Sign up for MarketBeat All Access to gain access to MarketBeat’s full suite of research tools:

The world’s largest aircraft manufacturer, The Boeing Company (NYSE: BA) stock, was piledriven over (-75%) off its highs at $446.01 in 2019 by the 737 MAX tragedies and the COVID-19 pandemic. However, the Company and the stock have since been in a turnaround recovery mode as shares trim their losses to (-11%) for 2022, faring better than the S&P 500 (NYSEARCA: SPY), down (-18%).

Supply chain bottlenecks prevent the Company from manufacturing more planes for delivery as it expects challenges to continue throughout 2023. For example, it lacks engines for its 737, preventing it from increasing deliveries. It expects $2 billion in abnormal costs for the 787 program as it reworks inventory and decreases production levels.

Investors may wonder if the shares have gotten ahead of themselves if the Company can’t boost its deliveries despite the growing backlog. The Company expects to see $3 billion to $5 billion in free cash flow in 2023. The Company is slowly and steadily working its way through the supply chain bottlenecks, as expressed by its CEO Dave Calhoun in a CNBC interview on December 13, 2022. He expects supply chain constraints to get much better after 2023.

Airlines usually replace wide-body aircraft after 25 years, but some stretch this to 30 years. United Airlines Holdings, Inc. (NYSE: UAL) announced on December 13, 2022, to purchase up to 200 Boeing 787 Dreamliners as part of its United Next plan to replace its aging fleet. Deliveries are expected between 2024 and 2032. United also exercised options to purchase 44 Boeing 737 MAX plans for delivery between 2024 and 2026 and 56 MAX airplanes between 2027 and 2028.

The new airplanes will replace its fleet of aging Boeing 767 and Boeing 777 currently being used, as they are scheduled to be removed by 2030. United Airlines’ total purchases could equate to nearly $34 billion in revenues with a list price ranging between $37 billion to $47.5 billion, but airlines don’t pay list price. Therefore, the exact value of the purchases can only be speculated upon as prices can change with the exercising of options. Boeing is expected to deliver 100 of its 787 airplanes between 2023 and 2032.

This doesn’t include orders from other major carriers like Southwest Airlines Co. (NYSE: LUV), which uses Boeing 738 and 737 aircraft exclusively, Delta Air Lines Inc. (NYSE: DAL), which orders 100 Boeing 737 MAX 10 aircraft, and American Airlines Group Inc. (NASDAQ: AAL) who decided to double its fleet on Boeing 787 Dreamliners with 47 more valued at $12 billion and 28 options.

On October 26, 2022, Boeing released its fiscal third-quarter 2022 results for September 2022. The Company reported an earnings-per-share (EPS) loss of (-$6.18) excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.07), a (-$6.25) miss but may not be comparable. It took a significant hit on fixed-price military contracts. Revenues grew 4.5% year-over-year (YoY) to $15.96 billion, missing analyst estimates of $18.03 billion. The Company resumed delivering its 787 airplanes and nine in the quarter.

The Company recorded losses on fixed-price defense development programs and generated an operating cash flow of $3.2 billion. The Company ended the quarter with $13.5 billion in cash with access to $12 billion of credit which remains undrawn. The total company backlog was $381 billion at the end of the quarter.

Boeing CEO Dave Calhoun commented, We continue to make important strides in our turnaround and remain focused on our performance. We generated strong cash in the quarter and are on a solid path to achieving positive free cash flow for 2022. At the same time, revenue and earnings were significantly impacted by losses on our fixed-price defense development programs. We’re squarely focused on maturing these programs, mitigating risks, and delivering for our customers and their important missions.”

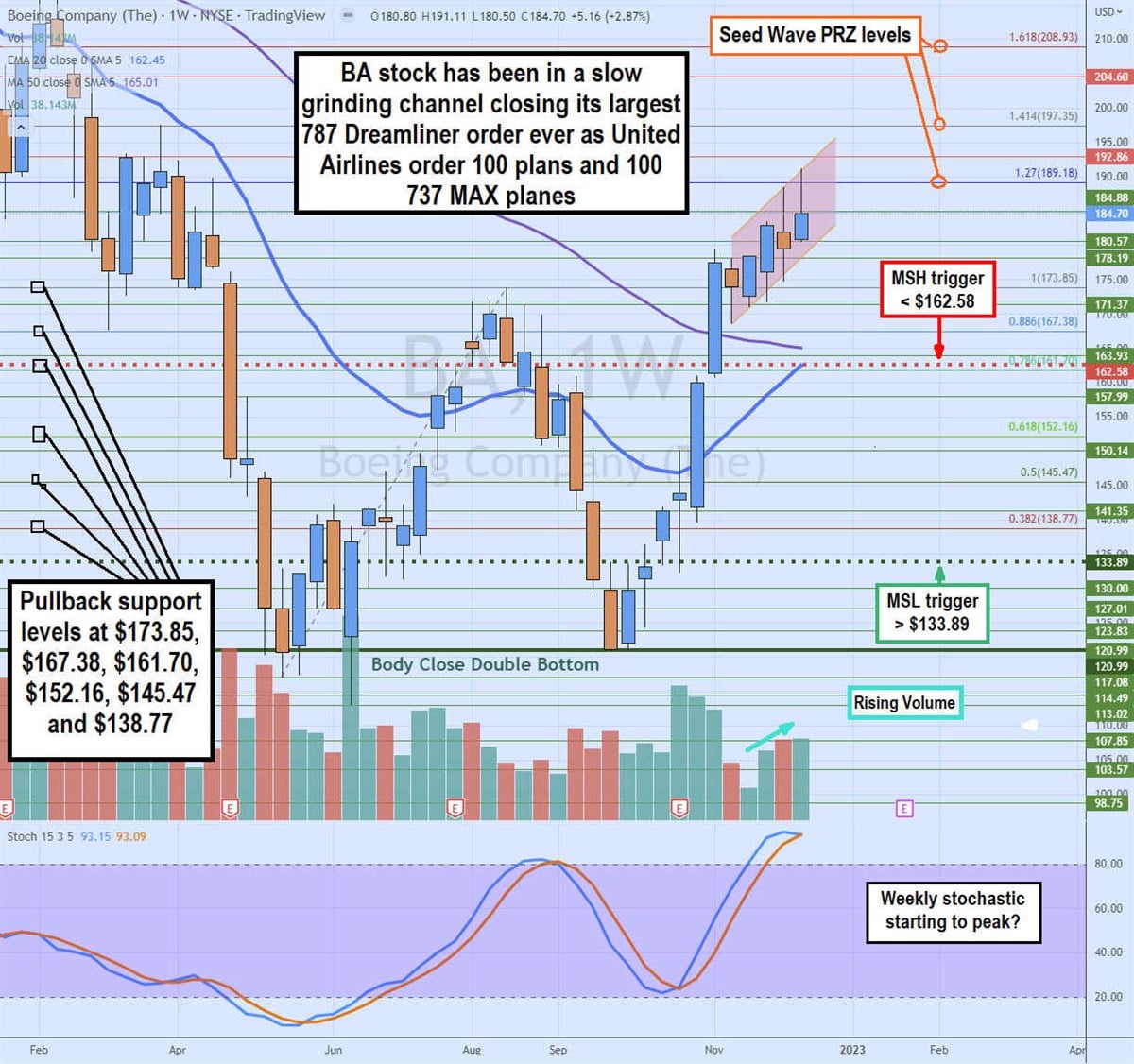

BA stock has been in a rising price channel after breaking through its prior swing high at $173.85. This was preceded by the body close double bottom around $121 in September 2022, which triggered a weekly market structure low (MSL) buy signal on the breakout through $133.89. The stochastic completed a full oscillation up through the 80-band as it potentially peaks near the 93-band. The weekly 20-period exponential moving average (EMA) is now supported at $162.45 as the weekly 50-period MA attempts to reverse the downtrend and cross up.

The weekly 50-period MA converges with the weekly market structure high (MSH) sell trigger at $162.58. Volume has been steadily creeping more lavishly for the past month. However, the rising flag channel can just as easily break down like an increasing wedge if the weekly stochastic falls back under the 80-band and the lower trend line at $180.57 gets broken to the downside. Pullback support levels sit at the $173.85 previous weekly swing high, $167.38, $161.70 under the weekly MSH trigger, $152.16, $145.47, and $138.77.

Before you consider Boeing, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Boeing wasn’t on the list.

While Boeing currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today’s challenging market? Click the link below and we’ll send you MarketBeat’s list of ten stocks that will drive in any economic environment.

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Sign up for MarketBeat All Access to gain access to MarketBeat’s full suite of research tools:

View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio.

Get daily stock ideas from top-performing Wall Street analysts. Get short term trading ideas from the MarketBeat Idea Engine. View which stocks are hot on social media with MarketBeat’s trending stocks report.

Identify stocks that meet your criteria using seven unique stock screeners. See what’s happening in the market right now with MarketBeat’s real-time news feed. Export data to Excel for your own analysis.

As Featured By:

326 E 8th St #105, Sioux Falls, SD 57103

[email protected]

(844) 978-6257

© American Consumer News, LLC dba MarketBeat® 2010-2022. All rights reserved.

© 2022 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer.