Amazon Web Services – AWS

Noah Berger/Getty Images Entertainment

Amazon Web Services – AWS

Noah Berger/Getty Images Entertainment

I last took a serious look at Amazon.com, Inc. (NASDAQ:AMZN) about six years ago when its stock was trading at about $600 a share. At the time, I determined the internet retail powerhouse was too expensive. Instead, I prefer taking ownership slices of quality, enduring businesses when their stocks are available at what appear to be reasonable prices.

However, reasonable is different depending on the enterprise-in other words, AMZN was a five-bagger since my last due diligence, a reminder that there are exceptions to every rule.

In my first published report on Amazon, I put the company and its common shares through my market-beating, data-driven investment research checklist of the value proposition, shareholder yields, returns on management, valuation multiples, and downside risk. The resulting investment thesis:

Below-average risk growth stock of a fundamentally sound company with a compelling value proposition will likely be significantly higher six years from now.

Although unlikely that triple-digit returns will continue forward, AMZN is still primed for double-digit compounding.

Unless noted, all data presented is sourced from Seeking Alpha and YCharts as of the market close on March 3, 2022; and intended for illustration only.

A complimentary Glossary of Investing Terms is provided in a linked Google Sheet for article brevity and quick reference. The glossary is exclusive to Seeking Alpha readers. It is recommended to open the sheet in a separate window or tab. For convenience, a link back to SA is provided.

AMZN is a non-dividend-paying large-cap stock in the consumer discretionary sector’s internet and direct marketing retail industry.

Amazon.com, Inc. engages in the retail sale of consumer products and subscriptions in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services (AWS). It sells merchandise and content purchased for resale from third-party sellers through physical and online stores. The company also manufactures and sells electronic devices, including Kindle, Fire tablets, Fire TVs, Rings, and Echo and other devices; provides Kindle Direct Publishing, an online service that allows independent authors and publishers to make their books available in the Kindle Store; and develops and produces media content. In addition, it offers programs that enable sellers to sell their products on its websites, as well as its stores; and programs that allow authors, musicians, filmmakers, Twitch streamers, skill and app developers, and others to publish and sell content. Further, the company provides compute, storage, database, analytics, machine learning, and other services, as well as fulfillment, advertising, publishing, and digital content subscriptions. Additionally, it offers Amazon Prime, a membership program, which provides free shipping of various items; access to streaming of movies and series; and other services. The company serves consumers, sellers, developers, enterprises, and content creators. Amazon.com, Inc. was incorporated in 1994 and is headquartered in Seattle, Washington.

(Source: Seeking Alpha)

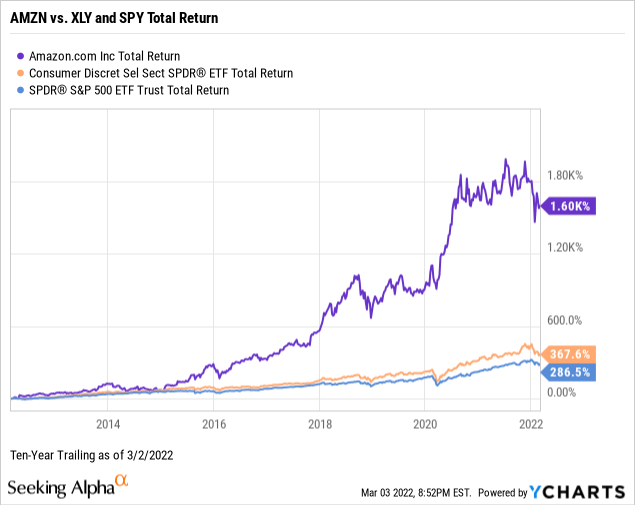

Ultimately, investing in individual common stocks should aim to beat the benchmark index over time. For example, the chart below demonstrates how AMZN has far outperformed its broader sector, represented by the Consumer Discretionary Select Sector SPDR Fund ETF (NYSE:XLY) and the overall market per the SPDR S&P 500 ETF Trust (NYSE:SPY) in the last ten years.

AMZN was an astronomical 16-bagger during that timeline.

AMZN’s departure from the crowd began around 2012, six years after the launches of Amazon Web Services and the predecessor to Amazon Prime and five years after the debut of Kindle Direct Publishing. Henceforth, the market began to recognize the company as a bonafide growth play supported by an outstanding value proposition.

My value proposition elevator pitch for Amazon: The coronavirus pandemic was an unexpected accelerator to the market dominance Amazon had already established, including the ever-growing reliance of large businesses on AWS, consumers and small businesses on Prime, and authors and book buyers on KDP.

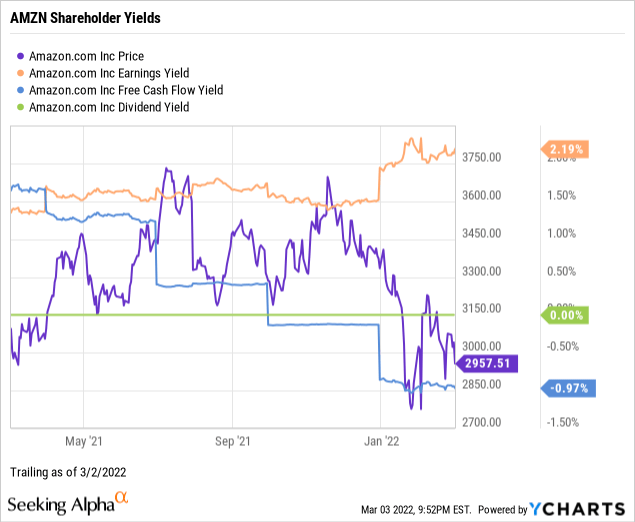

As part of my due diligence, I average the total shareholder yields on earnings, free cash flow, and dividends to measure how the stock compares to the prevailing yield on the 10 Year Treasury benchmark note.

I target an earnings yield greater than 6 percent or the equivalent of a P/E multiple below 17 times.

With trailing one-year earnings per share of $64.71, the earnings yield for AMZN was 2.19%.

I target a free cash flow yield or FCFY of 7 percent and higher or the equivalent of fewer than 15 times the inverted price-to-free cash flow multiple.

Based on $-28.70 free cash flow per share, the FCFY for AMZN was -0.97%.

Although not a dividend investor by definition, I prefer dividend-paying stocks for compensation in the short term while waiting for capital gains to compound over time. However, I am open to non-dividend paying stocks if the company executives and directors are competent capital allocators and potential dividend payers.

Of course, as a non-dividend stock, the trailing yield for AMZN was 0.00%.

Next, I take the average of the three shareholder yields to measure how the stock compares to the prevailing yield on the 10 Year Treasury benchmark note. The average shareholder yield for AMZN was 0.41% vs. 1.79% for the 10-Year.

Arguably, equities are deemed riskier than U.S. bonds. However, securities that reward shareholders at lower rates than the government benchmark, such as AMZN, favor owning the bond instead of the stock.

Remember that earnings and free cash flow yields are inverses of valuation multiples, and each suggests AMZN as overvalued. I’ll further explore valuation later in this report.

Although Amazon’s yields do not scream shareholder-friendly, aggressive share buybacks, a stock split influenced by Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) or a first-time dividend would instantly do wonders for AMZN’s yields for the benefit of shareholders.

My weighted shareholder yields rating for AMZN: Neutral.

Now, let’s explore the fundamentals of Amazon, uncovering the performance strength of its senior management.

When analyzing a business, I am biased toward established growth instead of executive promises and sell-side analyst projections.

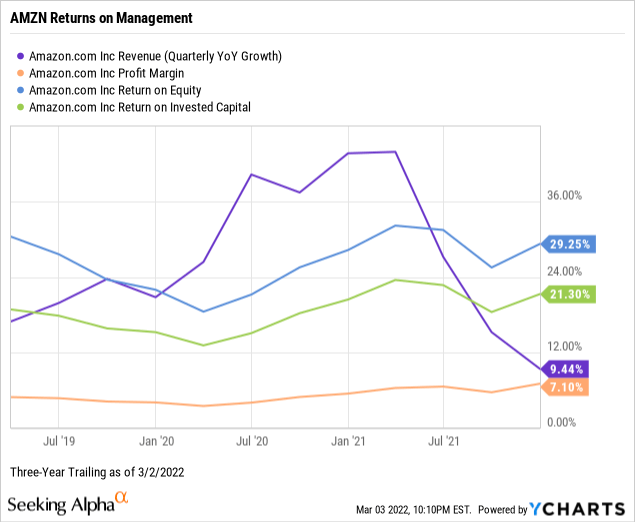

Amazon had a three-year CAGR revenue growth of 9.44%, down from YoY growth during the pandemic of 21.70% vs. the consumer discretionary sector’s 24.65 YoY median growth.

I screen for profitable companies to avoid unnecessary speculation, as witnessed in the money-losing disruptive growth stocks of late.

Amazon had a trailing three-year steady pre-tax net profit margin of 7.10%, again in line with the 6.68% median net margin level for the sector.

Return on equity or ROE reveals how much profit a company generates from shareholder investment in the stock. I target an ROE of 15 percent or higher to discover shareholder-friendly management.

Amazon had an extraordinary trailing three-year return on equity of 29.25% against a 17.70% median ROE for the sector.

Return on invested capital or ROIC measures how well a company uses its working capital to generate returns on its investment.

I target an ROIC above 12 percent, and Amazon had a 21.30% three-year trailing return. The performance indicates that senior executives are highly efficient capital allocators. On the contrary, returns market-wide appeared challenged during the pandemic.

The ROIC needs to exceed the weighted average cost of capital or WACC by a comfortable margin giving credence to management’s ability to outperform its capital costs. For example, Amazon had a trailing weighted average cost of capital of 7.04% (Source: GuruFocus).

The ample spread between ROIC and WACC, combined with positive topline growth, steady net profit margins, and outstanding returns on equity and capital, indicate superior management performance in Seattle. As a result, extraordinary growth will likely prevail.

My weighted returns on management rating for Amazon: Bullish.

As highlighted in my latest book, Build Wealth With Common Stocks: Market-Beating Strategies for the Individual Investor, I rely on four valuation multiples to estimate the intrinsic value of a targeted quality enterprise’s stock price.

The book is a case study on our concentrated family portfolio of predominantly dividend-paying common stocks that have collectively outperformed the broader market since 2009 based on an equal-weighted average total return of each position vs. the S&P 500 during the same holding periods.

Please note that I do not attempt to predict specific future share prices or percentage targets as I view such practices as arbitrary, if unreliable.

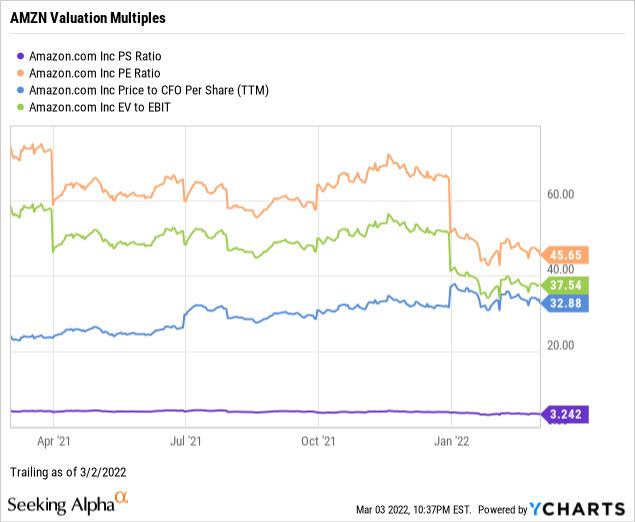

The price-to-sales ratio or P/S measures the stock price relative to revenues.

I target fewer than 2.0 times, and AMZN had a price-to-sales ratio of 3.24. By comparison, the trailing median P/S was 1.07 for the consumer discretionary sector and 2.86 times sales for the S&P 500. Thus, the weighted sector and market sentiment suggest that AMZN is somewhat overvalued relative to Amazon’s topline.

Although often a hit or miss multiple, I target price-to-trailing earnings or P/E of fewer than 17 times or below the target stock’s industry averages.

AMZN had a price-to-earnings multiple of 45.65, significantly higher than the sector median P/E of 14.97, indicating that investor sentiment overvalues the stock price relative to Amazon’s earnings per share. Further, AMZN appears trading at a premium to the S&P 500’s recent overall P/E of 23.83 (Source of S&P 500 P/E: Barron’s)

I target single-digit price-to-operating cash flow multiples for the best value.

AMZN had a price to cash flow of 32.88, compared to the sector median of 11.72, indicating the market overvalues the stock price relative to Amazon’s current cash flows.

Enterprise value to operating earnings or EV/EBIT measures whether a stock is overbought, a bearish or neutral signal, or oversold, a bullish or neutral signal, by the market.

I target an EV/EBIT of fewer than 15 times, and AMZN was trading at 37.54, compared to a sector median of 12.61 times, signaling the stock was overbought by the market.

Investing in the stock market is not rocket science. On the contrary, I have discovered that uncovering the common shares of quality companies temporarily trading at reasonable prices is basic science.

I am biased toward outstanding companies whose share prices are temporarily experiencing out-of-favor market sentiment as suggested by lower ratios of price-to-sales, price-to-earnings, price-to-operating cash flow, and enterprise value to operating earnings. Thus, I weigh the above key indicators to determine the overall market valuation of the targeted company.

The weighting of my preferred valuation multiples suggests that the market has continued to place a premium on Amazon’s stock price as of this writing. Therefore, based on the fundamentals and valuation metrics uncovered in this report, risks and catalysts notwithstanding, I would handicap AMZN as an expensive, overbought growth stock of a dominant operator in the internet and direct marketing retail industry.

Nonetheless, although the stock price is sky high relative to earnings, cash flow, and enterprise value, it’s reasonably priced to sales, the lifeblood of Amazon’s business model.

My weighted valuation rating for AMZN: Neutral.

When assessing the downside risks of a company and its common shares, I focus on five metrics that, in my experience as an individual investor and market observer, often predict the potential risk/reward of the investment.

I assign a downside risk-weighted rating of above average, average, below average, or low, biased toward below average and low-risk profiles.

Alpha-rich investors target companies with clear competitive advantages from their products or services. An investor or analyst can streamline the value proposition of an enterprise with a moat assignment of wide, narrow, or none.

For example, Morningstar assigns Amazon a wide moat rating.

We assign a wide-moat rating to Amazon.com based on network effects, cost advantages, intangible assets, and switching costs. Amazon has been disrupting the traditional retail industry for more than two decades now, while also emerging as the leading infrastructure-as-a-service, or IaaS, provider via Amazon Web Services, or AWS. This disruption has been embraced by consumers and has driven change across the entire industry as traditional retailers have invested heavily in technology in order to keep pace. COVID-19 has accelerated change, and given its technological prowess, massive scale, and relationship with consumers, we think Amazon has widened its lead, which we believe will result in economic returns well in excess of its cost of capital for years to come.

–Dan Romanoff, CPA, Senior Equity Analyst, February 3, 2022

A favorite of the legendary value investor Benjamin Graham, long-term debt coverage demonstrates balance sheet liquidity or a company’s capacity to pay down debt in a crisis. Generally, one-and-a-half times current assets to long-term debt is ideal.

As reported on its December 2021 financial statements, Amazon’s long-term debt coverage was 2.94, near three times the liquidity necessary to cover its longer-term leveraging needs. Moreover, in a further test of its paydown capacity, the long-term debt to equity for Amazon was 46.59%, well below my 200% ceiling. In other words, investors should become concerned only when a company’s debt is more than twice its equity.

Current liabilities coverage or current ratio measures the short-term liquidity of the balance sheet.

I target higher than 1.00, and Amazon’s short-term debt coverage was 1.14, providing the liquid assets necessary to pay down its current liabilities such as accounts payable, accrued expenses, and unearned revenue.

As a long-term investor, I use a five-year beta trend line and screen for stocks with betas lower than 1.25 or no more than 125% volatility to the market.

AMZN’s 60-month trailing beta was 1.12; however, its 24-month beta was 0.59, reflecting a stock that offers price volatility equal to or less than the S&P 500 on the whole.

The short interest percentage of the AMZN float was 0.94%, well under my 10% ceiling. Bears appear to view AMZN as a core-level growth holding in institutional and retail portfolios.

Amazon remains a fundamentally superior company with an attractive risk profile.

My weighted downside risk rating for AMZN: Below Average.

Catalysts accelerating or contradicting my overall bullish investment thesis on Amazon include, but are not limited to:

Amazon’s current stock price appears overvalued in the context of shareholder yields and valuation multiples beyond sales. Nonetheless, getting what we pay for in life works on both high and low prices, with overlying quality the ultimate differentiator.

Prospects remain optimal, and fundamentals and downside risk are alone worthy of ownership. GARP is rarely used in the investment universe these days, but AMZN presents as growth at a reasonable price.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOGL either through stock ownership, options, or other derivatives. Business relationship disclosure: I may initiate a beneficial Long position through the purchase of AMZN common shares over the next 72 hours. As a published author, I have an arms-length, independent contractor relationship with Kindle Direct Publishing, one of two organizations distributing my self-help books. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any other company whose stock is mentioned in this article.

Additional disclosure: David J. Waldron’s articles are for informational purposes only. The accuracy of the data cannot be guaranteed. Narrative and analytics are impersonal, i.e., not tailored to individual needs or intended for portfolio construction beyond the author’s family portfolio, which is presented solely for educational purposes. David is an individual investor and author, not an investment adviser. Readers should always engage in their own research and consider (as appropriate) consulting a fee-only certified financial planner, licensed discount broker/dealer, flat fee registered investment adviser, certified public accountant, or specialized attorney before making any investment, income tax, or estate planning decisions.