 33%. For the sake of comparison, the traditional cable content provider, Paramount (PARA), has a pre-tax profit margin of ~16%.

Alphabet

Streaming (Netflix)

Standard Cable (Paramount)

Pre-Tax Margin

33%

20%

16%

Quarterly Revenue Growth (YoY)

23%

10%

-1%

Source: Yahoo Finance

Another factor working in YouTube’s favor is its usage-based revenue model versus Netflix’s subscription model. The most avid watchers on YouTube see an increasing number of ads that are tied to the number of videos they watch.

For YouTube, more engagement means more profit.

Since all plans allow unlimited streaming and increased engagement for Netflix, does nothing to drive incremental profit, it just keeps users subscribed.

Usage-based revenues are fantastic because they allow the provider of a product or service to capture a portion of the value it generates for its users each time it’s used.

As shows become more expensive to produce and competition from other streaming services heats up Netflix finds itself in a precarious position. Invest more money into content to maintain its market dominance, or save money and lose share.

YouTube doesn’t have that problem, the content on YouTube costs Alphabet nothing to produce. In short, YouTube is growing faster than Netflix, is more profitable, and has less competition.

Apart from its usage-driven, ad-supported, business model, YouTube enjoys a few other tailwinds, notably the decline of cable and strong network effects.

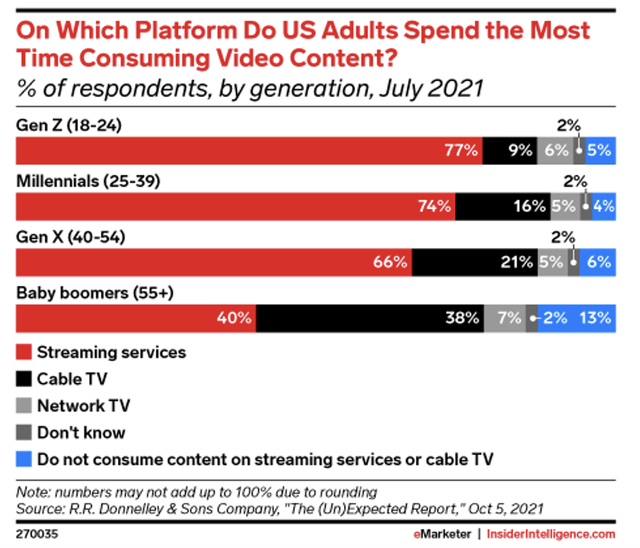

The Decline of Cable: The decline of cable and the adoption of alternative video entertainment like streaming and video sharing sites have revolutionized the way consumers watch video content.

eMarketer

eMarketer

It’s been reported already, but the decline in cable viewership presents challenges and opportunities to all the traditional cable video providers. YouTube is capitalizing on this trend in two ways, the first is increased viewership in its free ad-supported YouTube service thereby supplanting traditional TV viewership time. The second way is through YouTube TV, its online cable alternative, which directly competes with the traditional cable package.

I expect cable companies to continue their slow death as all channels are eventually replaced by an online alternative. Netflix and Disney (DIS) replace the scripted content then YouTube replaces the news, the weather, and so on.

Network Effects: Consumers want to go to the place with the most/best content. Video makers want to upload their content to the service with the largest audience. These two factors reinforce each other and create a virtuous cycle.

More content begets more content.

To further strengthen this effect, YouTube launched YouTube shorts to compete with TikTok in short-form video. While TikTok has a head start, the combination of YouTube shorts and regular YouTube in one app creates a strong competitor for TikTok. I believe that if TikTok is ever banned in the US (as was once tried) then YouTube is set to take an even greater share of the short form video market.

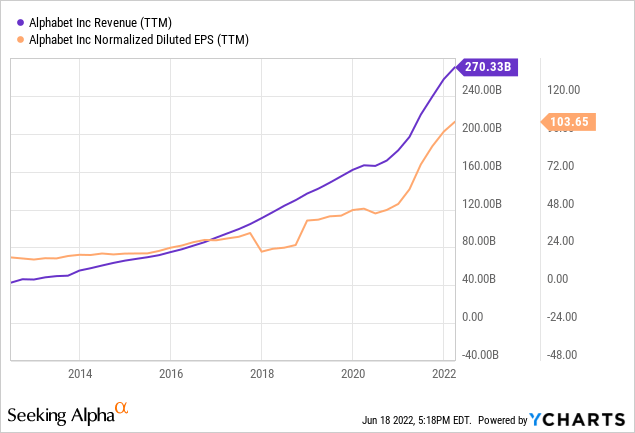

Now that I’ve covered YouTube’s performance, let’s touch on Alphabet’s financial performance over the past few years.

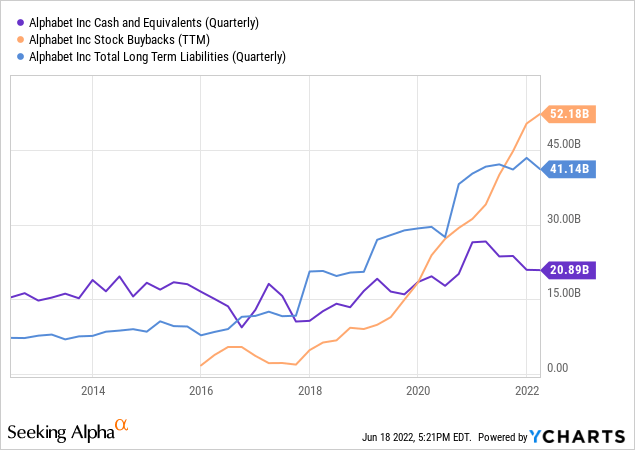

Alphabet’s revenue has grown exponentially since the early 2010s. Quarter after quarter (excl. one quarter at the start of the pandemic) Alphabet grew its revenues. The story for EPS has been similar to revenue growth, only it’s been further juiced by the buybacks that Alphabet began a couple of years back.

Alphabet exemplifies consistent profitable growth.

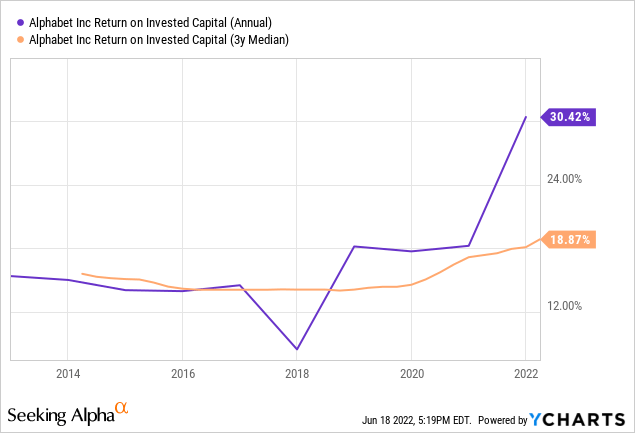

I always like to look at a company’s track record of deploying capital. After all, when you invest in a company that doesn’t pay a dividend, such as Alphabet, you better hope that they are deploying that capital well. Averaging around a 19% ROIC over the past three years, Alphabet’s management have been excellent stewards of their shareholders’ capital. I expect their ROIC to stabilize in the mid-teens as they continue to invest in YouTube and their cloud service.

When Alphabet runs out of internal growth opportunities and can’t find suitable M&A targets, they employ buybacks to return capital to shareholders. As you can see in the chart above buybacks have significantly increased over the past few years… largely fueled by an increased debt load. At least they took out some of the cheapest debt ever acquired.

Going forward I expect buybacks at Alphabet to continue, albeit at a potentially slower rate given the spike in bond yields.

To value Alphabet, I employed two different methods. First, I compared their forward PE ratio with US Technology Mega-Caps: Apple (AAPL), Microsoft (MSFT), and Meta (META). After that, I performed a discounted cash flow analysis.

Company

Current Stock Price

EPS 2023 Est.

2023 P/E

GOOG

$2,157

132.72

16.3

MSFT

$248

10.74

23

AAPL

$132

6.56

20

META

$164

13.88

12

Avg P/E Excl. Alphabet

18.3

Implied Stock Price

$2,429

Source: Author’s Calculations and Analyst Expectations From Yahoo Finance

Few companies are as large and powerful as Alphabet is, but Apple and Microsoft at least come close, and Meta is not far behind. Google’s forward PE of 16.3 is in the middle of the pack between Meta’s (12) and Microsoft’s (23).

But Alphabet is still quite different from its peers. Meta is a great company, but most of its earnings come from two aging products: Facebook and Instagram. Apple is another great company, but it makes most of its money from hardware sales. Because of that, I think the average PE of this grouping (18.3) is too low, perhaps Microsoft’s PE is more relevant, but just taking the average PE as a reference point, shares are worth around $2,429.

Base Case Assumptions:

Growth rate for next 7 Years (excl. 2022 & 2023)

13.0%

Terminal Growth Rate

3.0%

Discount Rate

9.0%

Share Count Change

0%

2022

2023

2024

2025

2026

Revenue

$296,830

$341,950

$386,404

$436,636

$493,399

Net Income

$73,696

$86,856

$98,147

$110,906

$125,324

Cash Flow

$66,254

$76,325

$86,247

$97,460

$110,129

Intrinsic Value per Share

$2,576

Current Share Price

$2,157

Upside Potential

19.4%

Source: Author’s Calculations and Analyst Expectations From Yahoo Finance

In addition to my forward PE comparison, I like to employ a DCF model to see how the valuation changes under various assumptions. For my base case, I took Analyst expectations for this year and next and used my own assumptions for growth beyond that. I’m using a 9% discount rate.

To partially offset my own bias, I also ran the numbers across a different range of assumptions for future growth and interest rates.

8% Discount Rate

9% Discount Rate

10% Discount Rate

Bull Case: 16% Revenue Growth

$3,523

$2,880

$2,423

Base Case: 13% Revenue Growth

$3,142

$2,576

$2,174

Bear Case: 10% Revenue Growth

$2,797

$2,301

$1,949

Source: Author’s Calculations

As you can, at least according to the DCF, under most scenarios, Alphabet’s shares are a good value at today’s prices. Even in my bear case, shares are not priced much lower than where they trade at today.

Before we move into my final take on valuation let’s note some of the risks facing YouTube, notably: Alternate Platforms, Ad Spending Slow Down, and “Web 3.0”.

Alternate Platforms: While much more niche than YouTube, platforms like Twitch, TikTok, Patreon, and yes… even OnlyFans, present a risk to YouTube. Twitch dominates video game live streaming, and TikTok dominates short-form video, if either company successfully makes inroads in medium/long-form video that would be a huge risk for YouTube.

Patreon and OnlyFans could further disrupt YouTube’s business, both platforms enable viewers to purchase subscriptions for “exclusive content” with a significantly lower take-rate compared to what YouTube takes from its creators. For example, OnlyFans has a take-rate of around 20% while YouTube takes about 45% of the revenue generated from ads.

Web 3.0: Another potential future competitor to YouTube is a Web 3.0 application, potentially supported by the Ethereum (ETH-USD) blockchain. NFTs created new avenues for patrons to support the arts where consumers received “ownership” over digital content for a fee. It’s possible we could see video content move from YouTube to NFTs for purchase. Another risk involving Web 3.0 would be the creation of a Decentralized Autonomous Organization (DAO) YouTube clone that is “owned” by the video-creators/coin-holders themselves.

Ad Spending Slow Down: The final risk I’d like to highlight is the potential for a significant deterioration of ad spending. As economists raise the likelihood of recession companies have begun to cut back on advertisement spending. Should this slowdown continue, it would have drastic effects across Alphabet company-wide. Less money spent on ads means less money for creators on the platform which could lead to a reduction in content quality and further exacerbate a shift to other platforms.

Alphabet is one of my highest conviction long-term bets. YouTube continues to take share from linear TV, and even streaming companies like Netflix. I believe YouTube’s usage-based revenue model is superior to Netflix’s subscription model because it lowers the hurdle for consumers to get hooked into the ecosystem and then it scales as they consume more.

Alphabet as a company has one of the best track records of any listed company. It has continually invested in the right places at the right time, Android and YouTube stand out to me as some of the smartest M&A moves ever executed by a company. Based on their history, YouTube, and the cloud, I have confidence that the strong ROIC levels will be maintained going forward and that Alphabet’s growth story is far from over.

The inflation-driven selloff has moved Alphabet’s valuation into, what I believe, are very attractive levels.

I rate Alphabet a “Strong Buy” with a 1-Year Price target of $2,500, the rough midpoint of my two valuation methods.

As always thank you for reading. I try to engage with all my readers, so if something has interested you, or if you have a question, please feel free to comment. I will do my best to get back to all of you with a response.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG, GOOGL, MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.