gorodenkoff/iStock via Getty Images

gorodenkoff/iStock via Getty Images

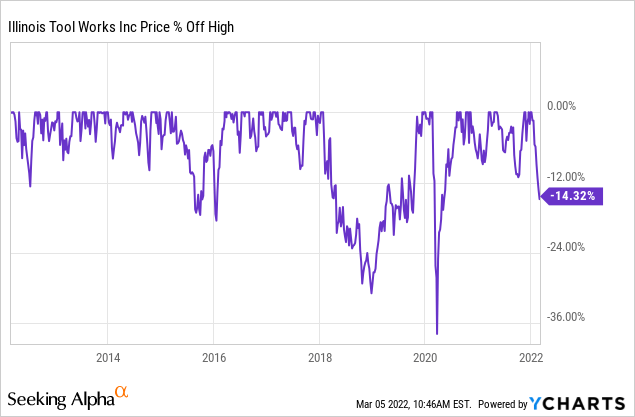

One of the stocks people really care about is Illinois Tool Works (ITW). The last time I covered the stock was back in September of 2021, which means everyone who requested the company is right, as it’s time to discuss this dividend growth beauty. The only reason I don’t own ITW is that I have 50% industrial exposure. Other than that, there really isn’t a reason to ignore ITW. The company has a long history of enhancing operating efficiencies, increasing free cash flow, boosting dividends and buybacks, and quickly recovering after corrections. In this case, we’re dealing with a correction as market “turmoil” has sent shares lower. It also doesn’t help that a lot of companies with international exposure suffer from the ongoing war in Ukraine. Hence, ITW is now adjusting itself to slower economic growth expectations, which is good news for people looking to buy ITW shares.

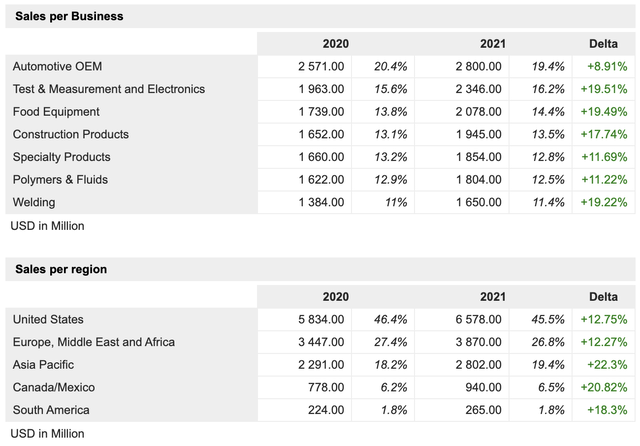

One of the best things about ITW is that the company is incredibly well diversified. Using FY2021 numbers, we see that its largest segment is automotive OEM, which generates close to 20% of total sales. After that comes test & measurement electronics, food equipment, and construction products with more than 13% sales exposure, each.

MarketScreener

MarketScreener

What also matters is that ITW has diversified international exposure. In EMEA countries, it generated $3.9 billion in sales last year, that’s 27% of total exposure.

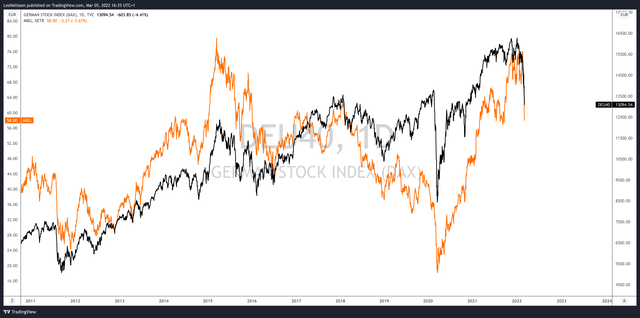

Companies with high Europe and high automotive exposure are currently in a very bad place. The German stock market index DAX (black line in the graph below), for example, is roughly 20% below its all-time high. Its automotive crown jewel Mercedes-Benz Group has lost a quarter of its value since February…

TradingView

TradingView

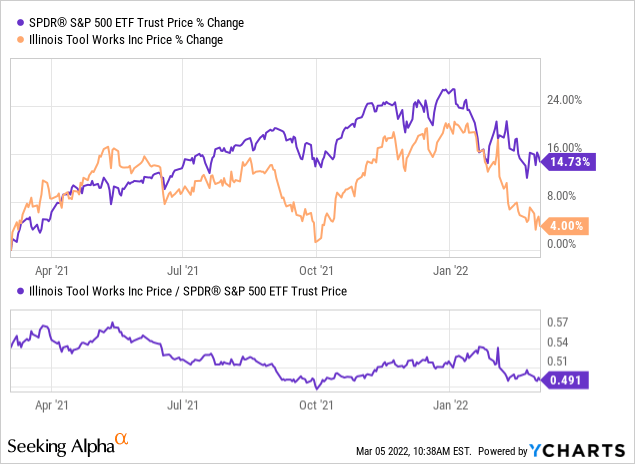

The situation in the US is different, but also far from perfect. The S&P 500 is down close to 9% year-to-date and up 14.7% compared to 12 months ago – excluding dividends. ITW is up 4.0% during this period but it has significantly underperformed the S&P 500 starting in February, which makes sense given its Europe and automotive exposure.

After all, Russia is completely got off from the world economy right now, except for some commodity exports. Automotive companies have halted sales in Russia. Unfortunately, for us, this means that supply chains are once again suffering. Ukraine is a major source of auto supplies, which means on top of semiconductor shortages, auto companies will now see a much broader variety of shortages.

Then, we’re already dealing with high inflation, labor shortages, and uncertainty regarding the Fed? What if the Fed hikes too fast? What if it hikes too late and lets inflation kill demand?

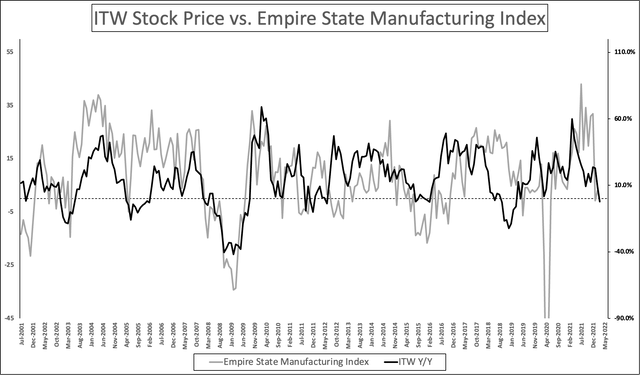

All of these things are reasons why economic sentiment in the US has fallen – as measured by the Empire State Manufacturing index. That’s a survey conducted by the New York Fed and it is highly correlated to the year-on-year stock price performance of ITW.

Author

Author

Historically speaking, a 20% year-on-year decline prices in a significant global manufacturing slow-down. Right now, the stock is down 14%. In 2020, the stock fell roughly 40%. During the 2015 manufacturing recession, investors lost close to 20%.

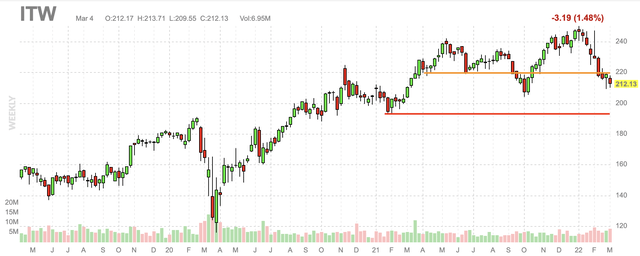

Based on that, I would try to buy the stock as close to $200 as possible. The lower the better is an obvious thing in trading, but that’s what I would consider a great long-term risk/reward for both traders and investors.

FINVIZ

FINVIZ

Yet, I think the stock is much better for investors than traders who look to make a buck by selling it at a profit once it bounces.

Why? Because of its free cash flow and dividend.

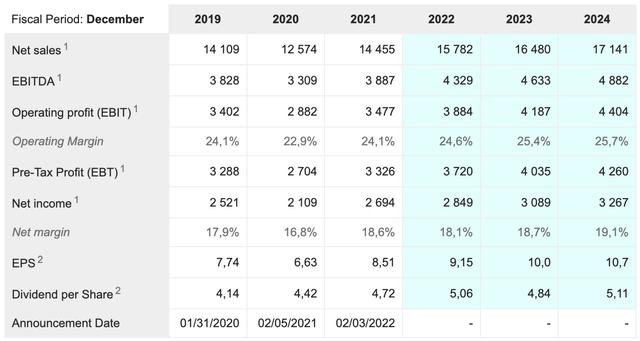

ITW has consistently improved its margins and sales. This year, ITW is expected to boost operating margins to 24-25% according to the company. Analysts’ consensus estimates are at 24.6%. This includes the recent MTS acquisition. Adjusted for that acquisition, margins would be 50 basis points higher.

MarketScreener

MarketScreener

The company’s earnings are what I like to call “high quality” earnings because high earnings result in high free cash flow. This year, the company is expected to do $2.9 billion in free cash flow. That’s 101% of expected net income. Next year, we’re likely looking at $3.2 billion in free cash flow.

MarketScreener

MarketScreener

Free cash flow is net income adjusted for non-cash items and capital expenditures. It’s cash the company can use to reduce debt or to distribute cash via dividends and buybacks.

In the case of ITW, the net leverage ratio is below 1.6x with an expected decline to less than 1.0x in 2024. This means there’s no need to reduce debt before distributing dividends.

On February 3, ITW announced a $1.5 billion stock repurchase program. This translates to 2.3% of shares outstanding.

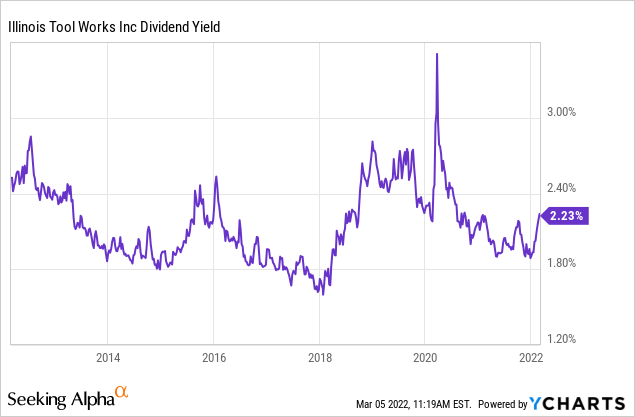

Meanwhile, the dividend yield is 2.3%, which is close to the 10-year average.

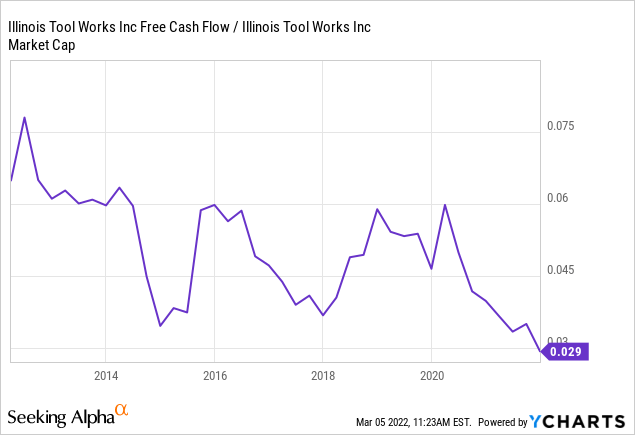

Seeking Alpha data shows that ITW’s dividend has grown, on average, by 12% per year since 2010. I expect this to continue as free cash flow is just too high. Close to $3.0 billion in free cash flow translates to an FCF yield of 4.5% using the $66.4. billion market cap. Moreover, FCF is steadily growing. In the 2017-2023E period, FCF is expected to grow by 6.2% per year. This includes the 2020 demand implosion. That’s more than decent.

Using the historic FCF yield range as an example, an implied 4.5% yield is not overvalued. It means investors are not overpaying to get access to the company’s free cash flow. Especially not if I apply the buying range I discussed in this article. If ITW falls 10% from current prices, its implied FCF yield will be close to 5%. That’s a good deal – assuming economic damage remains limited.

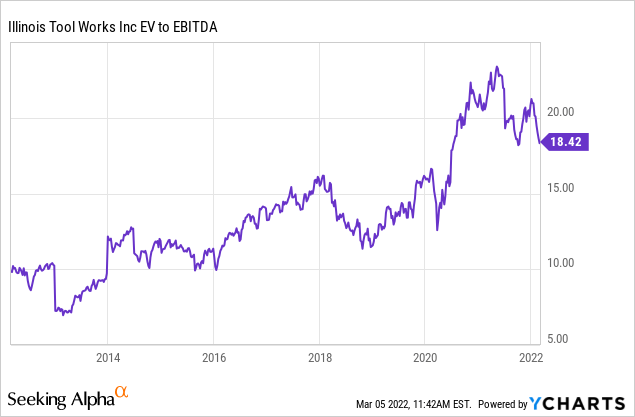

Moreover, the company has an enterprise value of roughly $71.9 billion. That’s based on its $66.4 billion market cap and $5.5 billion in expected net debt next year (provided by high free cash flow). $71.9 billion is roughly 16.3x expected EBITDA this year.

It’s not cheap, but it confirms that the stock has entered a “buy zone”.

I don’t know how bad things can get because of the war in Ukraine. However, what I do know is that ITW has entered a buy zone. The stock has limited exposure in Europe and the automotive sector, which still deals with a chip shortage. Moreover, it is expected to boost free cash flow this year and in the years beyond, which will allow management to continue dividend hikes and stock buybacks worth billions.

ITW is a great stock for dividend (growth) investors thanks to its >2.2% yield, double-digit long-term annual dividend growth, a healthy balance sheet, rising margins, and the fact that the valuation has come down.

While there’s always a risk when trying to buy a stock low – one might miss a big rally – I think investors should try to buy this stock as close to $200 as possible, or anything below.

These prices give investors a terrific risk/reward, a better yield, and as a result, a good basis for long-term wealth generation with diversified machinery.

(Dis)agree? Let me know in the comments!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.