MicroStockHub/iStock via Getty Images

MicroStockHub/iStock via Getty Images

I have been growing increasingly bearish and pessimistic about the outlook for U.S. interest rates and the bond market generally since the middle of 2020. The extend and pretend exercise of low interest rates and record rates of money printing can only continue so long, before something breaks. The Federal Reserve’s balance sheet is approaching $9 trillion in bonds, a source of direct interference in our free-market capitalistic system, outrunning any previous central bank shenanigan in human history. Now with inflation beginning to skyrocket as CPI YoY passed +7% in December, either interest rates will rise markedly in 2022 to rebalance the economy, or we risk even higher moves into the annualized 10% or greater CPI range by the end of the year (only rivaled by Civil War inflation), with a massive destructive interest rate spike into the stratosphere soon thereafter.

Really, the last remaining economic scenario to prevent a major rise in long-term interest rates, and properly match escalating inflation, is a stock market crash ASAP followed by a disinflationary recession to properly rebalance consumer supply/demand. Yippie! However, since the stock market refuses to decline for more than a day or two, a monster decline in bond market pricing, including products like the iShares 20+ Year Treasury Bond ETF (TLT), may lie dead ahead.

Don’t take my word for it. Financial managers and experts, left and right are coming to the same conclusion in late 2021 and early 2022. None other than the leader of the largest bank in the U.S., CEO Jamie Dimon of JPMorgan Chase (JPM) explained on Friday, during the company’s Q4 earnings release, an amazing and unprecedented number of 6 or 7 bank lending rate hikes would be necessary in 2022 to hold the economy together.

JPMorgan Chase Website

JPMorgan Chase Website

Specifically, Mr. Dimon, who many observers and investors including myself consider the most influential banker outside the central bank circle said,

… So, my view is a pretty good chance there’ll be more than 4. It could be 6 or 7. I mean, I grew up in a world where you — Paul Volcker raised interest 200 basis points on a Saturday night. And this whole notion that somehow it’s going to be sweet and gentle and no one is ever going to be surprised. I think it’s a mistake …

And the other fact is, it may very well be possible that they’re loan rates — and I’m a little surprised how low they stay. But the loan rates may react more to the actual QE and then QT. And so, at one point, the Fed is going to be letting run off $100 billion or whatever number a month they’re going to come up with. And then you may see loan rates react a little bit to that. And particularly, I just said about growth and demand for capital and stuff like that, that also tends to drive 10-year bond rates and all that …

The fear is the U.S. dollar’s value in foreign exchange markets will not hold up with the Fed sticking its head in the sand, refusing to raise rates any longer. Basically, Mr. Dimon is predicting the Fed will raise rates at nearly every central bank policy meeting in 2022 to fight inflation. In fact, during early 2022 many Fed bank presidents have said that rates will begin rising at the March meeting, at the latest. We’ll see if they can extend low rates and pretend rising inflation isn’t important into that date.

University of Pennsylvania – Wharton Website

University of Pennsylvania – Wharton Website

Jeremy Siegel, a well-respected Wharton professor and top prognosticator of U.S. financial markets (who has been correctly bullish on the direction of bonds and stocks for years), has turned increasingly skittish on debt markets since October in his public comments. He has been screaming on CNBC interviews at anyone that will listen (most refuse to) that the Fed is way behind the money growth curve and extreme tightening is coming this year.

January 12th 2022 Kitco Interview

January 12th 2022 Kitco Interview

Steve Hanke, perhaps the foremost monetary authority in the world teaching out of Johns Hopkins University, is calling for a 6% to 9% inflation number again in 2022, and believe it or not again in 2023. Regarding his excellent track record predicting inflation rates over the years, he loudly estimated CPI of well over +6% for calendar 2021 during the summer of 2020, when Wall Street consensus was stuck at sub-2% forecasts! His latest ideas are linked here in an interview from Kitco.com.

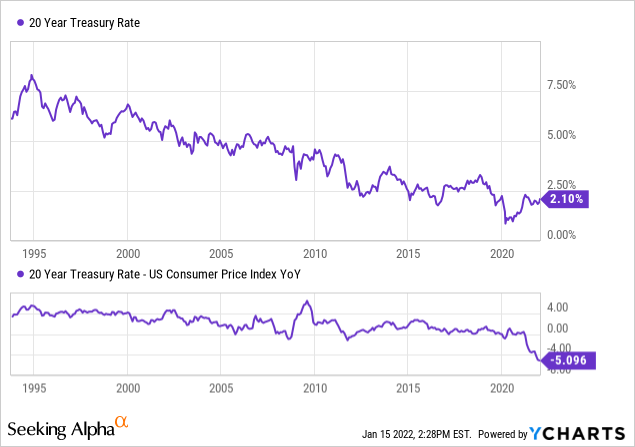

Why is the bond backdrop so bearish? Real interest rates have not been this negative in America since the late 1940s, when our economy reopened following the end of World War II military spending.

Below is a 27-year chart comparing 20-year Treasury bond interest rates vs. prevailing CPI rates. Notice the current -5% real interest rate has completely fallen off the graph, while long bonds have almost always returned interest BEYOND the existing inflation rate (you still have to pay taxes on dividend income to boot). 2% for a savings-like return does not remotely cover the 7% cost-of-living increase last year to preserve your purchasing power. So, effectively bond owners have been resolutely orphaned by Federal Reserve easing policies in 2021 and likely throughout 2022. I hate to say U.S. Treasury bondholders have been suckers or bag holders the past 18 months, but it is absolutely the truthful way to view the unusual pandemic economic situation engineered by U.S. central bankers.

YCharts

YCharts

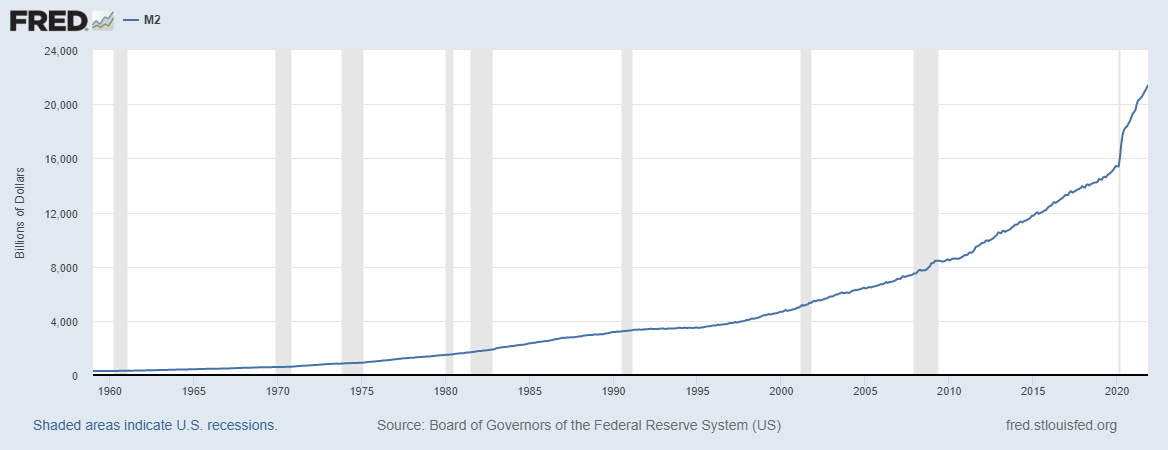

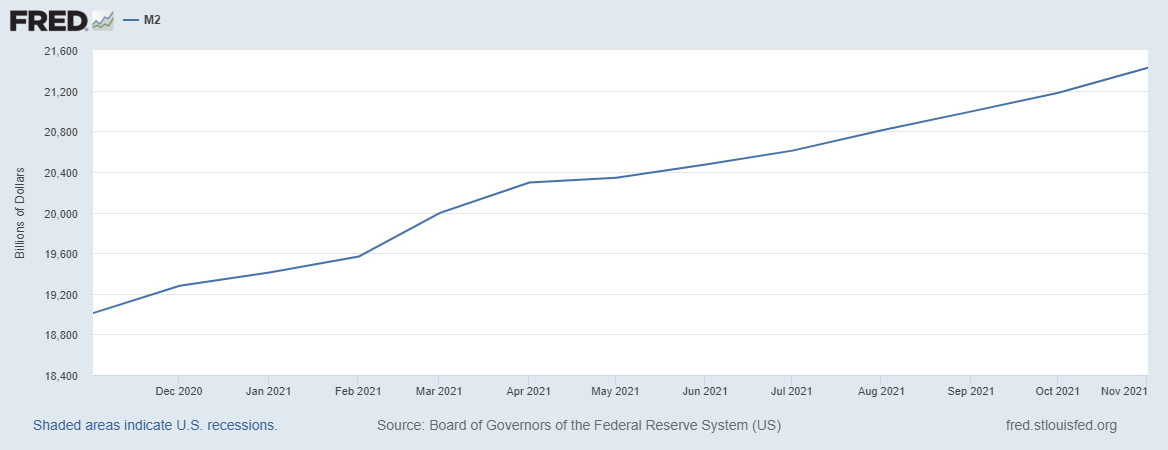

Yet more bearish news for bondholders, the primary variables making up macro cost pressures are equally skewed toward high to rising rates of inflation again in 2022. M2 money supply remains excessive at +12% YoY, a critical component of expanded pricing in the economy. In total M2 has gained a mind boggling +44% over less than two years, a record rate for our republic over 240 years of history. Previous “modern” records were around +25% over a similar 21-month span. Even the 1930s Depression years and 1860s Civil War expansion in base money supply were lower than today!

St. Louis FED M2

St. Louis FED M2

St. Louis FED M2

St. Louis FED M2

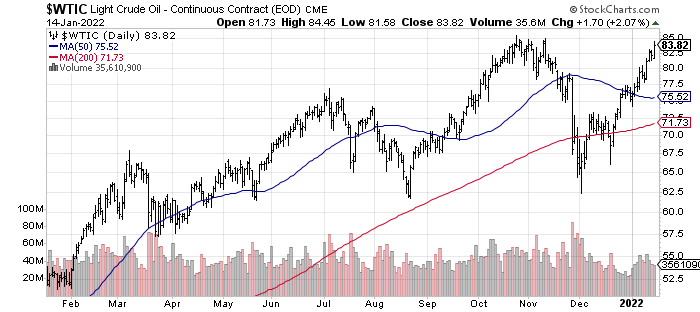

Crude oil and other base commodities are still high to rising in price. Energy prices remain a key driver in business and consumer spending. So, it’s hard to forecast a slowdown in inflation until crude oil decides to take a breather. West Texas Intermediate quotes are +60% higher than one year ago.

StockCharts.com

StockCharts.com

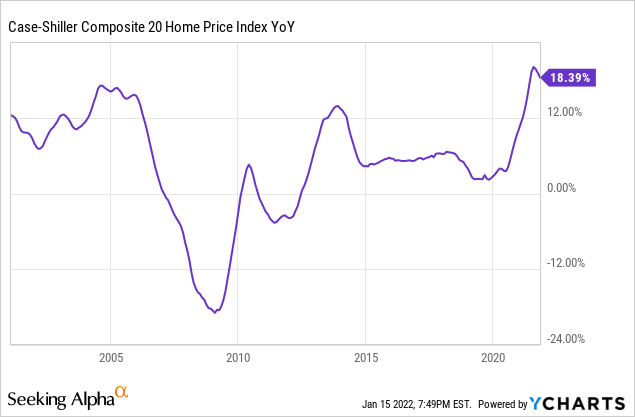

Home price gains remain close to modern records at +18% YoY in December. The single largest component of consumer spending, home ownership and rentals are a key driver of inflation. In addition, wealth creation is largely tied to home selling, rental income, and refinance activity.

YCharts

YCharts

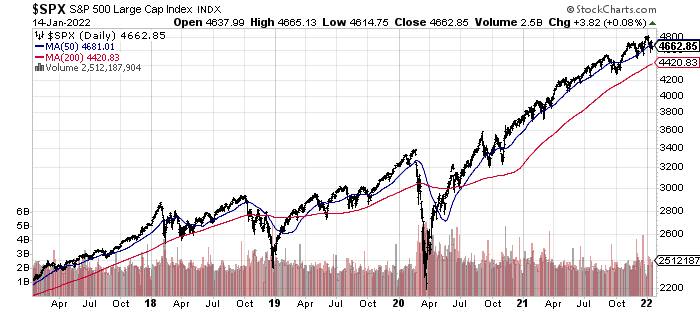

A sizable equity advance over the last 12 months is doing nothing to slow consumer confidence and future spending patterns, with the S&P 500 returning another +25% during 2021. Outside of wage growth, wealth gains from stock selling and margin borrowing are today the next largest contributor to incremental income growth.

StockCharts.com

StockCharts.com

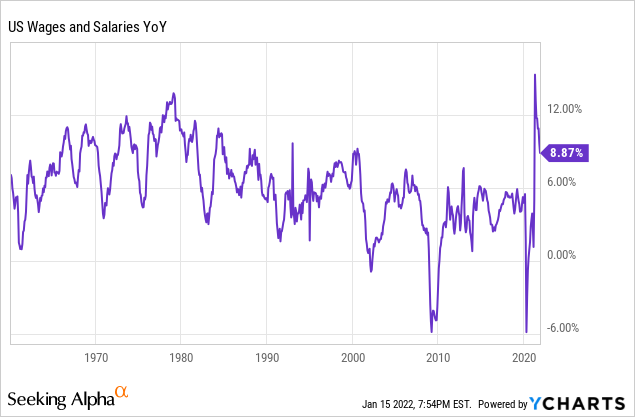

Lastly, hourly wage and salary gains around +10% YoY were reported in the second half of 2021. Wage pressures are a critical consumer spending and business cost component. Last year’s biggest wage advance since 1979 will not hold back inflation in 2022. More income means more money means more demand, and too much money chasing too few goods will continue until a rebalancing event takes place.

YCharts

YCharts

If CPI inflation averages +6% annually the next few years as Mr. Hanke projects, a 20-year Treasury bond yield above 5% is clearly a possibility (if not a probability). That’s a huge difference from present long-term U.S. government bond yields in the 1.7% to 2.1% range. To reach a 5% yield, the widely owned and traded iShares long-bond ETF would have to decline to a price around $60, assuming dividends rise to a $0.24 monthly trust average payout in 12-18 months (above the present cash distribution rate of $0.18 monthly). That’s a monster TLT price decline from $142.10 on Friday. Don’t say such a move is impossible. I have seen crazier changes in the macro economy setup over 35 years of trading/investing. If you calmly look at the math, and think through the total mismatch in bond yields vs. inflation, arguing TLT will stay close to its current price is borderline madness.

On the trading chart below, the gap down move in January 2021 (boxed in green) was finally filled in early December (marked with a green arrow) with a quick price advance to $155. Since early December, TLT has dropped like a rock released from a high cliff, slashing straight through its 50-day and 200-day moving averages.

StockCharts.com

StockCharts.com

Other indicators of momentum are looking quite bearish. Treasury bonds have dramatically lagged stocks following the pandemic sell-off low of March 2020 for equities. We can review the whopping TLT total return underperformance span of -90% vs. the S&P 500 straight up advance over 22 months. All told, T-bonds have still underperformed equities by -25%, comparing price fluctuations to two years ago before the COVID-19 virus problem appeared.

The Negative Volume Index peaked in July, circled in red. On Balance Volume stopped rising in early August. Both failed to confirm the new price high move in December. Plus, weakness in the two indicators is telling us aggressive sellers have been overwhelming buyers for months, on both low- and high-volume days.

I wrote several bearish articles on TLT in December 2020 and March 2021, explaining the rotten setup for bonds if inflation exploded higher with economic reopenings. Amazingly, bond yields and valuations have not budged much, failing to reasonably reprice against 7% CPI. In my mind, a game of catchup could hit at any moment, especially after the Omicron variant curveball and related economic slowdown fades into late February.

What could save the bond market in 2022 and keep TLT above $125? A dramatically lower stock market is the only answer I can logically devise. If some wind were taken from the sails of extreme wealth creation on Wall Street, long-term interest yields “might” be able to hold close to present levels. Consumer and business spending/confidence would slow with a major stock price drawdown. However, even this scenario may only provide a temporary respite for bonds, before inflation reaccelerates, following tremendous monetary expansion. [An outlier black swan, World War 3 event with America directly fighting Russia (over Ukraine) or China (over Taiwan) would surely weaken the global economy, but may not help Treasury bond valuations if supply-chain inflation spikes and the dollar swoons with a potential loss of confidence run on U.S. assets in a prolonged conflict.]

Wishful thinkers still claim high inflation is solely a function of reopening the economy after the pandemic shutdown in early 2020, or related supply chain issues, easily corrected by this summer. Yet, these arguments come from the same group of analysts that believed inflation above 2% was impossible, because of technology changes or fill in the blank _____ just 12 months ago.

Should investors be worried about the potential of a U.S. stock market crash in 2022? Sure, overenthusiasm by new retail investors (largely a function of zero for online commissions begun in late 2019) and record overvaluations in many areas of the stock market (like Big Tech) could result in a monumental bust sooner or later.

However, an even bigger disconnect in pricing vs. reality now exists in the U.S. bond market. Remember the Treasury bond, corporate debt, state/municipal bond, and money markets are worth many multiples of total equity market value. A spike in interest rates will have a greater impact on the workings of the economy and our day-to-day lives than a stock market crash.

While TLT may lead the list of ETFs most exposed to a rise in long-duration U.S. interest rates for government and corporate debt securities, others to consider selling and avoiding include iShares 10-20 Year Treasury Bond (TLH), Vanguard Total Bond Fund (BND), iShares Core U.S. Aggregate Bond (AGG), iShares 7-10 Year Treasury Bond (IEF), SPDR Bloomberg Barclays High Yield Bond (JNK), Vanguard Extended Duration Treasury (EDV), Vanguard Long-Term Treasury (VGLT), PIMCO Active Bond (BOND), Schwab Strategic U.S. Aggregate Bond (SCHZ), and literally hundreds of smaller ETF products. On top of this list, insurance companies and banks of all shapes and sizes are major holders of long-term bonds at risk of tanking in asset value during 2022.

If you want a sobering financial future to ponder, how would Americans handle both bond and equity markets tanking materially in 2022-23? If this worst-of-all-worlds economic event plays out in time, be sure to send thank you notes to U.S. Federal Reserve Bank members like Chairman Powell, including past Chairs Greenspan, Bernanke, and Yellen. It’s a mess completely of their making – the endgame of extend and pretend monetary policy over several decades.

As opposed to incredibly high real interest rates and material risk-free returns from Treasuries in the early 1980s, today’s setup may be the exact opposite for investors – namely reward-free risk, exaggerated by huge negative real yields. Food for thought anyway.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. Past performance is no guarantee of future returns.